Massive Insider Block Buys Calls

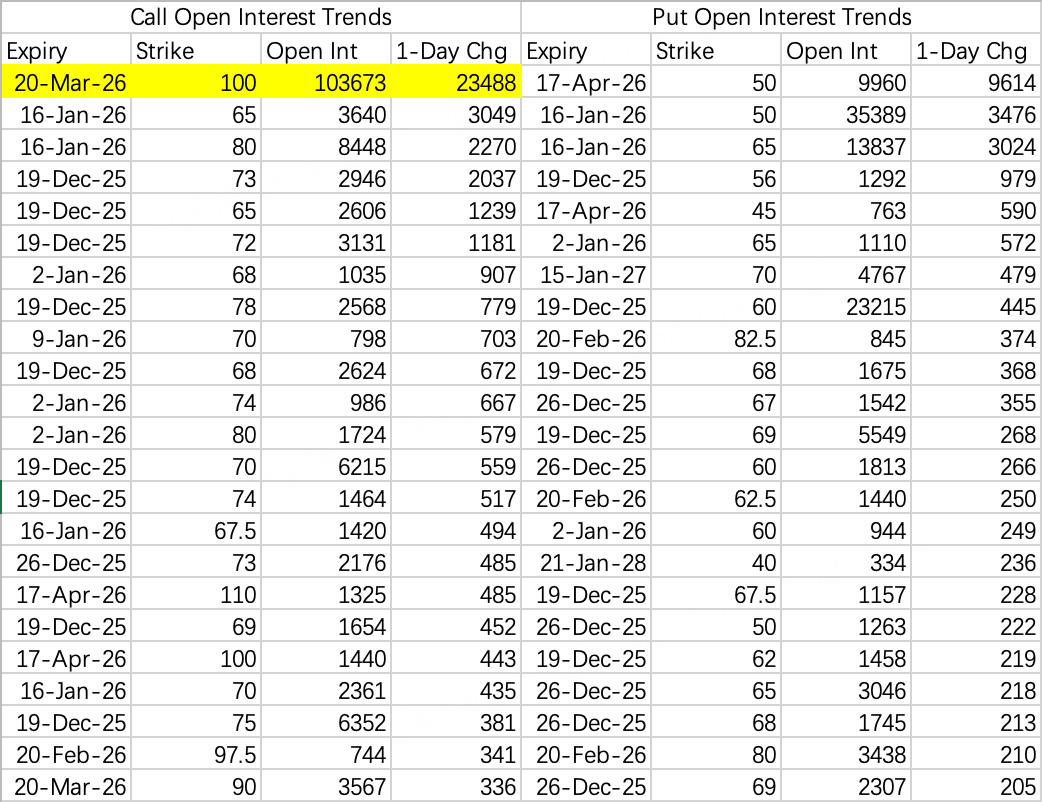

$CRWV$

Insider block buying continues with 23,000 contracts opened, pushing total open interest to 100,000 contracts $CRWV 20260320 100.0 CALL$ . News-wise, CRWV has been selected for the US Department of Energy's "Project Genesis" to support national-level AI research. The block buying preceded the news.

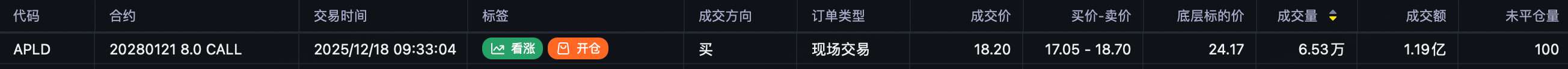

Another stock with massive block opening is APLD, with 65,300 contracts of the 2028 8 call $APLD 20280121 8.0 CALL$ traded, with a total premium value of $119 million.

