Minor chop

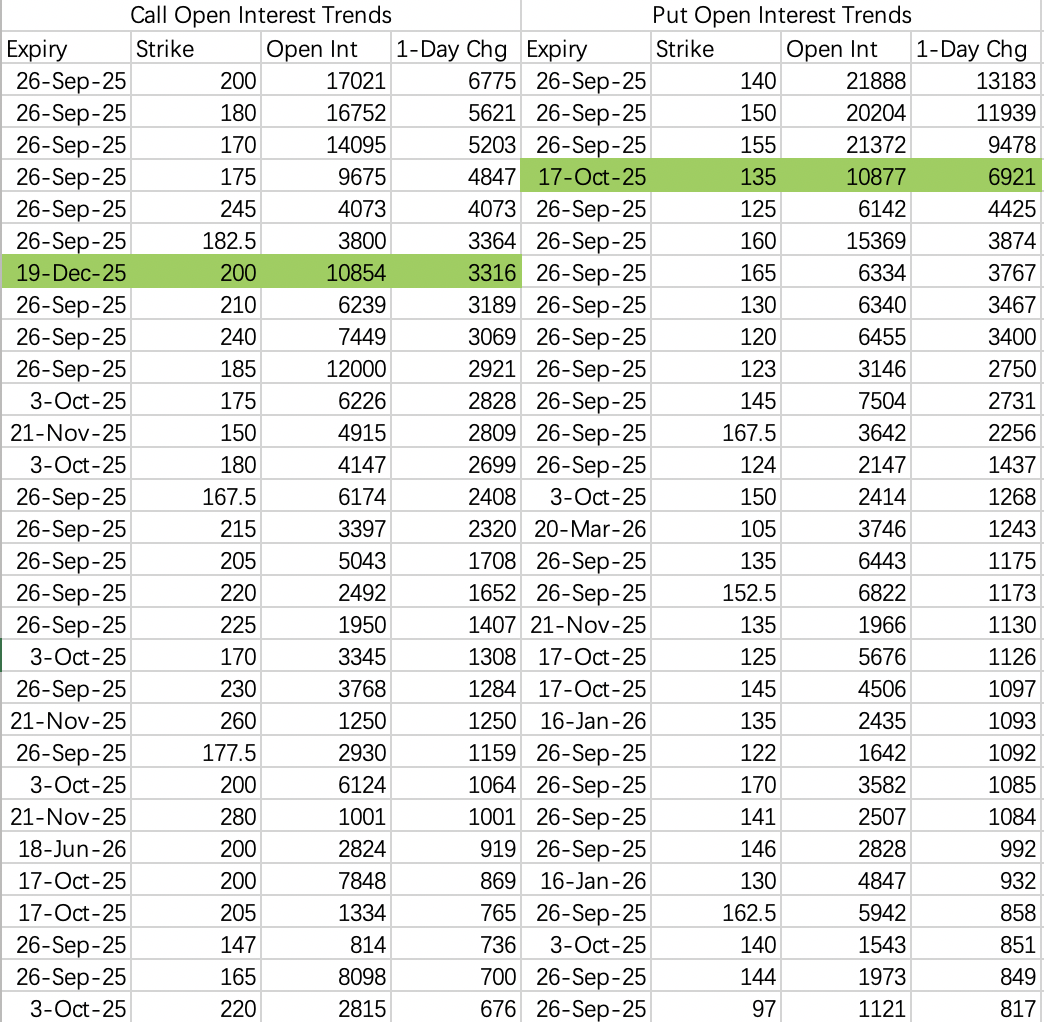

If you ask how to trade Micron tonight, I’d still keep selling puts. It’s possible fewer people will be watching MU this evening because the earnings move wasn’t eye-catching.

But this earnings print was impressive: MU rose 39% in September, yet the stock barely pulled back after the report. In a U.S. market where “sell the news” is common, that shows how high-quality the numbers were.

Consider selling calls near 200 into earnings; that’s very likely the next target for Micron. For sell puts, choose a conservative sub-150 strike $MU 20251003 150.0 PUT$ .

