NVIDIA Keeps Delivering Good News, But the Bears Are Still Pressing

The FOMC delivered a 25bps rate cut as expected. Powell’s comments about rising inflation and softening employment spooked the market briefly, but these macro issues won’t resolve quickly. The real focus now shifts to economic data over the next three months.

Looking ahead, the big October macro event is whether the US and China leaders will meet. My guess is most October puts are hedging this risk. Another wild card: the AI industry is growing far faster than anyone expected, and if you read between the lines, it’s clear that recent policy shifts are all about this underlying trend.

We’re standing at a historic inflection point—anything can happen. But one thing is clear: AI demand is exceeding supply, so any pullback in the sector is a buying opportunity.

$Intel(INTC)$

NVIDIA followed the US government’s lead, buying $5 billion in stock and announcing a partnership to co-develop custom x86 processors—this is a huge leap for Intel’s outlook.

How much of a leap? That’s hard to price in until we hear more from the CEO at the next earnings call.

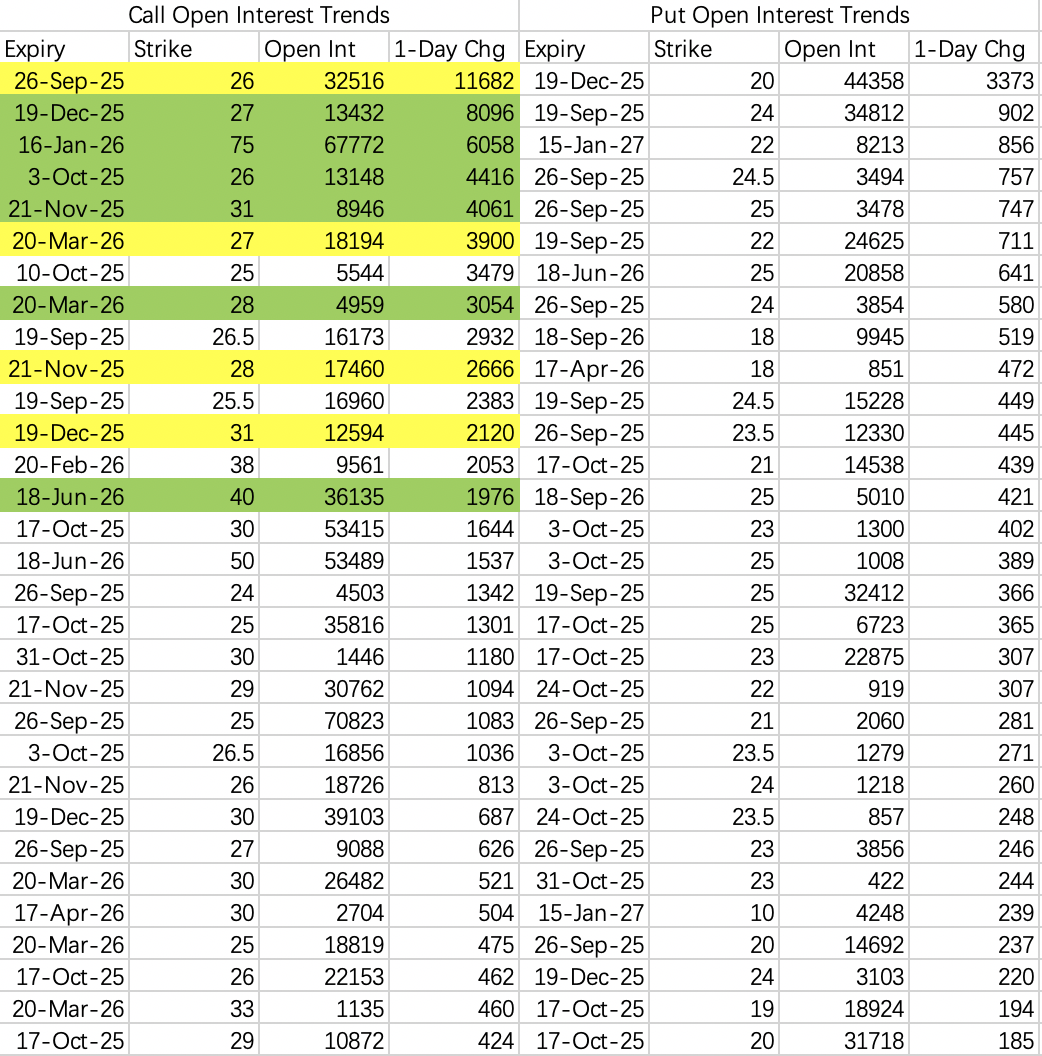

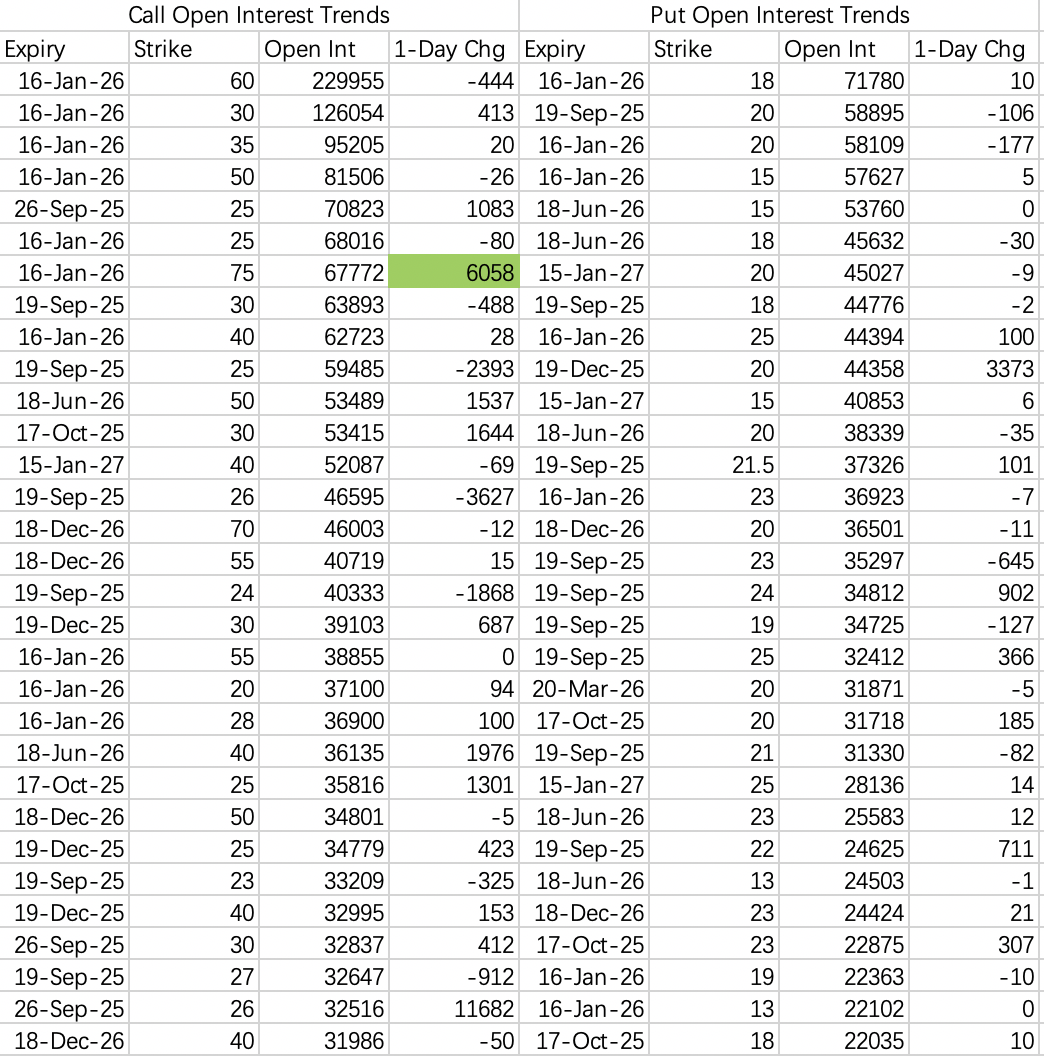

On the options side: the day before the announcement, there was a surge in call buying. For example, 11,700 new contracts opened on the $INTC 20250926 26.0 CALL$ (Sept 26, 2025), mostly buyers. There’s also bullish flow in $INTC 20260320 27.0 CALL$ , $INTC 20251121 28.0 CALL$ , and $INTC 20251219 31.0 CALL$ . Watch to see if these get closed or rolled.