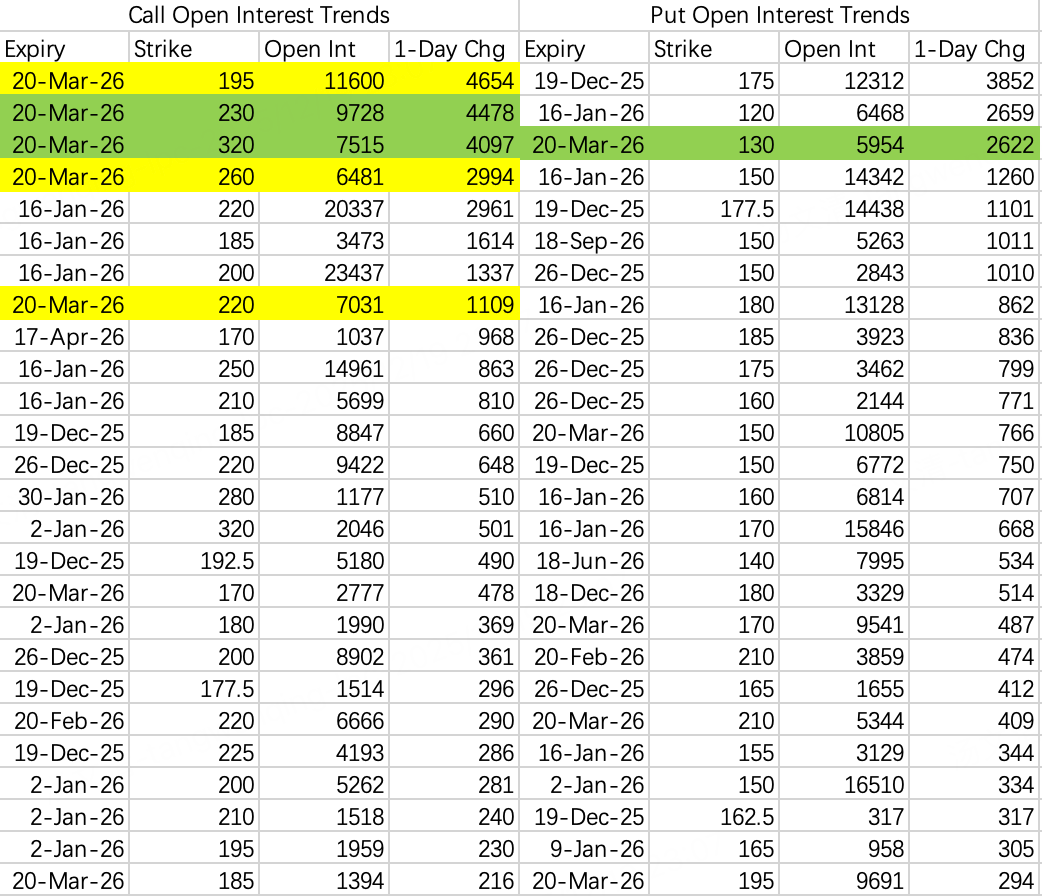

$ORCL$

The news of TikTok landing on Oracle has relieved the market, easing concerns about who would pick up the cloud services pieces if OpenAI were to collapse.

The bullish expectation is for a rebound above $195, but breaking above $230 remains difficult.

Having a buyer doesn't necessarily mean safety. Looking at options flow, the market still worries about risk, with many puts hedging against a drop to $150.

Who would have thought that being tied to OpenAI would one day become a major liability? No one anticipated this company would excel only at model building. Currently, it looks like OpenAI will retrace Tesla's path post-IPO. Even before going public, its deeply intertwined supply chain is already being heavily shorted.

