Violent shakeout

Looking at some extreme opening call spreads, it’s possible the week of Oct 3 will see even larger swings than last week.

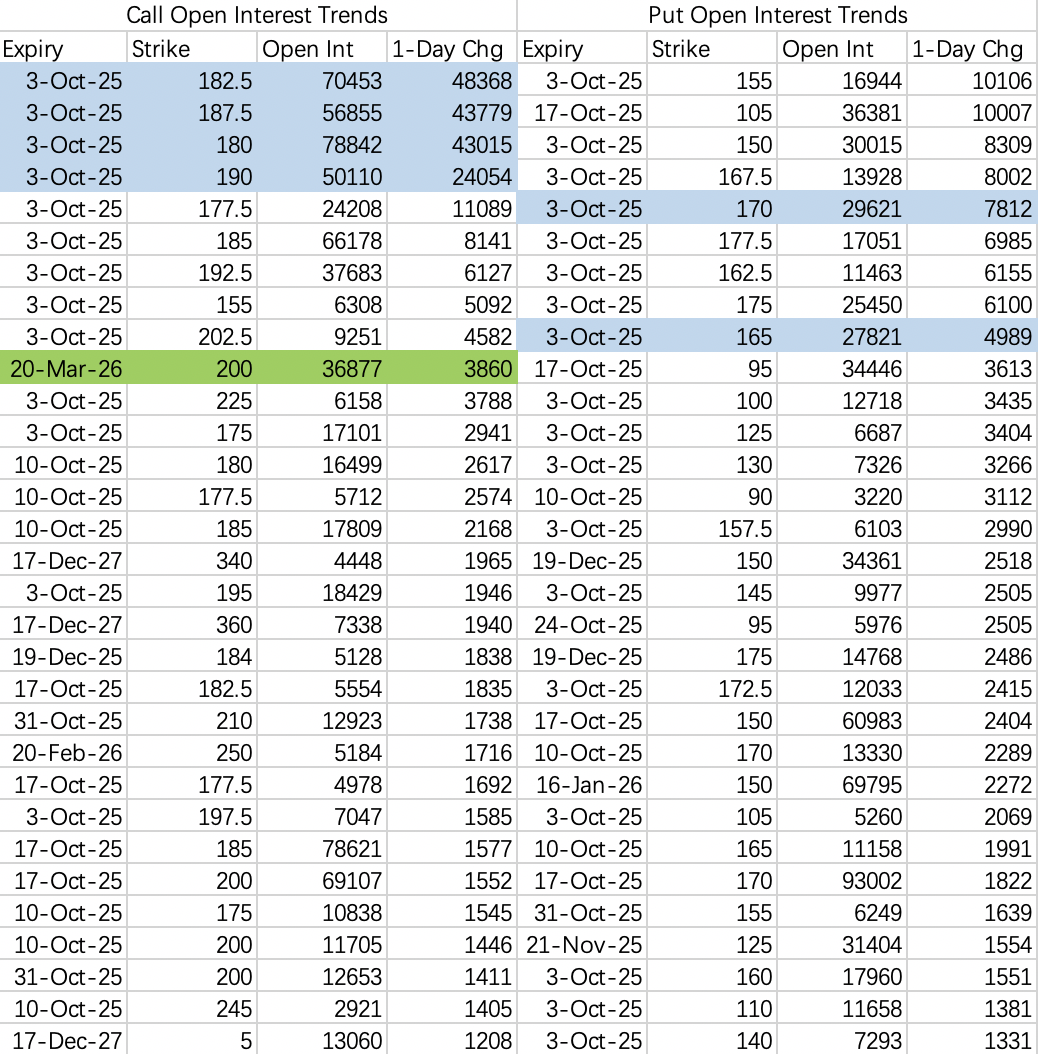

Specifically, institutions are selling calls $NVDA 20251003 182.5 CALL$ and $NVDA 20251003 180 CALL$ , hedged by buying calls $NVDA 20251003 190 CALL$ and $NVDA 20251003 187.5 CALL$ . Resistance looks similar to last week—below 185.

