Bears Target Google with $12 Million Put Purchase

$GOOGL$

The broader market is likely to continue its rebound today, with SPY potentially reaching 688. However, not every stock will ride this wave—sector rotation is evident as year-end approaches.

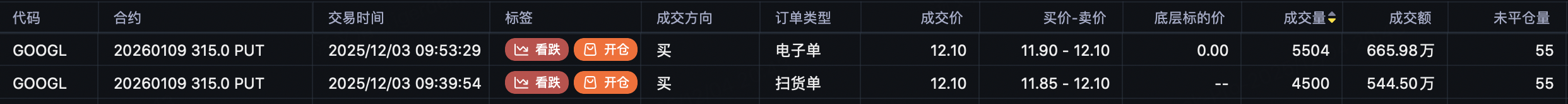

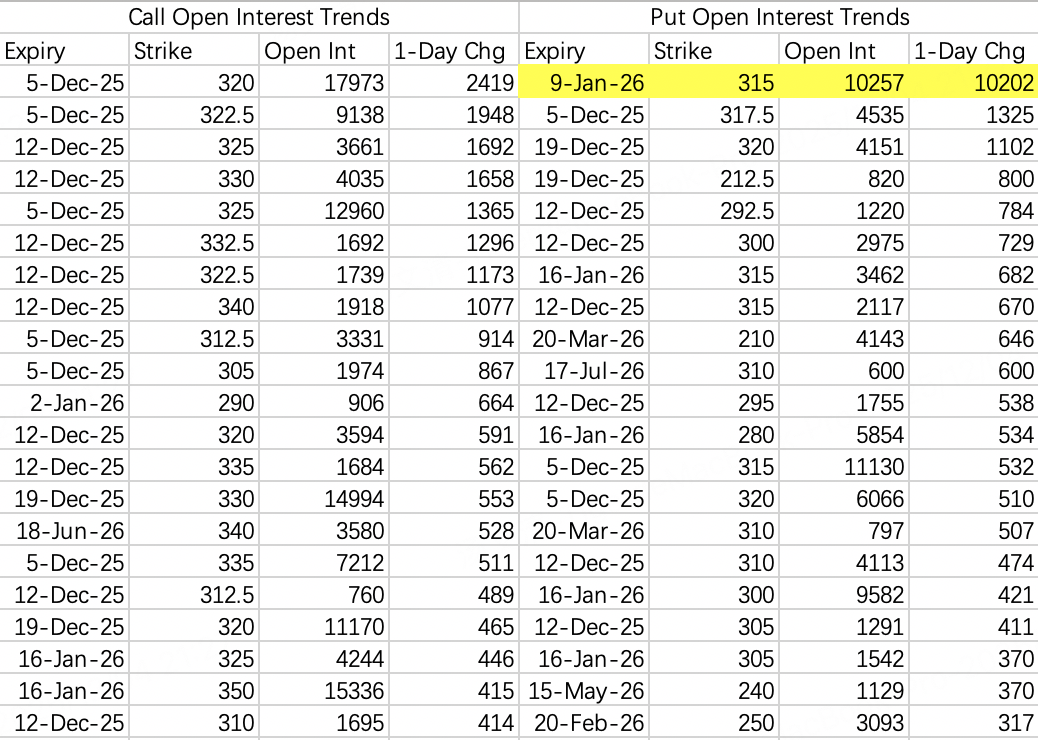

The rotation has turned against Google this time. Bears opened a position by buying 10,000 contracts of the Jan 9th 315 Put $GOOGL 20260109 315.0 PUT$ , with a total premium of approximately $12 million.

Overall, excluding this put activity, Google's options flow still appears strong, suggesting a likely trading range between $315–325. However, following this significant bearish bet, while the stock may hold above $315 this week, the outlook beyond next week becomes less certain.

