Hugging NVIDIA’s Leg

$NVIDIA(NVDA)$

My first thought after seeing this earnings report: you don’t even need to watch options flow anymore—just sell puts at or near the money and you’re fine.

This quarter’s results were ultra-transparent and in line with expectations. Next quarter’s outlook is also easy to predict due to timing, so again, very transparent and in line.

But here’s the thing: if both this and next quarter are “as expected,” why should I care about big-picture future prospects?

Because on the call, Jensen Huang laid out an even more ambitious roadmap: the long-term TAM for AI infrastructure is raised dramatically to $3–4 trillion, and both inference AI and agent AI will drive compute demand up by hundreds or even thousands of times.

What’s also notable: within these “in-line” results, networking revenue hit a record $7.3 billion.

This clearly signals NVIDIA’s transformation from a GPU seller into a true “AI infrastructure” company.

That’s a game-changer, and you’ll see more in-depth takes from analysts and media soon.

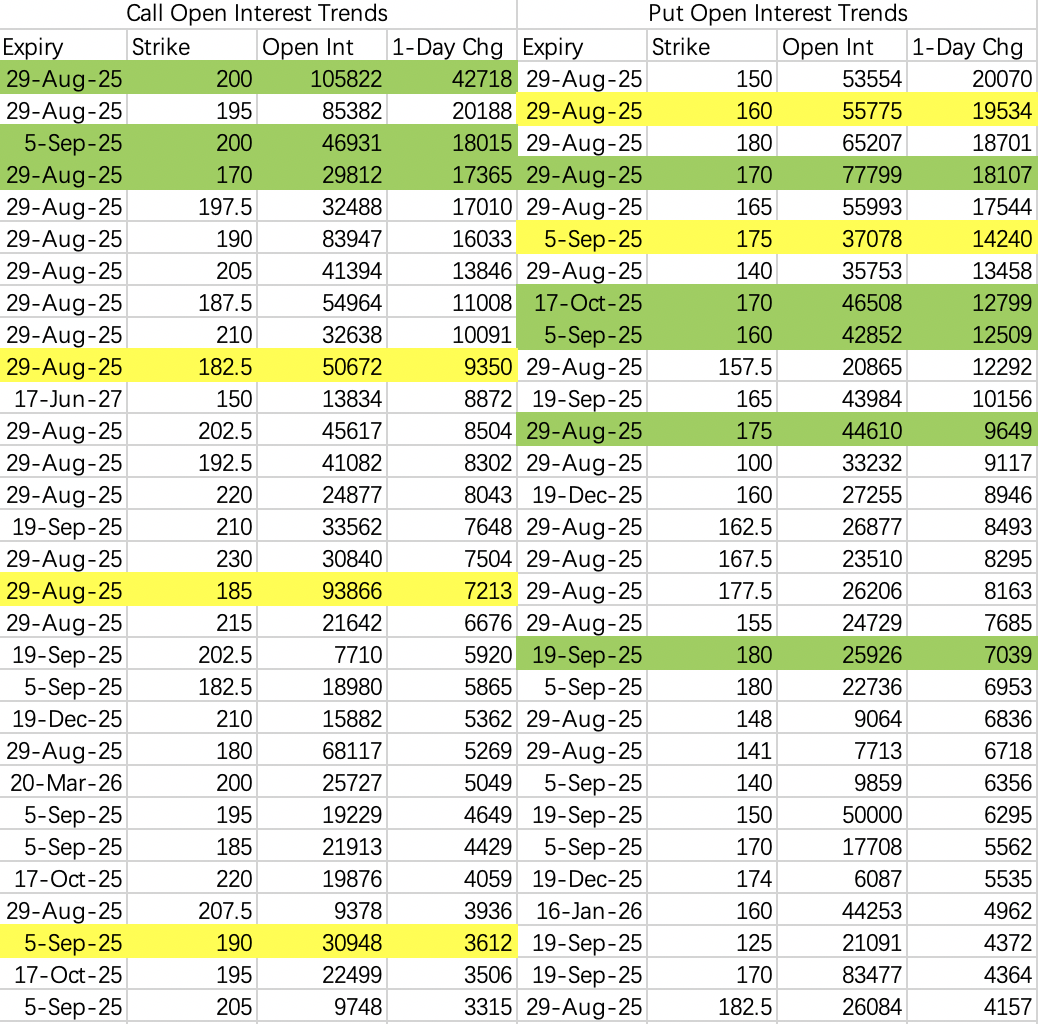

Back to the options flow:

The earnings “black box” is open, but Wednesday’s open interest is quite telling.