Bearish openings are quite pessimistic. While I still think it’s hard to break below 170 $NVDA 20251003 170.0 PUT$ , there are many new positions being opened below 160, which are dominating flows.

Same view as last week: trade the range. Near 170, sell puts $NVDA 20251003 170.0 PUT$ ; above 180, consider selling calls $NVDA 20251003 187.5 CALL$ .

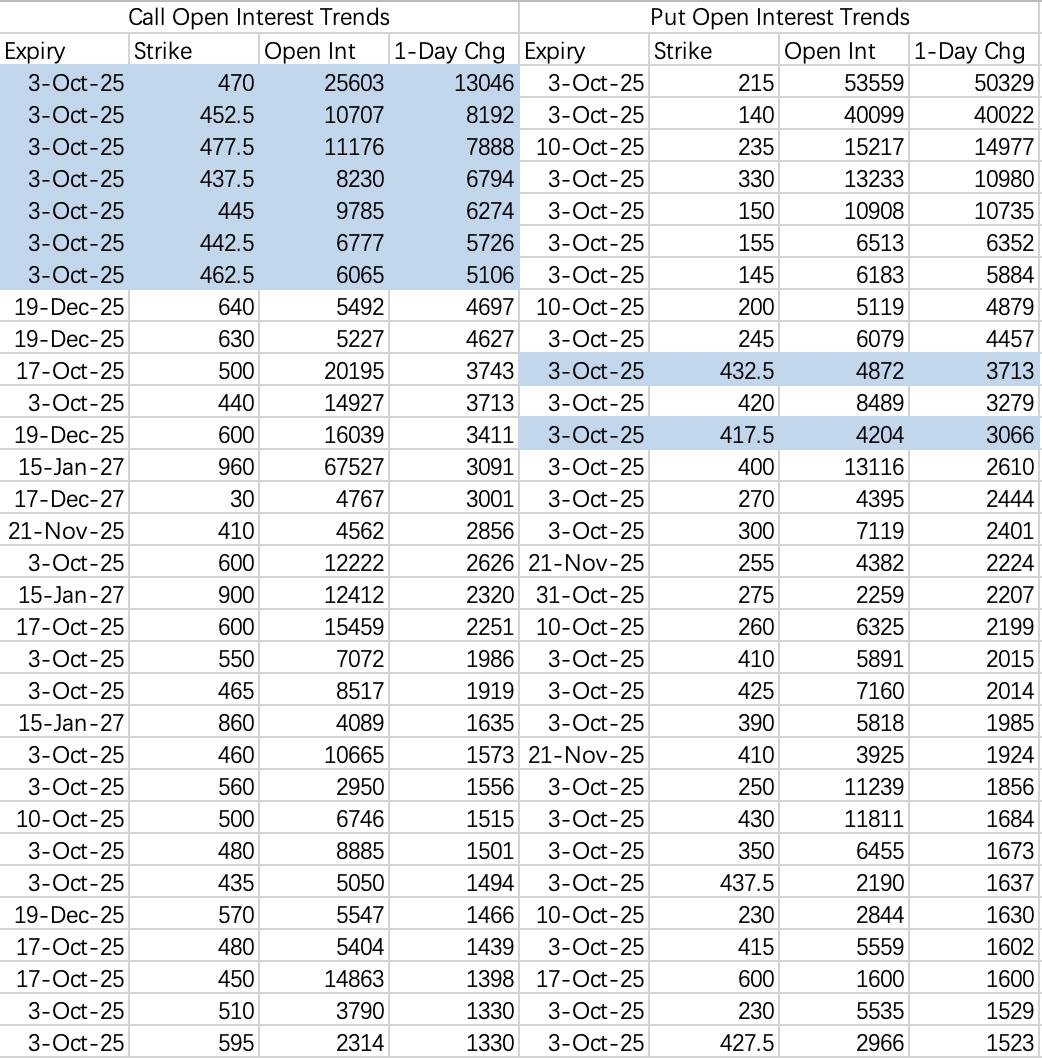

