Alibaba's earnings report is coming: what do you think? How to do it?

$Alibaba (BABA) $It is scheduled to report its second quarter fiscal 2026 results on Nov. 25.

According to the forecast of 16 brokerages, Alibaba's revenue in the second quarter of fiscal year 2026 is expected to be between 236.229 and 247.652 billion yuan, compared with 236.503 billion yuan in the same period of fiscal year 2025, showing that the year-on-year growth rate dropped from 0.1% to 4.7%.. The median was RMB 242.39 billion, a year-on-year increase of 2.5%.

Due to the intensified competition in the instant retail business caused by the impact of the "food delivery war" and artificial intelligence investment, according to the forecast of eight brokerages, Alibaba's non-GAAP net profit in the second quarter of fiscal 2026 is expected to be between RMB 8.238 billion and RMB 11.2 billion, compared with RMB 36.518 billion in the same period of fiscal 2025, a year-on-year decrease of 69.3% to 77.4%. The median was 8.238 billion yuan, a year-on-year decrease of 77.4%.

Investors will be looking at Alibaba Cloud's revenue growth rate (the company previously announced a three-year 380 billion yuan "AI + Cloud" investment plan and said there will be more investment). Morgan Stanley emphasized the need to focus on the "all other" part of the earnings report (including training on Qwen's large model and adjusted EBITA losses for affiliates). The market will also pay close attention to the latest guidance on related business trends and capital expenditures, the latest developments in competition between catering delivery and instant e-commerce, the quantitative synergy between instant e-commerce and Taobao/Tmall Group, and the gradual contribution of instant e-commerce to customer management revenue growth. contribution, and improving unit economics of instant retail.

Looking back at the last quarter, although the overall data of Alibaba's Q1 financial report for fiscal year 2025 is only stable, the accelerated growth of cloud computing and AI business, the improvement of domestic e-commerce activity, and the company's clear focus on the "consumption + AI" strategy have become the core highlights of the market; Investors regard it as a signal that the results of the transformation have been initially realized. Therefore, although some traditional businesses are still under pressure and profits have not fully exceeded expectations, market sentiment has still warmed up significantly, pushing Alibaba's stock price to rise sharply after the financial report was announced, with a maximum increase of 63%.%, has now dropped 20% from its high point.

On November 24, Alibaba's H shares rose by more than 2%, and U.S. stocks rose by 1.5% in night trading. In terms of news: Its AI assistant Qianwen App has been in public beta for one week and has been downloaded more than 10 million times, surpassing ChatGPT, Sora, and DeepSeek to become the fastest growing AI application in history.

Bull Put Spread

1. Strategy structure

Investors build a on BABABull Put Spread Bull Put Spread, consisting of two put options with the same expiration date:

