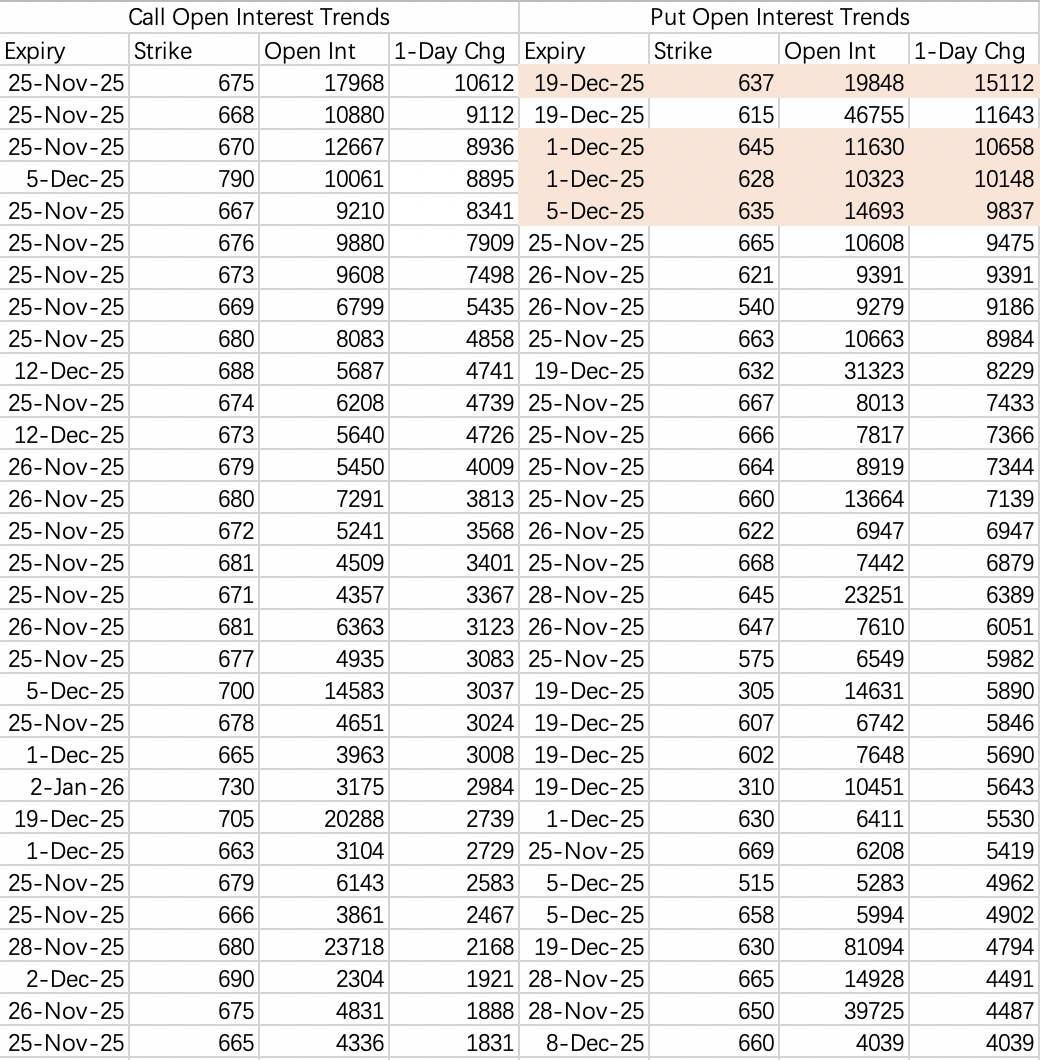

$SPY$

Quick take: It's Thanksgiving week—closed Thursday, half-day Friday. Expect the selling to pause this week, with SPY finishing above its 5-day MA. But the trend hasn't reversed. Next week still looks bearish—shorts are already positioned, targeting 635.

