All squeezed out

First, regarding Micron’s earnings report, the results are outstanding. The company expects its AI business to double by the end of fiscal 2025. Tied to the AI narrative, we all know what that means. The question is: following the prior rally, what price can we expect post-earnings?

Comparing industry peers, SK Hynix has already broken its all-time high, while Micron has yet to reach that level, so the potential is considerable.

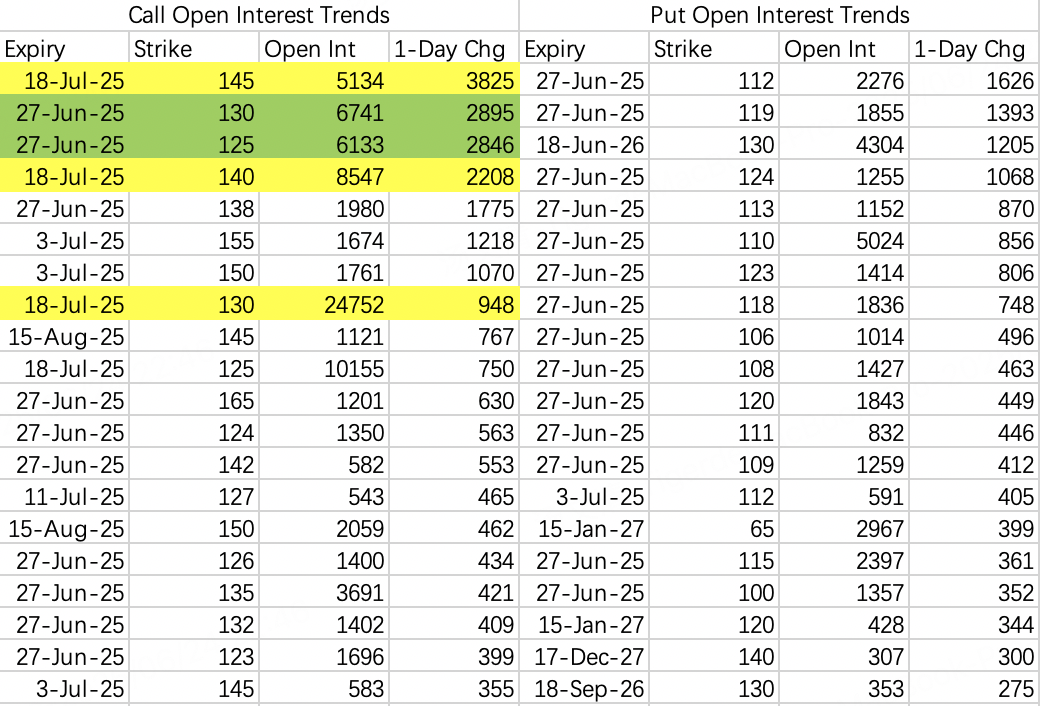

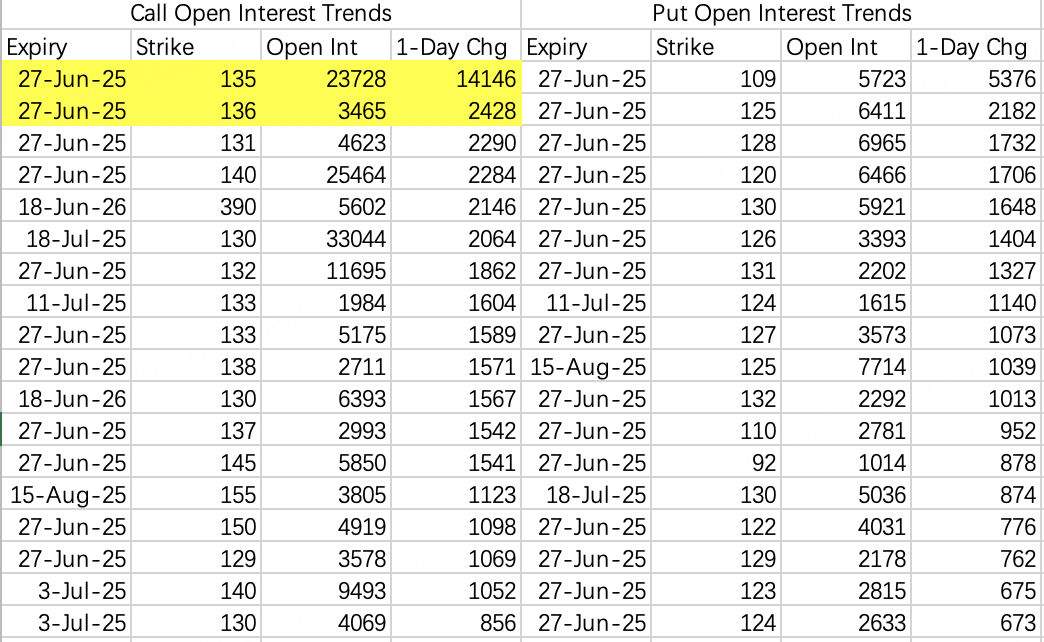

For this week’s earnings expectations, the stock price could reach 130. There are three types of bullish options trades:

For holders, selling calls at 145: $MU 20250718 145.0 CALL$ .

For weekly options traders, bull call spreads between 125-130.

