NVIDIA May Range-Bound Until Mid-Year

$NVDA$

Barring any surprises, NVIDIA looks set to continue grinding between 170 and 200 through the first half of the year—a sweet spot for option sellers.

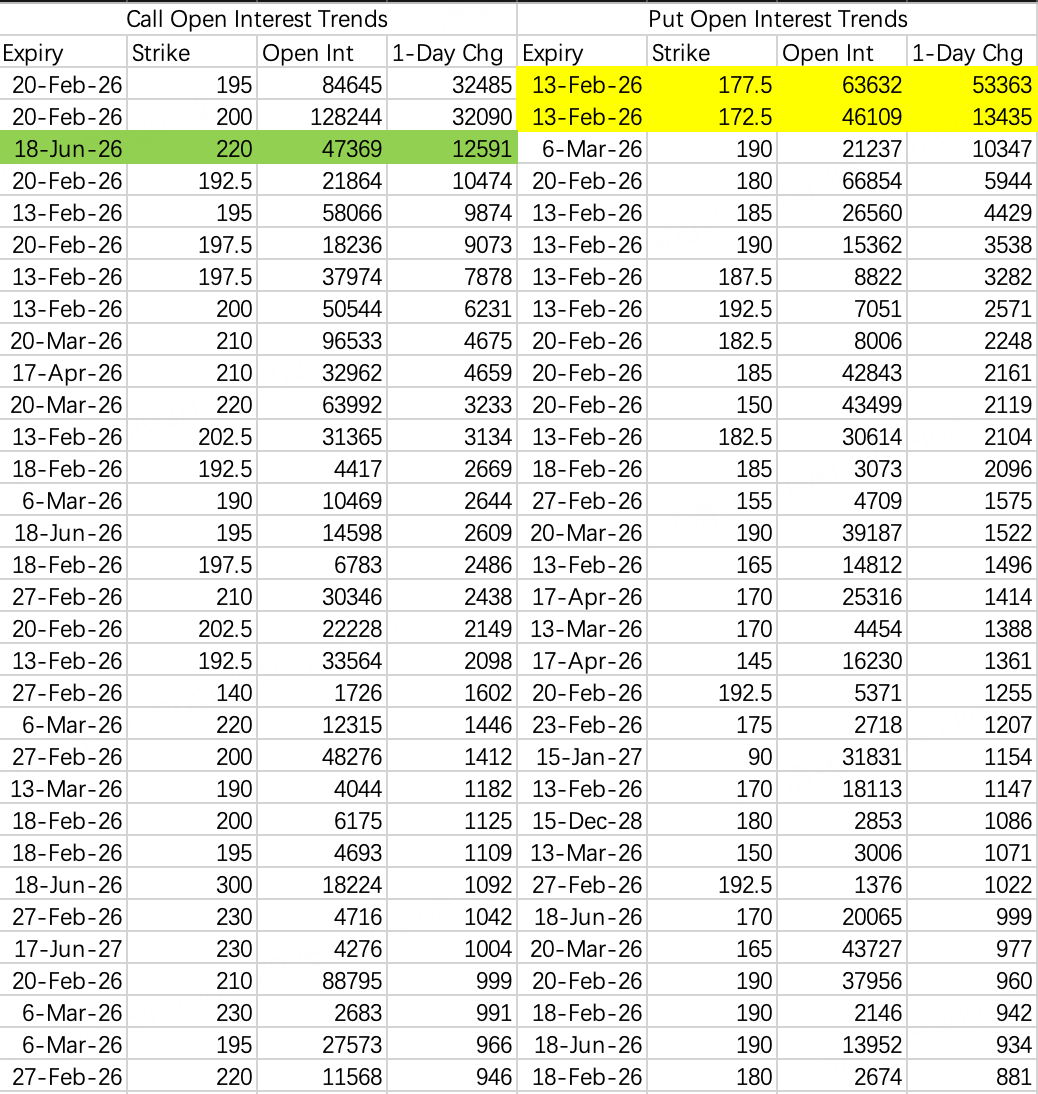

I came across 10k contracts opened on the $NVDA 20260618 220.0 CALL$ . Nothing flagged as a block trade, but digging into the fills shows the orders were chopped up into tiny pieces. The screenshot says it all. Most of the flow? Sell-side.

