Microsoft's financial report, making profits while maintaining stability

$Microsoft (MSFT) $It is scheduled to announce first-quarter fiscal 2026 results on Oct. 29. Wall Street expects this Microsoft FY26 Q1 EPS of $3.66 and revenue of $75.39 billion, implying an increase of 14.9% for the quarter.

In the last reported quarter, the company delivered an earnings surprise of 8.96%. The company beat the consensus earnings estimate in each of the trailing four quarters, with an average surprise of 7.02%.

Microsoft is about to announce its financial report for the first quarter of fiscal year 2026 (FY26 Q1, covering July-September 2025). The market generally expects its performance to continue to benefit from strong demand for cloud computing and artificial intelligence infrastructure. The company accelerated its AI strategic layout this quarter, consolidating its competitive barriers in the enterprise-level AI field by launching a number of key product and platform updates, including Microsoft 365 Copilot's intelligent routing and voice interaction capabilities, SharePoint AI agent integration, and the new Microsoft Marketplace AI application classification. Thanks to these innovations, Microsoft is expected to achieve steady improvements in enterprise user penetration and average revenue per user (ARPU), driving the continued growth of the overall cloud business.

At the business level, Microsoft expectsProductivity and business process segment revenue will reach US $32.2-32.5 billion, a year-on-year increase of approximately 14%-15%。 Among them, Microsoft 365 commercial cloud revenue is expected to grow by 13%-14% at constant exchange rates, mainly driven by the expansion of E5 suite and Copilot deployment.The smart cloud segment is expected to generate revenue of US $30.1-30.4 billion, a year-on-year increase of 25%-26%, the Azure business is expected to grow by approximately 37% (at constant currency) and continue to be the core engine of performance. With the release of Azure AI Foundry, AI agent services and intelligent retrieval functions, the company has significantly improved the processing capabilities of complex tasks and the attractiveness of enterprise-level AI platforms. Microsoft also disclosed that its contract backlog totaled US $368 billion, providing sufficient visibility into future revenue and supporting its huge capital expenditure and data center expansion plans.

More personal computing segmentsEstimated revenue$124-$12.9 billion, a year-on-year decrease of about 3%. Although the Windows OEM and device business remains under pressure, the launch of games, advertising and the new version of Windows 11 (25H2) is expected to partially offset the decline. Xbox content and services are expected to maintain high single-digit growth, thanks to the launch of a number of popular games and the expansion of the cloud gaming ecosystem. Overall, Microsoft's deep investment in AI and cloud is forming sustained growth potential. Even if the personal computing business is weak in the short term, the company is still expected to achieve steady double-digit revenue growth in FY26 Q1 and further strengthen its global AI and cloud service market leadership.

How has Microsoft performed over the past few earnings seasons?

