Notable Block Trades

$NVDA$

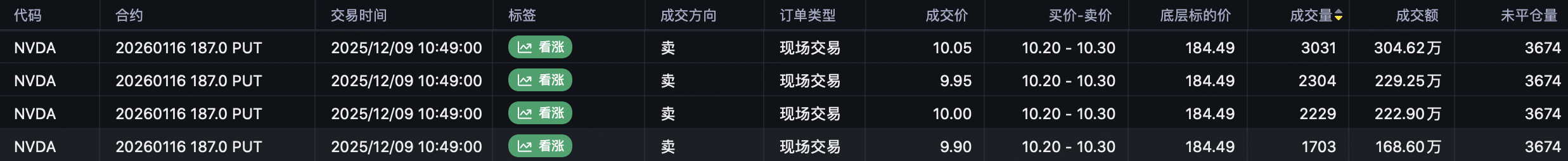

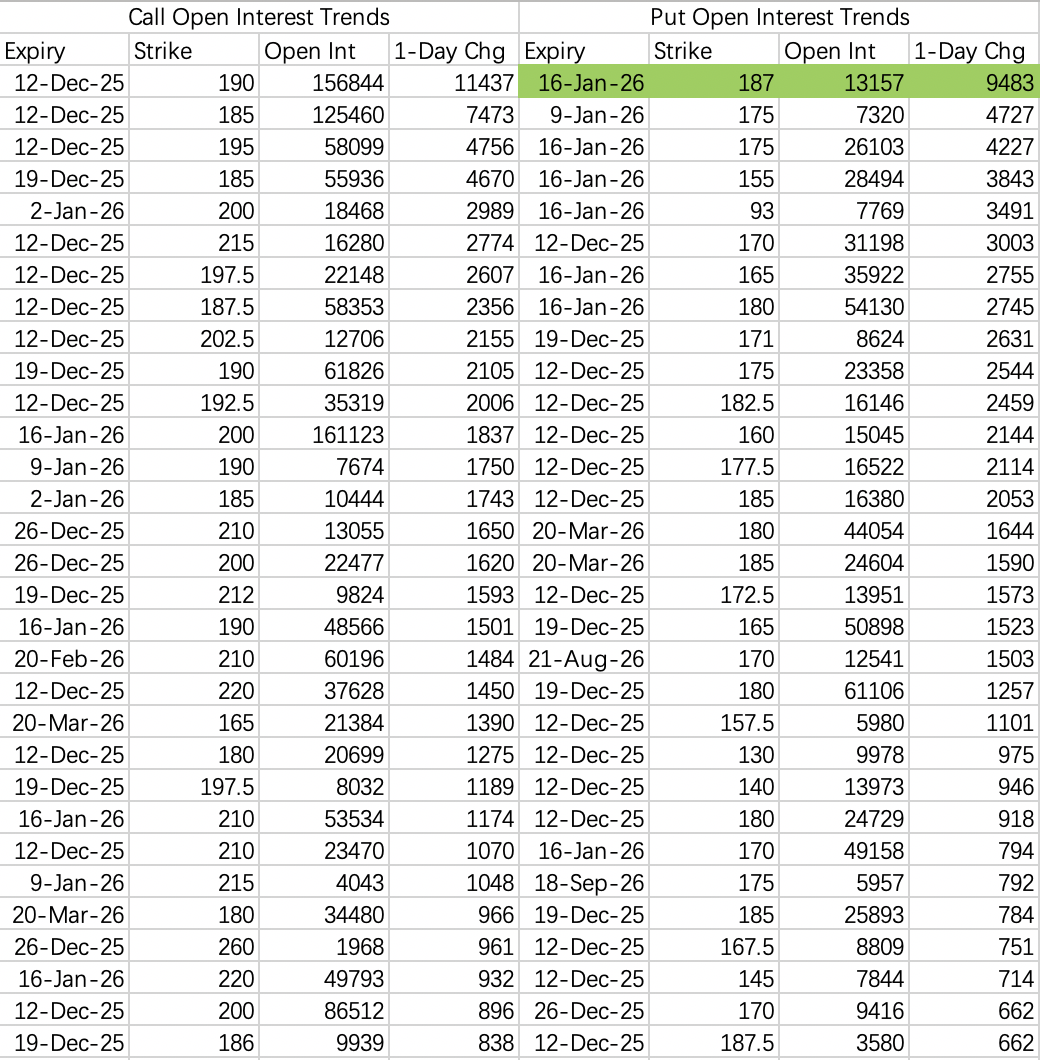

A large player positioned for the H200 news with an unusual in-the-money sell put: $NVDA 20260116 187.0 PUT$ . Premium volume was ~$10 million, with 9,483 contracts opened.

Typically, selling in-the-money puts is done only with high conviction that the stock will be at or above the strike price at expiration. This aligns with the earlier judgment for the Dec-Jan period: limited upside, but also resilient downside.

While the trade rationale is understandable, it's worth noting such an unconventional block doesn't necessarily come from a seasoned trader.

Contradicting this flow are other put openings, which still anticipate a pullback below $180. However, this remains consistent with the overall $170–200 range view.

The market appears skeptical about the actual order volume H200 might generate. For the "chip trade resumption" narrative to gain real traction, it will likely need follow-up news on concrete chip procurement from domestic tech firms. File this as a potential supportive, bottoming catalyst.