For July monthly options traders, bull call spreads between 130-140.

A conservative strategy is selling puts at 115: $MU 20250627 115.0 PUT$ .

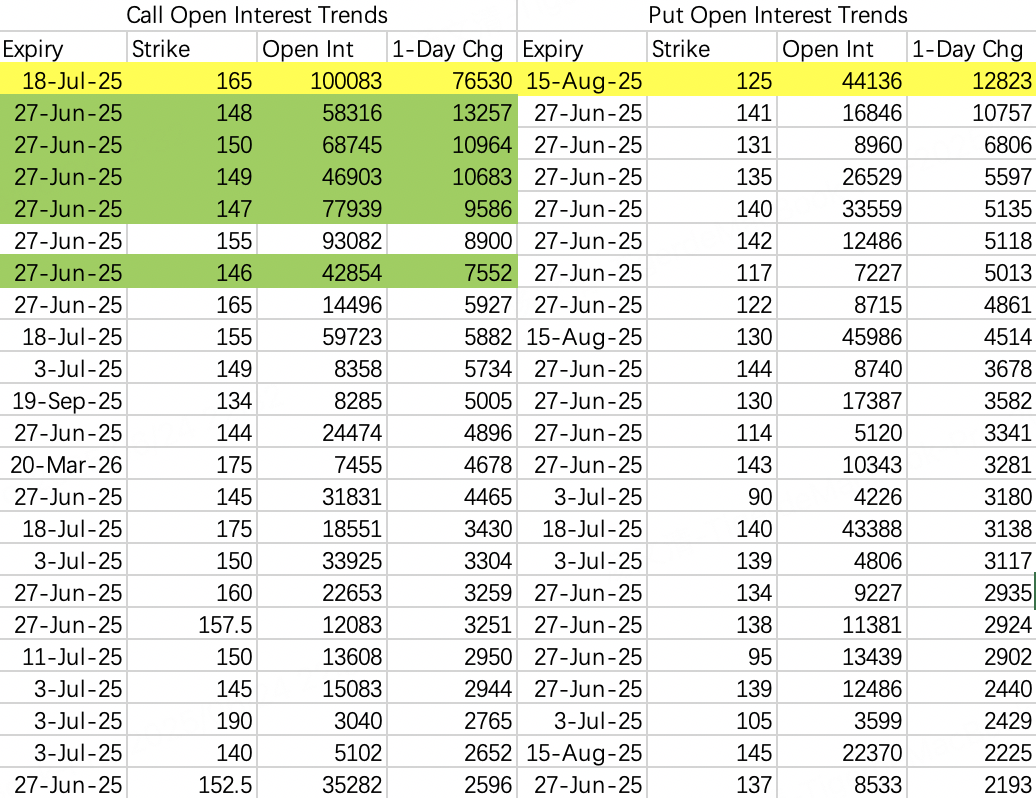

This week, there’s been a sudden surge in open interest for 146–150 calls expiring this week, causing institutions’ sell-call positions to almost face a short squeeze. I suspect the squeeze might materialize tomorrow.

Given the open interest numbers, it’s unlikely for semiconductors to pull back this week. The scale of this open interest, relative to trading volume, is abnormal. I’ve closed my sell-call positions above 150.

Although selling calls between now and mid-July would typically make sense, the market conditions suggest that options sellers are being hunted.

