$NVDA$

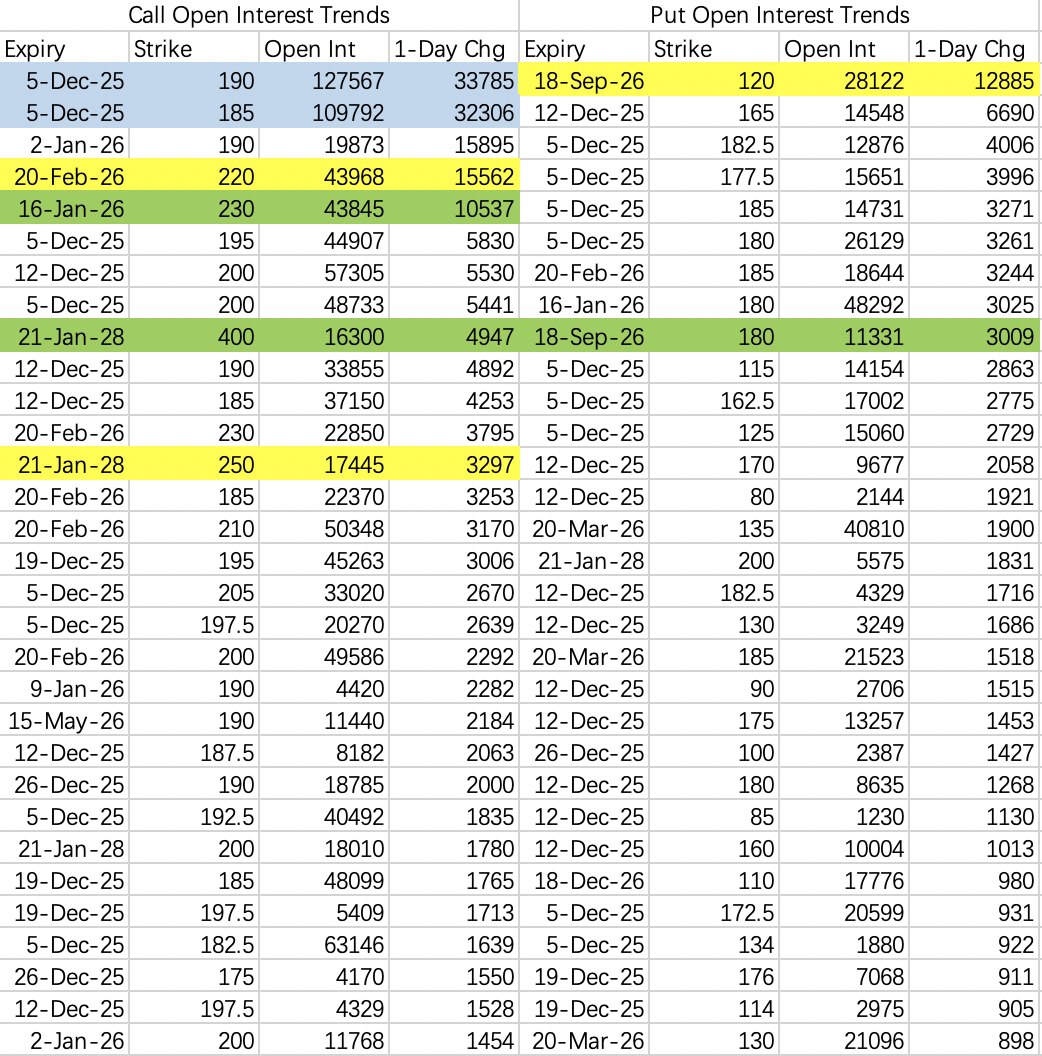

Following Trump's hints about the Fed chair nominee last night, the market gapped up then sold off, printing a bearish upper wick. Interestingly, a significant number of puts were closed, including 28k contracts of this week's 165 put $NVDA 20251205 165.0 PUT$ , signaling shorts are backing off from an immediate assault.

Notably, bearish news like OpenAI pausing ads to accelerate new models and Amazon's chip development challenging NVIDIA had little impact.

The likely closing range for this week now looks like $180–185.