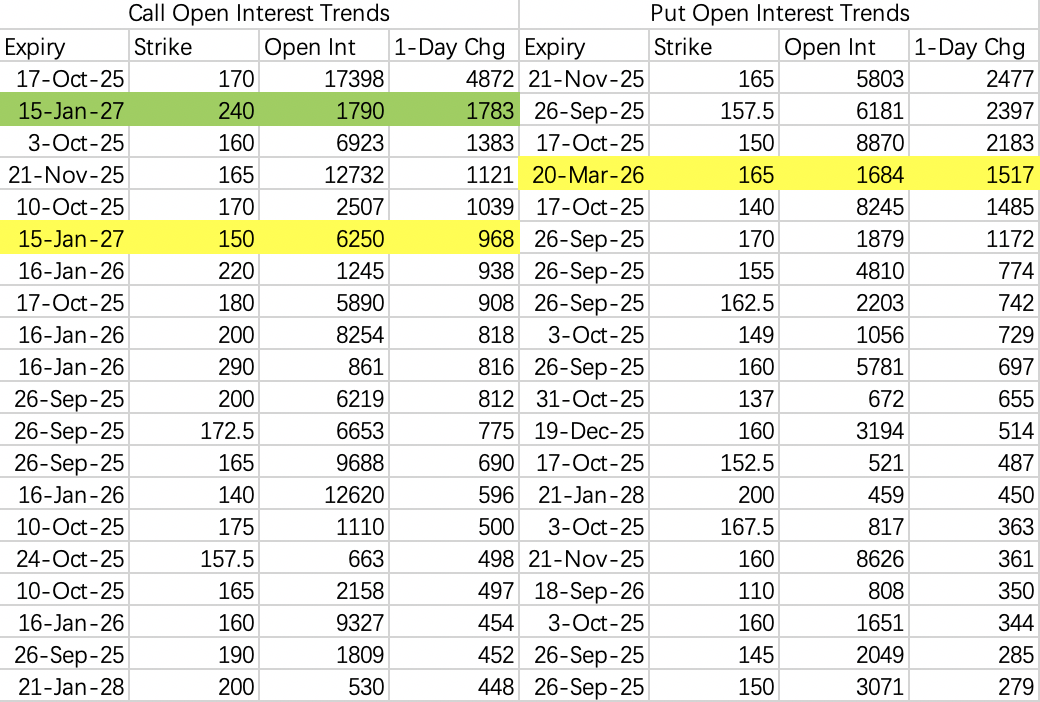

All AI-linked names are undergoing a round of revaluation, with intense long-short battles. As one of China’s largest cloud providers, Alibaba naturally faces questions about whether the stock has run too far.

Before Wednesday’s gap-up, the base case was a possible pullback to 150, with a longer-term uptrend toward 200. After the jump, this consolidation phase needs a rethink—mainly because sell-put strikes are tough to pick now; 150 offers very little premium.

On Tuesday, there was a large long-dated call spread targeting the 150–240 zone: bought $BABA 20270115 150.0 CALL$ , sold $BABA 20270115 240.0 CALL$ .

