Watch This Week’s Tug-of-War Between Bulls and Bears

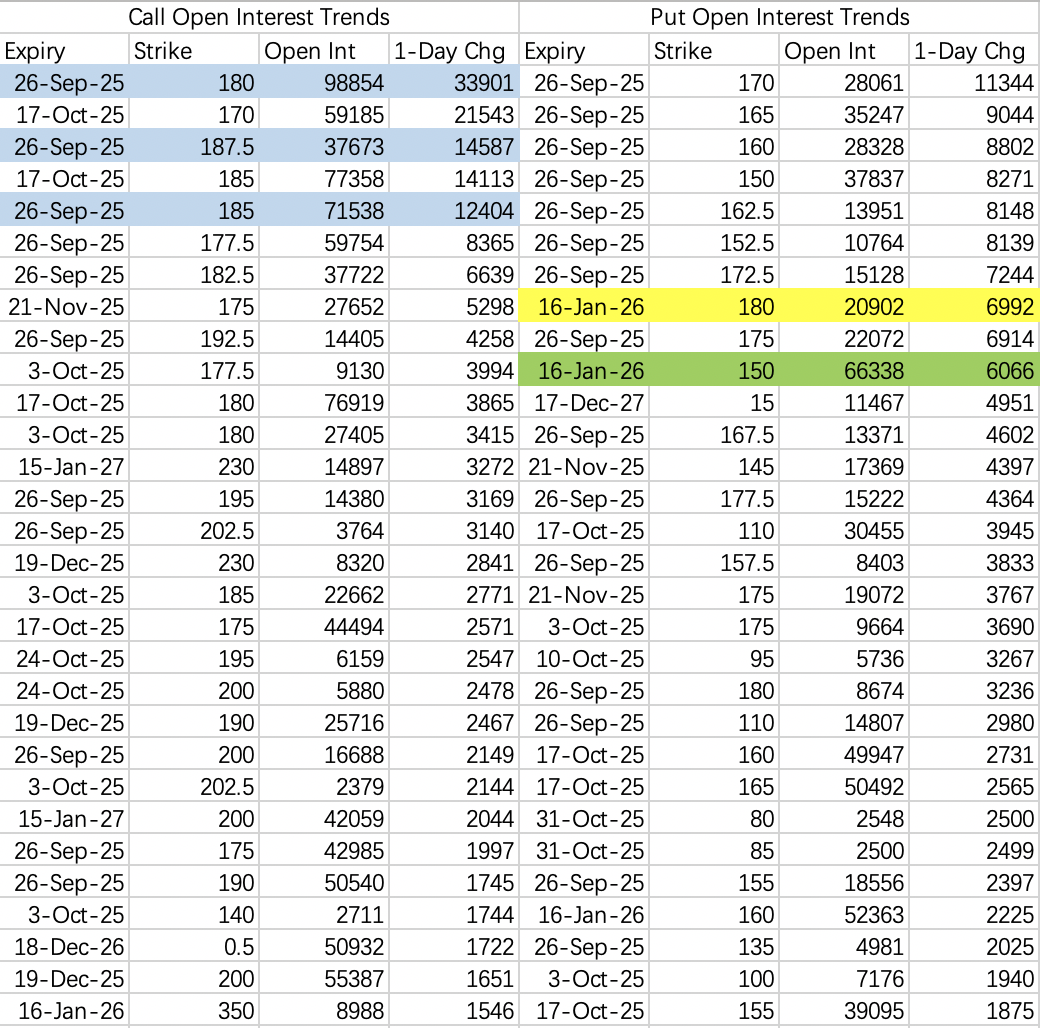

$NVIDIA(NVDA)$

From the put open interest, there’s strong expectation of a pullback this week—some are targeting $150$ as the floor, but I think $160$ is a more realistic level.

Call option flow is similar to last week: sell the $180$ call ($NVDA 20250926 180.0 CALL$ ) to hedge long $185$ and $187.5$ calls ($NVDA 20250926 185.0 CALL$ , $NVDA 20250926 187.5 CALL$ ).

Despite the pullback expectations, the highest win-rate strategy at these levels remains selling calls.