Biggest bearish bets are for a pullback below $175 in the next two weeks ($NVDA 20250905 175.0 PUT$ ), and some at $160 ($NVDA 20250905 160.0 PUT$ ).

If this were NVIDIA from a couple of years ago, that’d be a textbook bearish trade: September macro risks + in-line earnings = pullback. But with these results, it’s going to be tough to break below $170.

On the bullish side, there are bets on a move to $190–200. Given Jensen’s bullish AI outlook, $NVDA$ above $200 this year looks very doable.

For this week, as long as we stay above $170, keep selling puts on any dip.

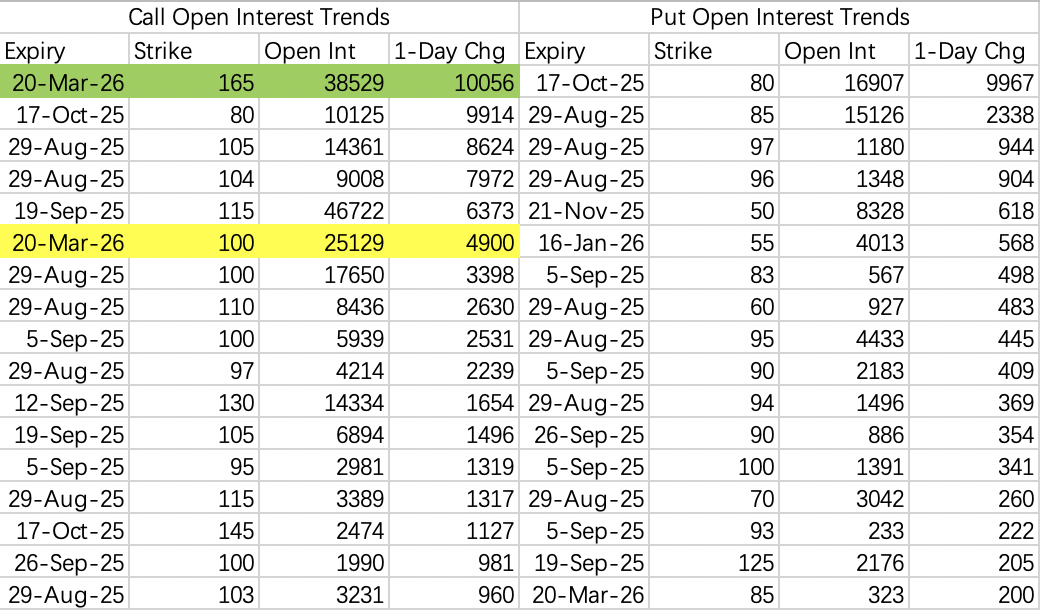

$CoreWeave, Inc.(CRWV)$

No surprise that $CRWV$ is a big beneficiary of NVIDIA’s earnings. The huge TAM upgrade for AI infrastructure has opened up upside for $CRWV$ as well.

There’s continued heavy buying of medium-term $100 calls ($CRWV 20260320 100.0 CALL$ , 5,000 contracts), hedged by selling twice as many $165 calls ($CRWV 20260320 165.0 CALL$ ).

But keep in mind, despite the massive potential, $CRWV$ still faces real pullback risk—target retrace is $80–85.