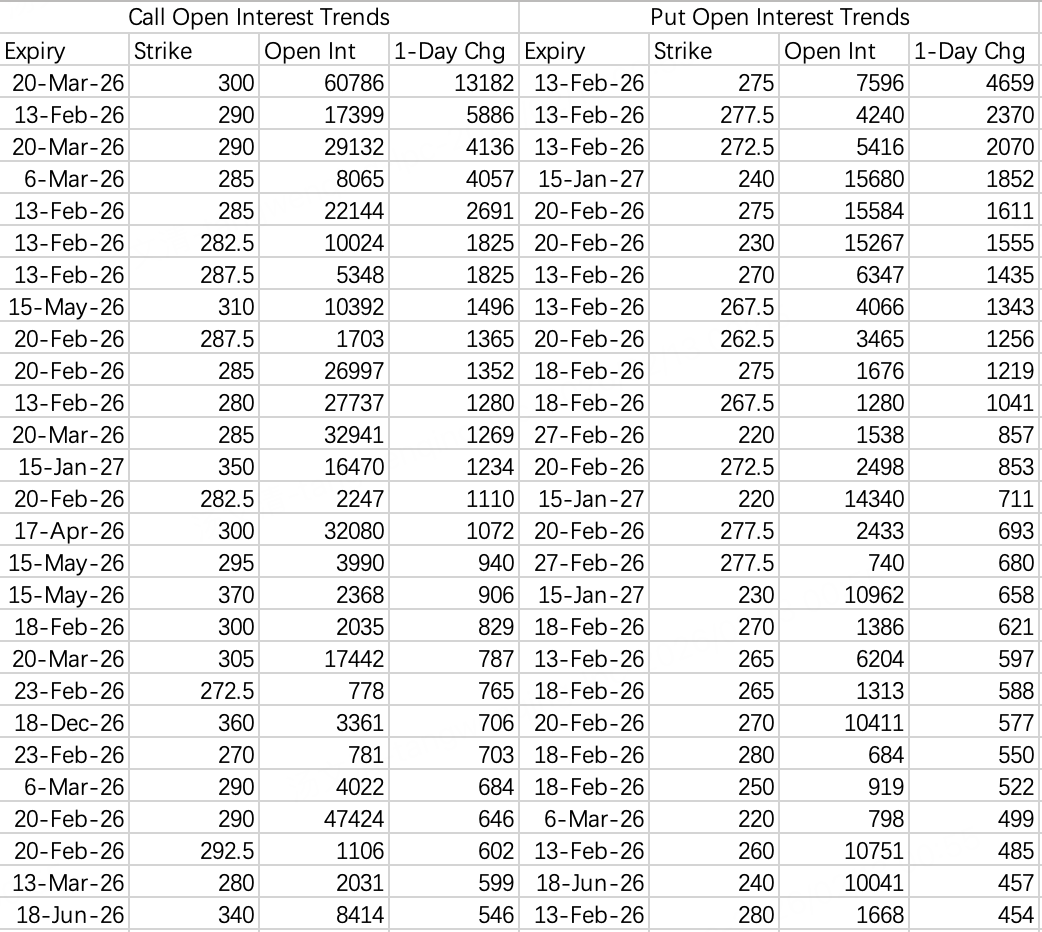

Not a coincidence—Broadcom showed the exact same footprint. $AVGO 20260618 400.0 CALL$ also saw around 10k contracts, finely sliced, same direction: sells.

Why the cloak-and-dagger? Likely to avoid getting front-run. Both are ~0.35 delta. If the stock runs the wrong way, margin calls come fast.