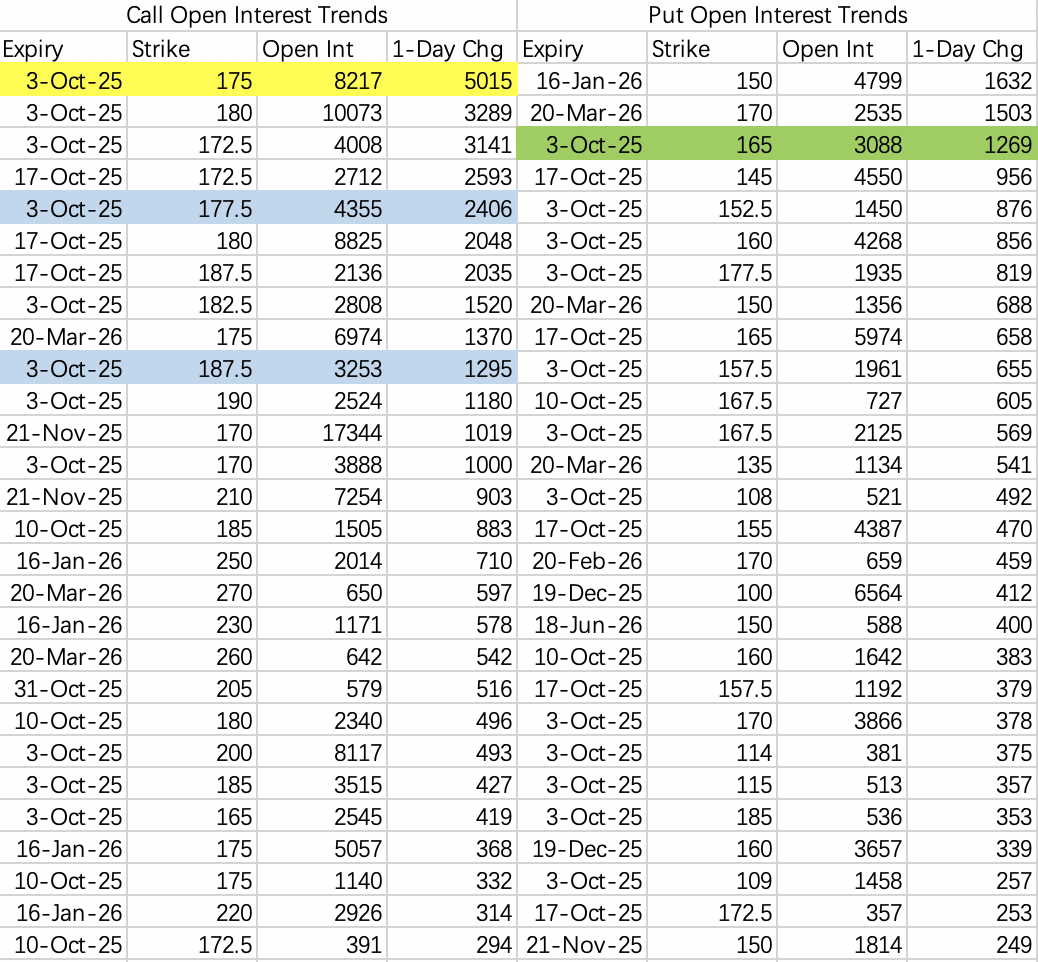

Given institutions are again aggressively opening bullish call positions, there’s some squeeze risk in Tesla.

Sell-call strikes: $TSLA 20251003 437.5 CALL$ $TSLA 20251003 442.5 CALL$ $TSLA 20251003 445 CALL$ $TSLA 20251003 452.5 CALL$ . Hedging buy-call strikes: $TSLA 20251003 462.5 CALL$ $TSLA 20251003 470.0 CALL$ $TSLA 20251003 477.5 CALL$ .