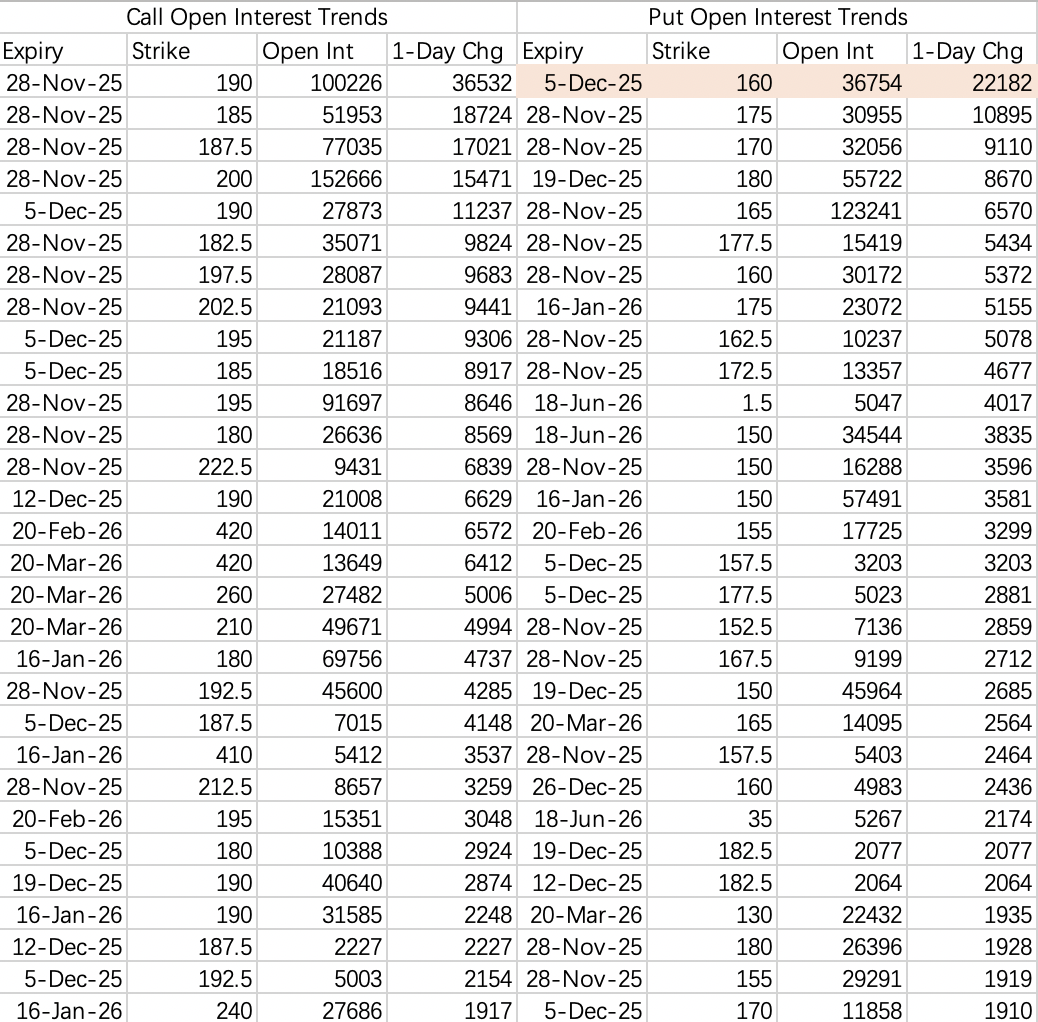

$NVDA$

Same logic applies to NVDA. It'll likely hold above $165 this week, but $160 is on the menu for next week. Even though the Dec 5th 160 put is a sell, the overall open interest tells us the expected price level has shifted lower.

The strategy for NVDA remains selling calls on rallies and positioning short into strength. "Strength" here means any approach toward near-term resistance or high open interest strike zones.