Same trade, same thesis. These are both AI hardware names with no major capacity catalysts in sight for H1. So valuation continues to digest through time and chop.

$INTC$

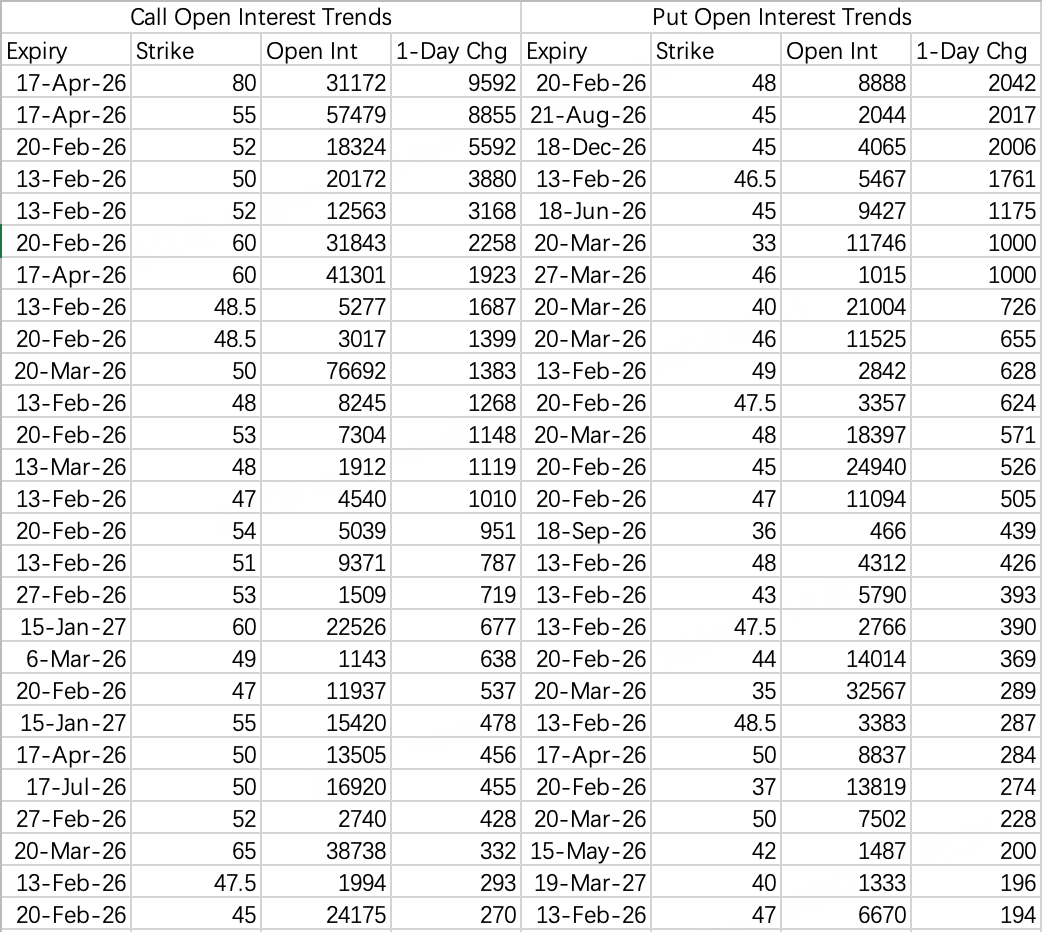

Another sell-side friendly name. Intel's pullback offers a clean entry to sell puts: $INTC 20260220 45.0 PUT$ .

$AAPL$

Apple and memory stocks are now seesawing. Memory goes up, hardware margins go down. Even $CSCO, pure B2B, couldn't dodge the gross margin hit.

And here’s a ghost story: strong jobs data + oil bouncing hard = inflation whispers creeping back. Next stop—market pricing in a Fed pause or even a hike. No more easy money. Then look at names leveraged to AI infra builds—Oracle’s chart says it all.