Bear put spread: $TSLA 20251003 432.5 PUT$ $TSLA 20251003 417.5 PUT$ .

Therefore, the suitable short strangle zone this week is $TSLA 20251003 470.0 CALL$ and $TSLA 20251003 417.5 PUT$ .

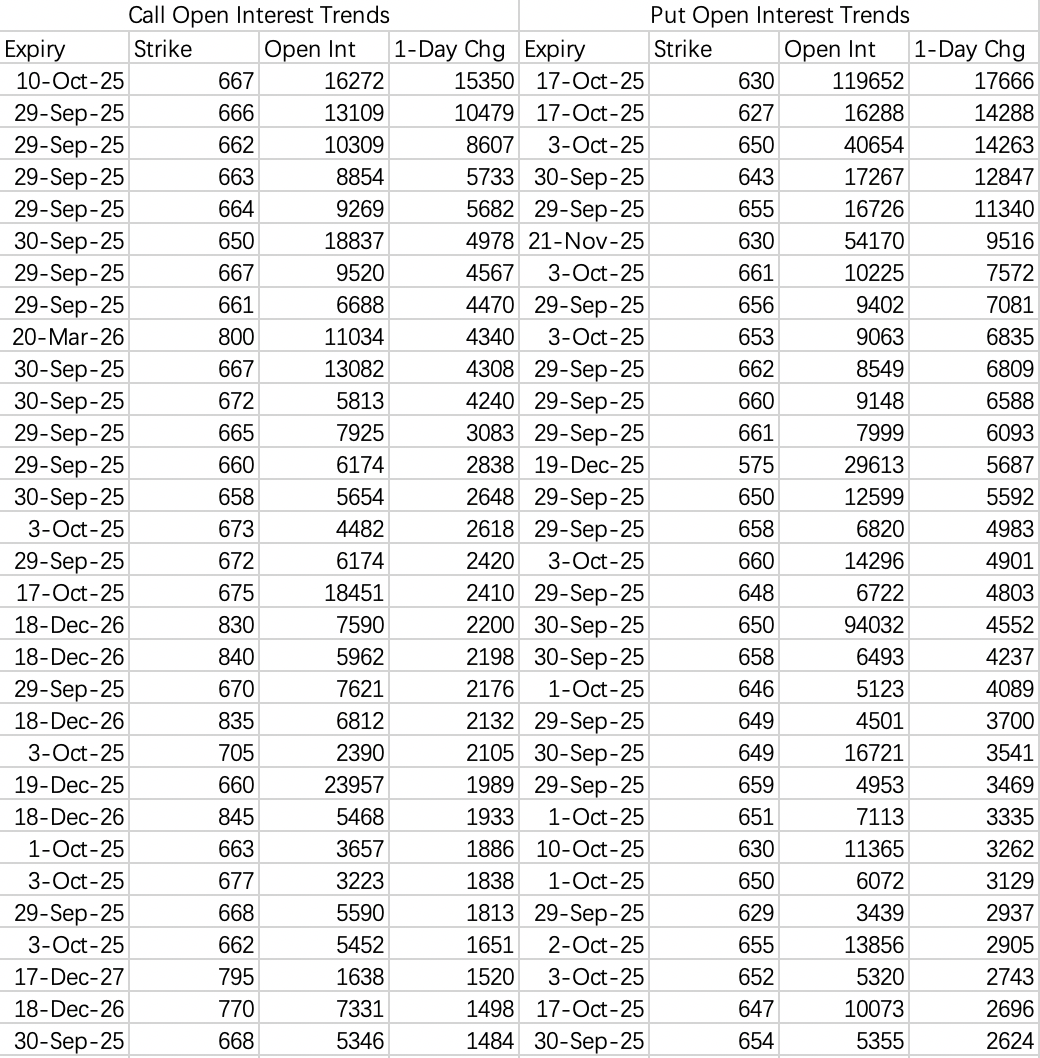

SPY positioning is subtle as well. Expected range this week: 650–670, wider than last week’s 655–665.

