Passing NVIDIA Earnings, Disappointing Price Action

$NVDA$

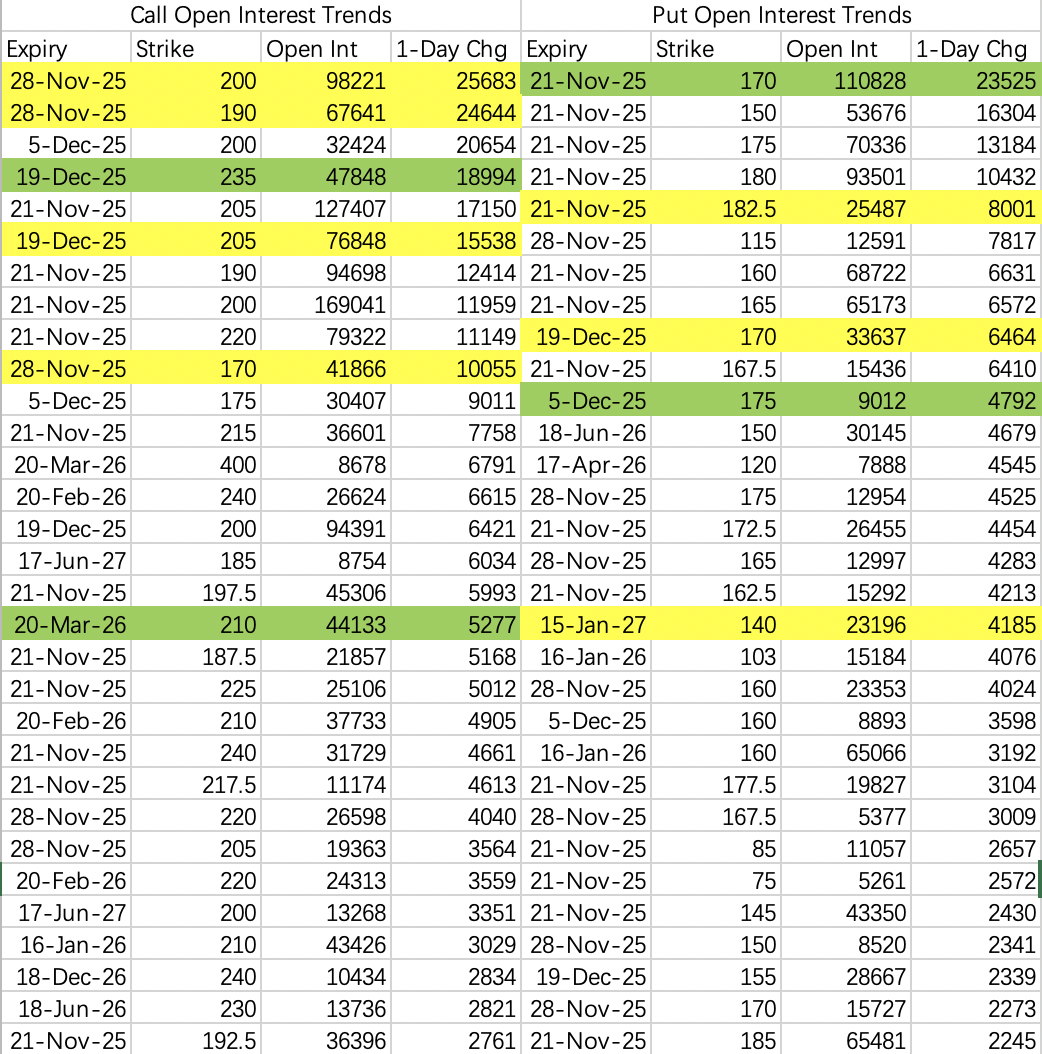

Theoretically, this was a very strong earnings report, with FY2026 EPS projections at $9. A stock price reaching $200 would be reasonable, and last Wednesday's option openings indeed saw bets placed right at that $200 threshold:

For instance, single-leg, near-expiration call buys at 200 $NVDA 20251128 200.0 CALL$ , 190 $NVDA 20251128 190.0 CALL$ , and even in-the-money at 170 $NVDA 20251128 170.0 CALL$ .

More aggressive traders opted for call spreads, like the 205–235 $NVDA 20251219 205.0 CALL$ $NVDA 20251219 235.0 CALL$ . Reaching that range wouldn't have been an issue a couple of months ago, but in the current climate, the pre-market hasn't even touched $200.

Unsurprisingly, the stock is poised for a post-earnings pullback. Put openings reflect significant pessimism, with at least half the bearish bets targeting $170. This includes both buyers $NVDA 20251219 170.0 PUT$ and sellers $NVDA 20251205 175.0 PUT$ , levels to watch if the stock corrects.

In short, the $195 open isn't ideal. While it dragged SPY higher at the open, it clearly falls short of where the earnings report should have taken it. I'm still leaning towards selling calls tonight, but it might be wise to watch the data flow and reassess tomorrow.

$GOOGL$

The stock was poised to test $290 today, but pre-market gains fueled by positive Nano Banana 2 news lifted it higher. Banana 1 was impressive enough; Banana 2's image generation is significantly more refined and highly usable, which will likely trigger another wave of viral adoption.