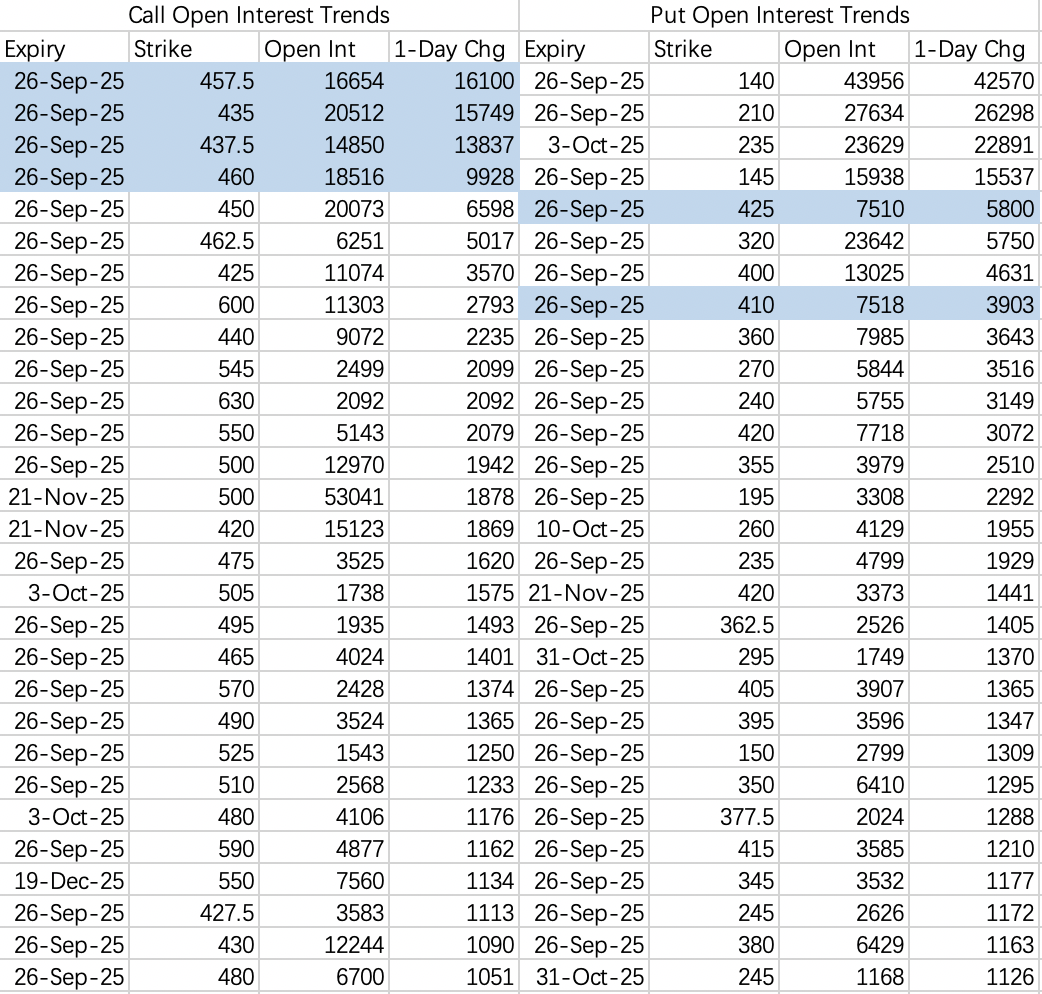

$Tesla Motors(TSLA)$

Overall price action mirrors last week, but the downside pressure is less intense.

Institutional call selling is focused on the $435$–$437.5$ strikes ($TSLA 20250926 435.0 CALL$ ), hedged with long $457.5$ and $460$ calls ($TSLA 20250926 457.5 CALL$ , $TSLA 20250926 460.0 CALL$ ). For call selling, you can consider strikes above $460$.

On the put side, there’s open interest in the $425$ and $410$ puts ($TSLA 20250926 425.0 PUT$ , $TSLA 20250926 410.0 PUT$ ). This week, TSLA could pull back below $425$ but hold above $410$. If it drops below $425$, it could be a good spot to sell puts.