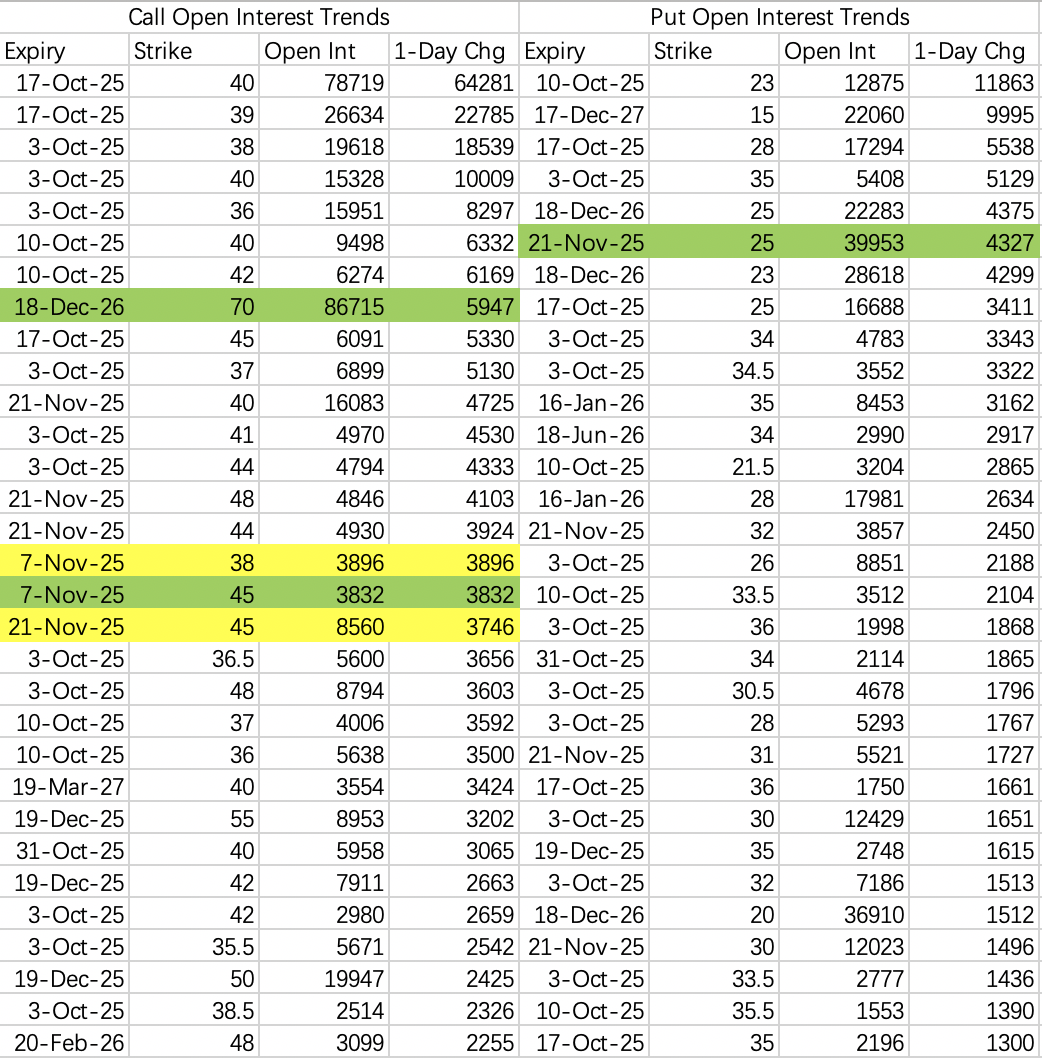

Intel is tough to analyze—new cooperation headlines can pop up anytime.