$NVDA$

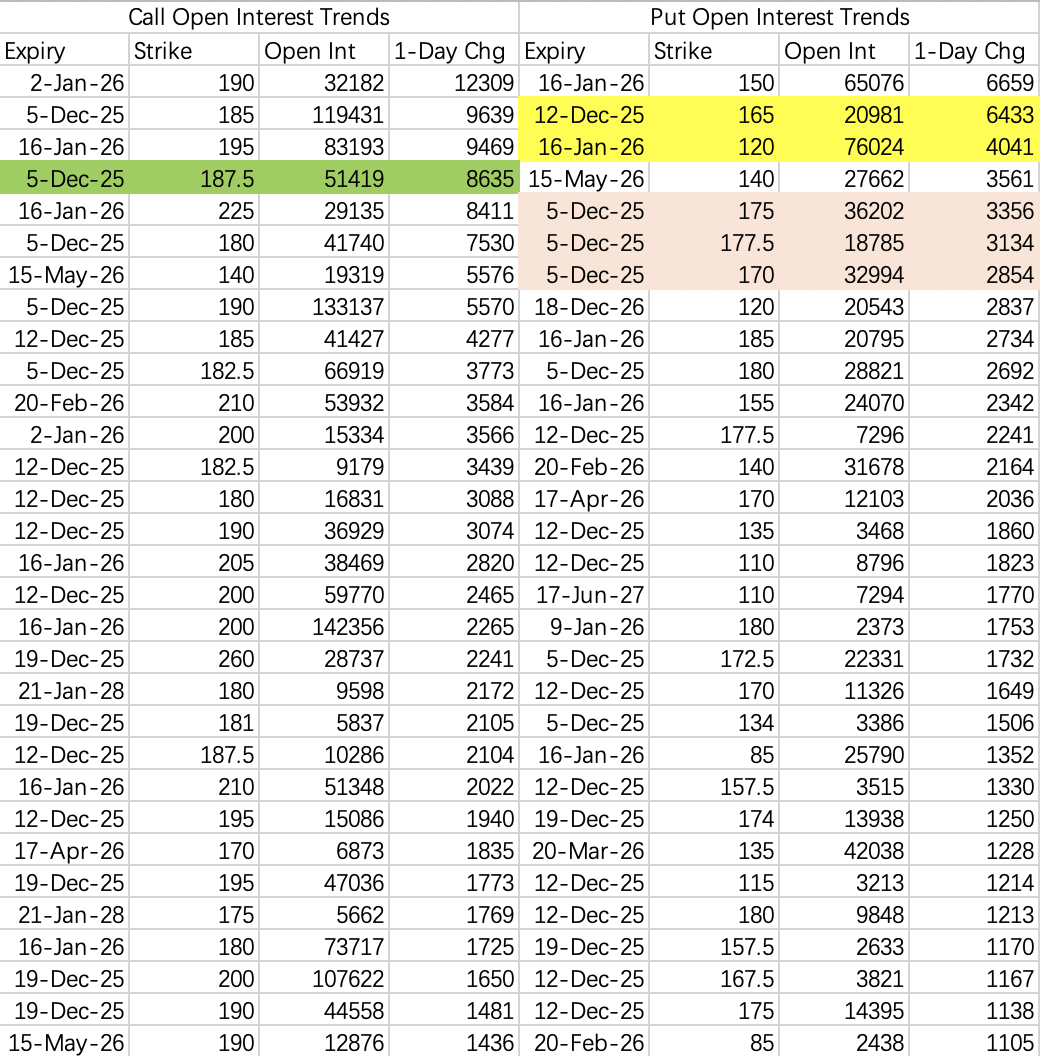

Maintaining the view of a $180–185 trading range. This week, consider selling the 175 Put $NVDA 20251205 175.0 PUT$ and the 185 Call $NVDA 20251205 185.0 CALL$ . Put buying for hedging purposes is expected to persist in the coming weeks.