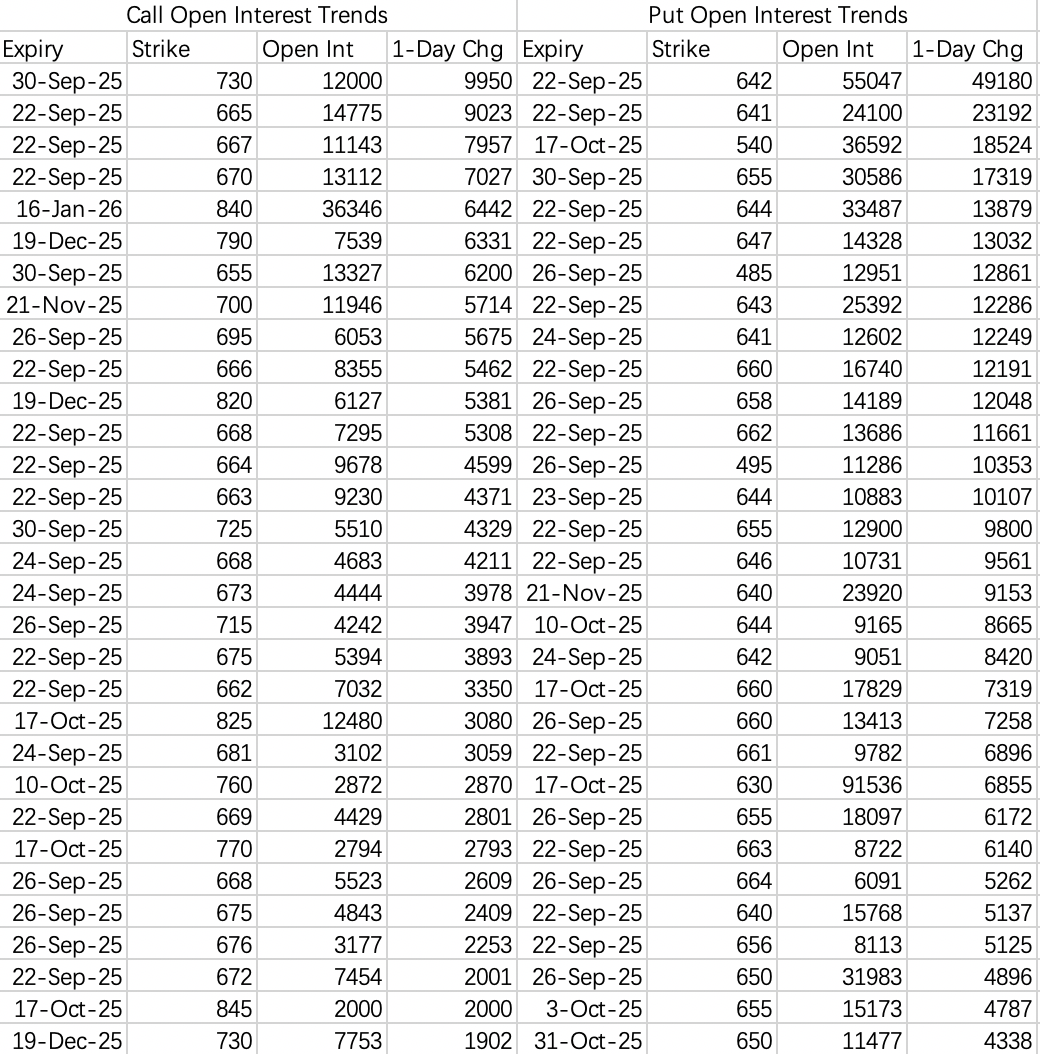

$SPDR S&P 500 ETF Trust(SPY)$

There’s an expectation of a pullback toward $640$—a move of less than 3% would be tolerable. But, as always, predictions are tough. Good luck to the bears.