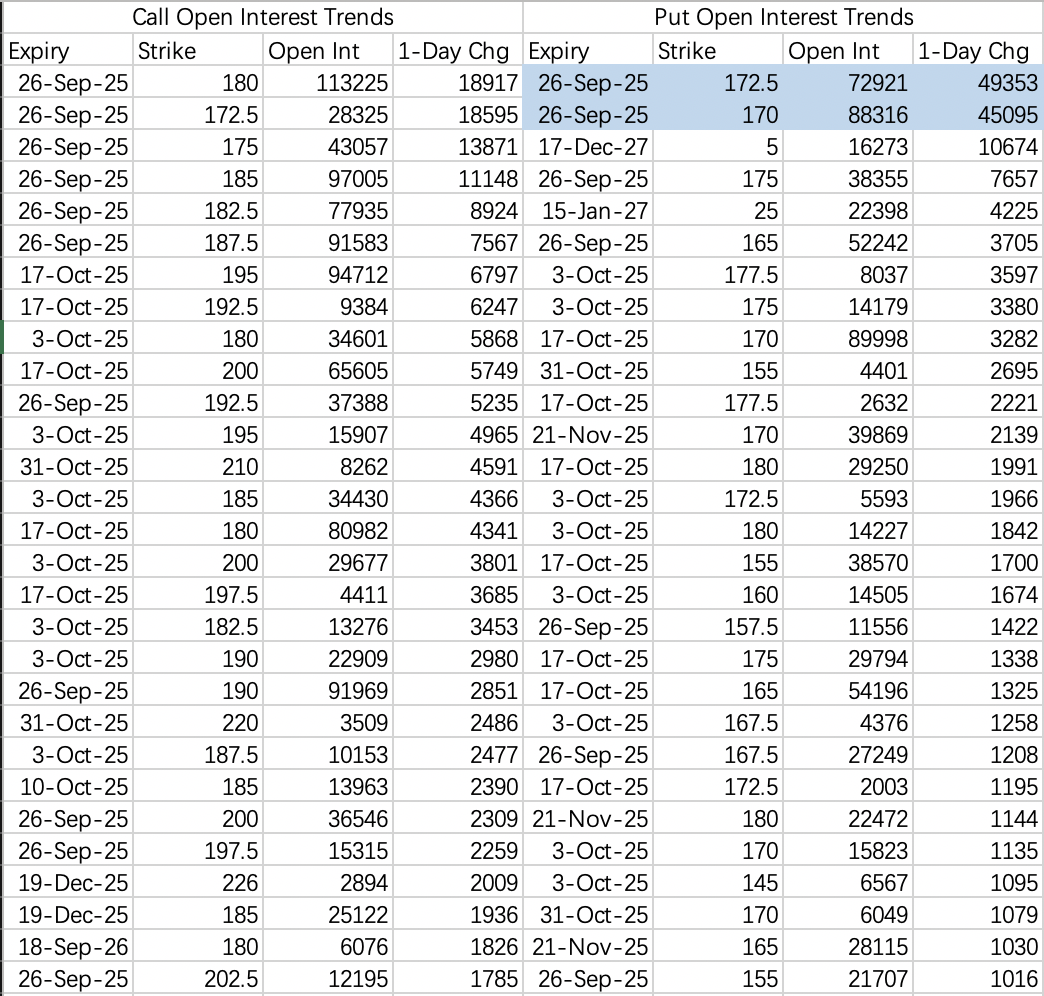

This week remains a tight 170–180 range; you can comfortably sell puts $NVDA 20250926 172.5 PUT$ . Expect a push toward 190 starting in October.