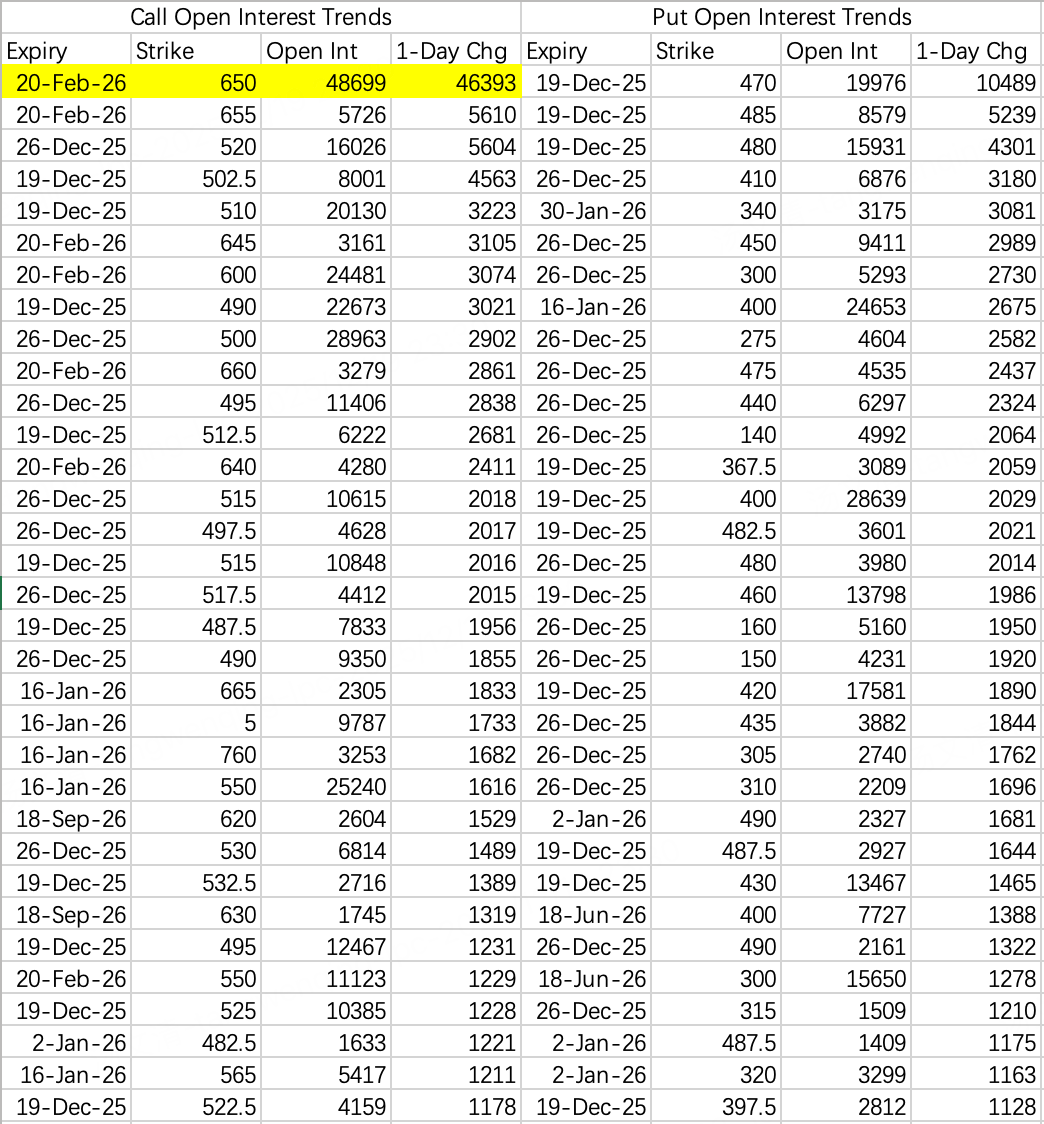

$TSLA$

In contrast, the insider bullish thesis on Tesla is quite straightforward. Institutions closed next week's 510 call $TSLA 20251226 510.0 CALL$ and bought the Feb 650 call $TSLA 20260220 650.0 CALL$ with 46,000 contracts opened.

In short, you can continue to safely chase the rally by selling puts: $TSLA 20251226 450.0 PUT$ .