Based on general market action, the 40 calls have heavy opening flow and form near-term resistance. Views on put-side pullback levels are split: conservative camp prefers 25 for safety; aggressive camp thinks 34 is reasonable.

Sharing two speculative setups: sell put 25 + buy call 45 $INTC 20251121 25.0 PUT$ $INTC 20251121 45.0 CALL$ ; and buy call 38, sell call 45 $INTC 20251107 38.0 CALL$ $INTC 20251107 45.0 CALL$ .

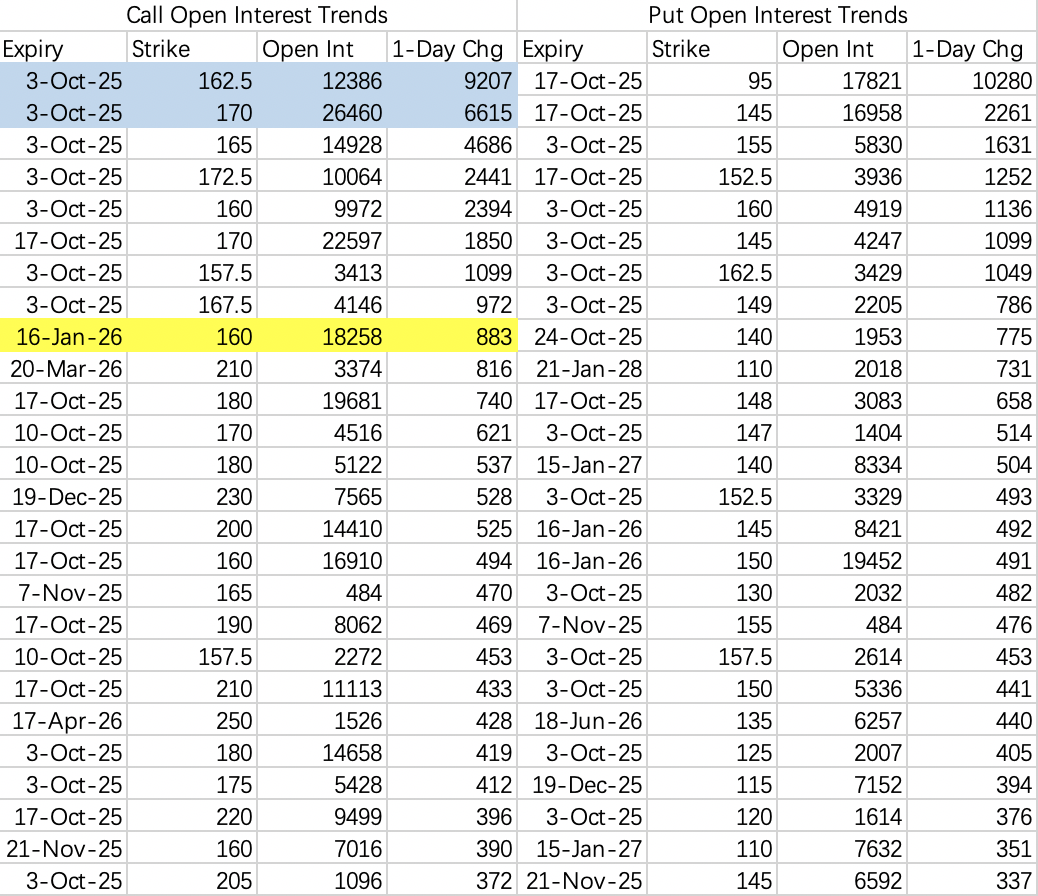

After a long sideways stretch with no breakout signs, institutions this week sold the 162.5 calls $AMD 20251003 162.5 CALL$ and bought the 170 calls $AMD 20251003 170.0 CALL$ .

Reference sell-put strike: 150 $AMD 20251003 150.0 PUT$ .