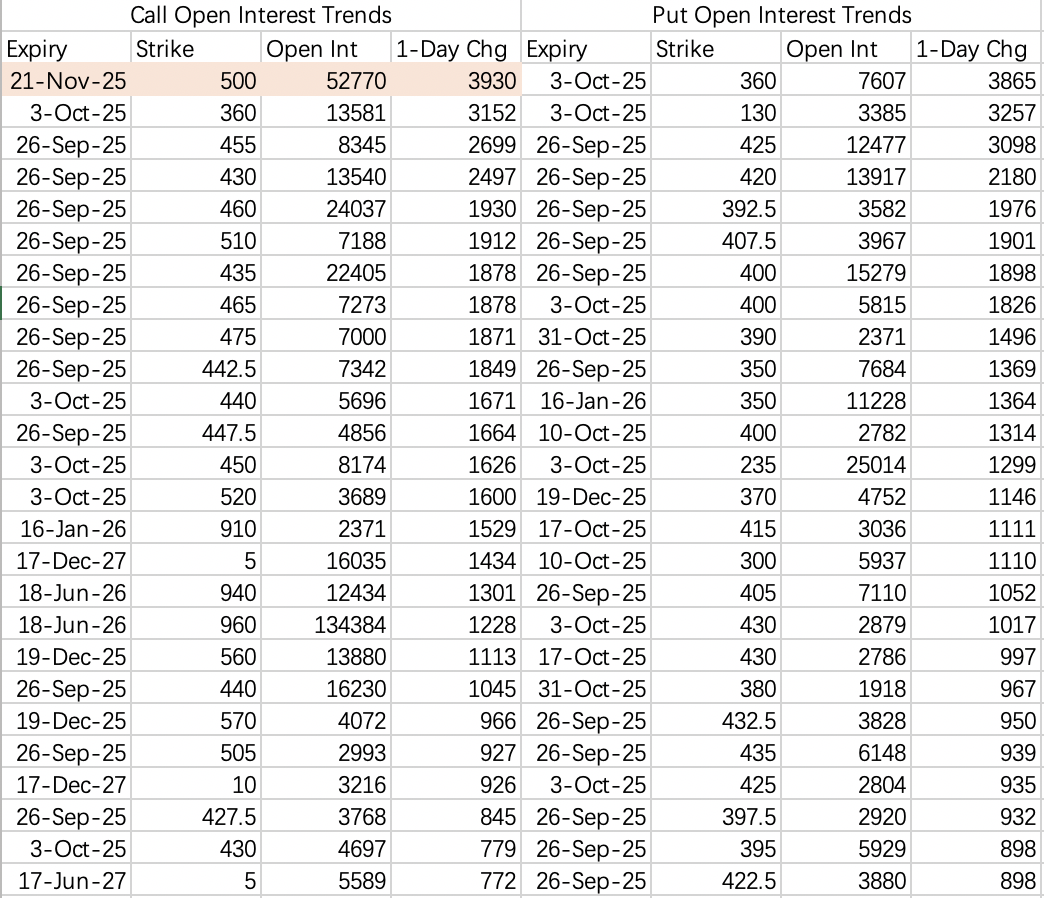

Continue opening the November-expiry 500 calls $TSLA 20251121 500.0 CALL$ , with both buys and sells active. Price likely continues to consolidate in the 420–450 band near term.