While it's unclear where the $650 target comes from, I'm bullish on Tesla competing with Google for the AI top spot next year. Tesla has autonomous driving and robotics, and Musk himself brings extensive financing experience and a history of crushing shorts—making it a formidable contender.

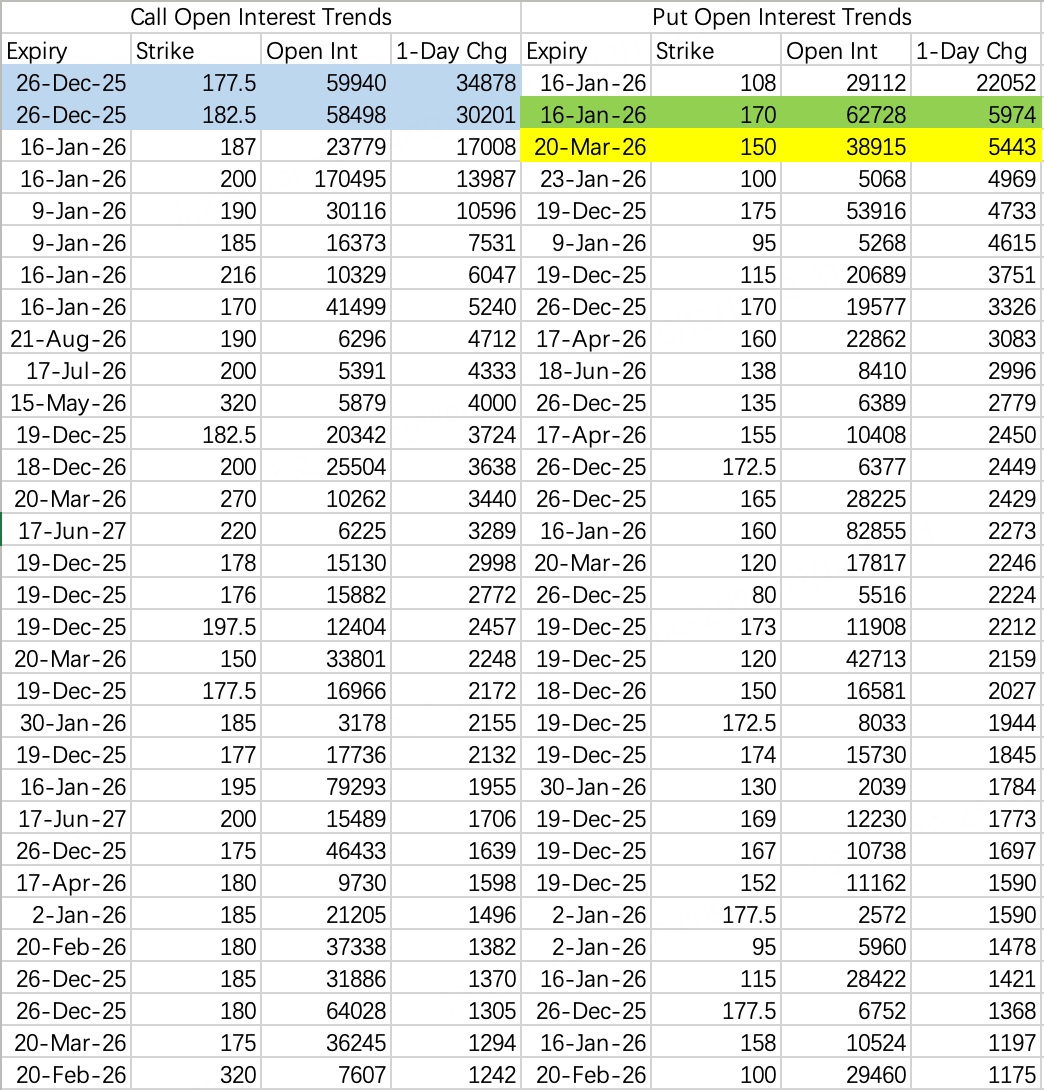

$NVDA$

The bearish overhang on NVIDIA hasn't lifted. The logic for GPUs differs from memory, creating a somewhat contradictory picture.

