AMC shares are super-volatile amid a short squeeze. Options can be a way to capitalize on the moves, with a measure of prudence.

AMC Entertainment Holdings shares are once again exploding, having been caught in a short squeeze.

The stock’s realized and implied volatilities are soaring. AMC at one point today more than doubled. There are two options strategies, below, to try to capitalize off this uncommon move. (Note that the data in this article are as of the close of trading June 1.)

The first chart of AMCAMC,+95.22%,below, tracks two years, showing the stock had been in a general decline through most of 2019. In fact, AMC had been falling since making all-time highs in the mid-$30s in 2015 and 2016.

The stock then slumped further due to the pandemic. Things began to change, however, when it rallied amid a short squeeze in late January 2021. The stock exploded from $2 to $20 in less than a month.

Now another short squeeze is under way, and the stock has risen from $9 to over $60 in the last month.

It is impossible to justify these moves in terms of fundamental or even technical analysis, but there are opportunities presented by the options markets. As might be expected, the options have gotten extremely expensive. The next chart is a one-year, showing thecompositeimplied volatility of AMC options on top and the price of the stock on the bottom. (Composite implied volatility is a weighted volatility of the most active options on AMC.)

The composite implied volatility has risen to more than 200%. (Don’t worry about what that means statistically, just use it as a comparative measure — 200% is alothigher than the “normal” volatility, up to four times that of its pre-pandemic level.)

So, what option strategies make sense? Simply buying expensive options is justifiable while volatility remains high, believe it or not. The 10-day realized (historical) volatility of AMC is now an astounding 211%. The 20-day historical volatility (HV) is 160%.

However, those volatilities will drop quickly if the stock starts to stabilize — wherever that may be. But as long as they hold up, at-the-money options are not a lot more expensive than that, in terms of implied volatility. However,out-of-the-moneyoptions are much more expensive, and those are generally unattractive purchases — certainly not based on a statistical basis.

Many traders want to sell the options because they think they are so overpriced. Well, they may be overpriced, but at current volatility levels, the stock can move a great distance and cause ruin for an options-selling strategy.

One can see from the one-year chart of AMC that after the last short squeeze, the stock dropped quickly, but never got back to the prices from which the short squeeze was launched. That is typical behavior in a short squeeze.

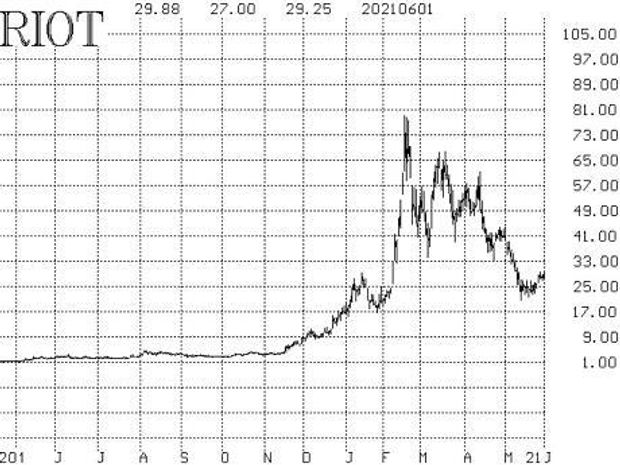

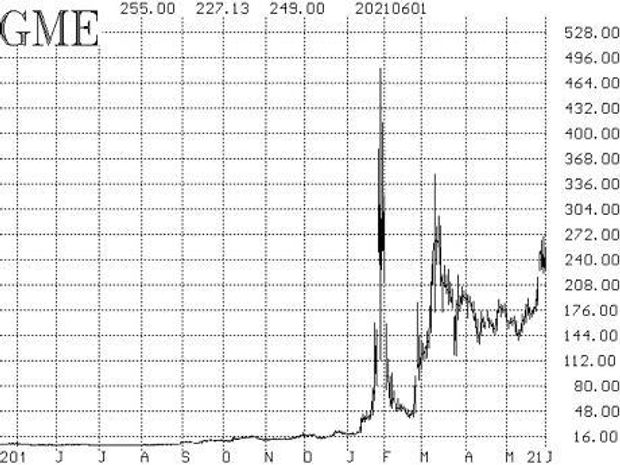

Consider the two following charts — of Riot BlockchainRIOT,+2.74%and GameStopGME,+13.34%— both of which have been short squeezes. RIOT was also a short squeeze when it first came public, in late 2017 (not shown on the chart).

In both of those cases, a similar pattern appears: The short squeeze ends, the stock falls, but not all the way back to its “pre-squeeze” price, at least not for a while.

Two options strategies could take advantage of this:

- A bear put spread.Buy puts with striking prices just below the current elevated stock priceandsell puts with a significantly lower strike price. This strategy generally has an advantage in that the implied volatility of the put you are buying is lower than the implied volatility of the put you are selling. You can’t lose more money than the debit you pay for the spread, but you could lose 100% of that debit if the stock continues to rise and the options expire worthless.

- Sell put credit spreads with strikes at or near the price of AMCpriorto the short squeeze.AMC was in the teens before this latest round of short squeeze began. The potential gain here would be the credit initially received, but the margin requirement — which is equal to the risk in the spread — is the difference in the strikes, less the credit received. A derivative of this strategy, for extremely aggressive accounts, would be to sell puts (naked) with strikes in the teens.

Obviously, there are lot of options combinations that could be considered, but these are two relatively simple spread strategies that will pay off if AMC behaves like other short squeezes: Eventually the stock peaks and begins to fall, but it doesn’t fall far enough to reach its “pre-squeeze” levels.