Super bull market? A roundup of bullish block trades

Long-awaited block trade roundup:

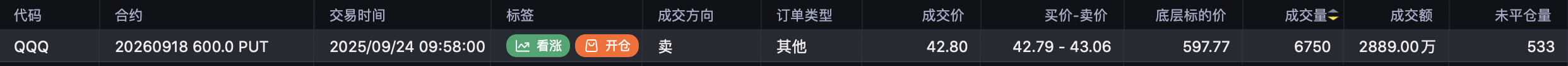

Sell put 600 $QQQ 20260918 600.0 PUT$ , volume 6,750, notional $28.89M. A one-year-out 600 put that, in theory, is a “can’t-lose” sell; in practice it implies the big player expects no VIX > 30-type selloff soon, otherwise margin calls could force a cover.

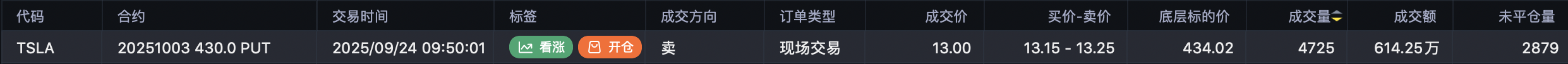

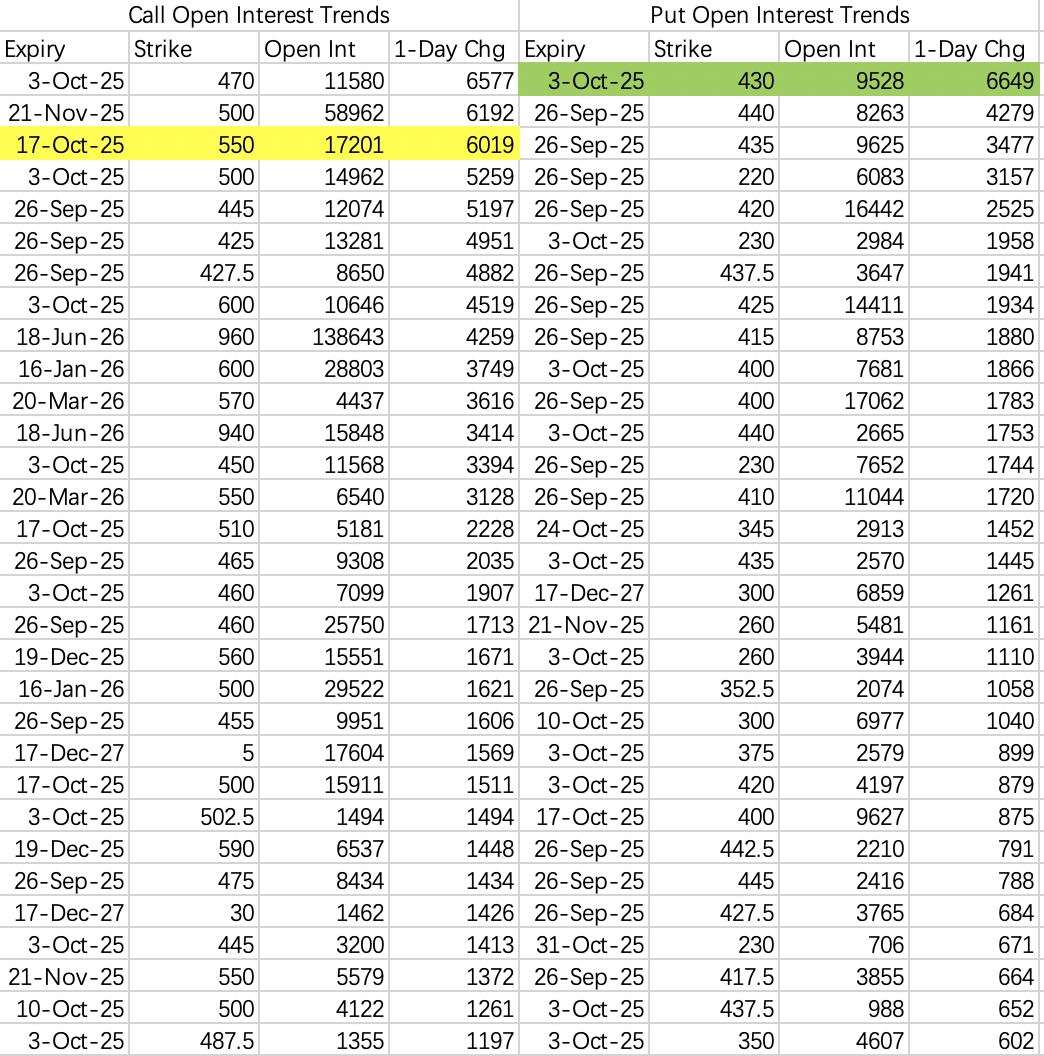

