Will Tesla Rally to $500?

$Tesla Motors(TSLA)$

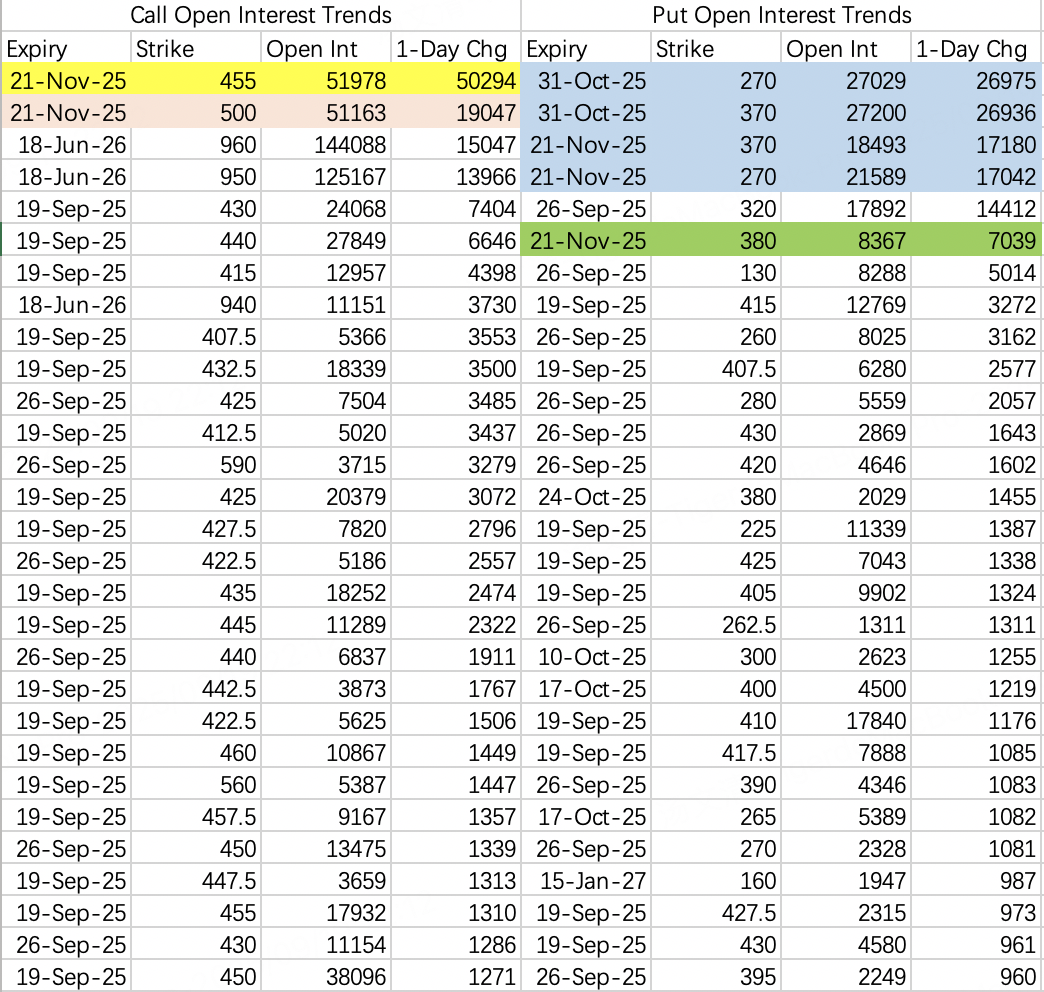

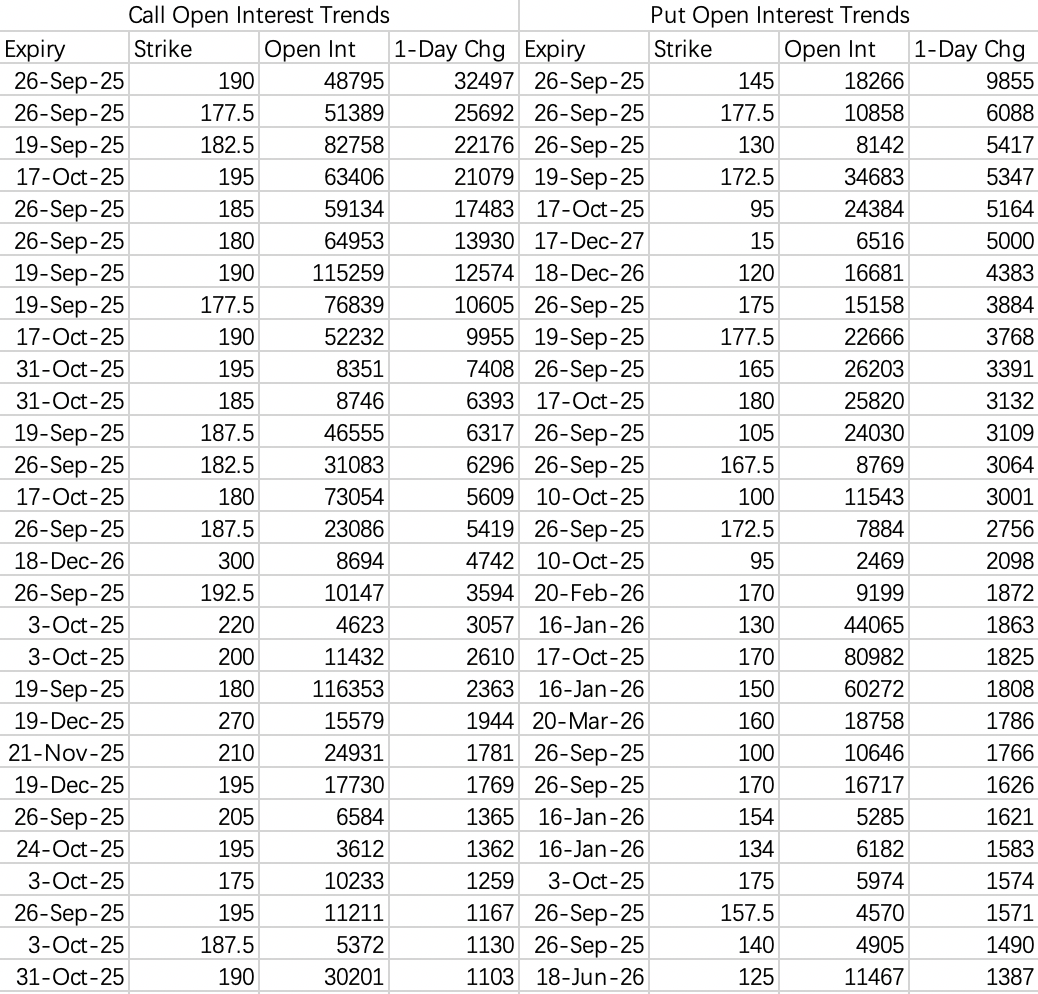

Thursday’s open interest flow was unusual, with exceptionally heavy activity in November expirations.

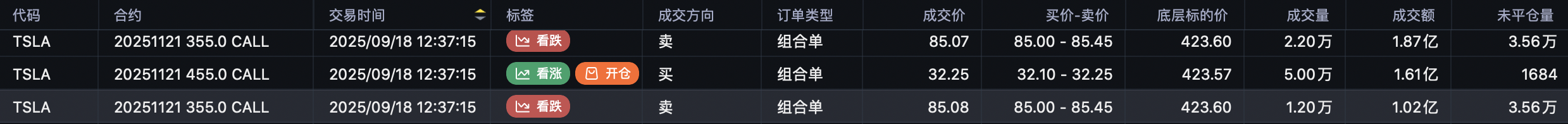

Institutions executed a large long call roll: closing 34,000 contracts of the November $355$ call ($TSLA 20251121 355.0 CALL$ ), and rolling into the November $455$ call ($TSLA 20251121 455.0 CALL$ ), opening 50,000 contracts. While contract size increased, notional value decreased (closed $287M$, opened $161M$).

Rolling up to a much higher strike is rare in institutional flows. Sometimes, after a rally, institutions get more conservative (e.g., Oracle rolled calls to $280$, below spot at $300$). Here, however, they’re clearly staying bullish on Tesla’s uptrend.

In addition, 19,000 contracts of the November $500$ call ($TSLA 20251121 500.0 CALL$ ) were opened, with a notional value around $38M$. Unlike the $455$ call, flow in the $500$ call looks retail-driven—both buys and sells. Personally, I suspect this is still likely a single institution opening a position, using a small outlay to bet on a Tesla move to $500$.

I also believe the same institution is hedging, opening put spreads for October and November ($370$/$270$):

Buy $TSLA 20251121 370.0 PUT$ , open 17,000 contracts

Sell $TSLA 20251121 270.0 PUT$ , open 17,000 contracts

and

Buy $TSLA 20251031 370.0 PUT$ , open 26,000 contracts

Sell $TSLA 20251031 270.0 PUT$ , open 26,000 contracts

There’s also a sizable new position selling the November $380$ put ($TSLA 20251121 380.0 PUT$ ), with 7,000 contracts opened, notional estimated at $16M.

Bottom line: Tesla remains a very attractive sell put candidate over the next two months, and you could even consider $400$ strikes. I’m only recommending the more conservative strategies—aggressive upside comes with risk, especially as these large players are also hedging with puts.