My take: more capital will likely chase this story, and Intel looks like a strong sell put candidate.

Judging by the open interest buildup, some of these bullish calls were likely initiated around August 18–19.

$Oracle(ORCL)$

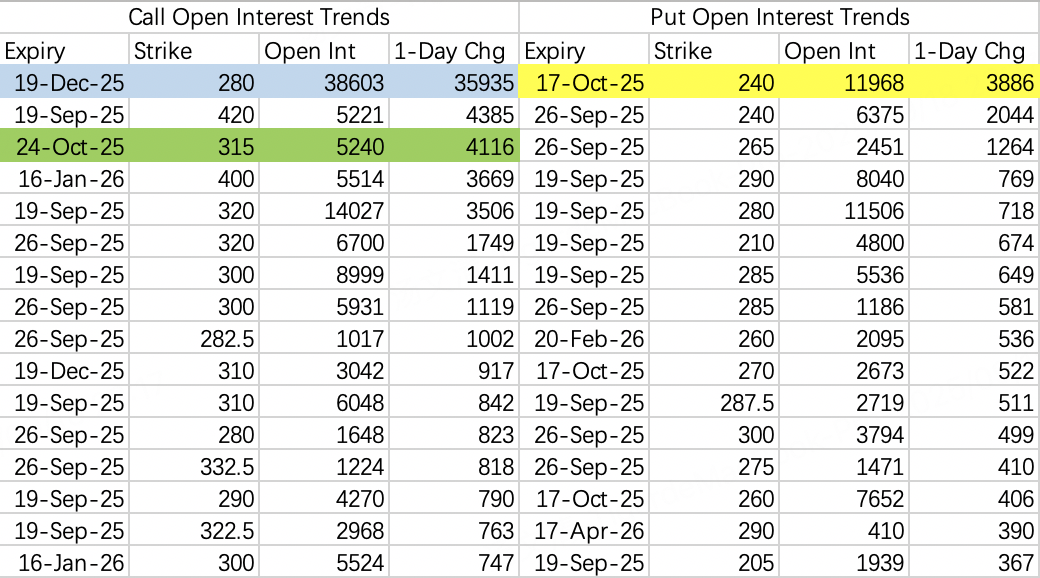

After a long wait, institutions finally rolled their long calls—buying the December $280$ call ($ORCL 20251219 280.0 CALL$ ). The view seems to be that the latest earnings already priced in most of the year-end gains, with a year-end price target of $320$.

Unless we get new bullish catalysts, $ORCL$ is likely to consolidate for a while. On the options side, 4,116 contracts were sold on the October 24 $315$ call ($ORCL 20251024 315.0 CALL$ ), betting the stock won’t break out soon.

On the bearish side, there's fresh open interest in the October 17 $240$ put ($ORCL 20251017 240.0 PUT$ ). My view hasn’t changed: $240$ seems unlikely, but a retest of $280$ is probable.