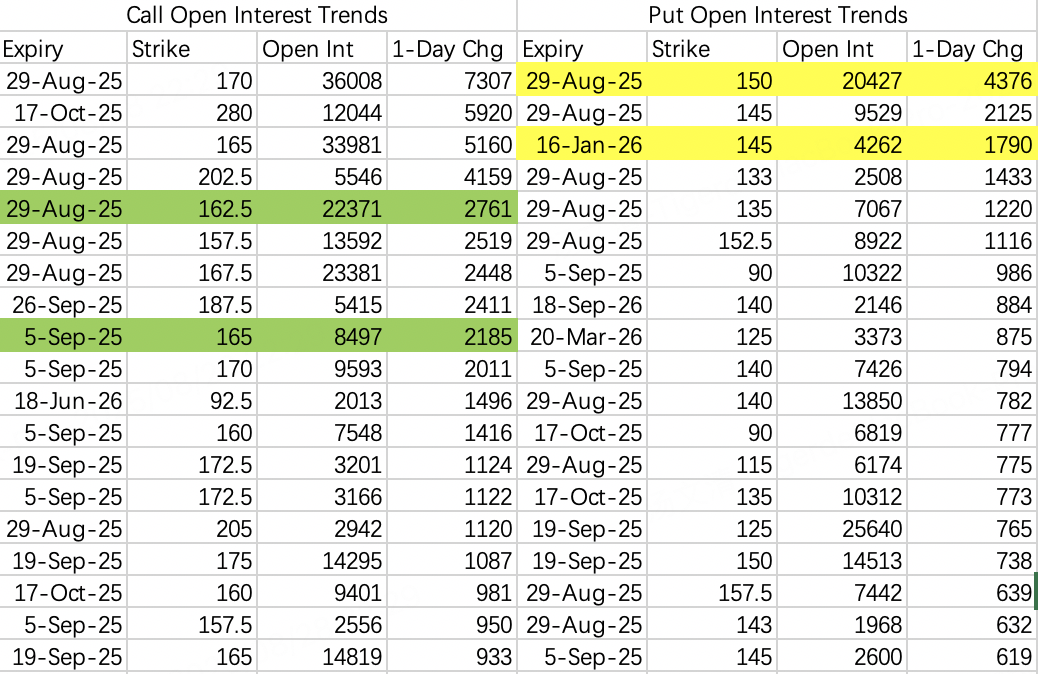

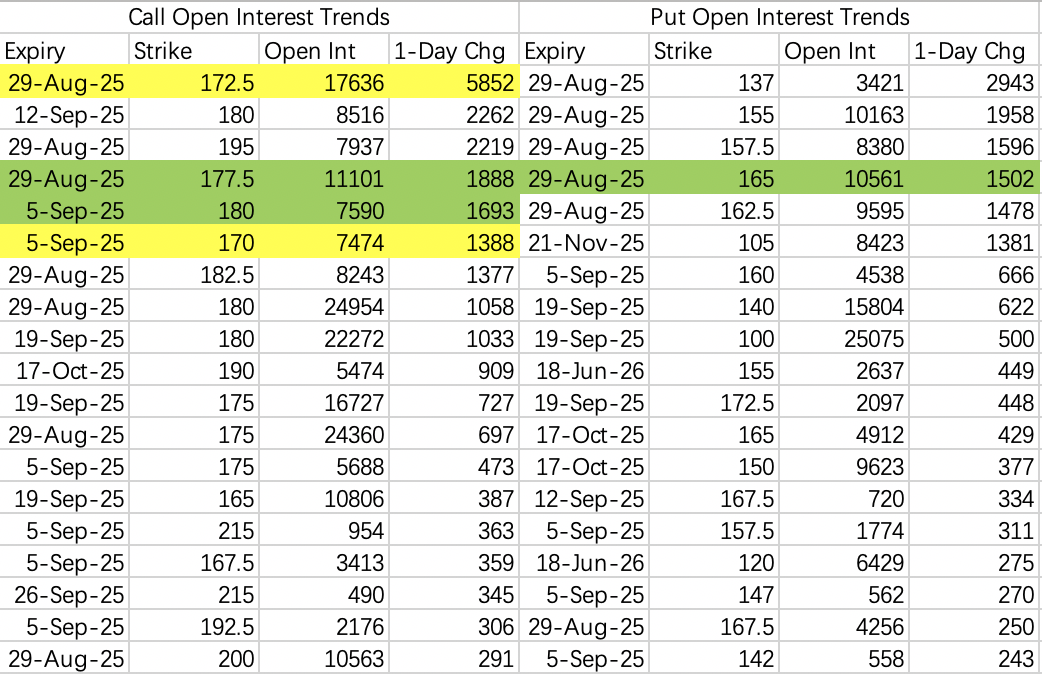

$Palantir Technologies Inc.(PLTR)$

$PLTR$ seems to have become the go-to AI stock for a pullback; odds are the price will keep correcting toward $140.

$Advanced Micro Devices(AMD)$

The options flow here looks a lot like $NVDA$, and the share price will likely follow a similar path. $AMD$ is still the perennial runner-up—selling the $160 put is a solid idea.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?