AMD: Target Price 300

Since the beginning of September, there has been exciting news every day. After the frequency of AI usage increased exponentially, all basic infrastructure has become very tight.

This time, it's AMD's turn to enjoy a sharp rise. After securing a $60 billion deal with OpenAI, it has moved a step closer to the trillion-dollar market capitalization threshold. However, before that, we need to see what the next steps are after AMD's surge.

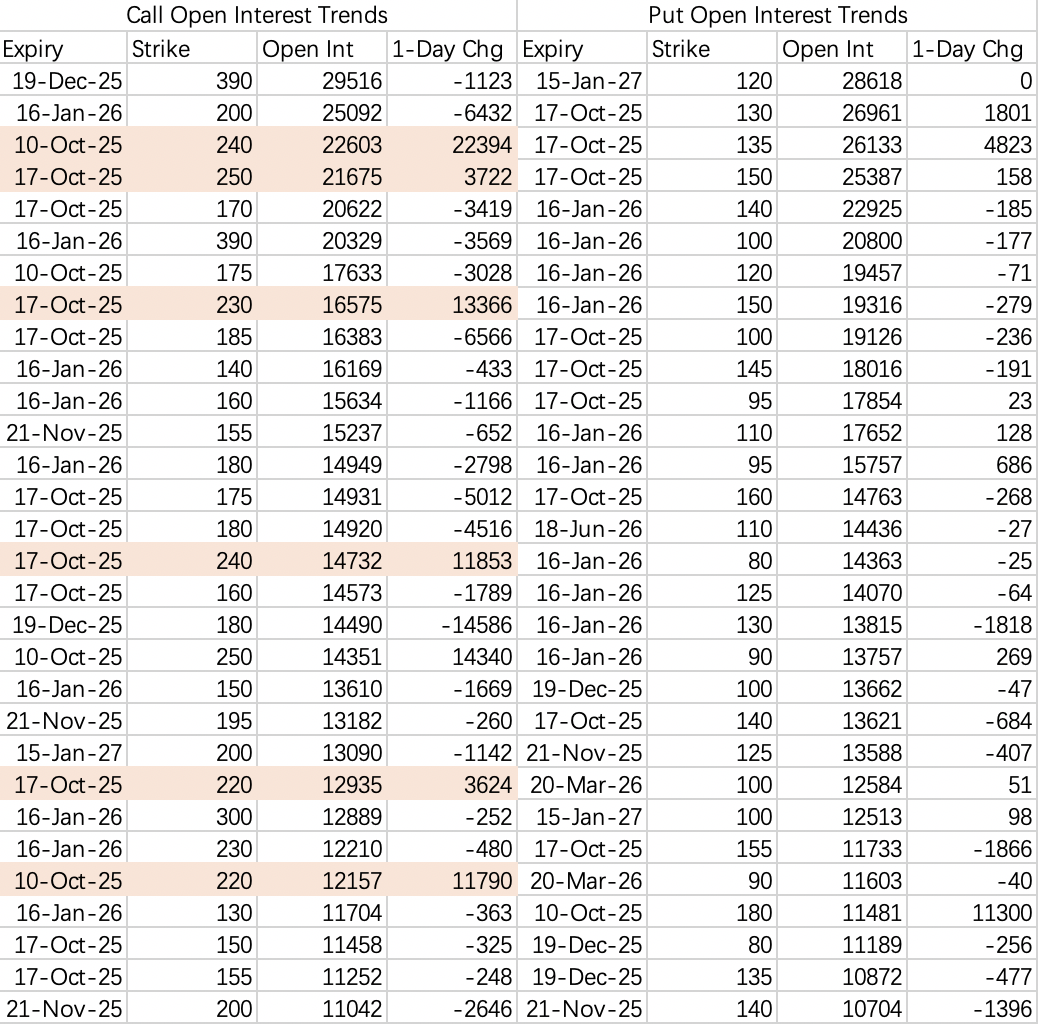

First, looking at the overall options open interest: on the day of the surge, a large number of out-of-the-money call options were closed. Both long and short positions reached their profit-taking or stop-loss levels. However, there wasn't a significant amount of long-dated opening positions; most were near-dated. The main reasons are likely the increased implied volatility (IV) after the surge, and the fact that analyst reports haven't been released yet, leaving long-term plans open for discussion.

Put options didn't change much, for the same reason – with major positive news, there's no rationale for shorting.

Looking at Monday's opening positions: call option openings were concentrated in the 230~250 range, with both long and short positions, forming a concentrated holding area. This will likely become a near-term resistance level in the next couple of weeks.

