Has the pullback ended? Hard to say—it largely depends on whether Powell's speech at Jackson Hole takes a hawkish or dovish tone.

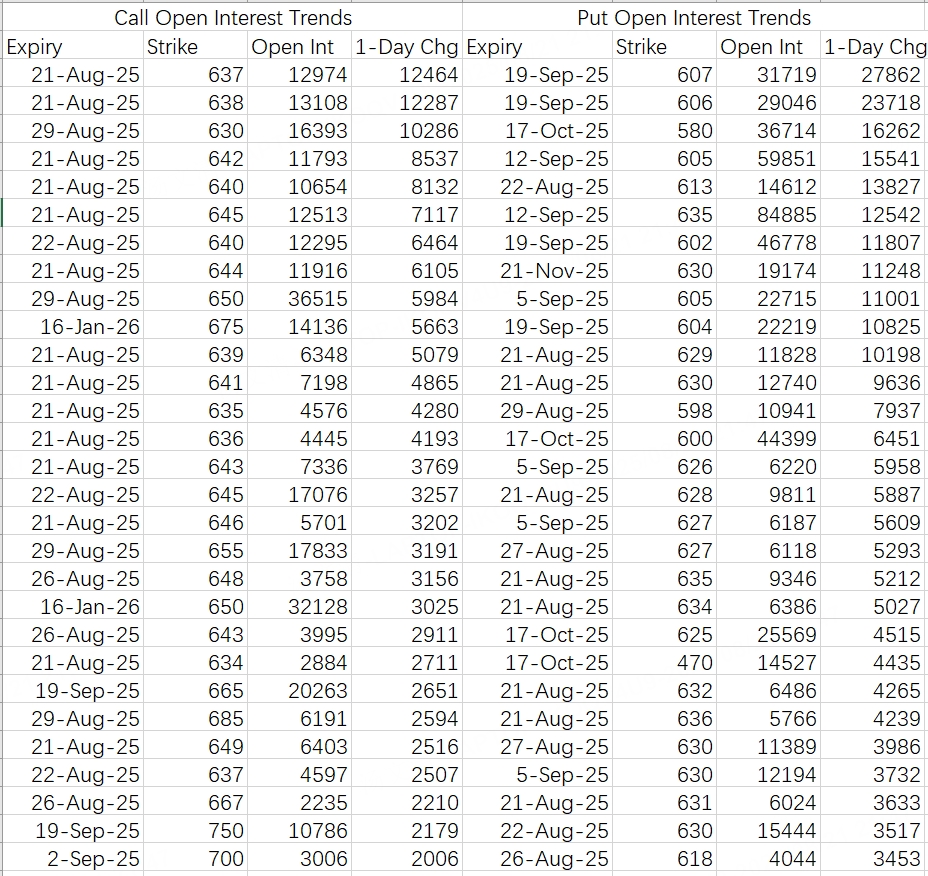

While Wednesday’s drop and subsequent rebound felt misleading, the put option openings should be taken seriously. The overall hedging level has shifted down a notch. Previously, SPY was hedging against a 630 pullback, but now it's targeting 610.

Historically, the market tends to be volatile during August and September. Proceed with caution, and avoid using leverage when going long.

