- China’s recovery may have already started in December and the magnitude is likely to be stronger than expected, according to a Morgan Stanley report

- High-frequency data such as intracity mobility and subway passenger volumes point to a recovery from the Covid fallout in China

Hong Kong stocks rose to a six-month high on the final trading day of the Year of Tiger on renewed optimism that China’s growth will accelerate after the pivot to reopening of the economy.

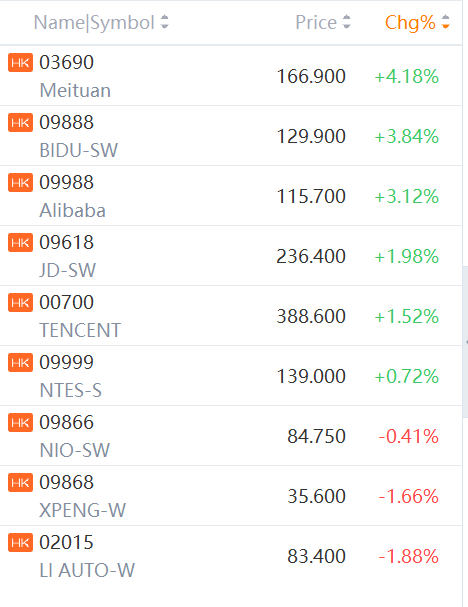

The Hang Seng Index gained 0.6 per cent to 21,775.43 as of 10.04am local time, heading for the highest level since July 5. The Hang Seng Tech Index advanced 0.9 per cent and the Shanghai Composite Index added 0.6 per cent.

Alibaba Group Holding advanced 3.12 per cent and Tencent Holdings added 1.52 per cent. CNOOC gained 3 per cent to HK$11.10 and PetroChina added 2.6 per cent to HK$3.98 after the two Chinese oil producers projected higher profits for last year.

Optimism has been growing that China’s Covid-19 infections have already peaked after its abrupt lifting of all pandemic restrictions last month. High-frequency data such as intracity mobility and subway passenger volumes point to a recovery from the Covid fallout.

Morgan Stanley said in a report on Thursday that China’s recovery may have already started in December and the magnitude is likely to be stronger than expected.

Meanwhile, Huaibei GreenGold Industry Investment tumbled 37 per cent to HK$1.20 on the first day of trading in Hong Kong.

Other major Asian markets were mixed as traders mulled over a set of mixed US economic data, which showed a robust labour market and weakening home construction.

Japan’s Nikkei 225 and Australia’s S&P/ASX 200 both climbed 0.1 per cent, while South Korea’s Kospi retreated 0.3 per cent.