$TSM$

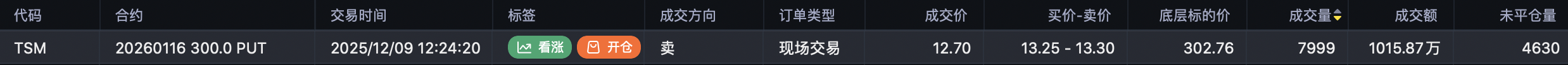

Similar to NVIDIA, a large sell put block appeared here, choosing the at-the-money $300 strike $TSM 20260116 300.0 PUT$ . Volume was 7,999 contracts, with a premium value of ~$10.15 million.

$AAPL$

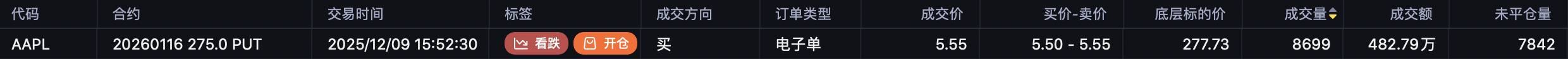

Apple saw significant put opening: $AAPL 20260116 275.0 PUT$ , volume 8,699 contracts, premium ~$4.8279 million.

Consider selling calls: $AAPL 20251219 285.0 CALL$ .

$AMD$

Range-bound. Consider selling the 235 call $AMD 20251212 235.0 CALL$ and the 200 put $AMD 20251219 200.0 PUT$ .

$AMZN$

Also range-bound. Consider selling the 215 put $AMZN 20251219 215.0 PUT$ and the 240 call $AMZN 20251219 240.0 CALL$ .

$NFLX$

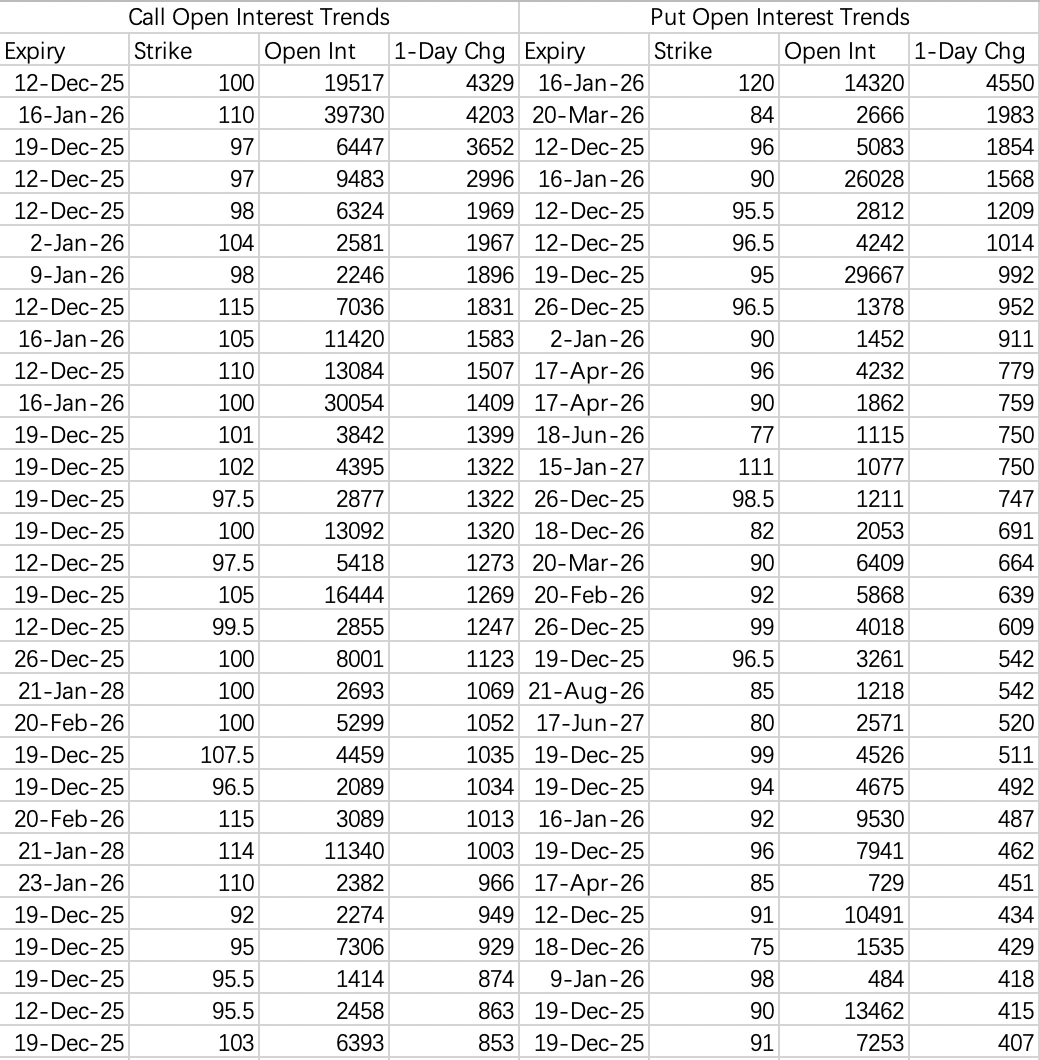

Put openings remain concentrated in the $90–95 range, suggesting a potential near-term bottom. The qualifier "near-term" is key, as a monthly death cross isn't resolved in days. The rebound is weak, so be cautious about assignment risk when selling puts.

$ORCL$

Oracle reports earnings after the close. A trade idea: sell the 200 put $ORCL 20251212 200.0 PUT$ . While booking massive long-term orders is risky (echoes of Cisco in 2000), for this quarter, such orders could bolster confidence among tech firms to continue investing in AI cloud services. Therefore, not overly bearish near-term.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.