$NVIDIA(NVDA)$

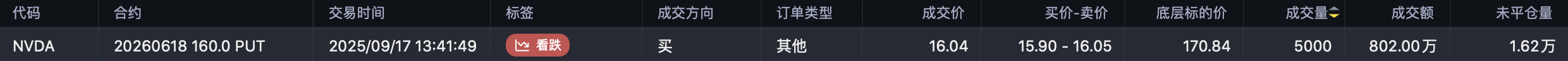

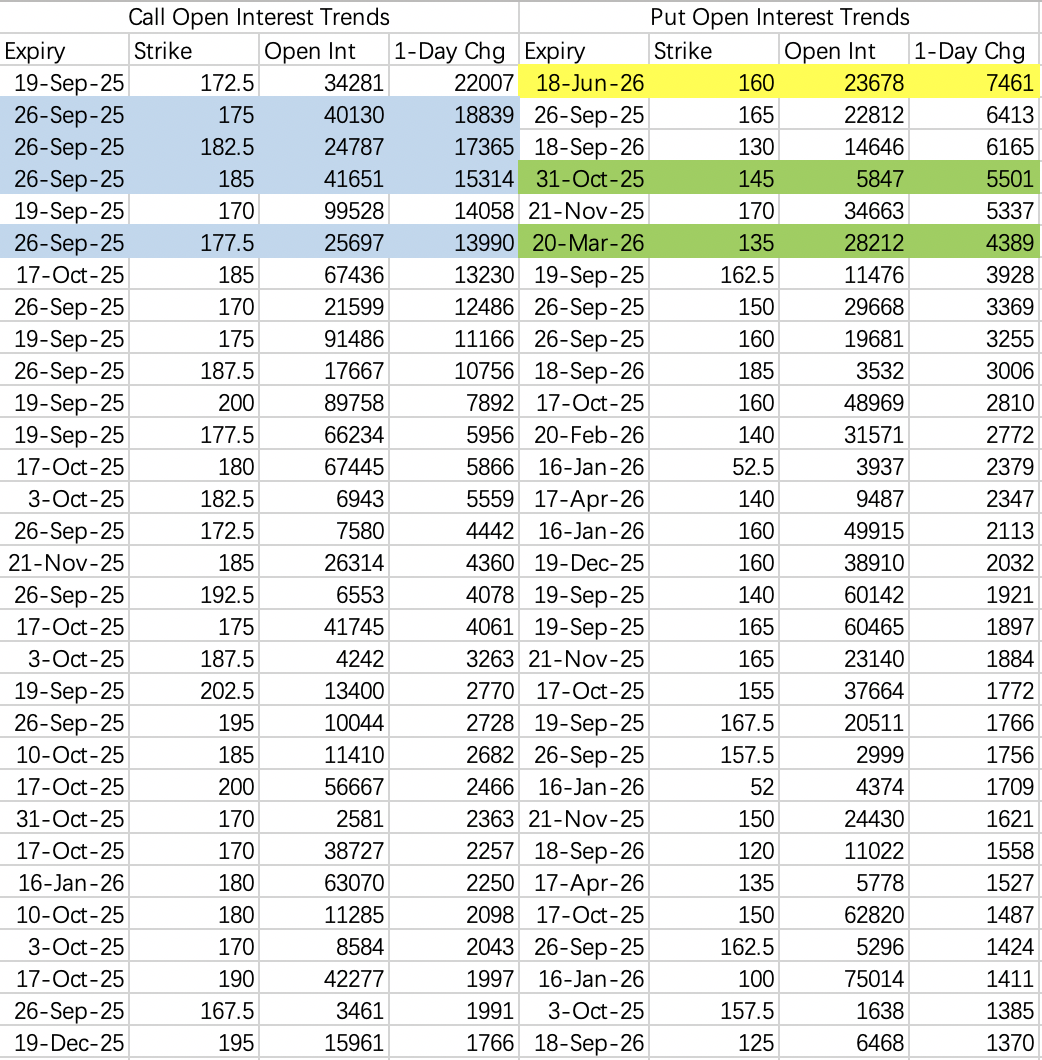

NVIDIA remains a magnet for aggressive bearish bets: someone bought 5,000 contracts of the $NVDA 20260618 160.0 PUT$ (June 18, 2026), totaling $8.02 million.

On the bullish side, big sell put orders are coming in for strikes in the $135–145$ range (like $NVDA 20251031 145.0 PUT$ ). Still, there’s a persistent belief in the market that $NVDA$ could correct to below $160$ but hold above $140$—and based on the put flows, next week carries significant downside risk.

If you’re running sell put strategies, it may be wise to close early on rebounds. After Thursday’s bounce, consider switching to sell calls—possible strike: $185$ ($NVDA 20250926 185.0 CALL$ ).

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Brando741319·09-19Good1Report