Sell put 430 $TSLA 20251003 430.0 PUT$ , volume 4,752, notional $6.14M. Interpreted as expecting TSLA to close above 430 on Oct 3, or at least above 417.

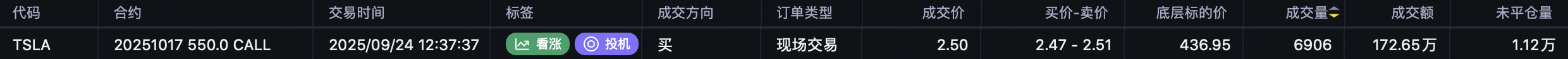

Buy call 550 $TSLA 20251017 550.0 CALL$ , volume 6,906, notional $1.72M. Bullish TSLA.

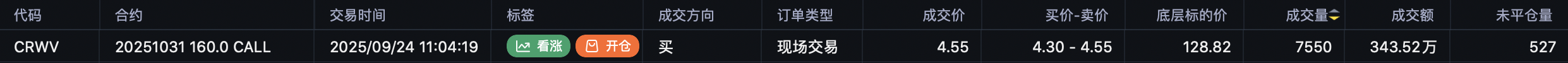

Buy call 160 $CRWV 20251031 160.0 CALL$ , volume 7,550, notional $3.435M. Likely a bet on a move to 160 into or on earnings.

