As AI Demand Surges Again, Massive Long-Dated Bearish Bets Target NVIDIA

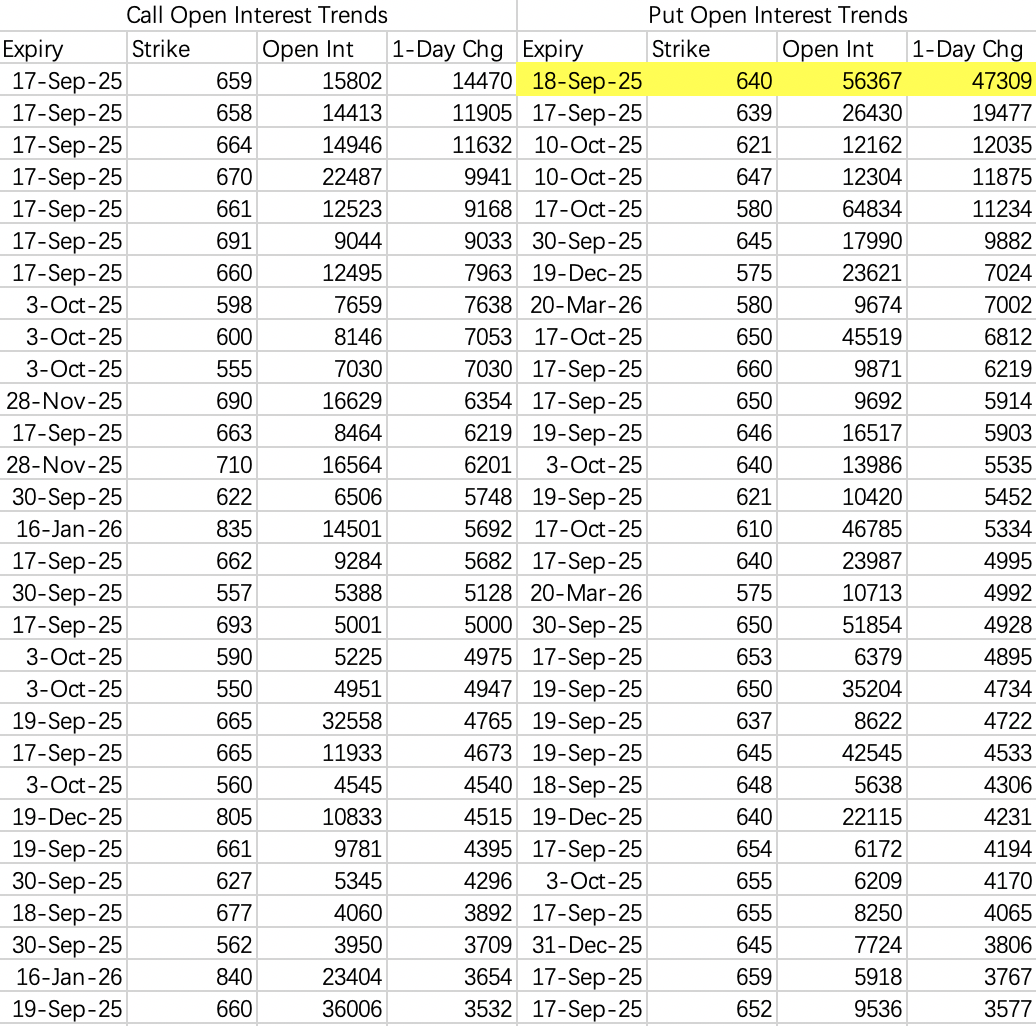

$SPDR S&P 500 ETF Trust(SPY)$

Starting with the broad market: $SPY$ option flow is diverging from spot market FOMC expectations. The market consensus is a 25bps rate cut (high probability), and the S&P’s move is within ±1%. But option flow shows traders broadly hedging for a 3%+ pullback.

Notably, 47,000 contracts of the $SPY 20250918 640.0 PUT$ were opened, mostly on the buy side, with over $1 million notional. Most bearish flows are opening below the $640$ strike.

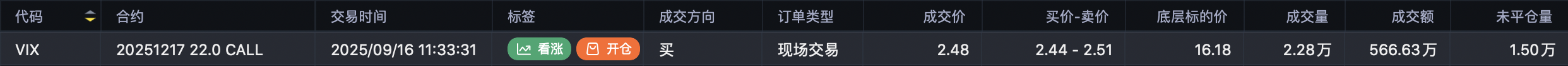

Meanwhile, big VIX option trades show someone buying 22,800 contracts of the $VIX 20251217 22.0 CALL$ (over $5.66 million notional), also hedging for a 3%+ S&P drop.