$Intel(INTC)$

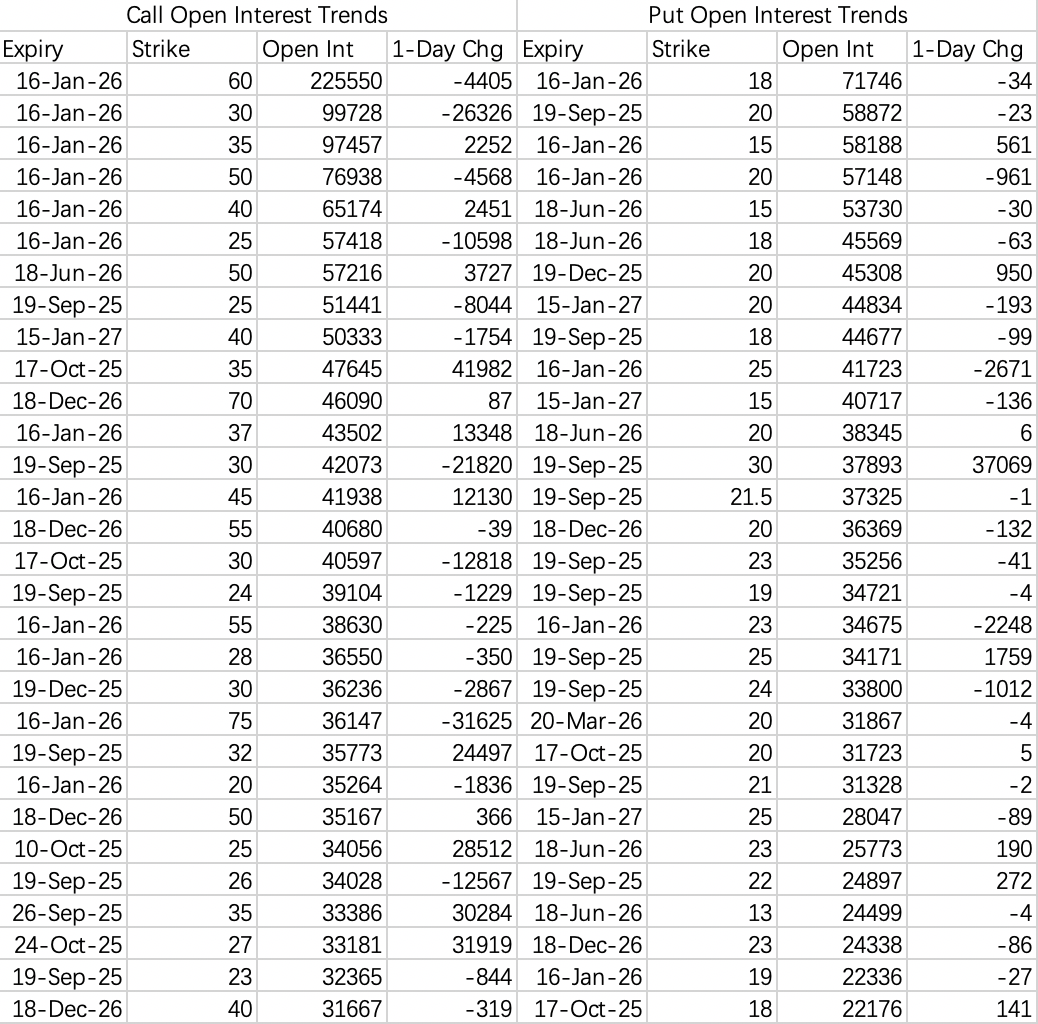

Options positioning is extremely active, mostly centered on bullish calls, as higher implied volatility supports both buying and selling strategies.

There are two camps on Intel’s forward path: bulls see upside to $37$ and even $45$ ($INTC 20260116 37.0 CALL$ , $INTC 20260116 45.0 CALL$ ), while bears expect a gradual fade back to $27$–$28$, e.g., selling calls at $27$ ($INTC 20251024 27.0 CALL$ ).

Short term, the story is the same as Oracle: Intel can’t yet prove NVIDIA’s help will drive near-term revenue. The bullish case needs more confirmation—maybe from earnings. I don’t expect a big near-term revenue beat, but the stock probably won’t collapse either. That makes Intel another solid sell put candidate.

$NVIDIA(NVDA)$

No big change—still expect rangebound action in $170$–$180$, with possible dips to $165$.