$TSLA$

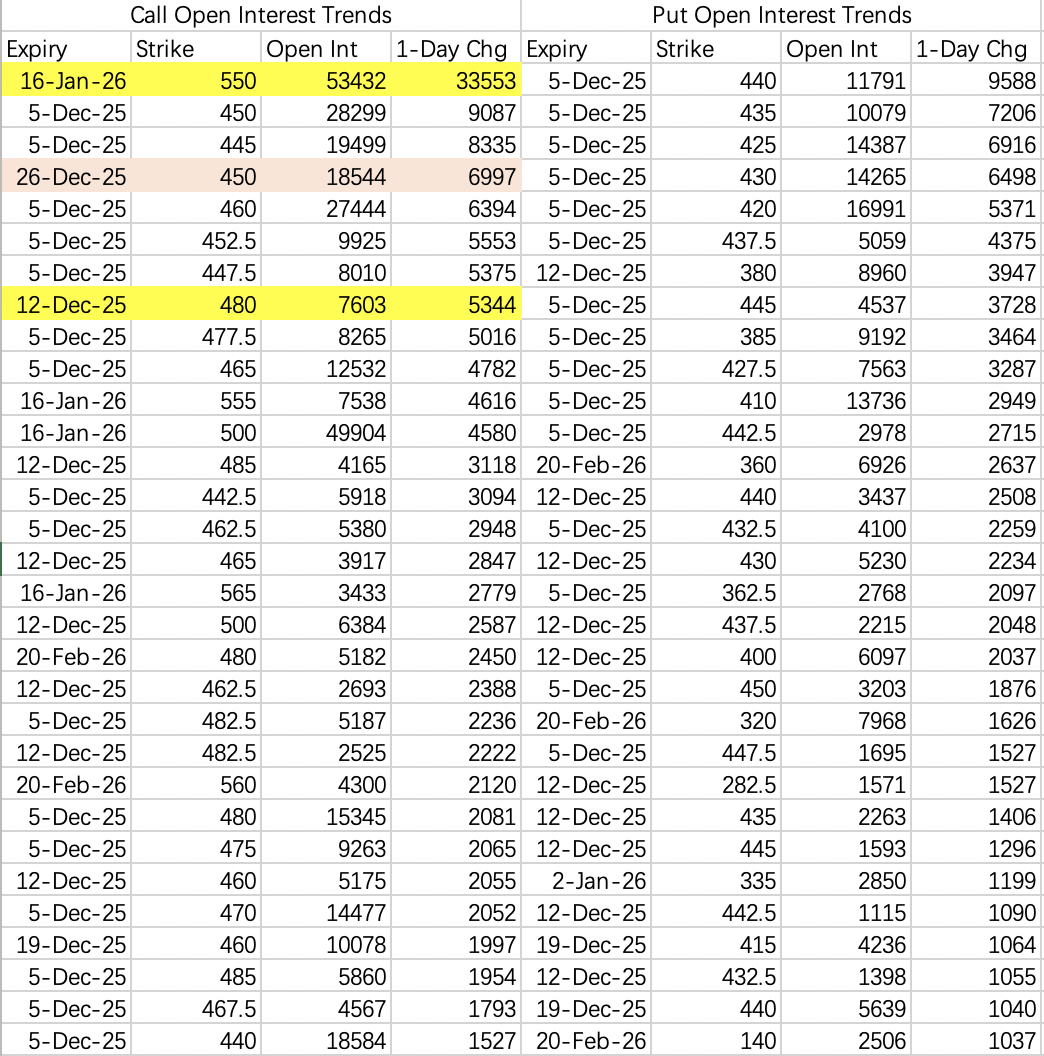

Initially considered selling calls on strength, but Wednesday's options flow was more bullish than anticipated. There was even opening buy flow in the 480 Call $TSLA 20251212 480.0 CALL$ .

Notably, the previous large 800 Call position was closed $TSLA 20260618 800.0 CALL$ , while the Jan 550 Call saw 33.5k contracts opened $TSLA 20260116 550.0 CALL$ . Although these are independent single-leg trades, it resembles a roll-down from the 800 to the 550 strike. It's difficult to judge at this point whether this signals insider information or retail speculation.

