Pullback? Gone.

Once the news broke that NVIDIA is investing in OpenAI, I figured the pullback was very likely off the table. Not even a one-week dip window—industry developments are just moving too fast.

Although the stock jumped 3.9%, it didn’t break 185, and even pulled back premarket. If this kind of news had landed with an earnings print, the reaction would be hard to imagine.

The market is very rational right now; quite a few skeptical shorts even suspect a Ponzi-like setup. That actually creates a good opportunity to go long.

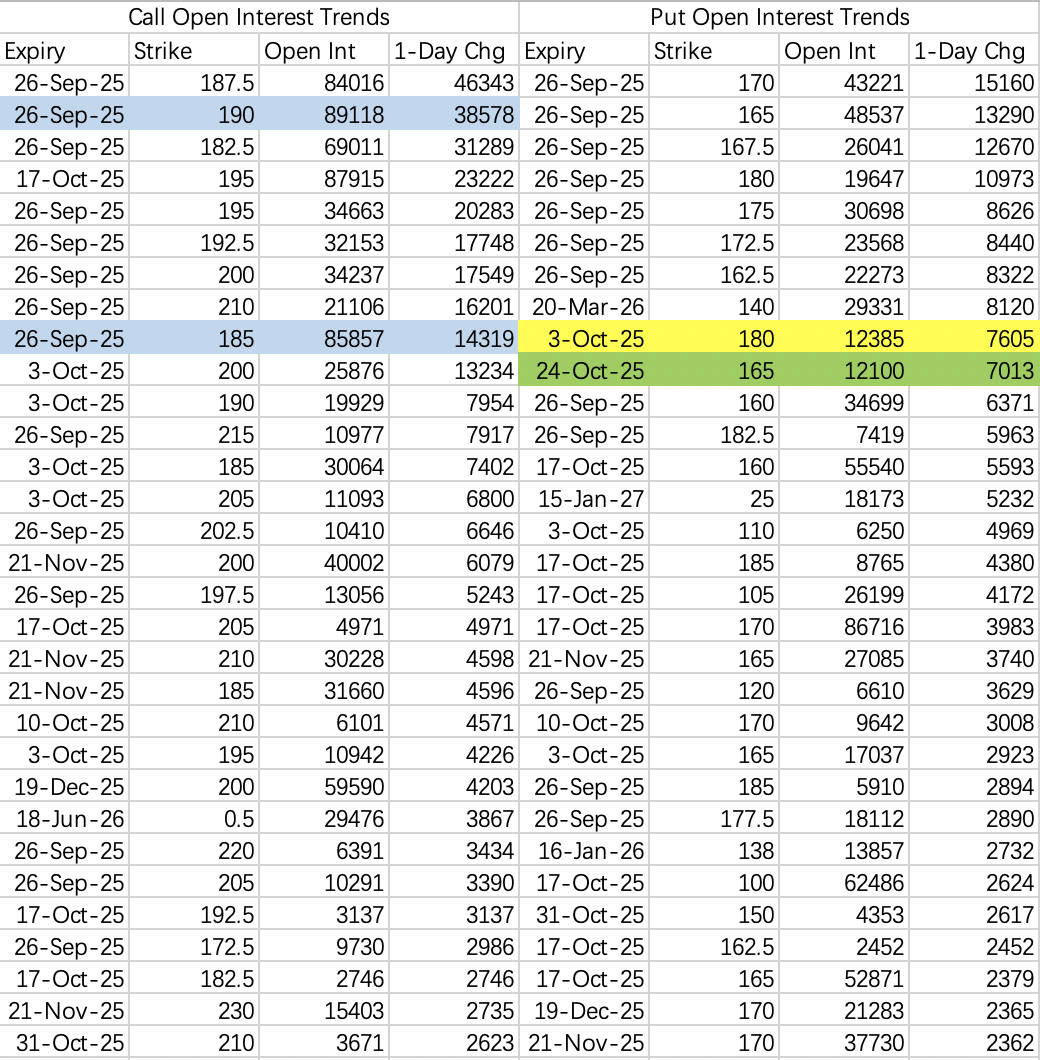

Into earnings, NVIDIA could push toward 200. You can use any premarket weakness to sell puts; a conservative strike would be 170 $NVDA 20251003 170.0 PUT$ . If you’re less conservative, consider at-the-money.