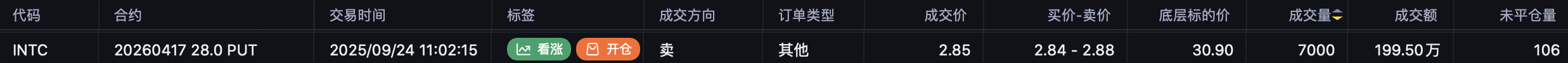

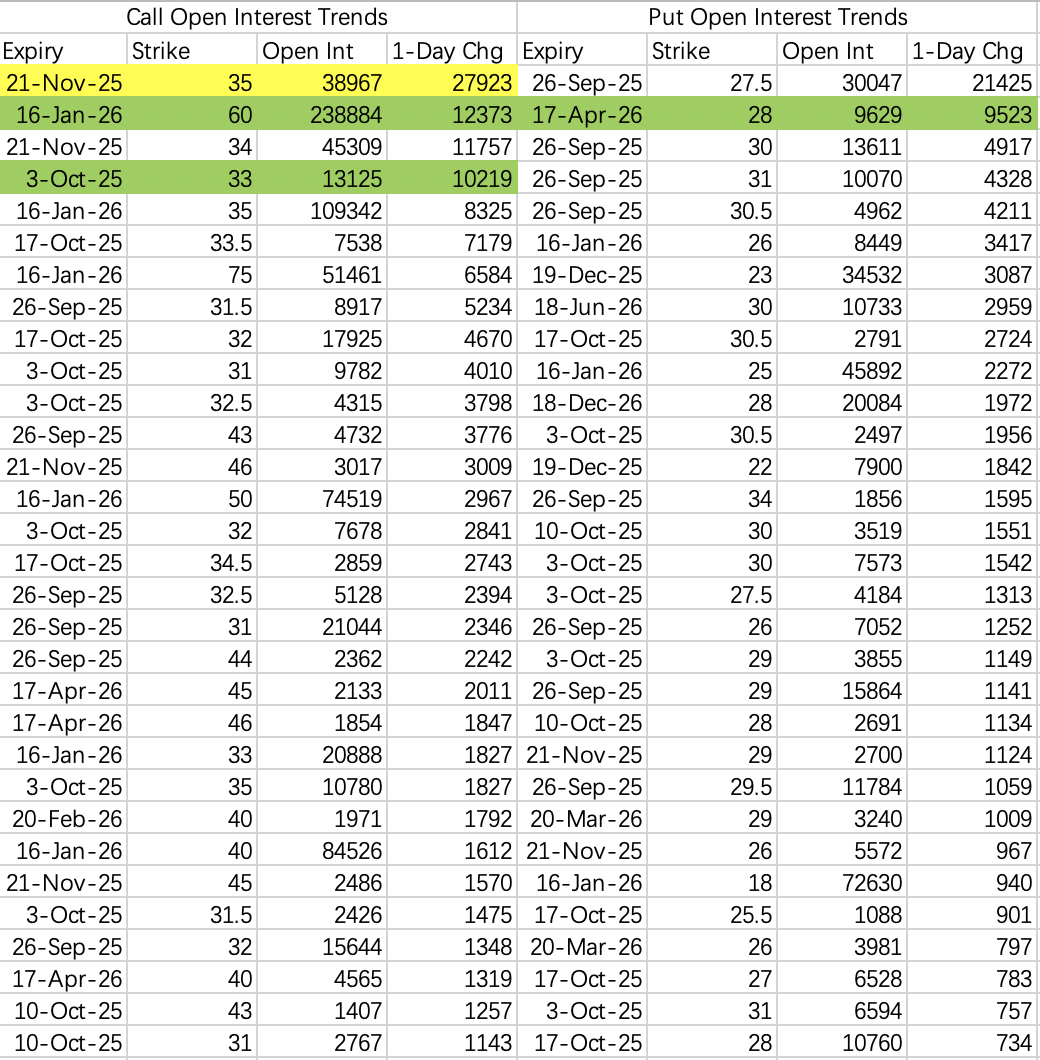

Sell put 28 $INTC 20260417 28.0 PUT$ , volume 7,000, notional $1.995M. View: Intel is worth buying at 25 or can hold above 28 next year.

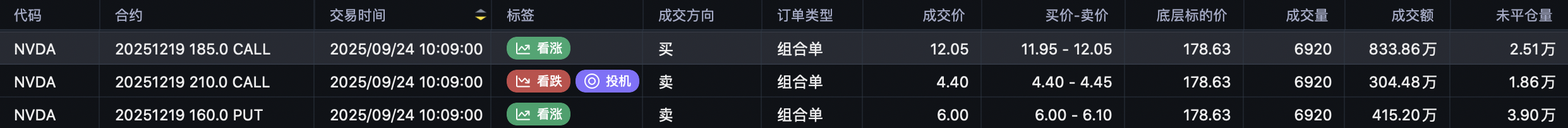

Sell put 160 $NVDA 20251219 160.0 PUT$

Buy call 185 $NVDA 20251219 185.0 CALL$

Sell call 210 $NVDA 20251219 210.0 CALL$

Overall view: bullish NVIDIA with a year-end price zone above 190.