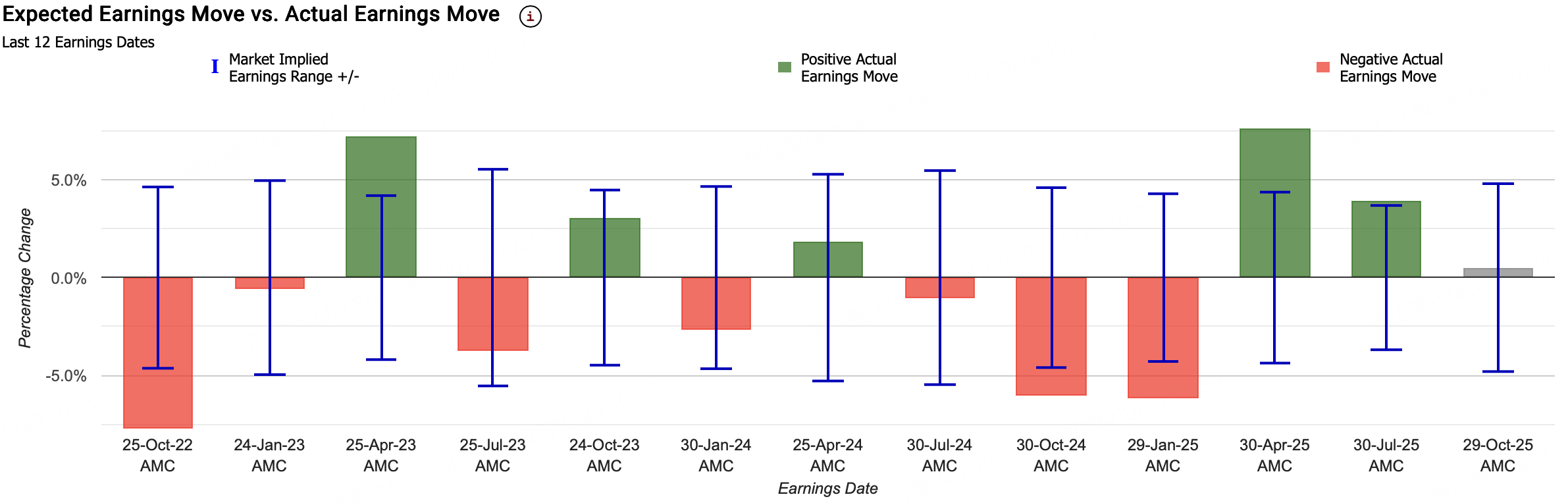

Microsoft's current implied change is ± 4. 8%, indicating that the options market bets on its single-day rise and fall of 4.8% after its performance; In comparison, its post-performance stock price change in the first four quarters was approximately 5.95%.

In the last 12 earnings quarters, the options market hasOverestimating Microsoft's (MSFT) Stock Price Move 50% of the Time Post-Earnings。 Before the earnings report was released, the average market expected stock price fluctuations to be±4.7%, and the average fluctuation of the stock price after the actual financial report is announced (absolute value calculation) is only4.3%。

Over the past six earnings seasons, Microsoft's actual stock price movements were: +1.8%,-1.1%,-6.1%,-6.2%, +7.6%, +3.9%.

In response to Microsoft's performance release, we adopt a selling wide straddle strategy.

Sell Wide Straddle Strategy

By selling wide straddles, investors intend toTaking advantage of market overvalued volatilityGet the benefits. If Microsoft's stock price remains stable and fluctuates less than market expectations after the release of its financial report, this strategy will make the most profit. On the contrary, if the financial report triggers violent fluctuations, the risk of loss will increase significantly. Therefore, this strategy is applicable toShort-term stability, low volatility expectationsAnd haveRisk tolerance and stop loss mechanismOf investors.

The specific operation is as follows:

First, the selling strike price is$537.5 Call option (Call);

Second, the selling strike price is$517.5 Put Option (Put)

Analysis of profit and break-even point

Net premium revenue:Revenue = Sell 517.5 Put + Sell 537.5 Call = 3.55 + 15.68 =$19.23/Share→ Net revenue per contract$1,923, which is the strategyMaximum potential profit。

Profitability conditions:When Microsoft's (MSFT) share price at expiration between$517.5 vs $537.5When, all options will expire and become invalid, and investors will retain all premium rights.$19.23。

Break-even point below:$517.5 − $19.23 =$498.27→ If the stock price falls below$498.27, investors began to lose money.

Above breakeven point:$537.5 + $19.23 =$556.73→ If the stock price breaks through$556.73, investors began to lose money.

Maximum loss (below):Downside risk theoreticallyInfinitely close to the stock price returning to zero, maximum loss = $498.27 − 0 − premium received ≈Near infinity (maximum loss ≈ stock price decline × 100 − premium)。

Maximum loss (above):Because selling the call option isSelling naked, when the stock price continues to rise, lossInfinite expansion。

Strategy Characteristics and Risk Analysis

Profit logicInvestors are betting on lower share price volatility than market expectations after earnings. Revenue mainly derived fromTime value decay (Theta) and implied volatility fall (IV Crush)。 If Microsoft's stock price remains stable or fluctuates slightly after the earnings report, this strategy can achieve maximum returns.

Risk characteristicsSell wide straddle isUnlimited Risk Strategy, may suffer huge losses when the stock price fluctuates unilaterally greatly. Especially if the financial report exceeds market expectations and causes a sharp rise or plunge, the loss may far exceed premium's revenue.

Directional neutralityThe strategy does not rely on the prediction of Microsoft's stock price rise and fall, as long as the price is in$498.27–$556.73Running within the range, investors remain profitable. Therefore, this strategy is best suited toShort-term volatility or excessive volatilityThe situation.

Volatility riskIf the actual volatility caused by the financial report is higher than the level reflected by the implied volatility, the option price may continue to be high, resulting in floating losses; On the contrary, if volatility drops rapidly, the realization of strategic benefits will be accelerated.

Time decay advantageAs the option is nearing expiration,Time value lost quickly, as long as the stock price remains stable, the value of investors' positions will improve every day that passes. Time decay is the main source of profit for this strategy.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- mnmjeffxd·2025-10-29Great article, would you like to share it?LikeReport