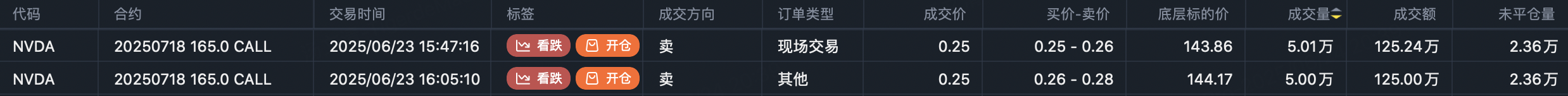

On Monday, NVIDIA had a massive sell-call order: selling 76,000 contracts of July-expiry 165 calls: $NVDA 20250718 165.0 CALL$ . The trading volume was around 100,000 contracts.

With the current price at 145, the strike price of 165 is far out-of-the-money. The seller seems bearish, but due to the large trading volume, the strike price had to be set this far out to avoid significant impact on the stock price.

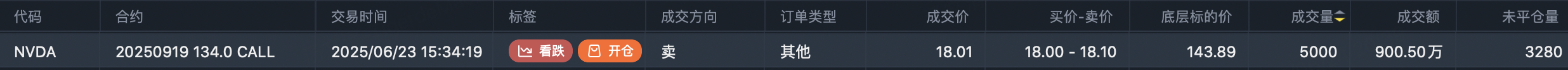

Another bearish trader sold deep in-the-money calls for September at 134: $NVDA 20250919 134.0 CALL$ .

On the downside, there was also a large sell-put order for August-expiry 125 puts: $NVDA 20250815 125.0 PUT$ , with 12,000 contracts opened.

Let’s observe whether this short-squeeze trend continues or ends following Micron’s earnings.

AMD’s bullish options also saw abnormal open interest, with 14,000 contracts opened for the 135 call expiring this week. After the market opened, the stock price surged, forcing institutions selling calls to roll their positions to 141.

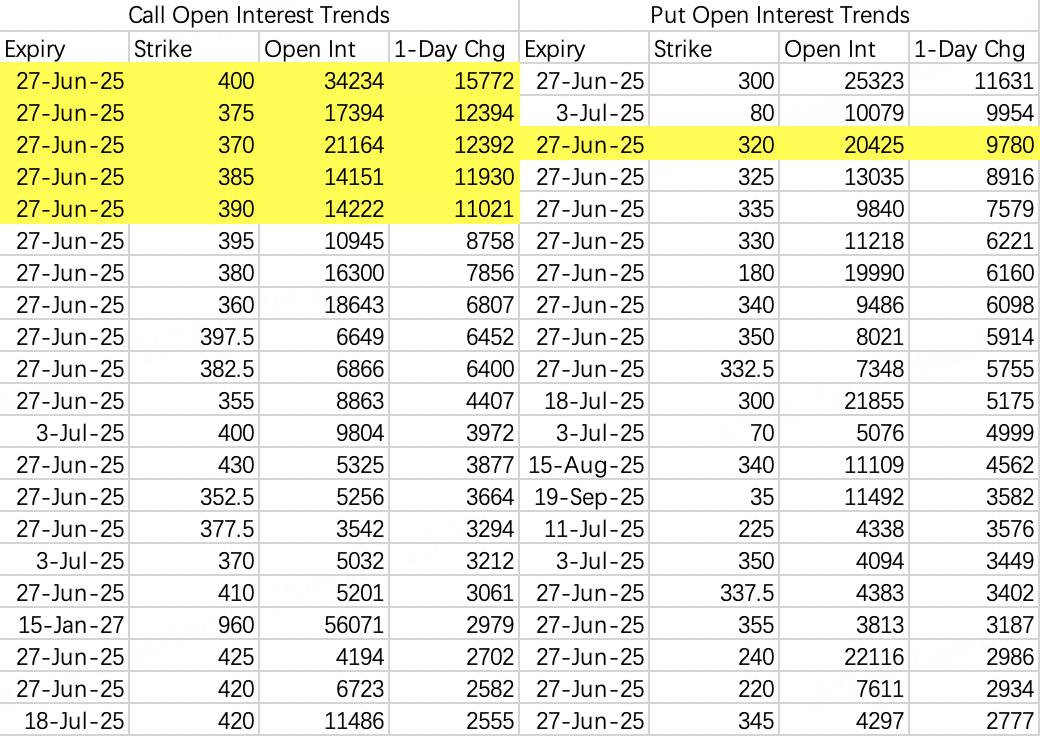

After Monday’s short squeeze, institutions rolled their sell-call positions to 370–380. The pullback levels are estimated at 300–320.