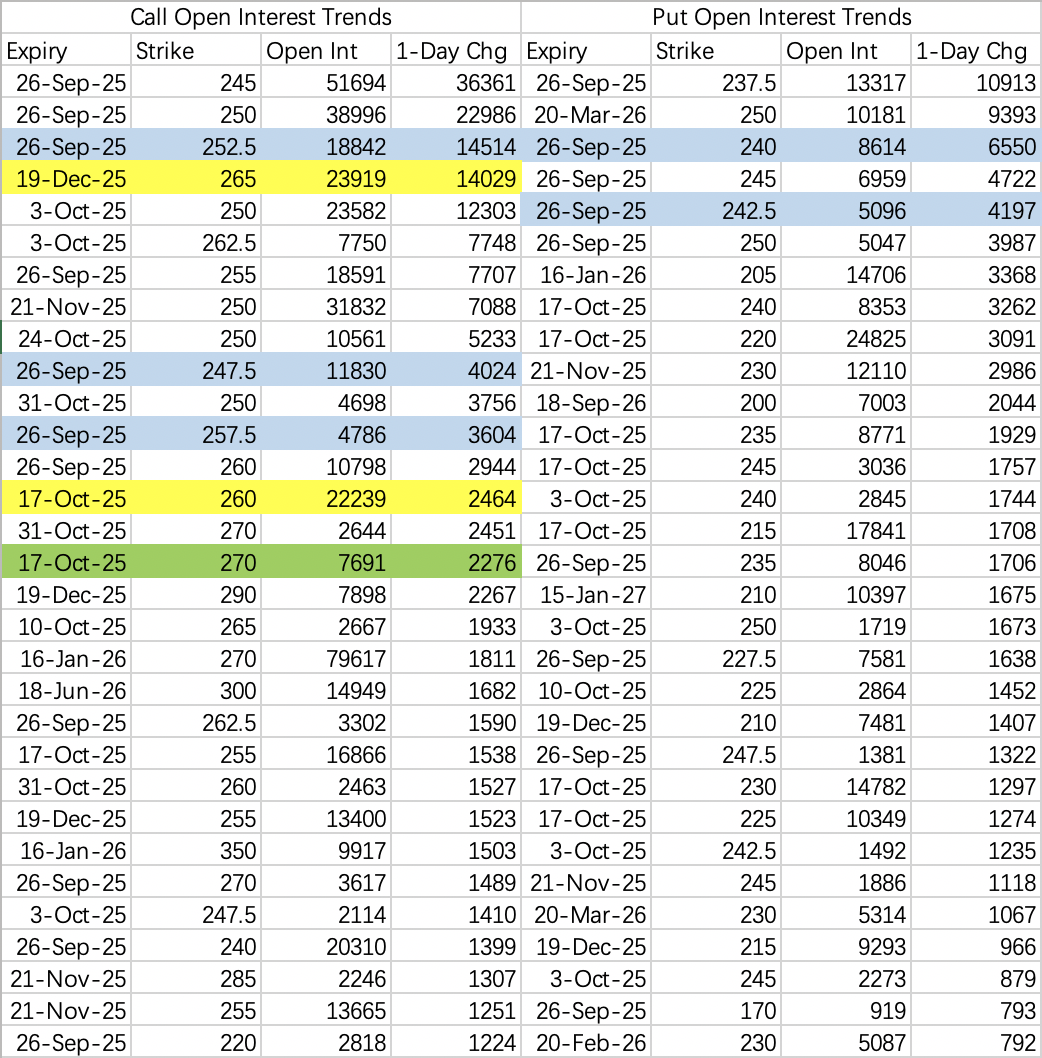

$Apple(AAPL)$

This week there are various spread structures centered around the $252.5$ call ($AAPL 20250926 252.5 CALL$ ). But the key takeaway is a massive buy in the year-end $265$ call ($AAPL 20251219 265.0 CALL$ )—14,000 contracts opened.