It's worth noting that Banana 1's release coincided with winning the Chrome antitrust case around September 2nd, making it unclear whether Google's rally then was due to Banana 1 or the positive legal outcome.

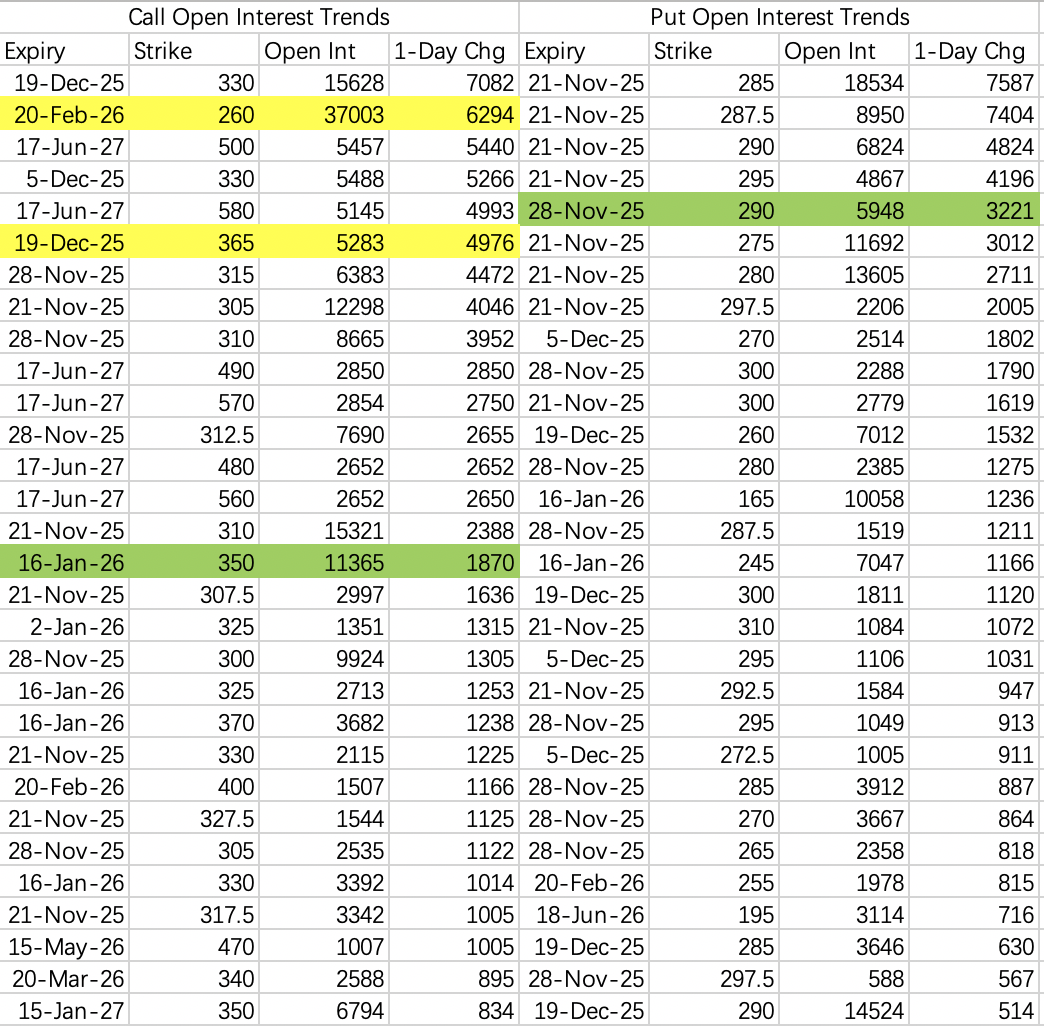

Currently, the combination of Gemini 3 solidifying AI ecosystem leadership and the Nano Banana 2 boost provides very solid support at the bottom compared to other AI sector stocks. Sell puts could be considered in the $280–290 range.

In fact, on Wednesday, institutions made a significant move, selling 17.8k contracts of the Feb '26 300 put $GOOG 20260220 300.0 PUT$ , indicating substantial confidence in the longer-term outlook.