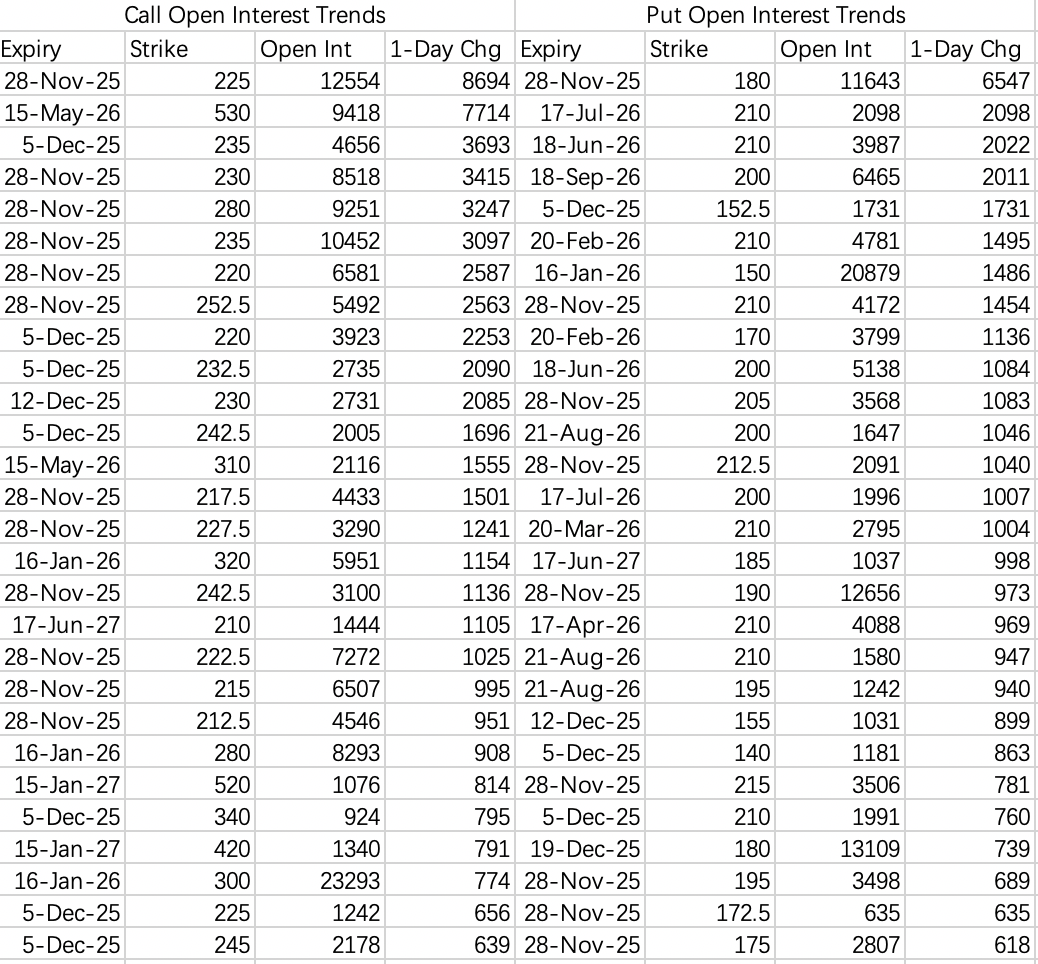

$AMD$

AMD looks done around $180 for now. Same story—watch for a pullback next week.

$META$

Showing some signs of basing. Like AMD, could see a retest of the prior low around $580 next week.

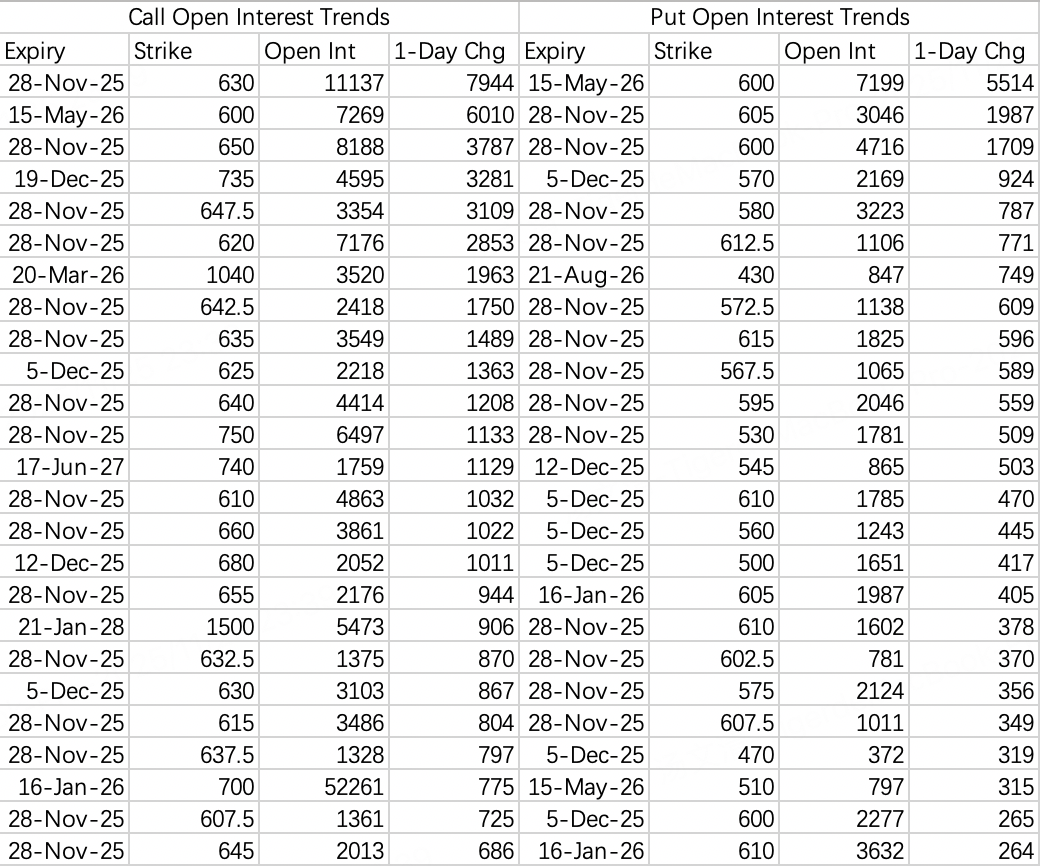

$GOOGL$

The clear AI leader in the market right now. Institutions are rolling long calls targeting $340 by March next year. Still, wouldn't recommend getting aggressively long here.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- denibalance·11-26pLikeReport