Alibaba continues to push higher. Institutions sold the 177.5 calls $BABA 20251003 177.5 CALL$ and hedged with bought 187.5 calls $BABA 20251003 187.5 CALL$ . Short-term sell-put reference strike: $BABA 20251003 165.0 PUT$ .

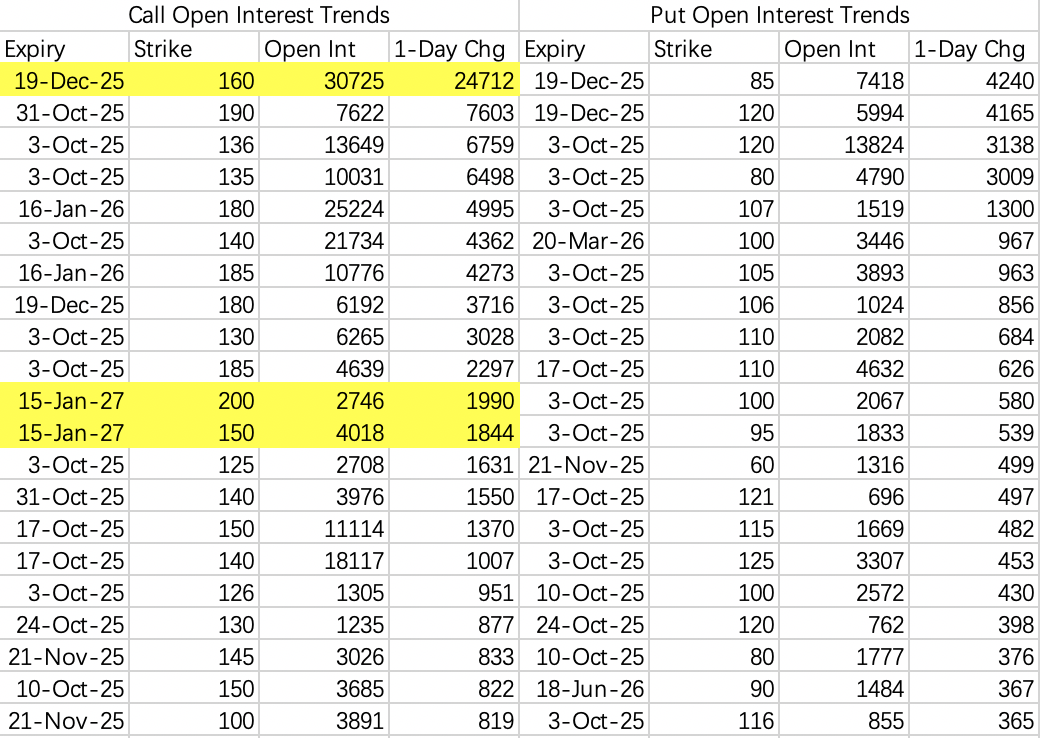

Hot take: CRWV could reach 160 by year-end.

Medium-term long calls have moved into CRWV, and the first roll has begun.

An institution closed 30,000 Oct-expiry 115 calls $CRWV 20251017 115.0 CALL$ and rolled 30,000 to Dec 160 calls $CRWV 20251219 160.0 CALL$ .

Block prints show the 115 calls as buys and the 160s as sells. As I’ve said before, broker-reported order direction can be inaccurate.

Why I’m fairly confident: when they gradually opened the 115 calls in early September, the flow was buy-to-open. Single-leg opening direction is more reliable than multi-leg. It wouldn’t make sense to say both opening and closing were “buys,” right? Still, this is my reasoned inference from experience and tape—believe it or not, your call.

There were also long-dated long-call openings: a large buy of 1,844 contracts of the 150 calls $CRWV 20270115 150.0 CALL$ ($7M notional) and 1,990 contracts of the 200 calls $CRWV 20270115 200.0 CALL$ ($5M notional).

For a growth name like CRWV, pure sell-puts aren’t ideal—you’ll sacrifice alpha. Consider outright long stock or a sell-put + buy-call hedged long strategy.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.