$SPY$

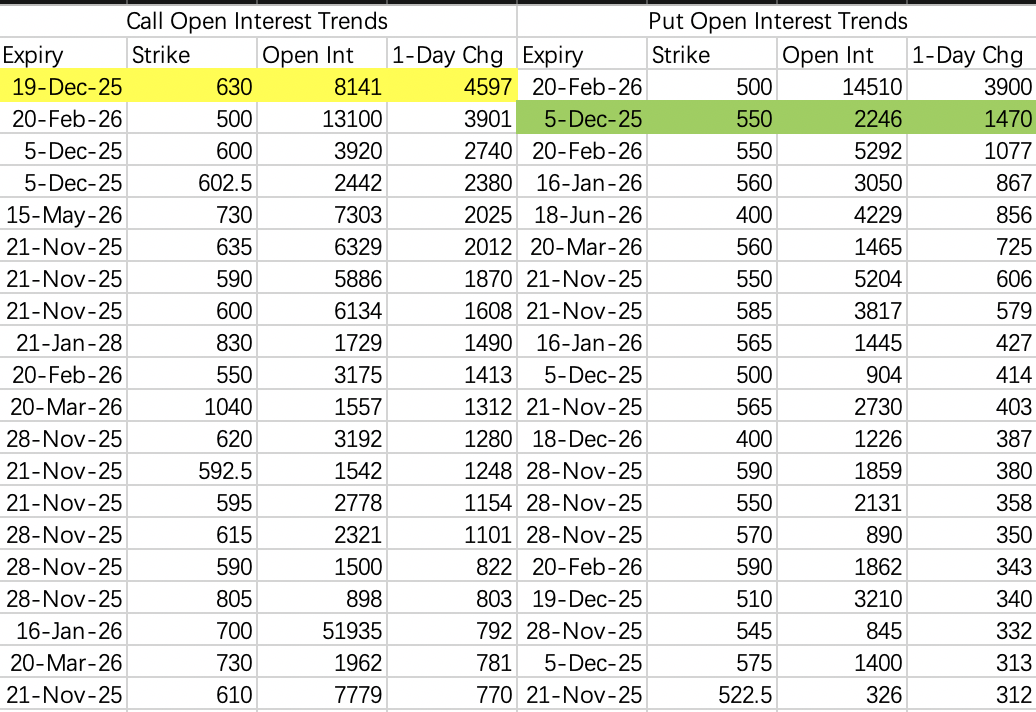

SPY options activity suggests a push toward 650 this week. Today's gap up, driven by NVDA's earnings beat and stronger-than-expected jobs data, is squeezing shorts. The probability of a trend reversal appears low for now.

$TSLA$

Resistance remains firm around $380, with large bearish orders continuing to buy the $TSLA 20251128 390.0 PUT$ . For selling puts, levels below $370 seem more appropriate.

$META$

On the bullish side, large call orders are emerging, e.g., $META 20251219 630.0 CALL$ , though the rationale behind this trade isn't entirely clear to me.

Conversely, a notable sell put order rolled down from the 580 strike, now targeting a safer $550 with $META 20251205 550.0 PUT$ .

$MU$

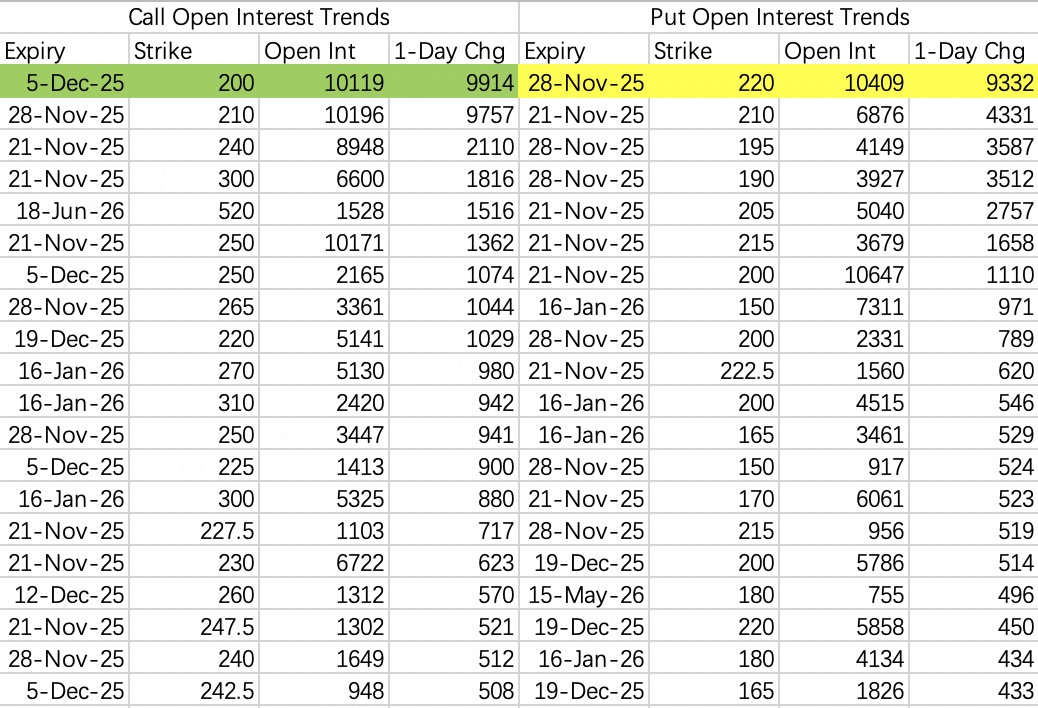

Micron is facing some pullback pressure, evidenced by a large in-the-money sell call order $MU 20251205 200.0 CALL$ and a sizeable buy put position for next week $MU 20251128 220.0 PUT$ .

However, these two trades suggest limited downside, with initial support seen around $200. Selling in-the-money calls is similar to shorting the stock, profiting as the price declines.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.