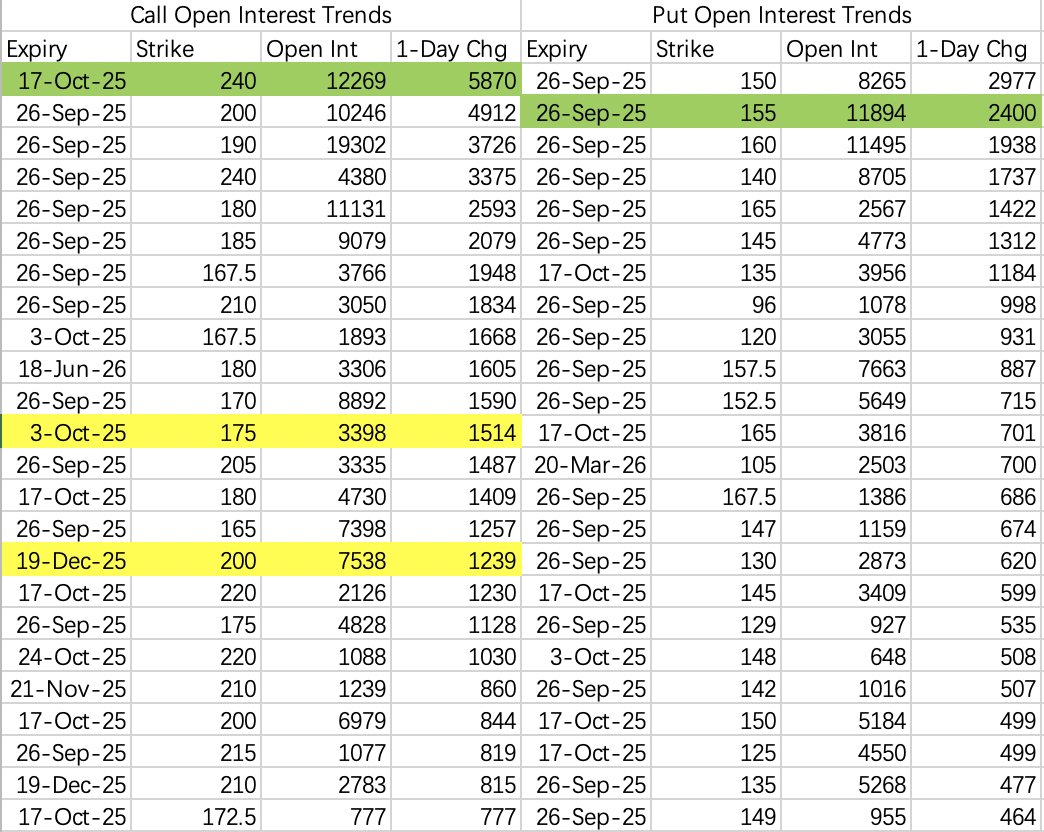

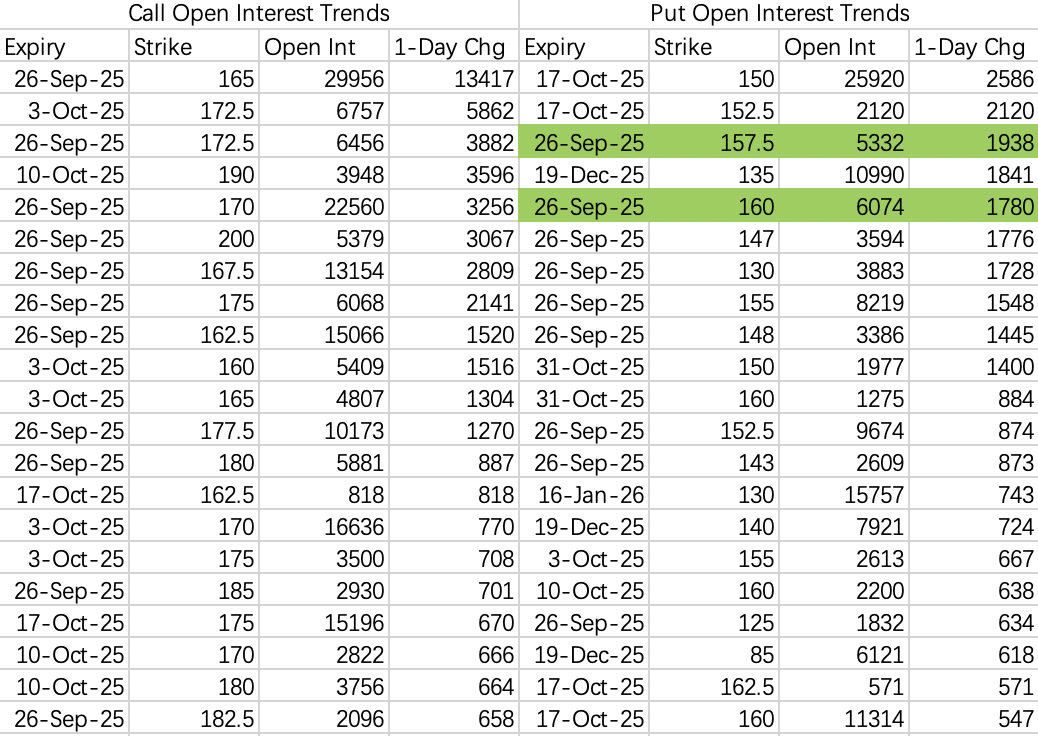

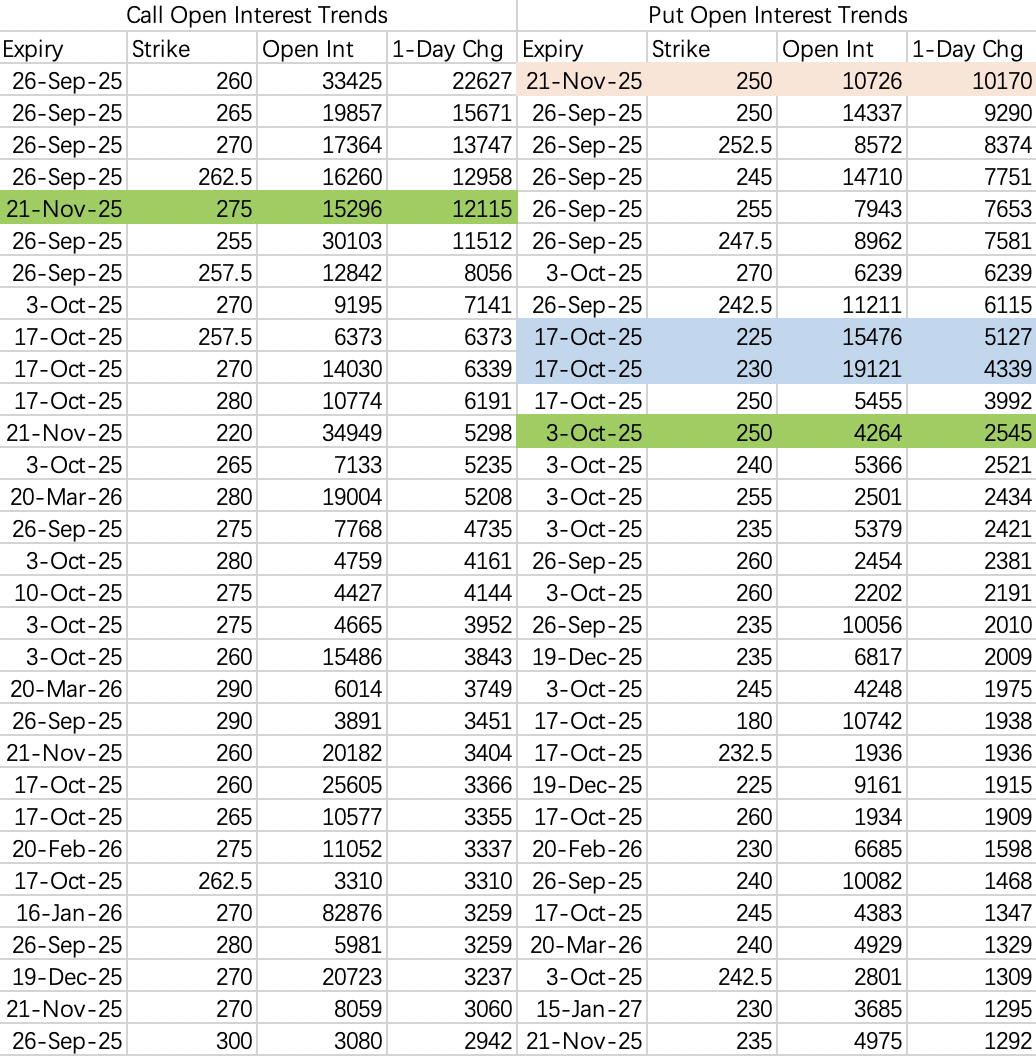

Micron’s earnings should be very strong barring surprises. For a bullish opening position, first choice is a 240 sell call $MU 20251017 240.0 CALL$ , with the current stock around 166.