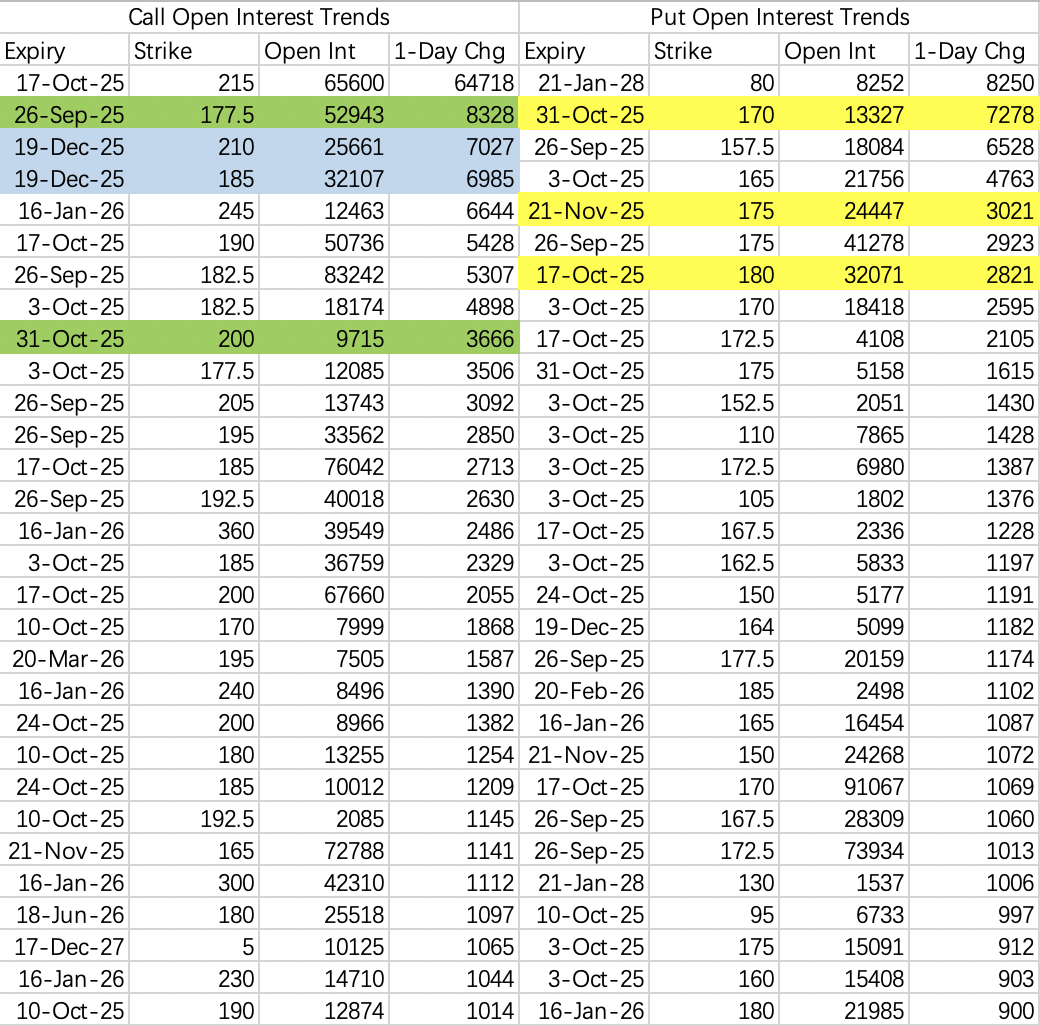

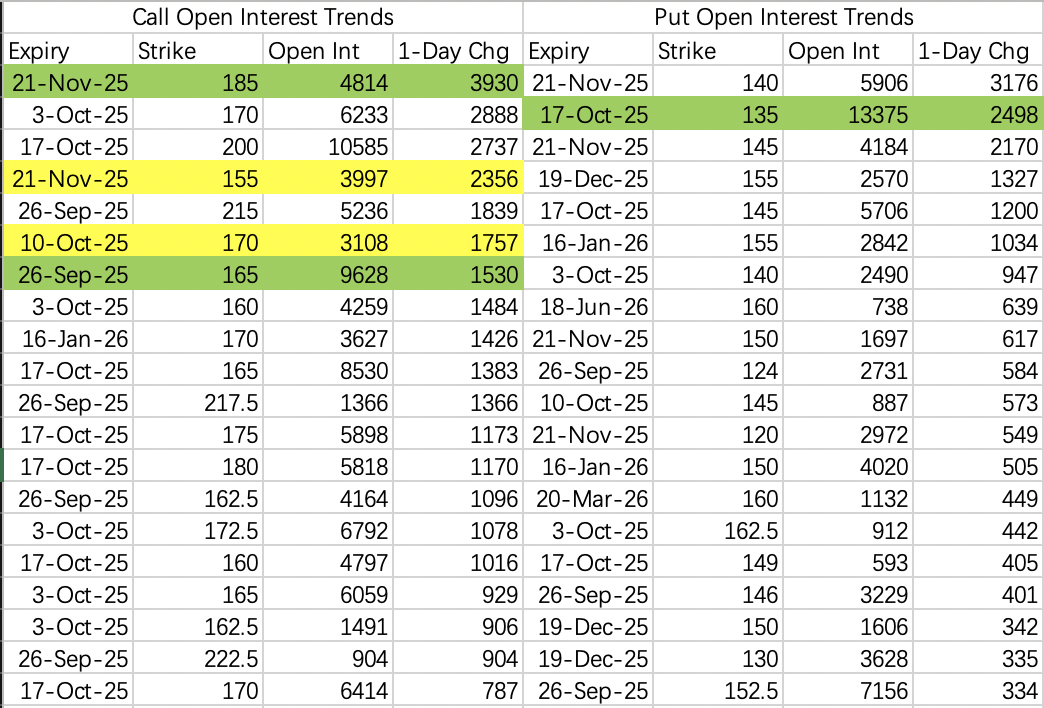

Options flows suggest tug-of-war around 170, and likely sub-200 in October.

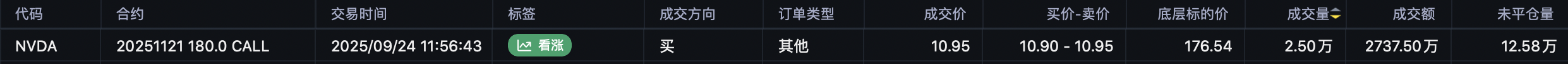

Notably, the “$200M guy” closed 25,000 of the 180 calls $NVDA 20251121 180.0 CALL$ , leaving 100,000 contracts open. Trimming here is puzzling—unclear what informational edge is at play.

215 calls expiring Oct 17 $NVDA 20251017 215.0 CALL$ saw 64,000 opened; direction uncertain, but taken with other flows, it implies October spot likely below 215.

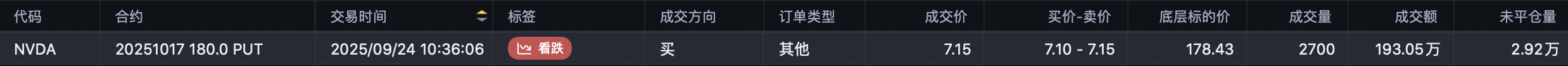

A large bearish October position bought the 180 puts $NVDA 20251017 180.0 PUT$ , volume 2,700, notional $1.93M. Given a possible pullback to 170, the bearish hedge makes sense.

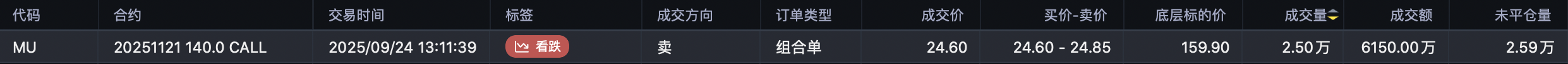

A bullish block closed 25,000 of the November 140 calls $MU 20251121 140.0 CALL$ without a roll—might reassess for a few days, similar to ORCL.

Conservative bears see sub-185 by late November; aggressive bears want a retest of the 20-day MA around 145. I’d wait and use those levels to choose long-call strikes.

How to read Intel’s news?

“Save Intel” X

Make U.S. government investment pay off √

Politically, government-backed capital “shouldn’t lose,” which makes a large sustained decline in Intel less likely.

