- Flagship fund is down 5% this year after a 149% gain in 2020

- Newcomer Dimensional is gaining ground on Cathie Wood’s firm

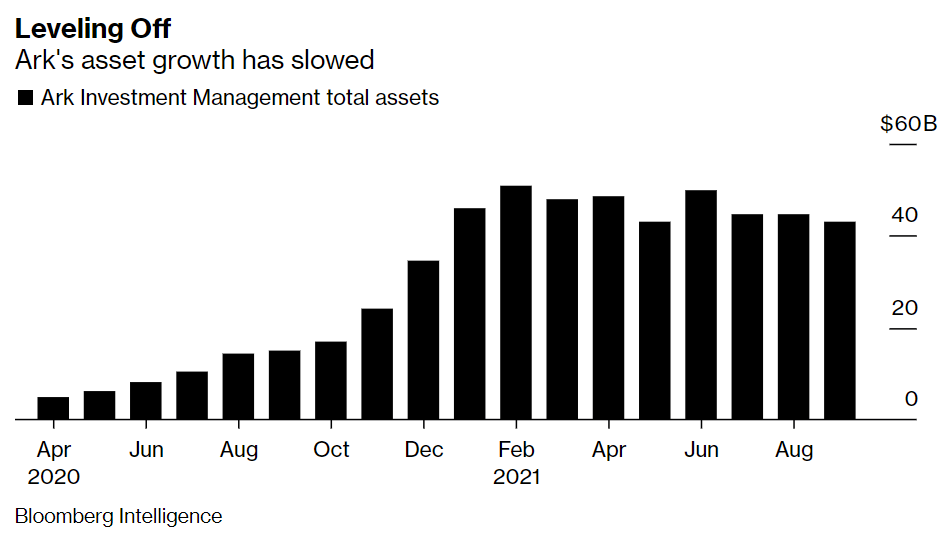

After vaulting up the ranks of the U.S. exchange-traded fund leaderboard, Ark Investment Management is starting to slip.

With about $42.4 billion in its ETFs, Cathie Wood’s firm now ranks as the 11th largest issuer by assets, according to Bloomberg Intelligence data.

The money manager had cracked the top 10 earlier this year, buoyed by a torrent of inflows as investors flocked to Wood’s innovative vision. But competition is rising just as the shine comes off Ark’s flagship $21 billion ARK Innovation ETF (ticker ARKK).

As the firm’s assets have dipped slightly, rival WisdomTree has edged ahead. Meanwhile, industry newcomer Dimensional Fund Advisors is nipping at Ark’s heels, with less than $3 billion separating the two issuers after the quant giant’s latest mutual fund conversions.

At the same time, ARKK has fallen over 5% this year -- after soaring nearly 150% in 2020 -- as the prospect of inflation and rising rates takes the shine off the kind of long-term tech bets favored by Wood.

“Nobody’s running for the door, but the market hasn’t been supporting the core funds the way it was in 2020,” said Dave Nadig, chief investment officer at data provider ETF Trends. “Add to that the strong asset growth in ‘big cheap beta’ and huge moves like DFA converting funds, and the top of the leader board’s going to be in flux for a while.”

Wood and Ark’s ETFs beat most of the market in 2020, boosted by hefty allocations to electric-vehicle maker Tesla Inc. and other disruptive names. The outperformance came to an abrupt end this year when a spike in Treasury yields unseated many growth-centric stocks.

While rates have declined in the months since, many of Ark’s previous high-flyers have yet to recover as inflationary fears remain.

To be sure, Ark funds are still sitting on $12.6 billion of inflows so far this year. It’s far too early to sound the death knell for the firm, according to Bloomberg Intelligence’s Eric Balchunas.

Wood’s entire ETF stable commanded around $15 billion a year ago. Assuming no mass exodus, it’s possible that “Ark mania” could reignite again should speculative technology stocks come back into vogue, he said.

“While Ark mania may have died, Ark is alive and well at more than $40 billion, which is an astounding amount for an indie active issuer,” said Balchunas, an ETF analyst. “If they can hang tough during these tougher times, it bodes very well for when they go into ‘shiny object’ mode again.”