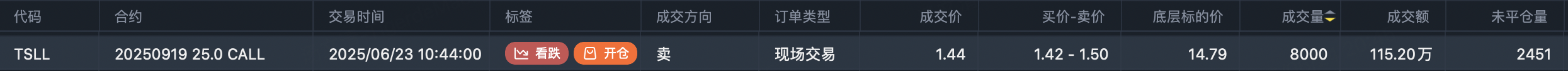

Additionally, at Monday’s peak, someone sold calls for a 2x leveraged bullish ETF on Tesla with a strike price of 25: $TSLL 20250919 25.0 CALL$ . This trade is quite interesting. You can compare TSLA and TSLL prices to see the shocking extent of leverage ETF decay.

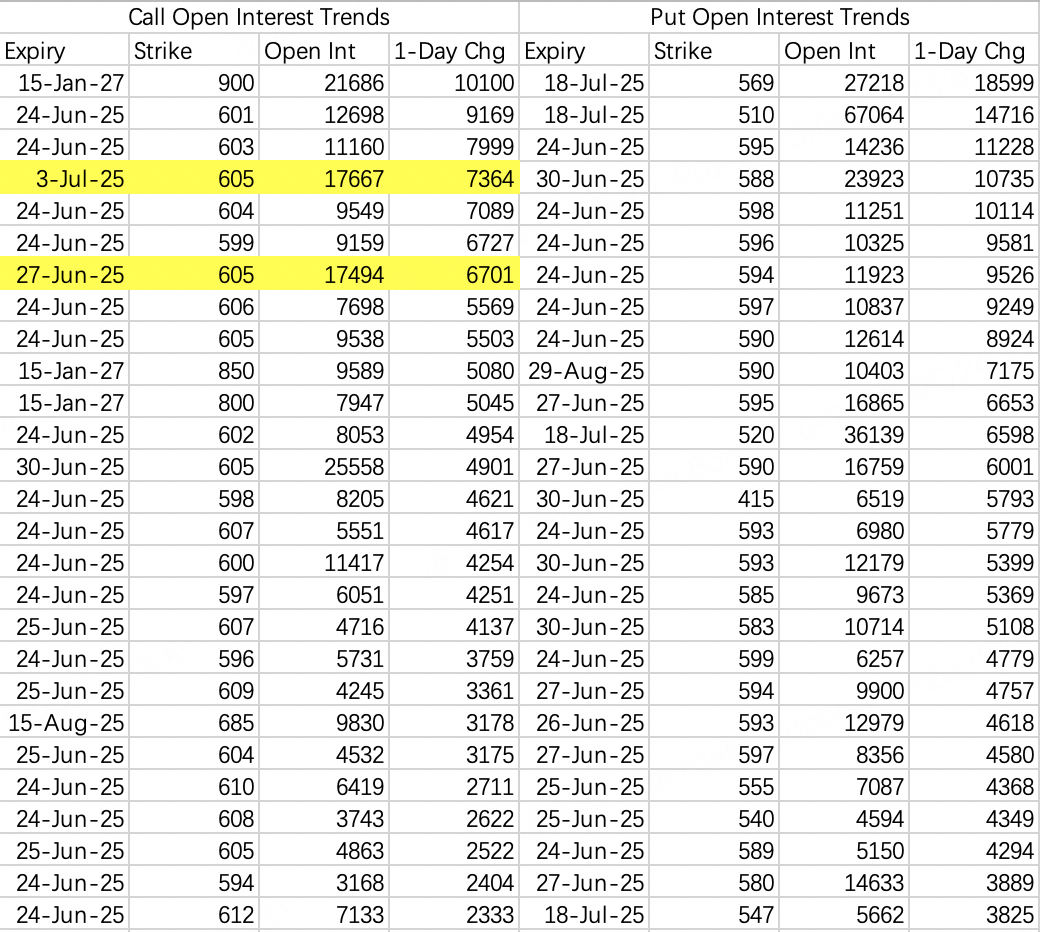

SPY is also a major short-squeeze zone, with gains exceeding expectations. Based on Monday’s volatility, the highest expectation was 605, but SPY has already reached 606.