Expect the stock to continue trading in the $170–180 range next week. Although put openings look ugly, a major drop over Christmas is unlikely.

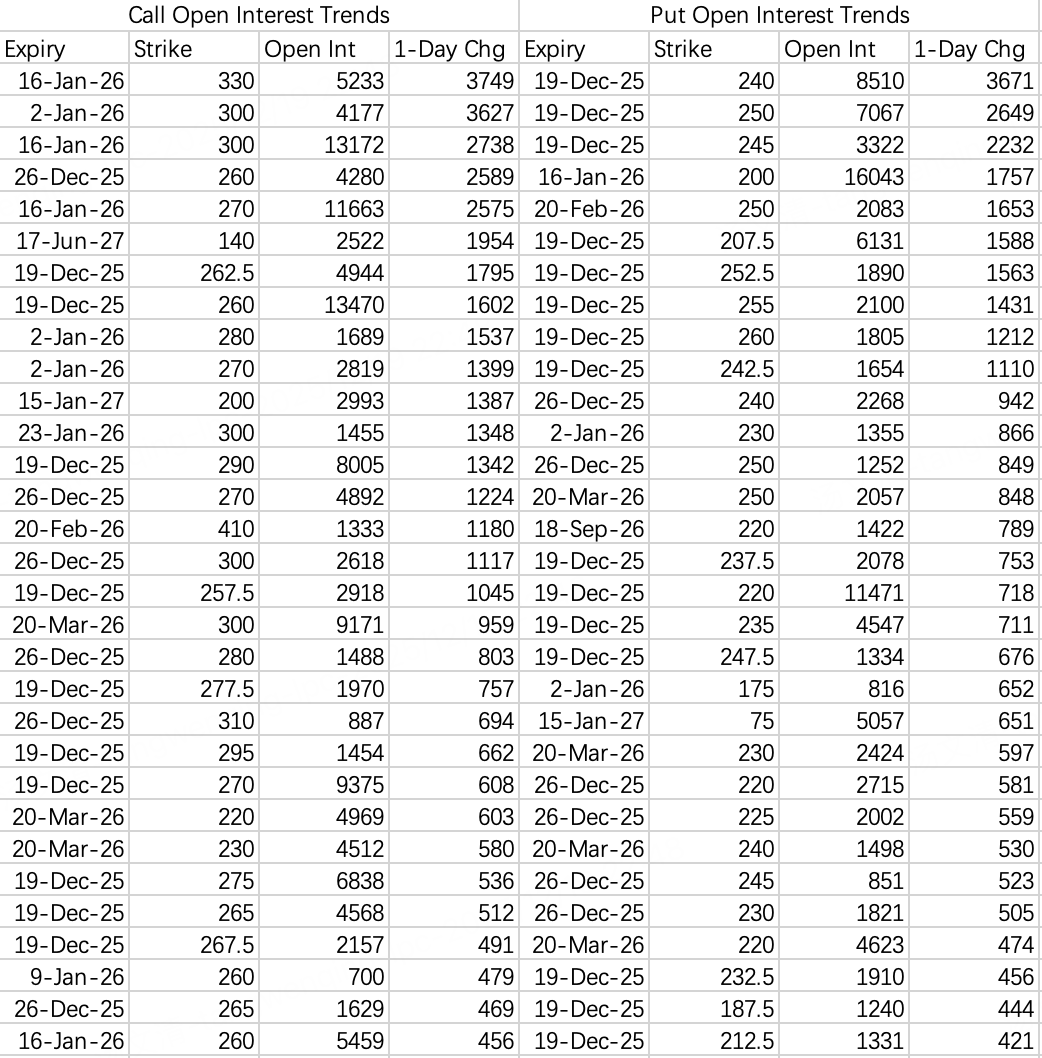

$MU$

Target price $300, suitable for selling puts to chase the rally. Sell put strikes can be chosen at $240 or $250 $MU 20251226 250.0 PUT$ , but be aware of a potential pullback to $230.

