The Premium Harvester is Here: A Whale Sells Hundreds of Thousands of Chip Stock Puts

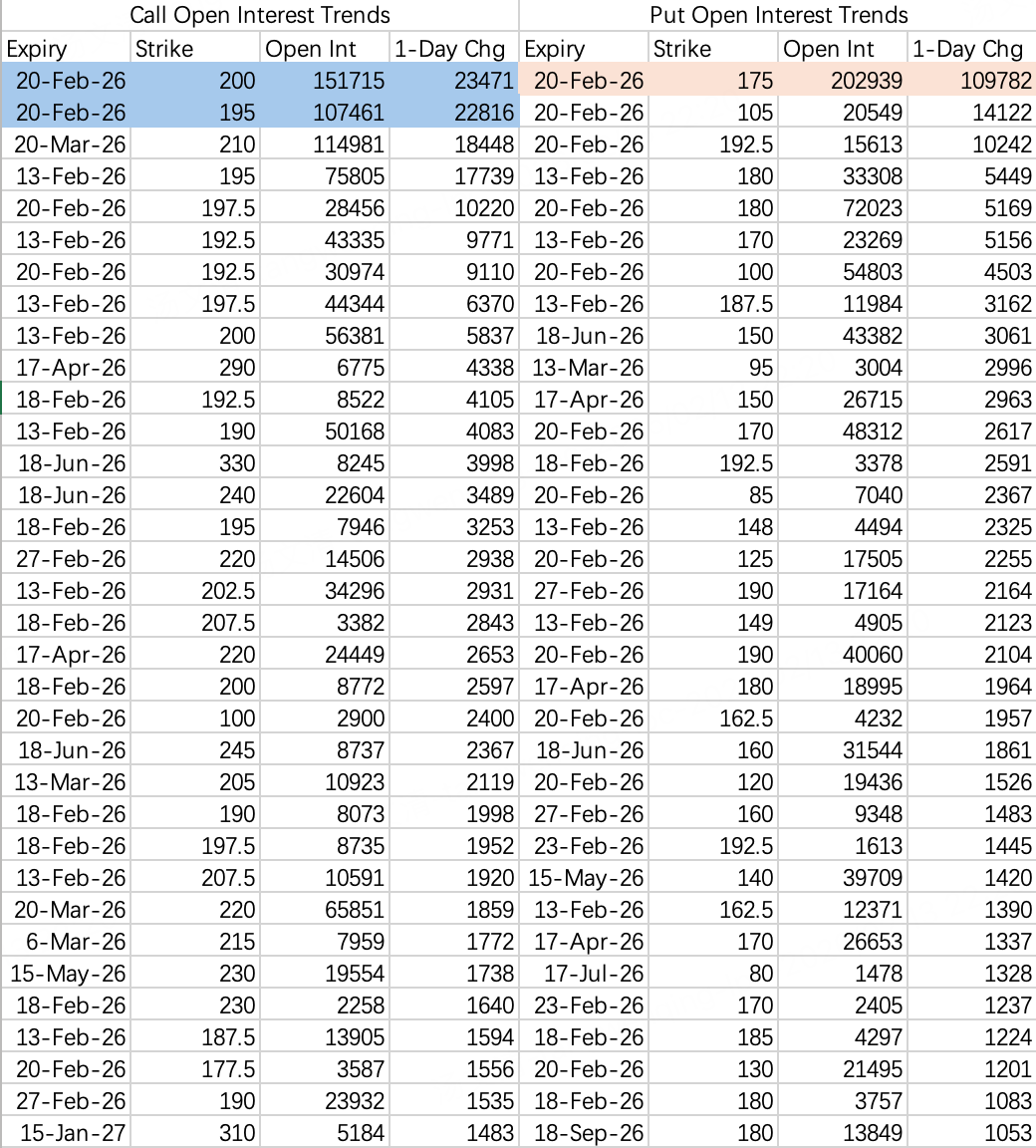

Checking the option flow today, I ran into a familiar sight — a wave of deep OUTM put sales across major chip names. Last seen on Jan 26. Flashback to Jan 22:

$NVDA 20260220 175.0 PUT$ — 109.8k opened

$AMD 20260220 187.5 PUT$ — 74.9k opened

$ORCL 20260220 137.0 PUT$ — 56.8k opened

$SMH 20260220 380.0 PUT$ — 43.4k opened

$AVGO 20260220 305.0 PUT$ — 41.0k opened

$MU 20260220 362.5 PUT$ — 24.4k opened

$TSM 20260220 345.0 PUT$ — 17.7k opened

I dug into the execution data. Turns out, except for NVDA and AVGO, most of these were sell orders. NVDA and AVGO showed as "buy" prints, but those were likely buys from the market maker side—hard to define directionally.