$INTC$

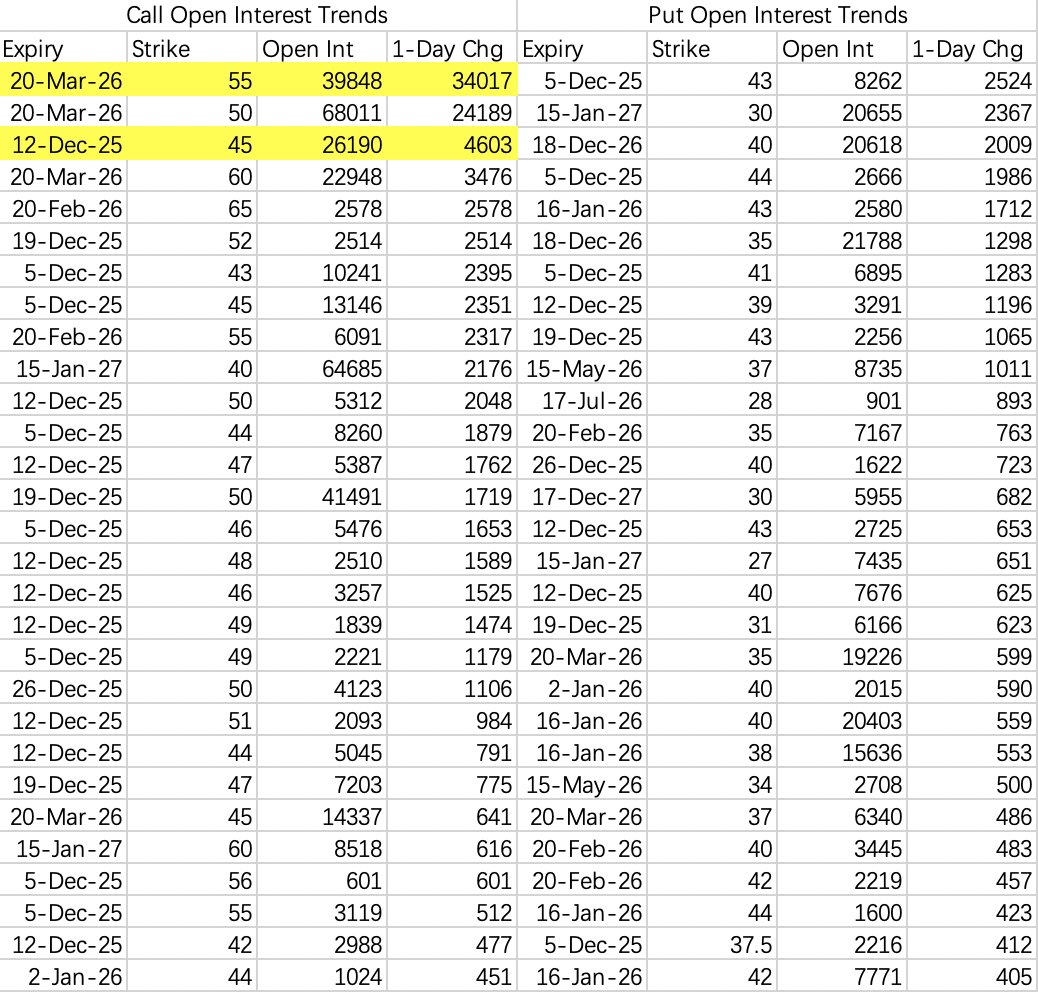

Institutions closed their long 48 Call $INTC 20260320 48.0 CALL$ and rolled to the same expiry 55 Call $INTC 20260320 55.0 CALL$ , indicating further upside targeting $50.

Intel's options flow also shows relative strength. For those looking to chase momentum, selling the 41 Put $INTC 20251212 41.0 PUT$ could be considered.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.