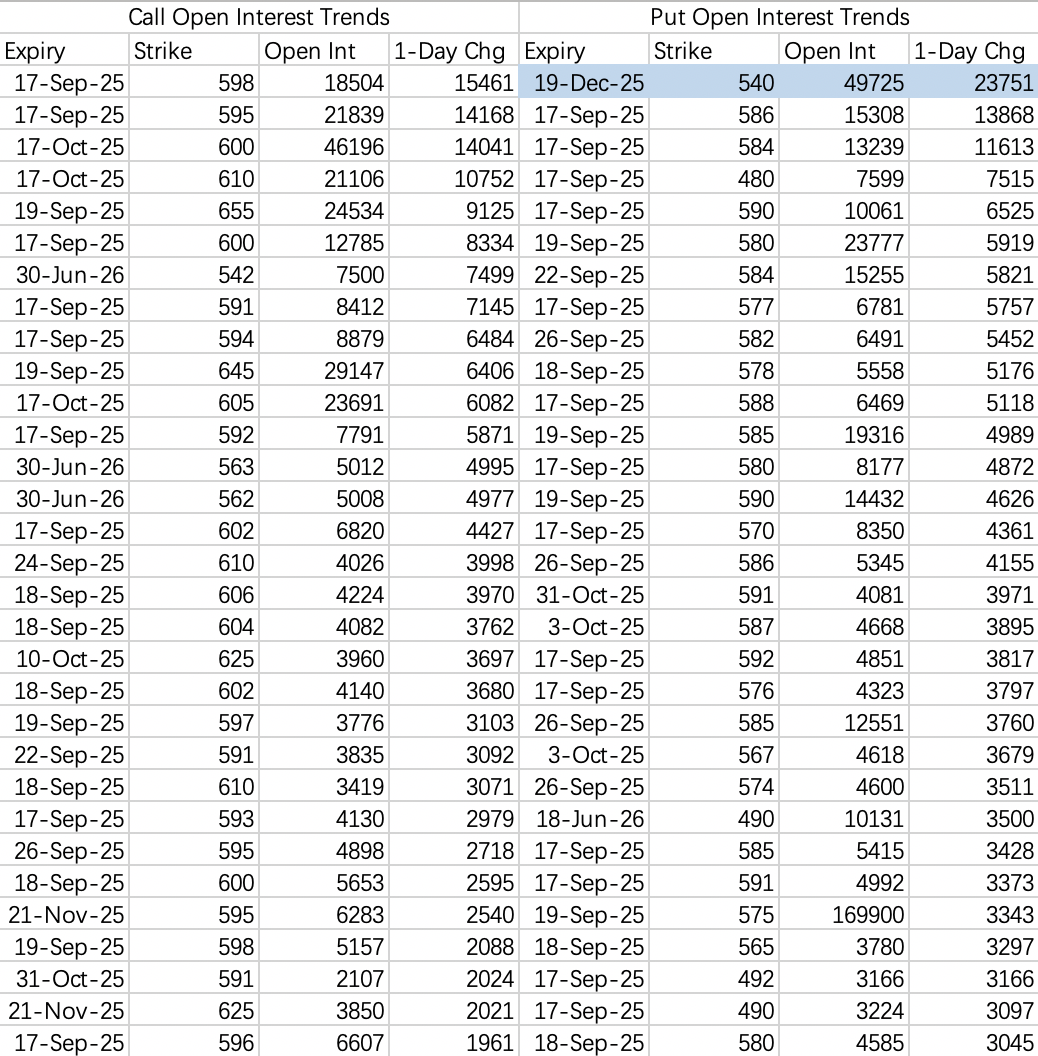

$Invesco QQQ(QQQ)$

QQQ’s bearish flow is more “normal”—outside of some long put rolling, new put positions are pricing in a move of just 0.6–1% down, which is in line with expectations.

In theory, a 25bps FOMC cut shouldn’t move markets much, but given historic September/October volatility, the heavy put buying is classic institutional protection.

$NVIDIA(NVDA)$

On Wednesday, media reported that Chinese internet regulators told domestic tech giants to halt all NVIDIA chip purchases. $NVDA$ dropped 2%—a far cry from the panic seen during the Deepseek scare earlier this year.

Why the muted reaction? Anyone who understands today’s AI computing supply knows it’s severely supply-constrained—even without China, NVIDIA’s revenue growth is explosive.

It’s rational for China to stop purchases now; the outlook for domestic AI chip development is unprecedented. If they don’t start building their own capabilities now, when will they?

Biden and Trump’s chip policy moves might hurt NVIDIA’s growth, but it’s the difference between tripling and doubling revenue—still huge.