Top bullish opening flow is the 35 calls $INTC 20251121 35.0 CALL$ , mostly buys, with 27,900 opened. Useful as a near-term reference.

As noted above in the block section, pullbacks are suitable for selling puts; 420 or 430 strikes both work.

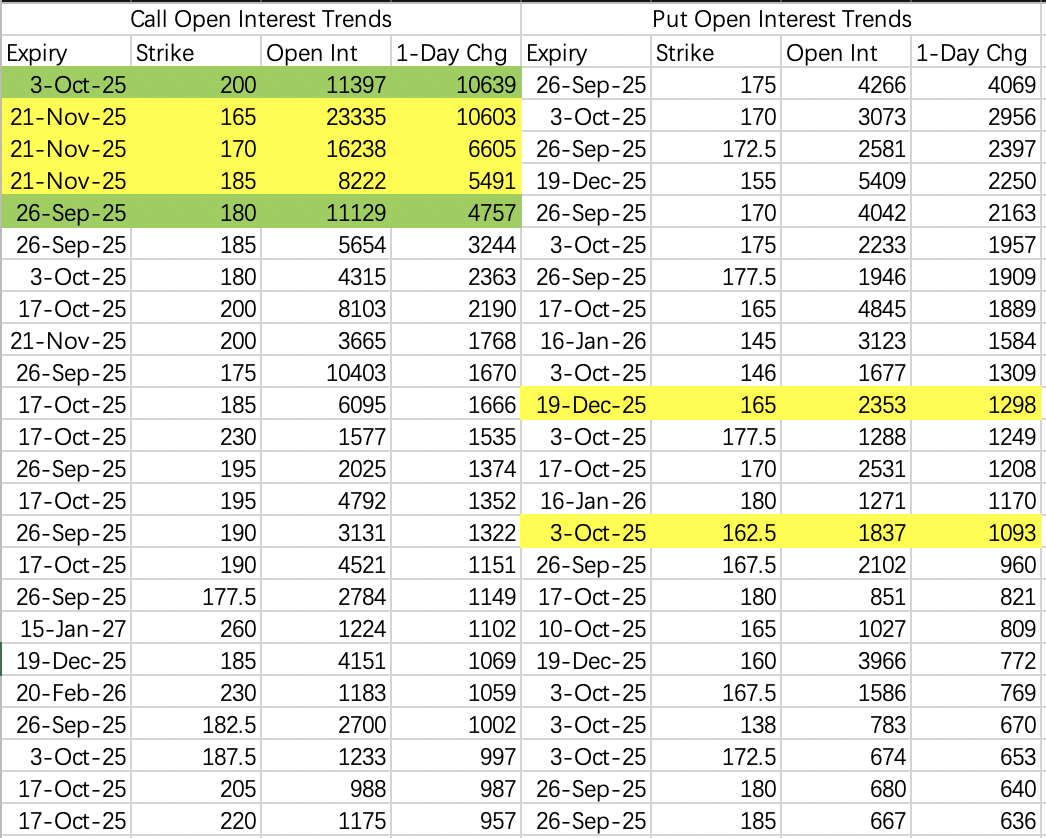

Bullish toward 200; on dips consider selling puts $BABA 20251003 170.0 PUT$ .

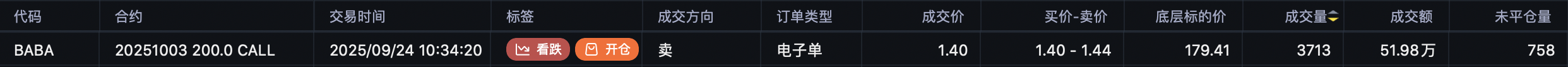

Bullish opening flows offer good guidance: around 200 it’s mainly sell calls $BABA 20251003 200.0 CALL$ .

