Summary

- I am very bullish on Microsoft as I believe the company is undervalued relative to the company's fundamentals and long-term potential.

- The company is scheduled to report earnings on July 27th, and it will be a closely watched event, not just for MSFT shareholders but for the entire market.

- Whatever the company reports, market participants will take the company's results as a barometer for the health of the economy.

- I focus on: (1) Microsoft's topline growth in the cloud business segment, (2) Microsoft's level of shareholder returns, (3) Microsoft's guidance for 2H 2022.

- Going into earnings, I am increasing my exposure to MSFT stock and buying time-sensitive call options as a short-term play.

Thesis

I am very bullish on Microsoft (NASDAQ:MSFT) as I believe the company is undervalued relative to the company's fundamentals and long-term potential. The company is scheduled to report earnings on July 27th, and it will be a closely watched event, not just for MSFT shareholders, but for the entire market. Whatever the company reports, market participants will take the company's results as a barometer for the health of the economy. That said, here are the three key metrics that I will monitor like a hawk: (1) Microsoft's topline growth in the cloud business segment, (2) Microsoft's level of shareholder returns, (3) Microsoft's guidance for 2H 2022.

Microsoft Earnings Preview

According to the Bloomberg Terminal, as of July 17th, 30 analysts have submitted their estimates for Microsoft's results. Total sales are estimated between $51.82 billion and $53.0 billion, with the average estimate being $52.51 billion. Notably, if we take the average as the anchor, sales are estimated to grow 13.8% as compared to the same quarter in 2021. Respectively, EPS estimates are $2.36 and $2.35 with an average of $2.3.

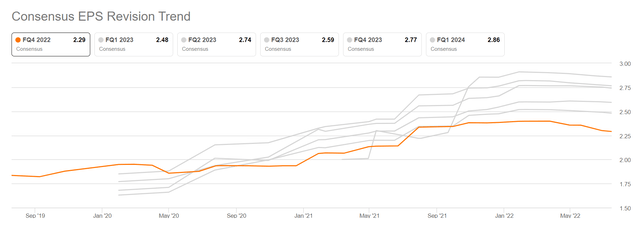

I would like to highlight that EPS expectations for Microsoft's upcoming quarter flattened in 2022 and even started to decrease. While this takes some pressure off from the results, it also shows that Microsoft's business is not immune to a worsening macro-environment and there is downside risk for the company's financial performance.

Seeking Alpha

Most importantly, about a month ago Microsoft issued a profit warning, which was related to losses on currency exposure. A strong dollar usually negatively impacts international corporations such as Microsoft. And ever since the profit warning, the greenback has done nothing but strengthen.

1. The Cloud Business Segment

In October 2021, Microsoft made a statement that implies how the company's cloud business is poised to benefit from inflationary forces:

Digital technology is a deflationary force in an inflationary economy. Businesses - small and large - can improve productivity and the affordability of their products and services by building tech intensity. The Microsoft Cloud delivers the end-to-end platforms and tools organizations need to navigate this time of transition and change.

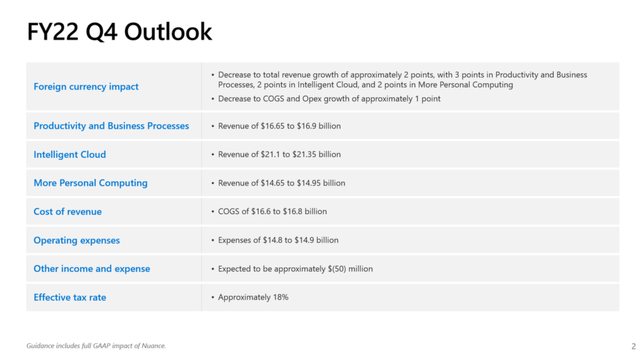

Now the market expects concrete numerical support for this statement. The expectations for Microsoft's cloud topline growth are highly elevated and have not decreased one iota, even amidst the challenging macro-environment. Notably, Microsoft guided revenue from intelligent cloud between $21.1 and $21.35 billion. If materialized, this would imply a quarter-over-quarter growth of more than 10% - and about 50% on an annualized basis.

Microsoft Earnings Presentation Q3 2022

2. Shareholder Returns

In the past quarter, Microsoft returned $12.4 billion to shareholders in the form of share repurchases and dividends. Notably, this is an increase of 25% as compared to the same period one year prior. As of the past quarter, Microsoft still had$104.67 billion of cash and cash equivalents on the balance sheet. As an investor, I would like to see that Microsoft continues returning capital to shareholders. Now, especially as the stock is cheap, I would hope for an acceleration/increase of the $60 billion repurchase program, which was announced in September 2021. Personally, given Microsoft's cash holdings and healthy business model, I do not see it as probable that this key metric will surprise to the downside. In any case, if Microsoft had repurchased less than $8 billion worth of stock during the quarter, I would definitely be negatively surprised - and likely so will be the market.

3. Guidance For 2H 2022

In the past, Microsoft has voiced a bullish outlook on IT demand and especially Cloud. And I would like to hear further support for this statement. Any slight deviation in tone of confidence would likely be a huge disappointment for investors and might cause a significant sell-off in the stock. Microsoft's topline cloud growth is likely the single most important metric to watch for the upcoming results.

With regards to Microsoft's "More Personal Computing" segment, I expect a negative guidance. It was $14.5 billion in Q3 2022 in the past quarter, and I believe the number will remain flat for the Q4 quarter. Moreover, given slowing demand for PC sales, I expect an equally bearish guidance. However, this outlook is arguably priced in, and I argue that as long as Microsoft is not guiding a significant decrease of sales volume (I anchor on -10%), the market will probably ignore the negativity.

As of 2021, advertising accounts for approximately $10 billion of Microsoft's sales, ranking Microsoft as the 4th biggest digital advertising player in the US. In connection to the analyst conference call, I would like to learn more about Microsoft's partnership with Netflix (NFLX). This deal is definitely a positive catalyst for Microsoft's ad tech business segment as it lends credibility to the company's strength in ad-tech. It would be interesting to learn if, and how, Microsoft is pushing to expand this business segment going forward.

How I Trade The Earnings

My personal opinion is that Microsoft will crush expectations for the upcoming earnings event. My argument is anchored on the thesis that this "recessionary environment" is not driven by topline growth contraction, but by cost inflation. That said, high-margin tech companies such as Microsoft will only be bruised by the current slowdown. Moreover, I agree with CEO Satya Nadella that Microsoft's value proposition is structurally relatively resilient. Especially in a challenging economic outlook, Microsoft customers are pressured to invest in order todo more with less:

In an inflationary environment, the only deflationary thing is software.

Finally, the months from March to June were still signed by very healthy economic activity. Thus, it is too early to see a headwind from the recessionary slowdown, in my opinion. Any significant impact, if any, will likely materialize in the 2H of 2022 and 1H of 2023. This is why I am so focused on the guidance.