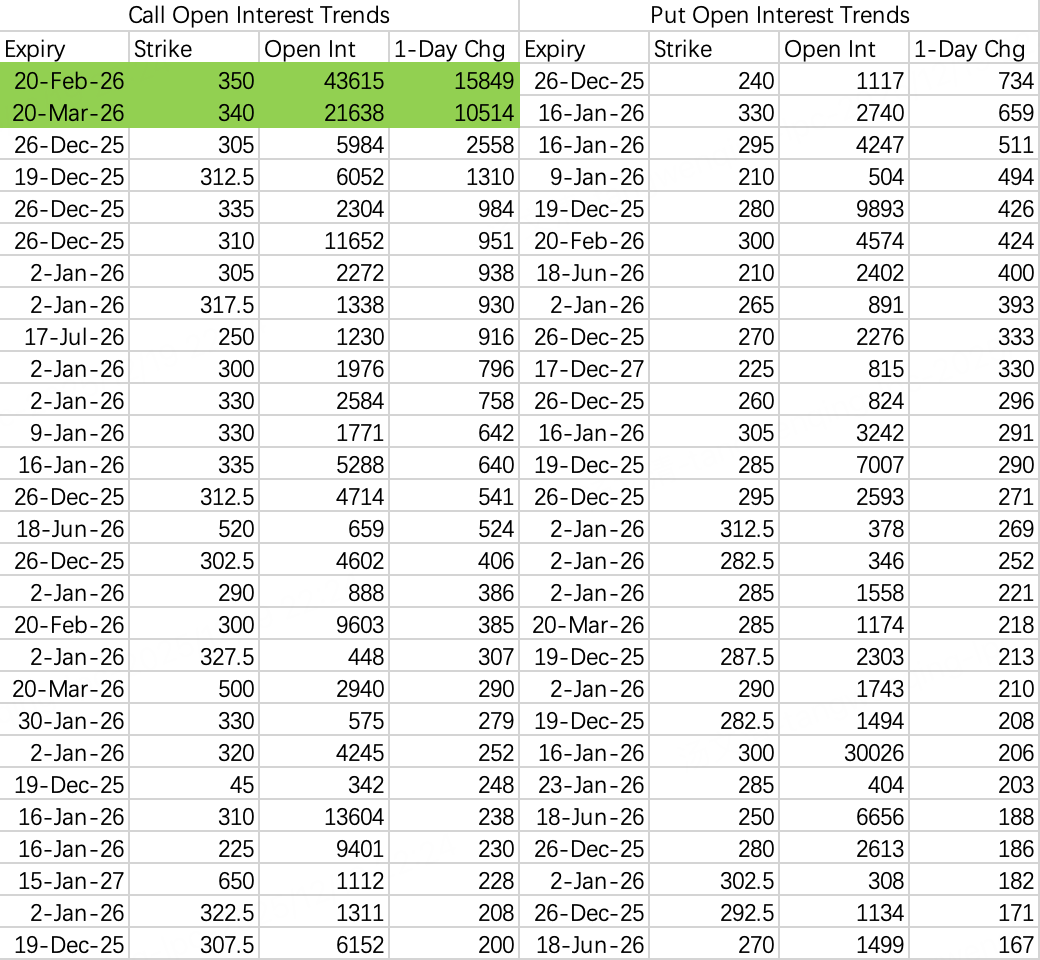

$GOOGL$

There are large sell call blocks at $350 and $340 $GOOGL 20260220 350.0 CALL$ $GOOGL 20260320 340.0 CALL$ , making a significant rally difficult.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- AuntieAaA·2025-12-20GoodLikeReport