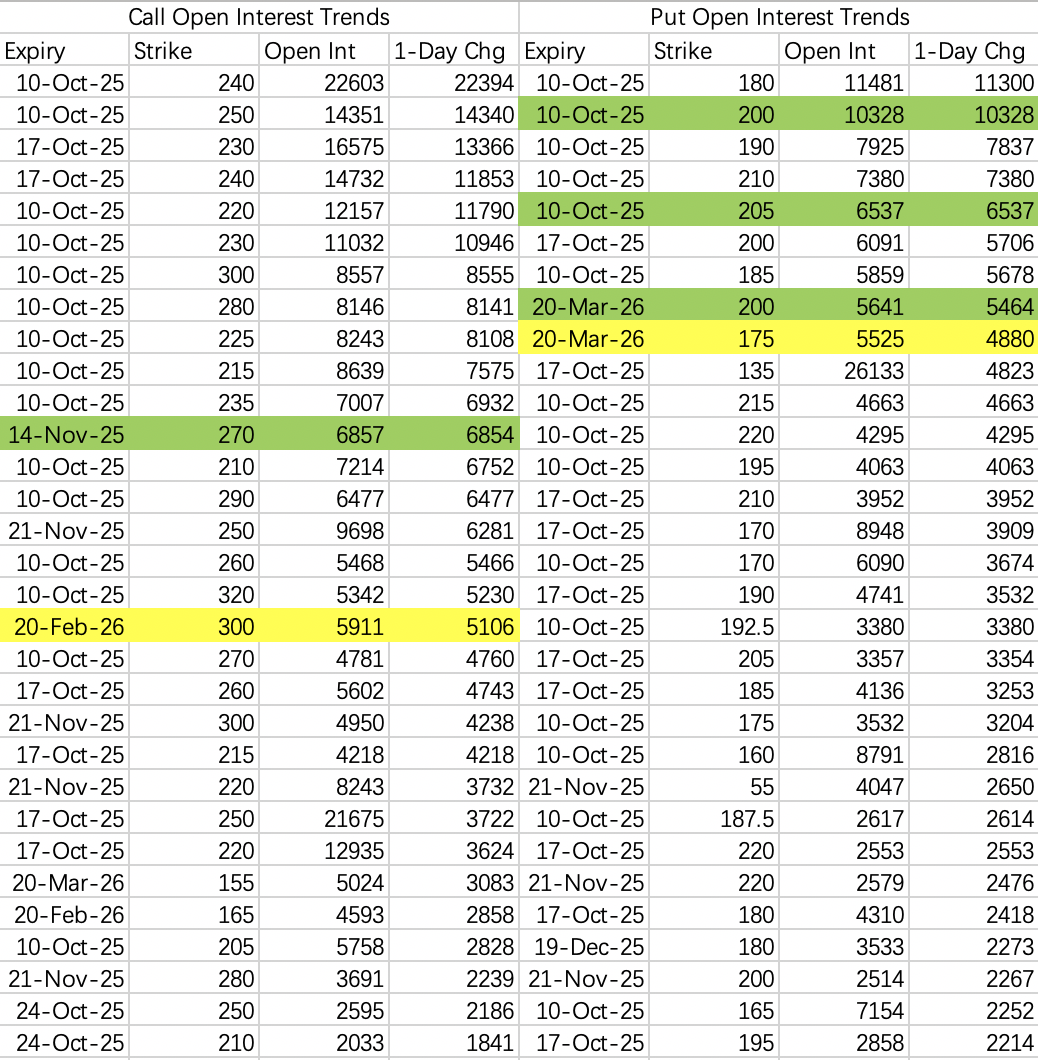

A relatively obvious trade to short IV by selling call options chose the November 14th expiration 270 call $AMD 20251114 270.0 CALL$ , which is very cautious.

Put option openings indicate a very bullish sentiment, primarily selling the 200 put. We can choose to sell the 190 put $AMD 20251010 190.0 PUT$ .

Yes, even though AMD surged 23%, it's still possible to continue going long. The market isn't bearish, and there's no reason to be bearish.

Noted a large long-dated roll trade: closing the December 180 call $AMD 20251219 180.0 CALL$ and buying the February 20, 2026 expiration 300 call $AMD 20260220 300.0 CALL$ . According to open interest data, 5,000 contracts of the 300 call were opened, with a transaction value of approximately over $3 million.

It's worth mentioning that Morgan Stanley's target price is 246, while Barclays' target price is 300. Morgan Stanley's basis is 30x P/E on 2027 EPS of $8.2; Barclays maintained their 2026 fiscal year forecast of $5.72 but raised the P/E ratio to 52x.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- AuntieAaA·10-08GoodLikeReport