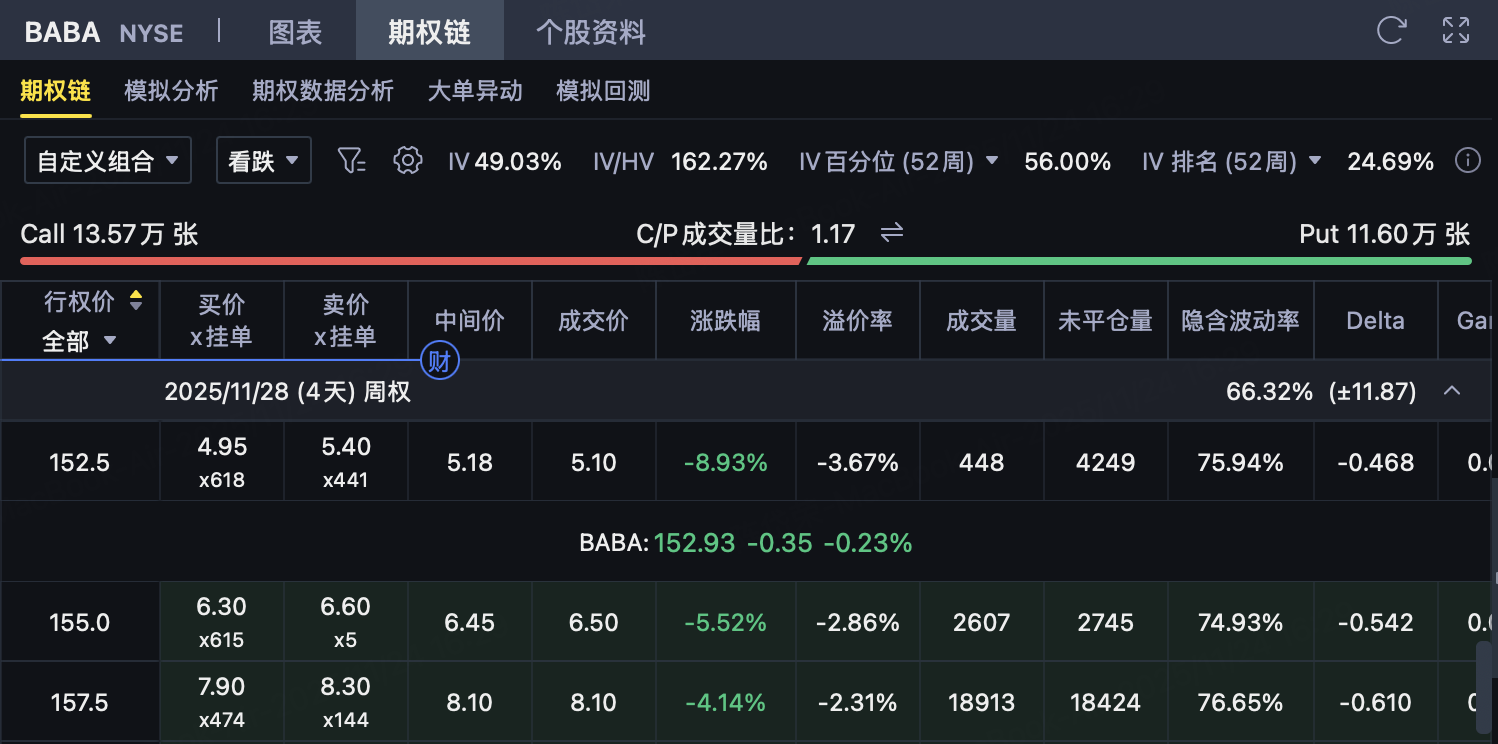

Sell higher strike price Put: K ₂ = 152.5, charge premium $5.10

Buy Lower Strike Put: K ₁ = 148, Pay premium $3.08

The combination belongs toBias bullish (or expect the stock price to remain above a certain range)The credit strategy has limited maximum returns and limited maximum losses. When the BABA is dueLocated at $152.5 or higher, investors achieve maximum profits.

Initial net income

The net premium obtained by investors when opening positions is:

Net income = 5.10 − 3.08 =$2.02/Share

1 mouth = 100 strands, therefore:

Total revenue = 2.02 × 100 =$202/contract

This is the maximum potential gain locked in when the strategy opens a position.

3. Maximum profit

When BABA Expiration Price≥ $152.5At that time, both Put shares are out of the price, and the investor retains all net income.

Maximum profit =$202/contract

4. Maximum loss

When BABA Expiration Price≤ $148, both Put shares are in-the-money, and investors suffer the biggest loss.

Strike spread = 152.5 − 148 =$4.5

Maximum loss (per share) = 4.5 − 2.02 =$2.48/Share

Total maximum loss = 2.48 × 100 =$248/contract

5. Break-even point

The breakeven point is calculated as follows:

Breakeven = 152.5 − 2. 02 =USD 150.48

Expiration price:

≥ $150.48 → Investor Earnings

< $150.48 → Investor losses

6. Risk and return characteristics

Maximum gain: $202/contract

Maximum loss: $248/contract

Profit/loss ratio: 1: 1.23

Applicable scenario: Investors expect BABA price to rise or remain above $152.5

Strategy nature: credit, long, limited returns, limited risks

Engage and Win Options Rewards!

Share your thoughts on options trading or the market in the comments below.

10 lucky participants will each receive a free copy of the Options Handbook!

Already have one, you’ll get a USD 5 Options Voucher instead!

The Options Handbook takes you from the fundamentals to advanced strategies, helping you gradually build your own trading system. You’ll also gain insights from 10 top traders, and learn how to avoid common options trading pitfalls — making your decisions clearer.

💬 Don’t miss out, drop your thoughts and win your reward!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Great article, would you like to share it?