Of all the things to consider before buying a stock, understanding who owns the company’s equity is rarely a top-of-mind factor. In the case of AMC, however, the story may be a little different.

Today, Wall Street Memes looks at AMC stock’s ownership and explains why it could have an impact on how the company operates – and how the stock behaves.

AMC largest holders

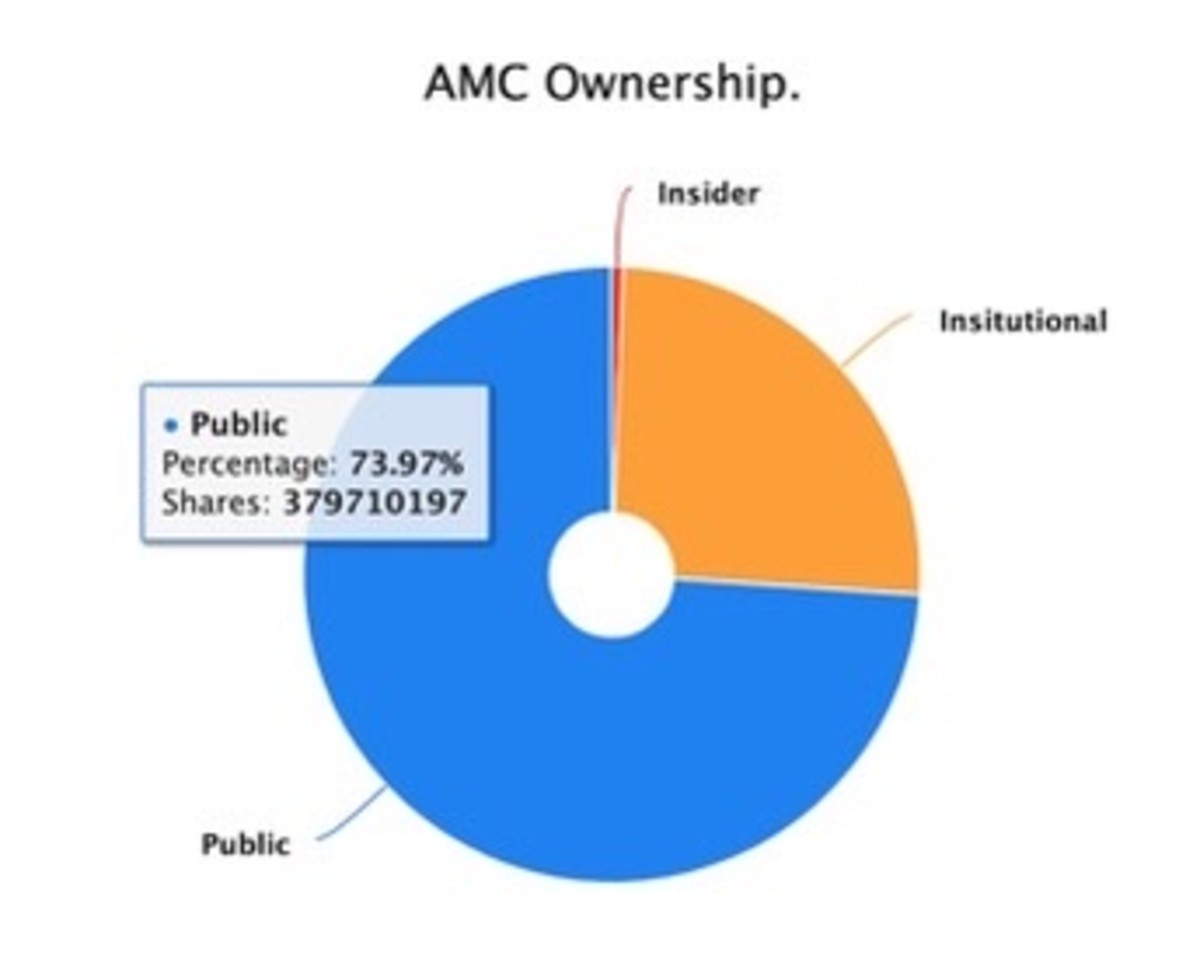

According to data provided byYahoo Finance, AMC has a float of 513 million shares. Of the total, about 74% is owned by the public, 25% by institutions and 0.3% by insiders – directors, company's officers, and those with access to company information before it becomes public.

Among institutions, Vanguard and Blackrock are the top holders, with 8% and 6% of the shares, respectively. Naturally, these firms turn their holdings into shares of ETF, which in turn can (and usually do) end up owned by more individual investors.

In May, AMC's previous largest shareholder, China's Dalian Wanda Group Co,sold30.4 million of its shares purchased in 2012 for roughly $430 million – funny enough, only days before AMC stock spiked from $14 to over $60 apiece. Currently, Wanda owns only 10,000 shares, representing a small $420,000 in market value.

After the large Wanda sale, AMC's CEO Adam Aronrevealedthat no entity held an ownership stake above 10%.

Implications for the stock

A company whose ownership is widely distributed across the general public, as is the case of AMC, can benefit in a couple of ways. For instance, AMC can implement or change company policy without necessarily being aligned first with a handful of key shareholders.

AMC’s ownership layout allowed for something curious to happen recently. CEO Adam Aron put to a vote theissuanceof 25 million new shares, which was then vetoed by a majority of AMC shareholders due to fears over a share price decline. Were AMC primarily owned by only a few, the polling would have likely not even taken place.

In the end, the ownership structure allows AMC the flexibility to make its strategic decisions with certain independence – unless the management team chooses to consult with the broader base of individual investors more often.

In conclusion

AMC stock is owned, by and large, by retail investors – roughly speaking, the AMC ape community. Based on the latest shareholder count providedby AMC itself, the percentage of general public ownership is now greater than 80%, with each retail investor holding around 120 shares ($5,000) on average.

Wall Street Memes believes that this is a good setup for AMC’s retail investors, as the fate of the company depends much less on the agenda of large institutions and a few insiders.

![[得意]](https://c1.itigergrowtha.com/community/assets/media/emoji_005_deyi.481846cc.png)