So what does it mean when a whale sells a boatload of OTM puts with delta between 0.13 and 0.18?

First clue: this was likely one institution. The timing across all 7 names was almost too coordinated — all executed in the final 90 minutes of the session. That’s a sweet spot: after a failed bounce, into the close bleed.

Selling deep OTM puts there? Probably short vol. And maybe a view that chip stocks won’t take out recent lows next week.

Charts attached for each:

$NVDA 20260220 175.0 PUT$ — 109.8k

$AMD 20260220 187.5 PUT$ — 74.9k

$ORCL 20260220 137.0 PUT$ — 56.8k

$SMH 20260220 380.0 PUT$ — 43.4k

$AVGO 20260220 305.0 PUT$ — 41.0k

$MU 20260220 362.5 PUT$ — 24.4k

$TSM 20260220 345.0 PUT$ — 17.7k

$NVDA$

Call spread active: sell 195 call, buy 200 call for next week expiry $NVDA 20260220 195.0 CALL$ $NVDA 20260220 200.0 CALL$ . Range-bound logic intact.

That $NVDA 20260220 175.0 PUT$ ? Now sitting at 200k open interest. Direction unclear, but one thing's for sure: next week, breaking below 175 will be tough.

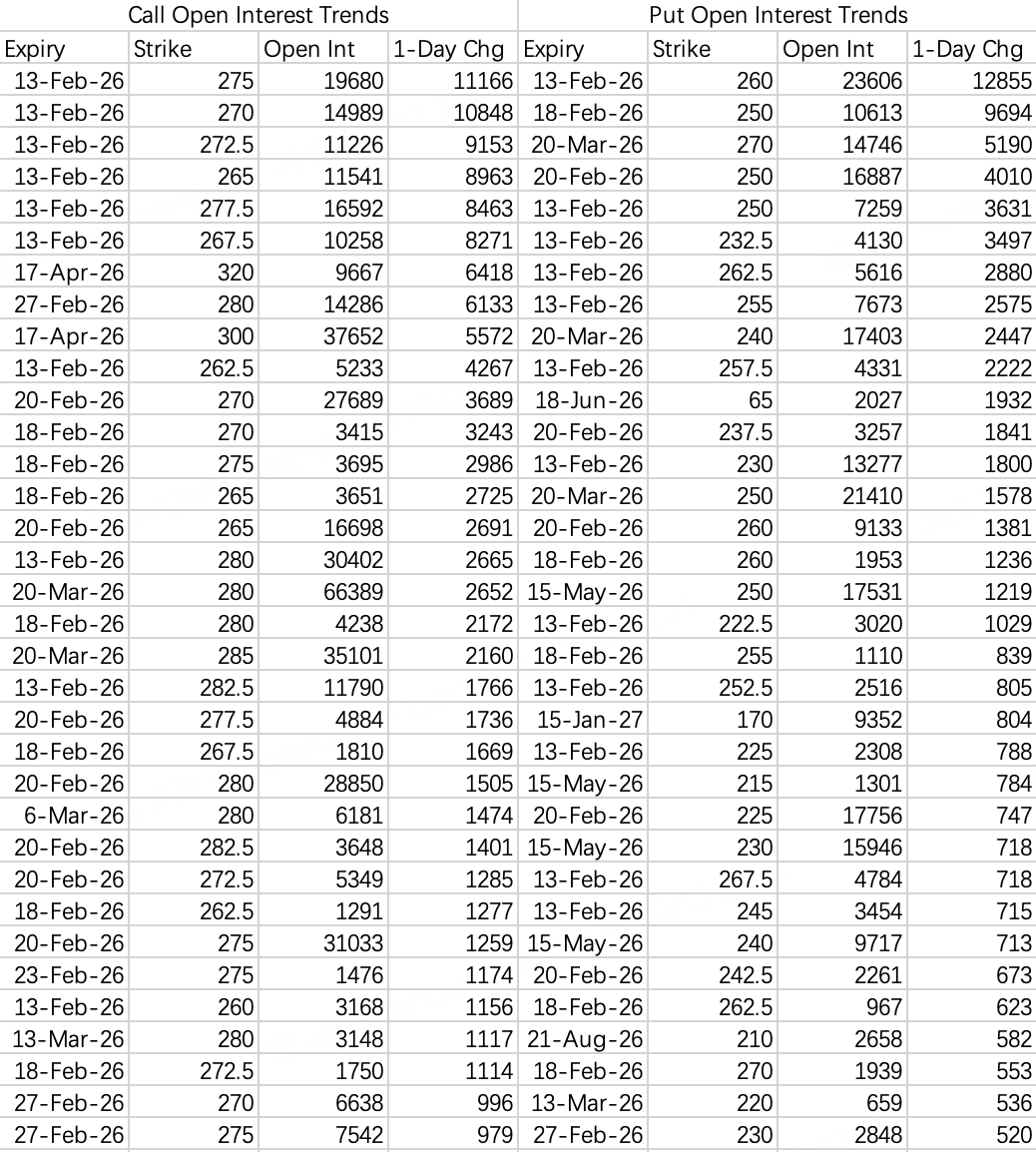

$AAPL$

Memory vs. consumer electronics—still seesawing. AAPL looks stuck between 250–260 for now. Consider sell put 250: $AAPL 20260220 250.0 PUT$ .

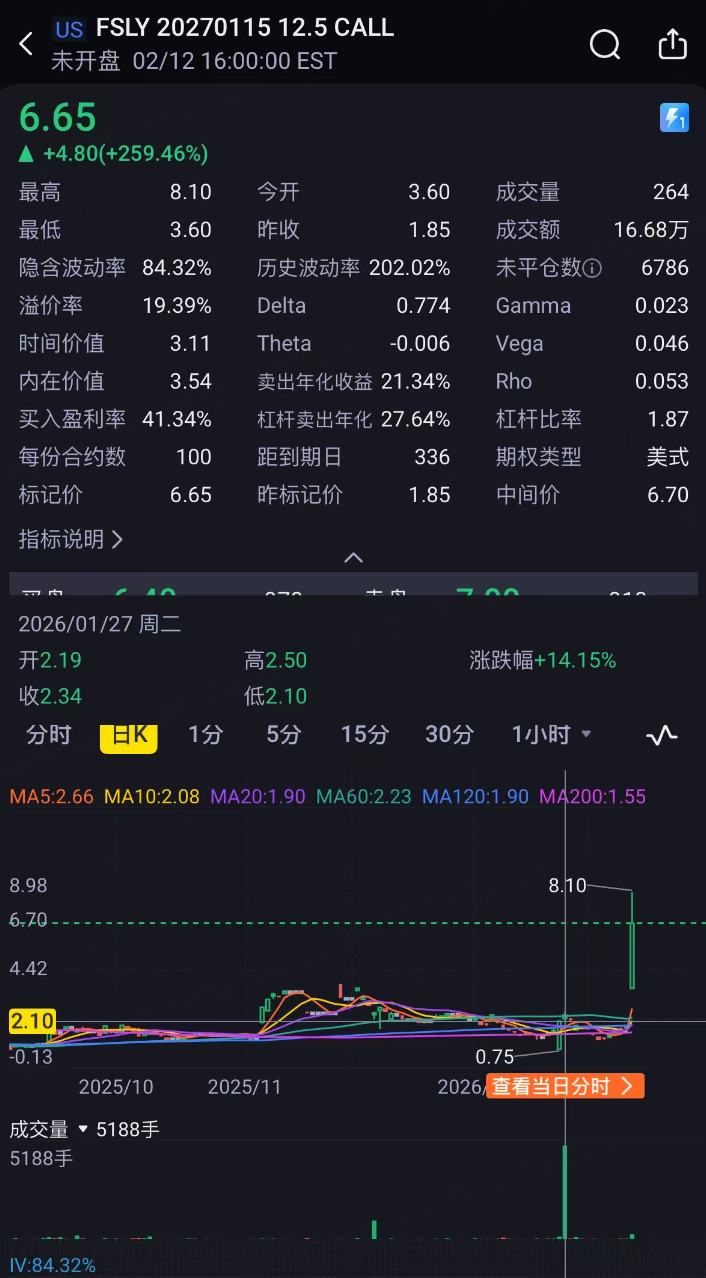

$FSLR$

70% post-earnings rip is rare outside biotech. Checked the options—most bullish flows targeted the 12.5 strike, and yesterday’s top closing calls were also 12.5.

Two longer-dated calls still hanging in there: $FSLR 20270115 12.5 CALL$ and $FSLR 20280121 12.5 CALL$ . Could be rolling soon. Worth watching where they roll to.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.