What To Expect From The US Stock Market In 2025

Entering the new year, it's time to update the forward-looking series of anticipation for this year's market overview. I have shared and discussed this series with you every January since 2019. It is obvious to all how accurate it is. Although the details are slightly biased, the general direction is generally correct. I suggest you keep it for later use and continue to review it later. Be prepared for more investment. As usual, let's start with the U.S. stock index.

Recently, some domestic economists are discussing the situation of the U.S. stock market, believing that the U.S. stock index will burst and fall in the next 3-6 months. Although I am skeptical about whether the data listed in the report will burst within 3-6 months, I agree that there is a bubble in the US stock index.

Looking back at the trend of the US stock index before the sharp drop in history

The existence of a bubble in the U.S. stock index is not a matter of this year, but two years ago, even since the COVID-19 pandemic Federal Reserve printed money in large quantities, there have been endless market voices about the existence of bubbles in such U.S. stock indexes.

Let's see that Buffett's cash ratio has been hitting a new high. It is not a problem that there is a bubble in the U.S. stock index. But when does the bubble burst? It takes some important events to pierce it quickly, otherwise there will be a "process" of turning.

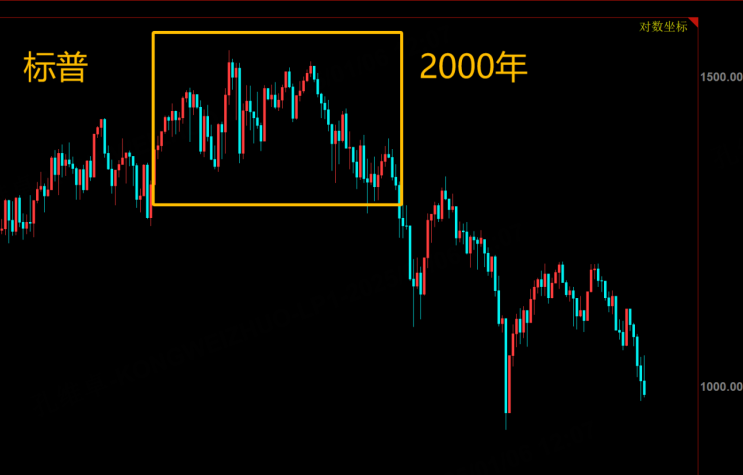

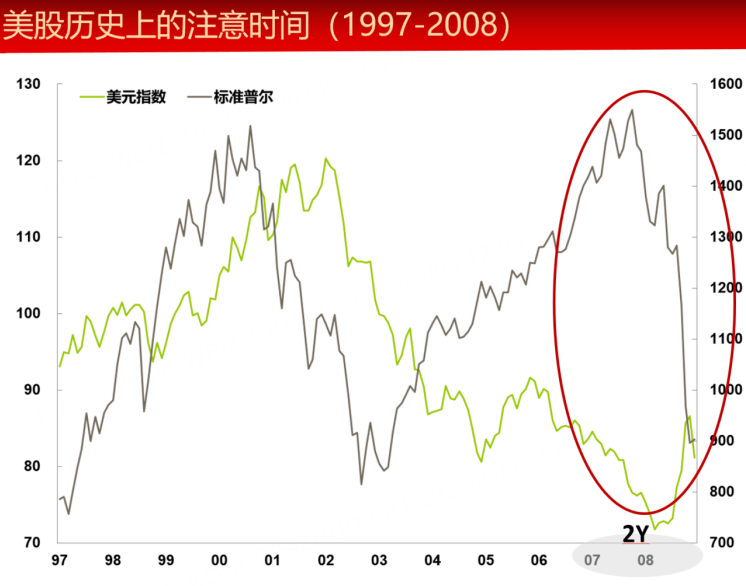

Looking back at the two major bubble bursts of the U.S. stock index in 2000 and 2008, you will find that it always takes about a year for the U.S. stock index to brew before the big risk comes, which may be the big top in the future, but it was not very clear at that time. Therefore, I personally prefer that the trend of the U.S. stock index in 2025 will be closer to the "sunset before darkness". The bright spots still exist but the market will gradually slow down until it turns.

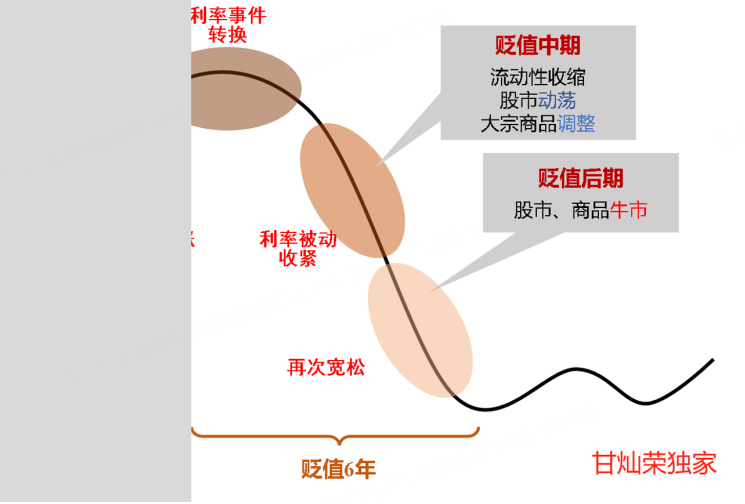

Calculated based on the US dollar interest rate cut cycle

Since the Federal Reserve started the interest rate cut cycle in September last year, the cycle of the U.S. dollar has officially entered the final stage. The bulk assets at this stage are usually long, but only the U.S. stock index has a small increase compared with other varieties. Either it is an emerging market index or a commodity. Affected by the spillover effect of the U.S. dollar interest rate cut, its increase is greater than that of the U.S. stock index.

Although the fundamentals are different from history, given the current bubble in U.S. stock valuations, it will be safer and more cost-effective to hold anti-inflation assets (such as crude oil, gold, agricultural products, etc.) in spillover dollars.

Therefore, under the interest rate cut cycle, even if the U.S. stock index is in the process of "topping", there may not be a big risk, but the rate of return is limited. Perhaps, as China's domestic economic stimulus policy continues to increase, it is not surprising that A-shares will perform better than U.S. stocks this year. It is also possible that spillover dollars will flow into the country. Everyone should look at the recent changes from a dynamic perspective and allocate assets reasonably.

$NQ100 Index Main 2503 (NQmain) $$SP500 Index Main 2503 (ESmain) $$Dow Jones Index Main 2503 (YMmain) $$Gold Main 2502 (GCmain) $$WTI Crude Oil Main 2502 (CLmain) $

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- NotWizard·01-07a lot of things will change, trump will take control, lets see what policies.LikeReport