$SPY$

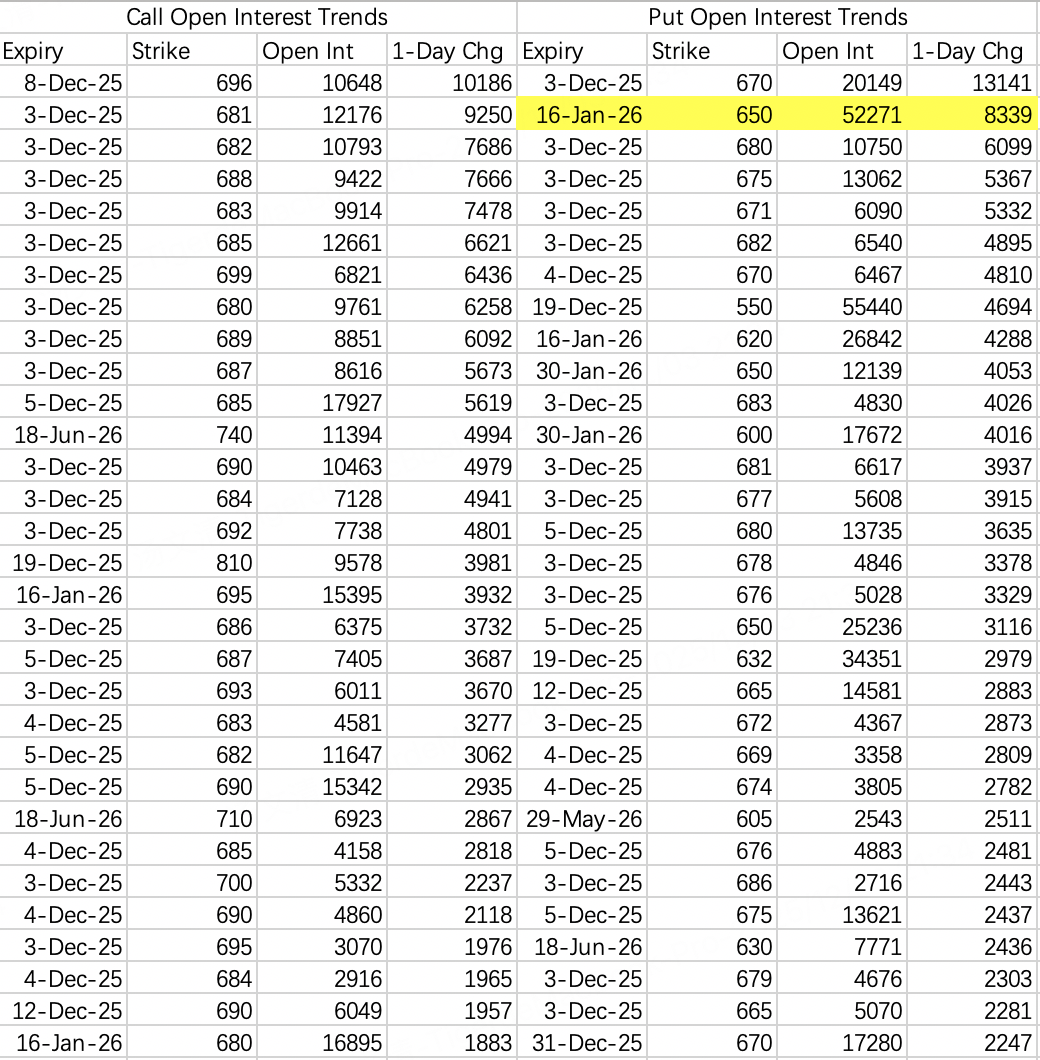

The immediate risk of a sharp drop to 650 has diminished. However, a pullback to 670 is still possible. Overall, the bias remains toward retesting the previous high around 689.

$AAPL$

Apple is leading the tech rally, but expect choppy action between $280–290 this week and next.

A large bullish order in the Dec 12th 290 call $AAPL 20251212 290.0 CALL$ supports the upper bound of that range, but it also creates overhead supply. Breaking above 290 next week will be difficult unless this position unwinds.