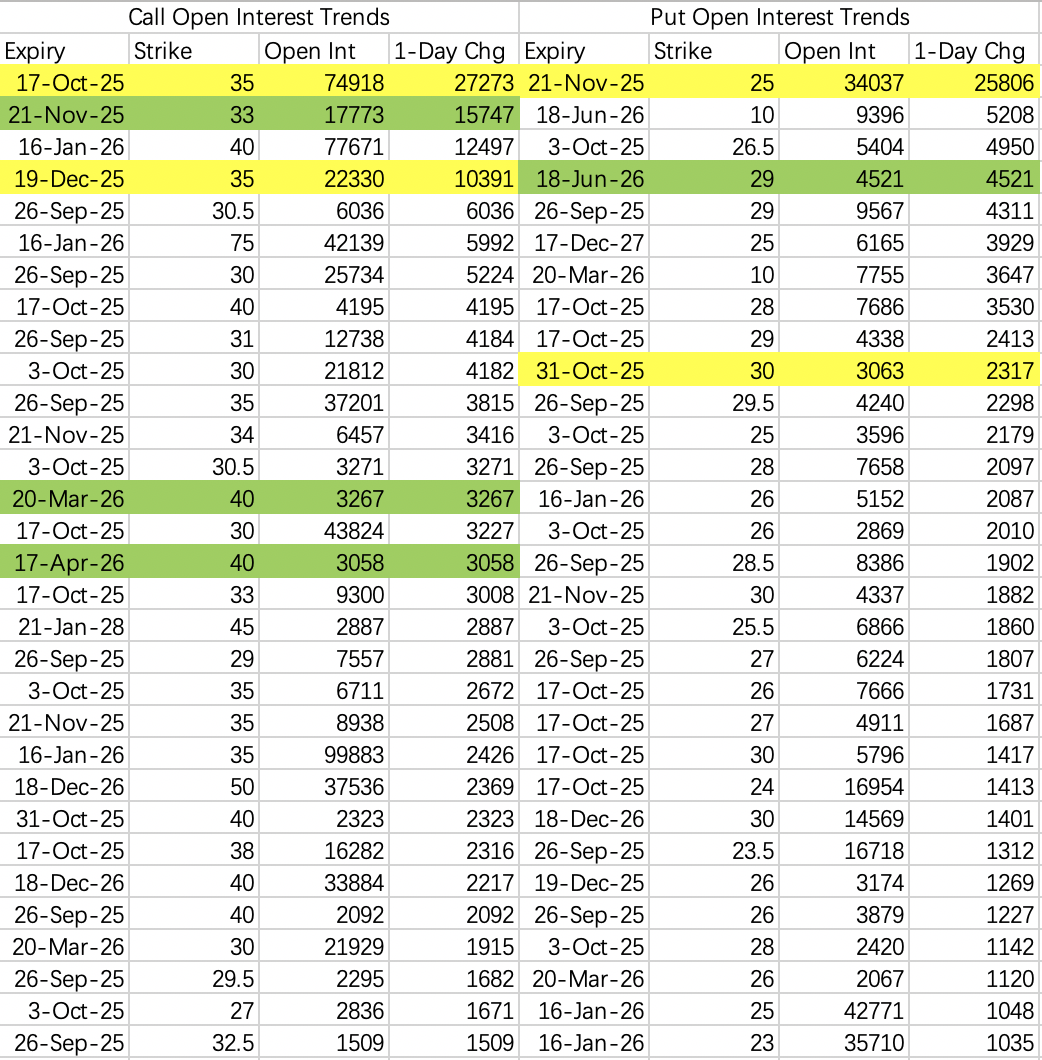

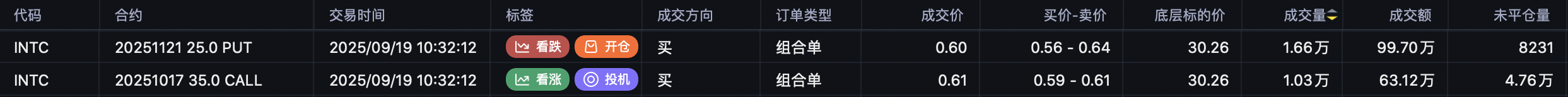

$Intel(INTC)$

The direct benefit of NVIDIA’s investment in Intel is the cash infusion. The indirect benefit is that it could trigger follow-on deals from other firms.

Otherwise, in the absence of short-term revenue catalysts, it’s tough to justify the big bullish bets—bulls expect the stock to rebound above $35$ but below $40$ this year.