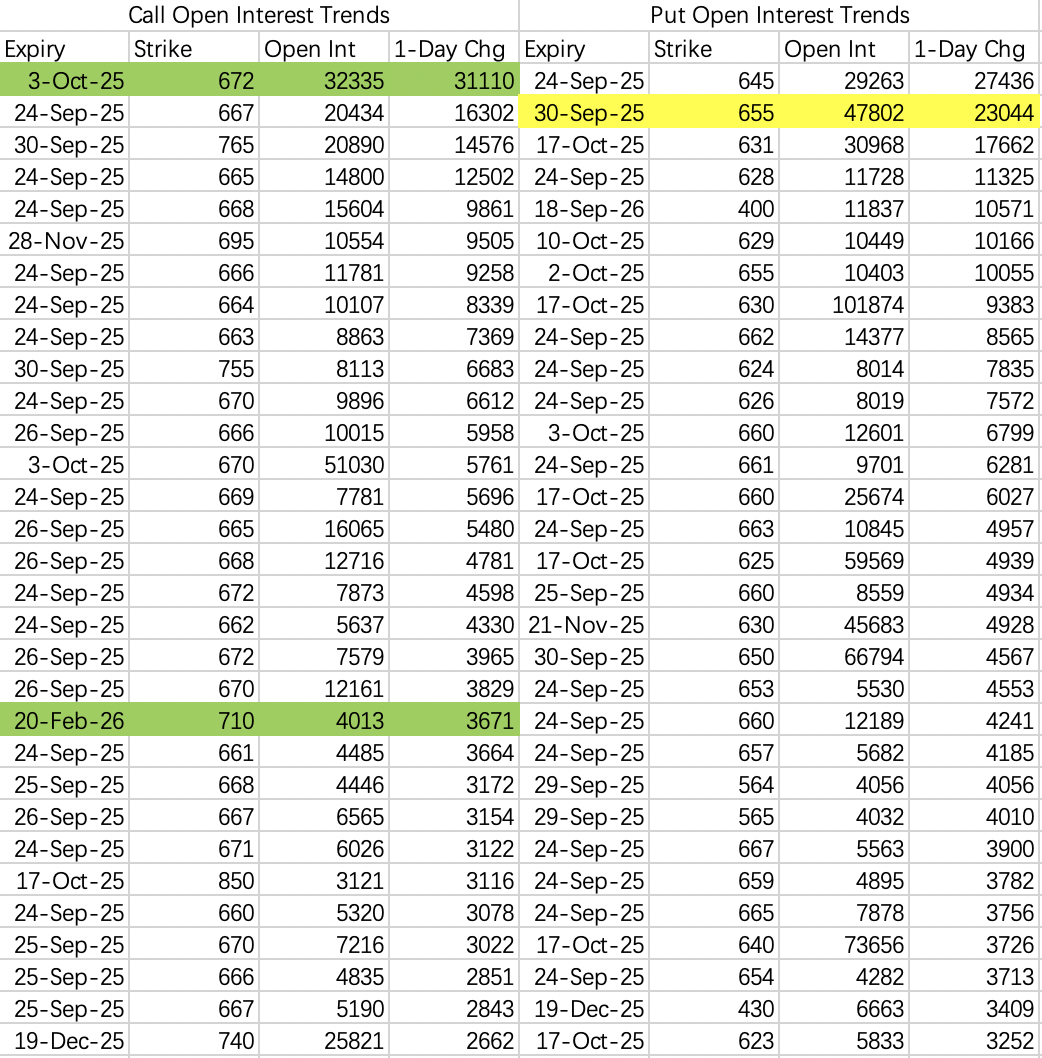

Barring surprises, the index should keep grinding higher during the pullback. An institution rolled sold calls from 663 to Oct 3, 672 $SPY 20251003 672.0 CALL$ .

Put-hedge roll: from the 640 put to the Sep 30, 655 $SPY 20250930 655.0 PUT$ .

$Taiwan Semiconductor Manufacturing(TSM)$

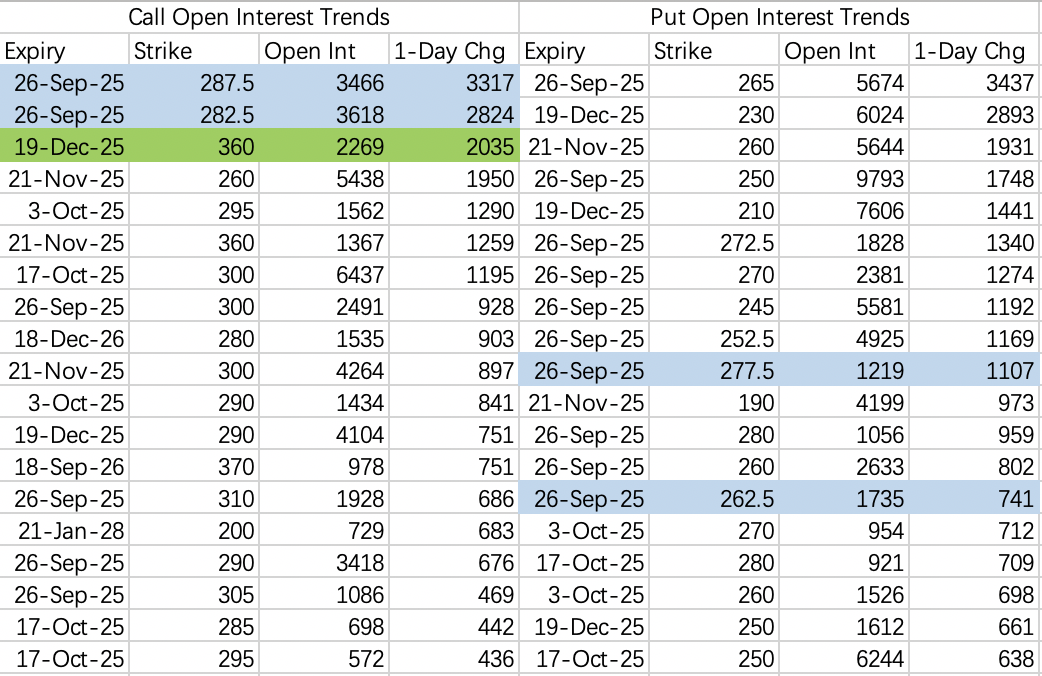

TSMC likely chops this week between 262.5 $TSM 20250926 262.5 PUT$ and 287.5 $TSM 20250926 287.5 CALL$ .

After the stock’s pop, there was a large volatility short via year-end 360 calls sold $TSM 20251219 360.0 CALL$ .

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.