$INTC$

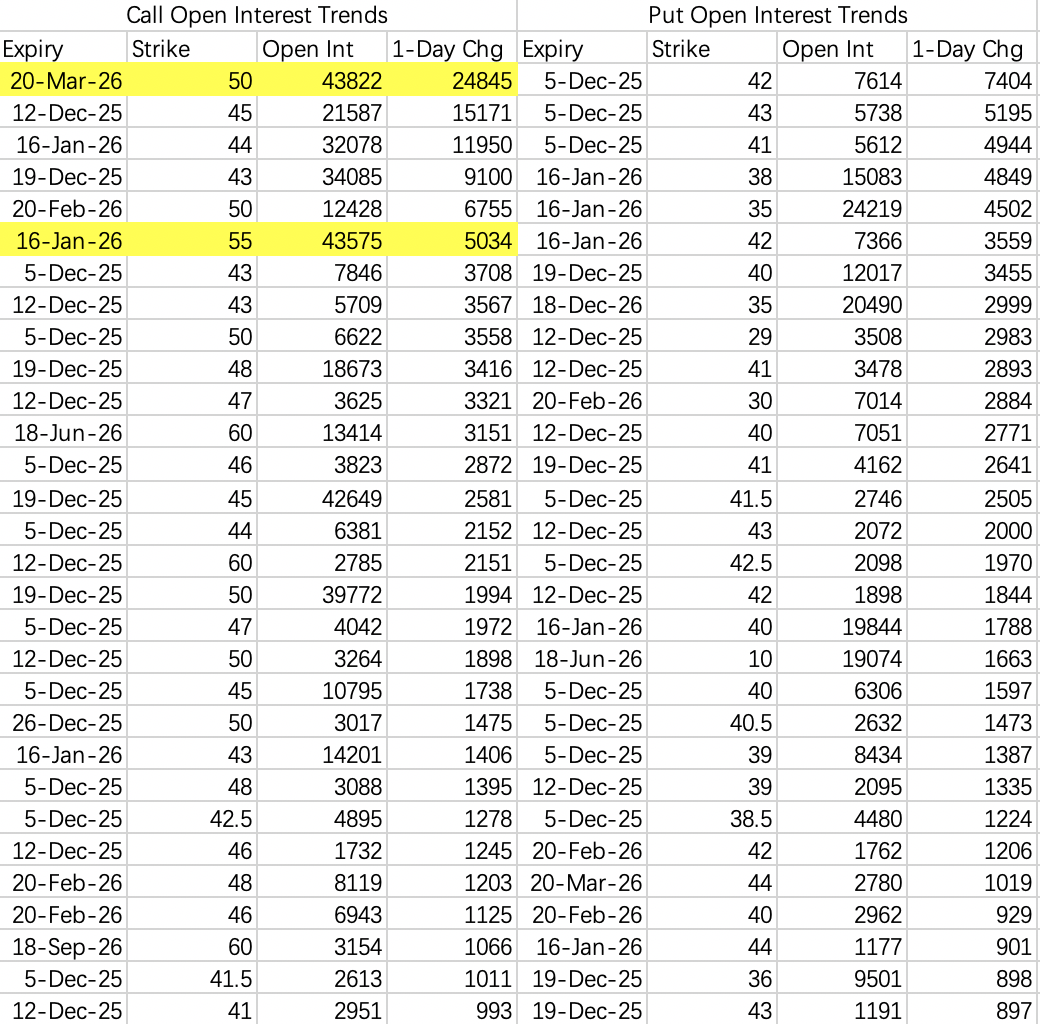

The explosive rally phase appears over. The short-dated call $INTC 20260116 45.0 CALL$ saw 19.7k contracts closed for profit-taking. Additionally, the large short-term call position $INTC 20251219 44.0 CALL$ was rolled to $INTC 20260116 55.0 CALL$ .

$TSLA$

The Dec 26th 440 call $TSLA 20251226 440.0 CALL$ saw 15k contracts opened as sells. Similarly, the 450 call $TSLA 20251226 450.0 CALL$ saw 9,864 contracts opened as sells. This flow suggests Tesla will struggle to break above $440–450 by year-end, potentially due to recent pressure from prominent short sellers.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.