There’s a lot to complain about with the 240 strike—if you’re worried about a face-ripper rally, don’t force a covered call sale.

Bullish call buys include $MU 20251003 175.0 CALL$ and $MU 20251219 200.0 CALL$ .

With the extra confidence from the NVIDIA investment tailwind, the downside entry for puts shifts up to 155 $MU 20250926 155.0 PUT$ .

If you’re bullish into earnings but think outright calls are pricey, consider sell put + buy call. Just note that if shares drop, the sold put premium can be offset by the call hedge, leaving you with the short-put loss profile.

AMD is also suitable for sell puts; consider the 155 strike $AMD 20250926 155.0 PUT$ .

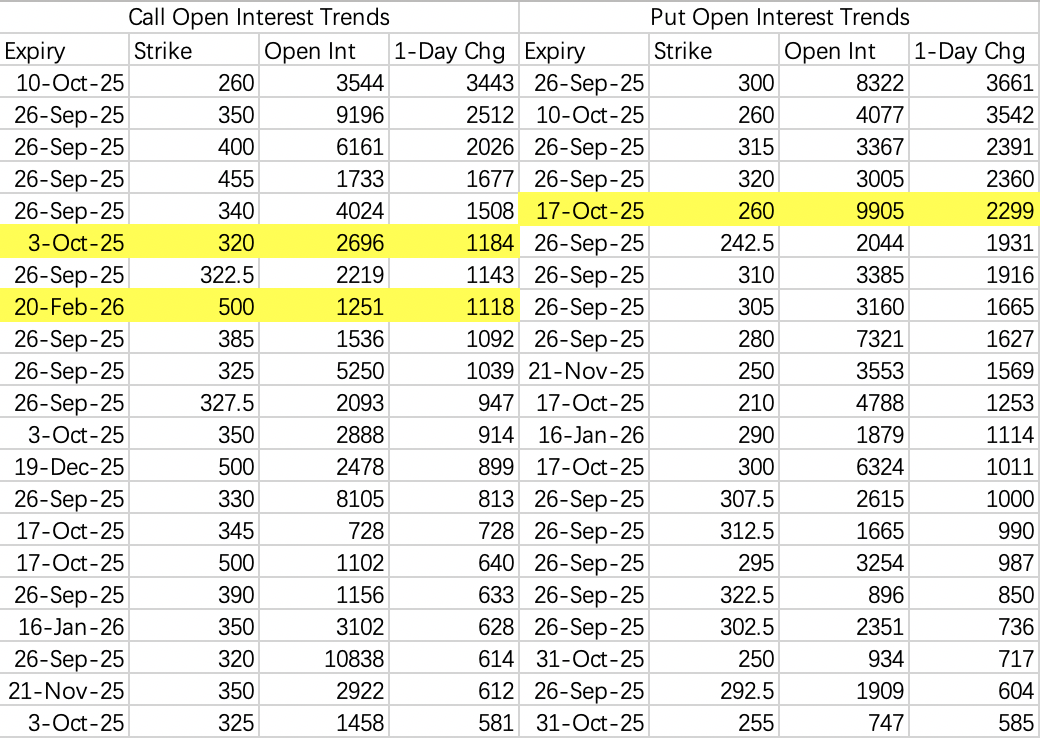

Shorts still want to drag Oracle back to 260, but longs are quietly opening 500 calls $ORCL 20260220 500.0 CALL$ .

iPhone 17 sales look strong, so a major pre-earnings pullback is unlikely. For a medium-term larger position, sell calls at 275 $AAPL 20251017 275.0 CALL$ .

For bearish entries, target 250; for sell puts, pick 250 or lower $AAPL 20250926 250.0 PUT$ .

Closed the short-term 95 calls $OKLO 20251121 95.0 CALL$ , and rolled to 150 calls expiring in 2027 $OKLO 20270115 150.0 CALL$ . Opened 31.7k contracts; notional traded was 1.45 billion.

I recall the last similar roll was in HOOD; the long-dated outlook can stay bullish.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.