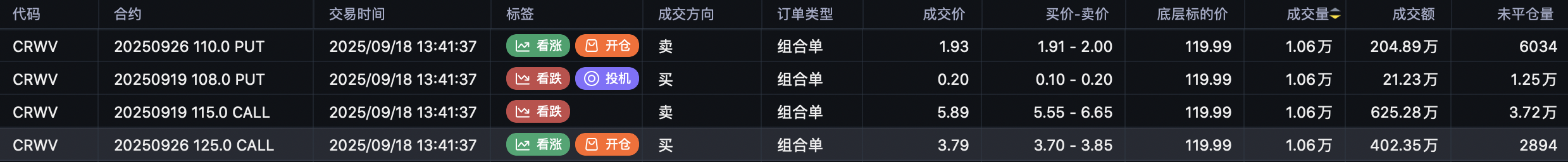

$CoreWeave, Inc.(CRWV)$

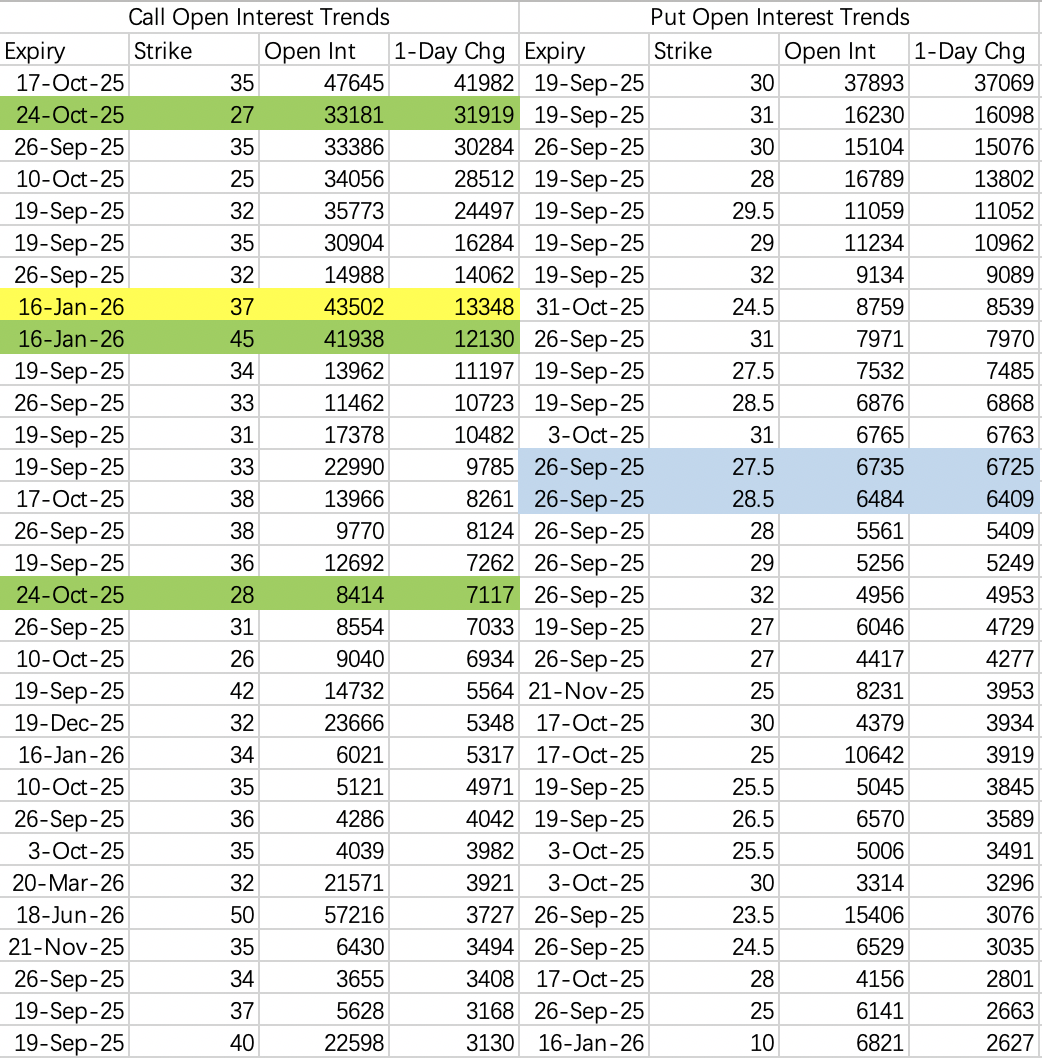

Institutions are rolling positions from this week’s $108$ puts and $115$ calls ($CRWV 20250919 108.0 PUT$ , $CRWV 20250919 115.0 CALL$ ) into next week’s $110$ puts and $125$ calls ($CRWV 20250926 110.0 PUT$ , $CRWV 20250926 125.0 CALL$ ).

On September 12, after a pullback, institutions rolled $126$ calls ($CRWV 20250919 126.0 CALL$ ) down to $115$ ($CRWV 20250919 115.0 CALL$ ).

I lean toward the put leg being a sell; the call side is less clear. Statistically, downside protection seems more favored than upside. Unless there’s a new bullish catalyst, expect CRWV to chop between $110$ and $125$ next week.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- AuntieAaA·09-20GoodLikeReport

- LEESIMON·09-20🩷GoodLikeReport