The bear case is simple: if there’s no continued good news, INTC will drift back toward $25$.

The top OI increase was a large straddle: long the $35$ call and $25$ put ($INTC 20251017 35.0 CALL$ , $INTC 20251121 25.0 PUT$ ), betting on a major move in either direction.

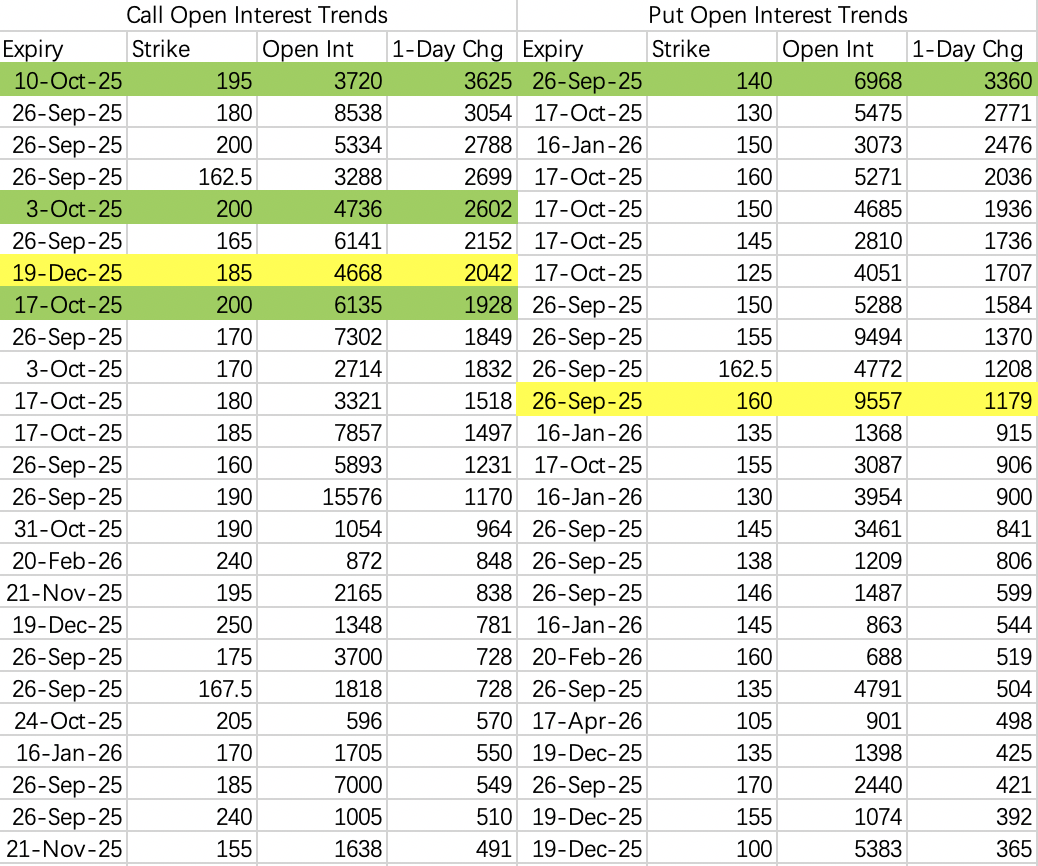

$Micron Technology(MU)$

Earnings are after the close Tuesday. With shares at $162.5$, options are pricing in a 10% earnings move—implying a $146$–$179$ range.

Interestingly, most call sellers are picking the $195$ or $200$ strikes ($MU 20251010 195.0 CALL$ , $MU 20251003 200.0 CALL$ ). That seems excessive.

Put flows are more conservative and within the implied range; for a cautious earnings volatility short, consider selling puts below $145$ ($MU 20250926 145.0 PUT$ ).

I would not recommend selling calls here—despite strong DRAM/NAND markets having partially priced in good news, the market could still be underestimating upside. There’s a nonzero chance of an earnings blowout.

$CoreWeave, Inc.(CRWV)$

Detected a large long-dated bullish position: 6,498 contracts of the $220$ call ($CRWV 20260320 220.0 CALL$ ) were opened, with an estimated notional value of $5M.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.