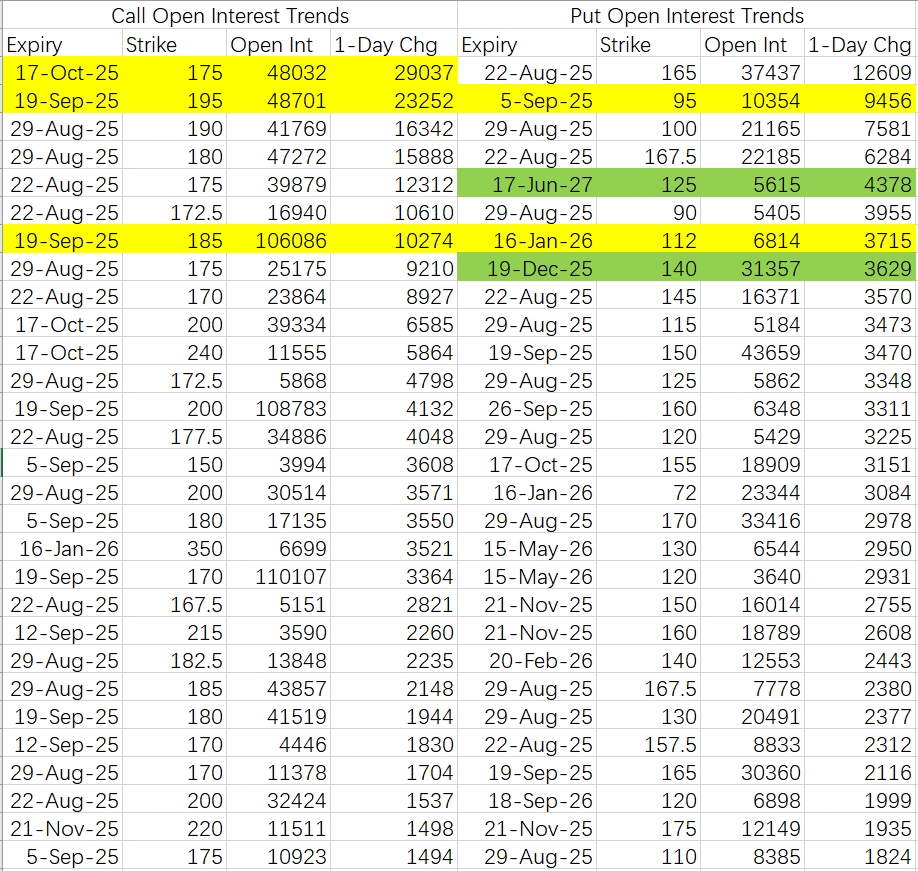

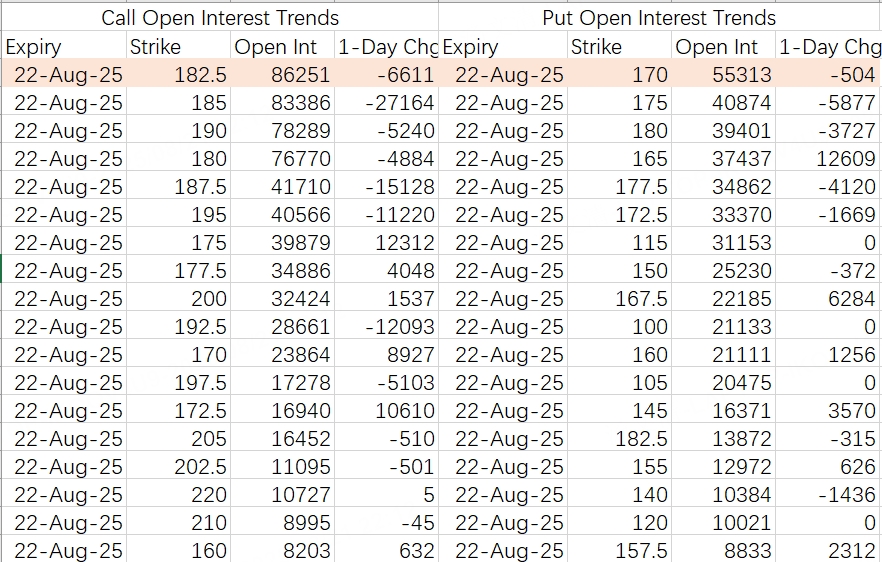

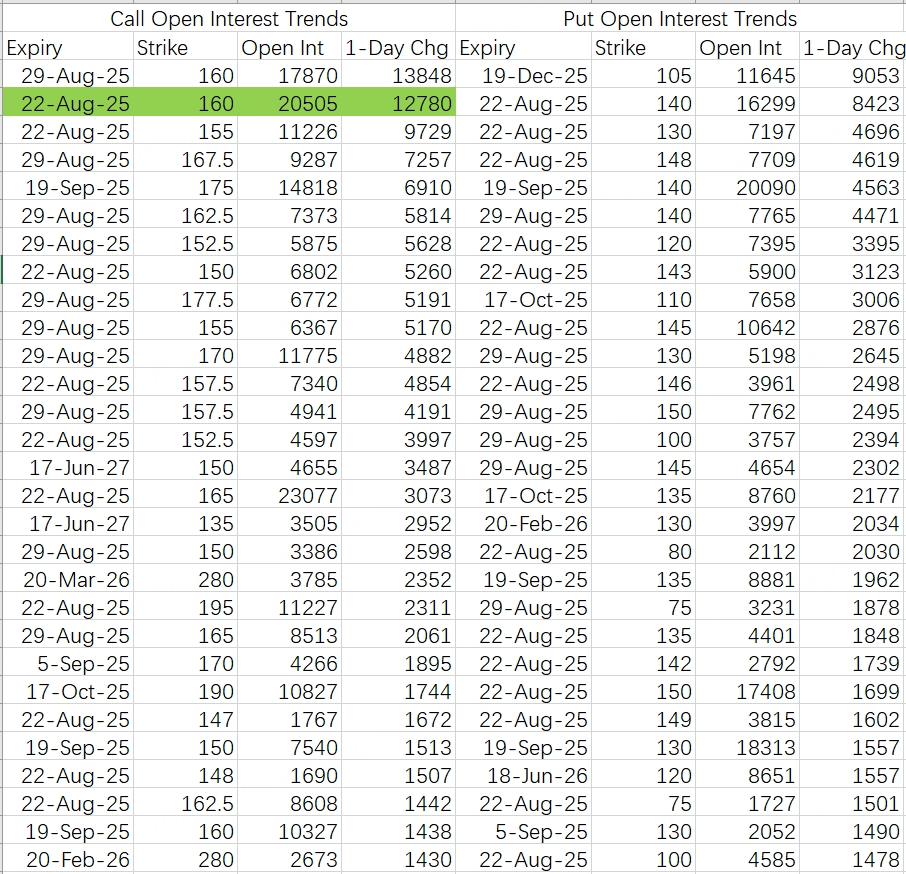

Nvidia is in a similar position. Bearish put options are being opened aggressively, indicating a potential pullback toward 160.

This week’s closing is expected to hold above 170.

AMD’s bearish put option positioning suggests a pullback to around 150.

$Palantir Technologies Inc.(PLTR)$

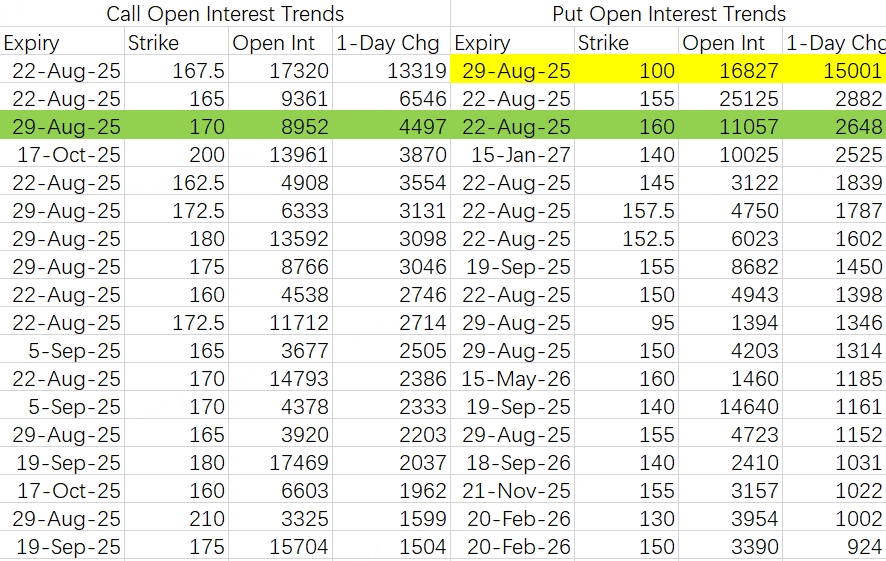

PLTR’s bearish put options suggest a pullback to around 140.

The strike prices for these bearish positions seem unusually low, which might indicate that the spike in out-of-the-money put activity is a result of rapid declines prompting hedging. However, compared to the put openings after the August 1st drop (as noted in the August 4 article), current expectations appear weaker.

A conservative trading approach is recommended for the near term.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- okalla·2025-08-21Great article, would you like to share it?LikeReport