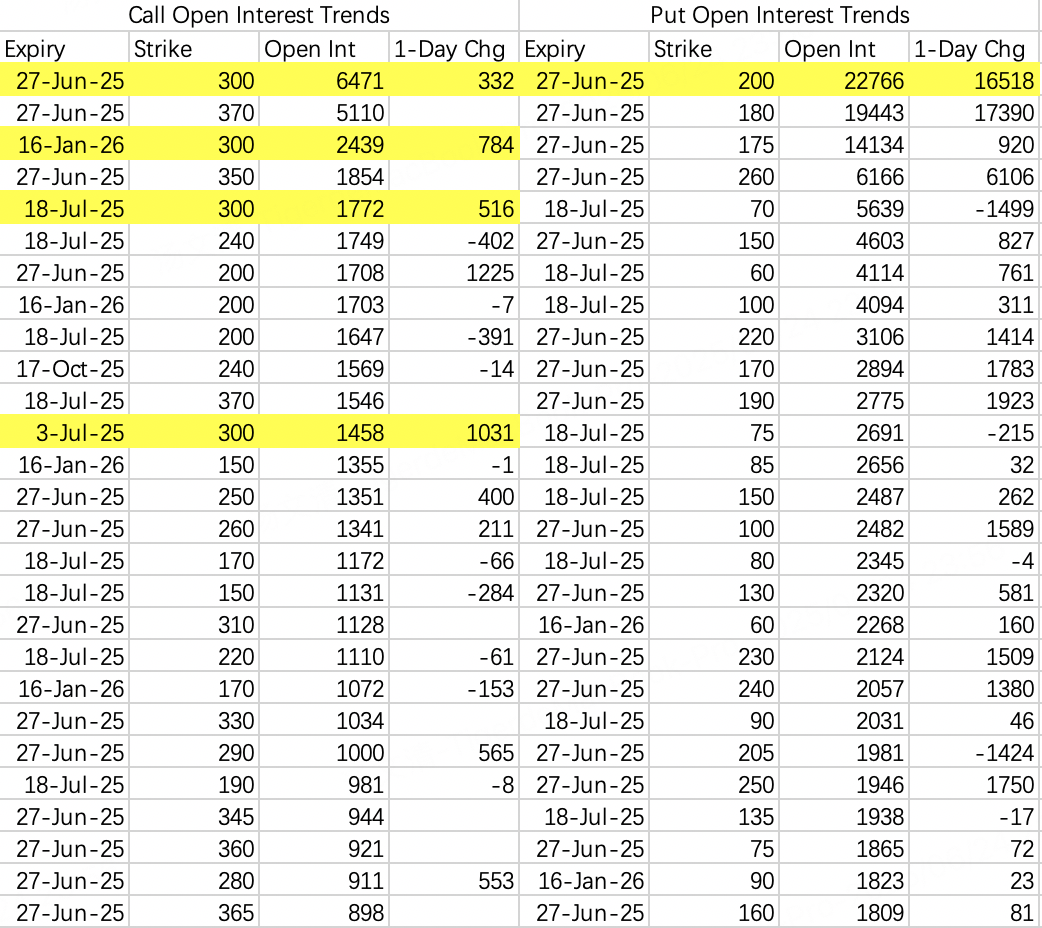

At present, it seems unlikely for CRCL to break above 300 this week. The initial downside target is set at 200, leaving the stock in a no-man’s land. Sellers can select strike prices above 300 or below 200 for short-volatility trades. Additionally, note that CRCL requires very expensive margins, so it’s better to choose strike prices conservatively to avoid being squeezed.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Tiger_CashBoostAccount·2025-06-27Great job on your latest stock market success! Your commitment to research and analysis is evident in your results.Trade with Tiger Cash Boost Account and use contra trading toenhance your strategies."Welcome to open a CBAtoday and enjoy access to a trading limit of up to SGD 20,000with upcoming 0-commission, unlimited trading on SG, HKand US stocks. as well as ETFs.

- How to open a CBA.

- How to link your CDP account.

- Other FAQs on CBA.

- Cash Boost Account Website.

LikeReport - How to open a CBA.