Equity market won't be a 'one-way street' as hiking cycle gets under way: Deutsche Bank's Ruskin

Stock-market bulls and bears are set to fight a "titanic battle" in the months ahead as the Federal Reserve prepares to lift interest rates, a top macro strategist warned late Tuesday.

The equity market, which has stumbled heavily to begin 2022, as Treasury yields rose and investors ramped up expectations for an aggressive series of rate increases and other measures by the Fed, will be "far from a one-way street," wrote Deutsche Bank's Alan Ruskin in a note.

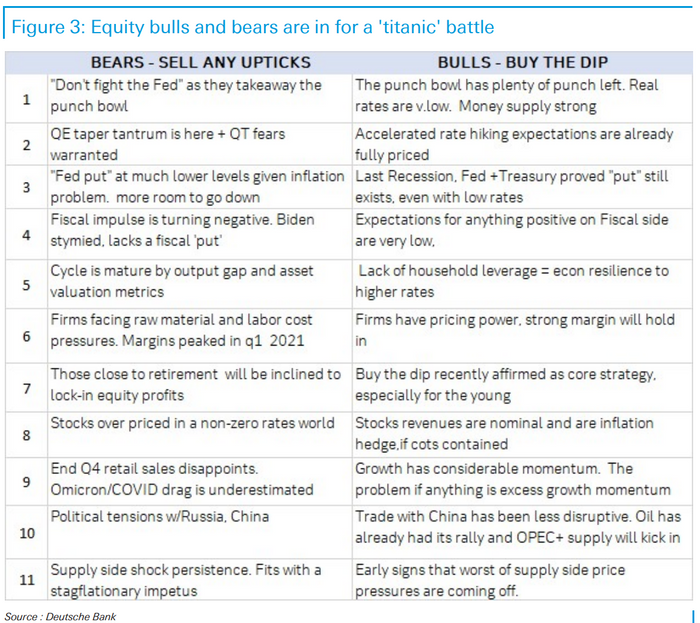

To that end, he offered up a list of 11 arguments "that bulls and bear can use to counterpunch each other." (See below.)

"As always it is how these factors are ranked and weighted in importance that counts. For example the idea that the Fed is taking away the punch bowl may be enough to trump most the other factors -- although historically (and contrary to popular opinion) equities have generally done reasonably well when tightening is under way," Ruskin wrote.

As noted by MarketWatch's Mark DeCambre, data compiled by Dow Jones Market Data going back to 1989 shows the average return for the Dow Jones Industrial Average during hiking cycles is nearly 55%, while the S&P 500 has seen an average rise of 62.9% and the Nasdaq Composite has averaged a positive return of 102.7%.

The Fed, at the conclusion of its two-day meeting on Wednesday, issued a statement that laid the groundwork for a widely expected March rate increase. Stocks initially extended gains following the policy statement, then erased their advance during Federal Reserve Chairman Jerome Powell's news conference, ending mostly lower.

Traders have priced in an aggressive round of rate hikes in 2022. Some have even penciled in the possibility of a 50 basis point, or 0.5 percentage point, rise in March rather than the more widely expected, and usual, 25-basis-point rise. Some market watchers contend that market participants have become overly aggressive on rate expectations, leaving room for a positive surprise if Powell doesn't significantly enhance the central bank's already hawkish posture.

Looking ahead, Ruskin said risky assets are likely to be resilient to 25 basis point rate increases at the March, May and June meetings, even if that pace isn't fully priced into the market, "as long as the path of tightening does not acknowledge a still quicker and more extensive tightening cycle ahead."

He noted that the market has only a little more than 50 basis points of hikes priced in for 2023, helping to keep expectations for the ceiling on the fed-funds rate, referred to as the terminal rate, below 2%.