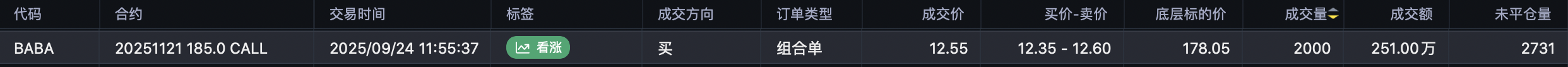

The 185 call saw notable bullish buying $BABA 20251121 185.0 CALL$ .

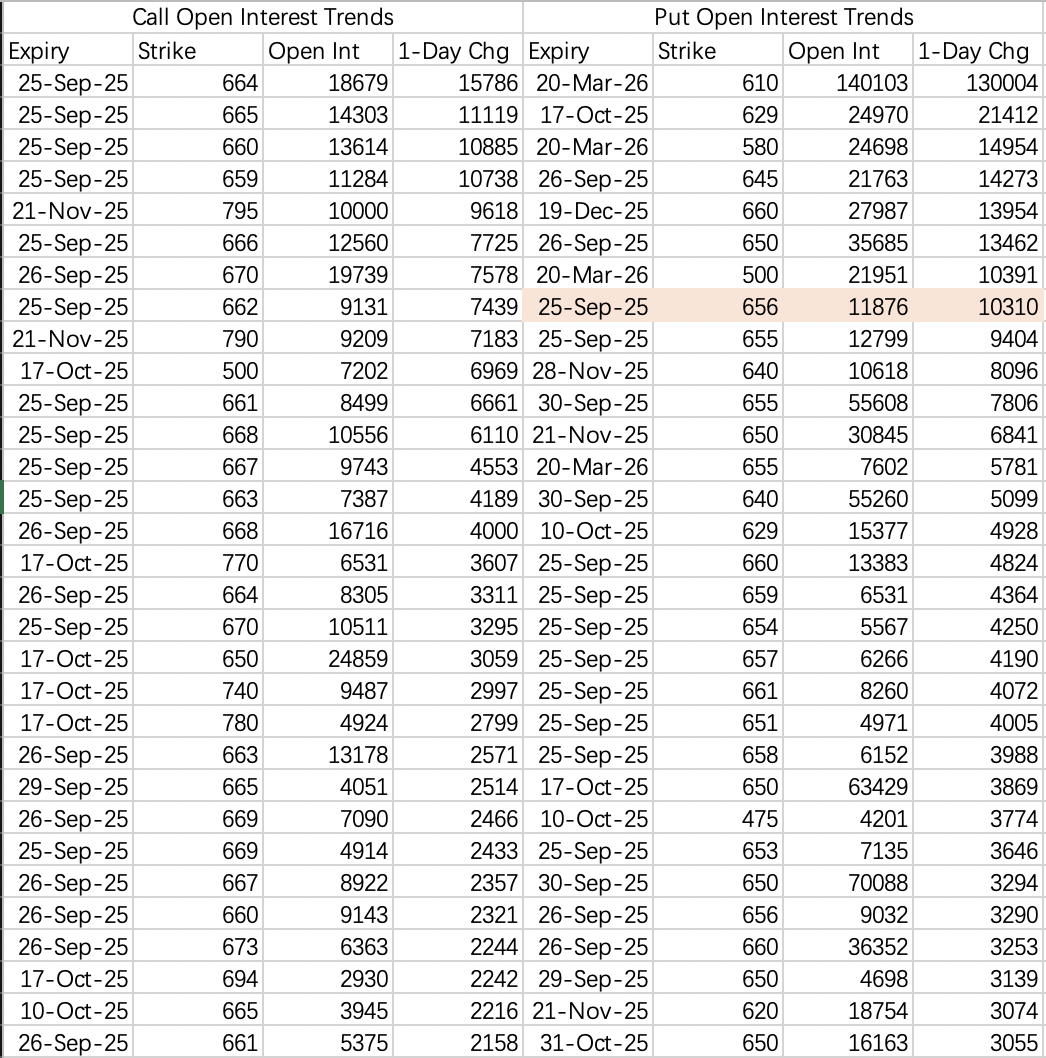

Expected weekly range 655–665, with no sharp pullback anticipated.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.