$KWEB$

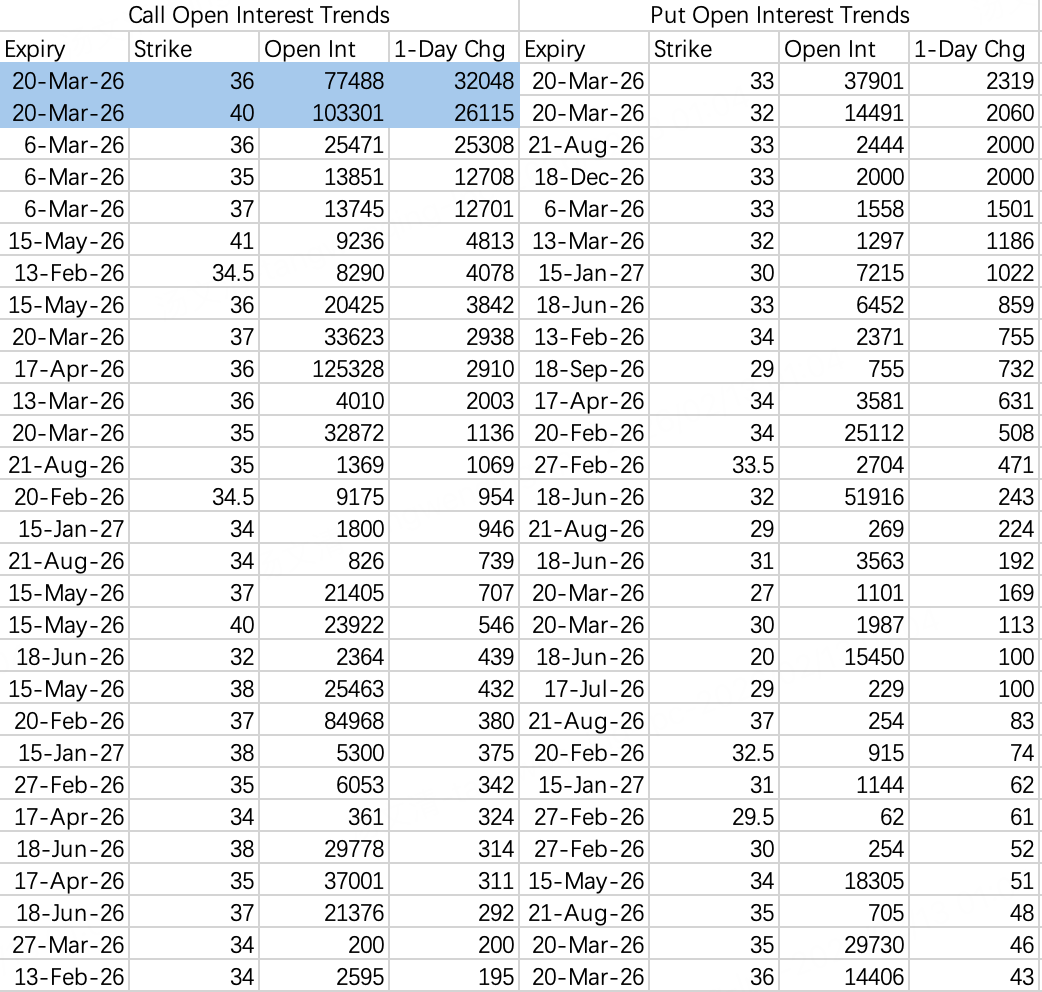

Open any forum and you’ll see rage-posting on Hang Seng Tech. And plenty of venting about Tencent’s Yuanbao burning cash on red packets. That massive FXI put order? Might’ve picked the wrong instrument. Consumer names in Hong Kong are actually holding up—the damage is concentrated in tech.

32–33 is right in the pullback target zone. Saw some bullish call spreads trying to catch the bounce. Feels early. One thing stands out: ASHR is holding way better than FXI or KWEB. And Alibaba is clearly outperforming KWEB.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.