That’s why this pullback is an ideal sell put opportunity; AI demand is rock solid, making another Deepseek-style crash unlikely.

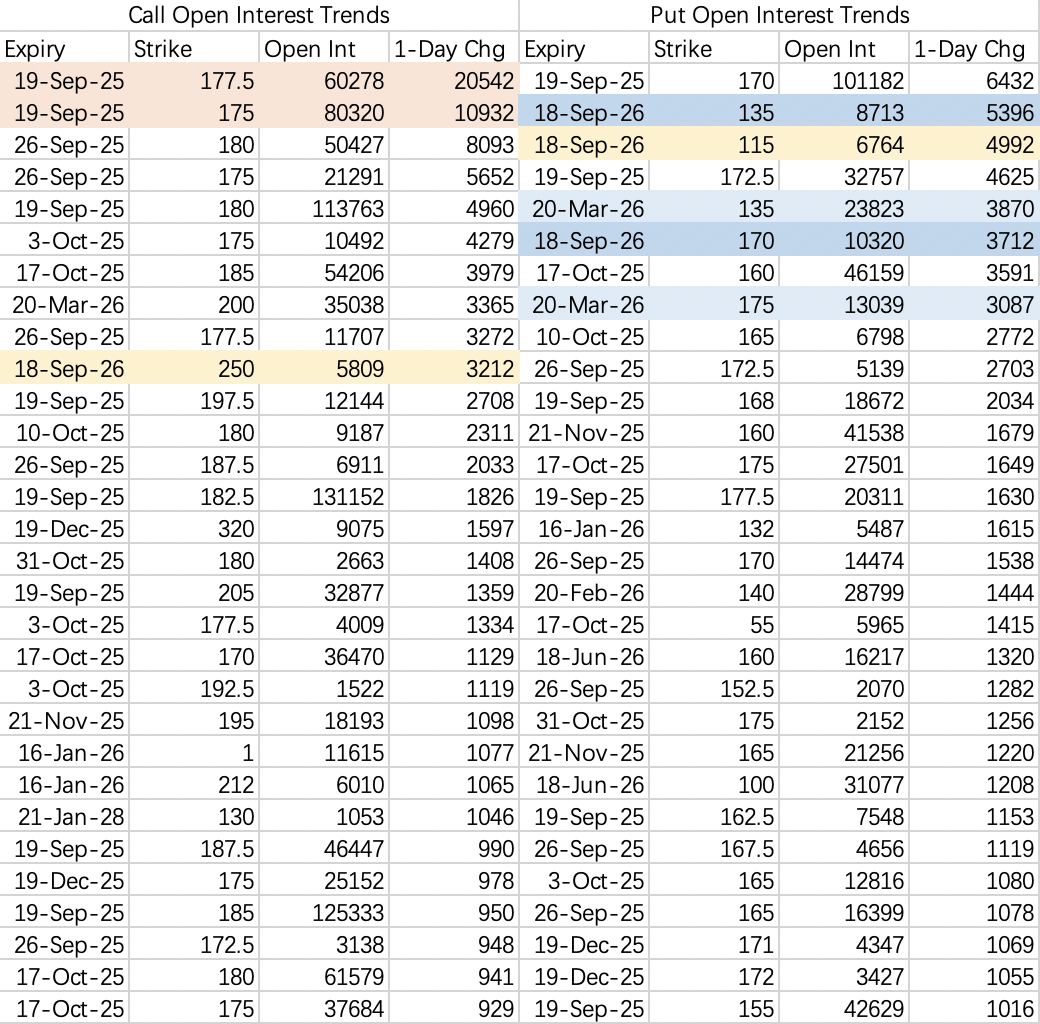

That said, yesterday we saw three massive bearish structures targeting $NVDA$—and the strikes are interesting, capping the downside at $170$ and the floor near $160$.

First massive trade:

Sell $NVDA 20260918 250.0 CALL$ (2,500 contracts, price ~$9.3)

Buy $NVDA 20260918 170.0 PUT$ (2,500 contracts, price ~$22)

Sell $NVDA 20260918 115.0 PUT$ (5,000 contracts, price ~$4.8)

All expiring September 18, 2026. Net cost about $4 per share, so breakeven at $170–4 = $166$.

Two more structures (without the call):

Sell $NVDA 20260918 135.0 PUT$ x2

Buy to close (?) $NVDA 20260918 100.0 PUT$

Net cost ~$4, so breakeven again below $166$.

Buy to close (?) $NVDA 20260320 95.0 PUT$

Net cost around $8.8; breakeven at $166.2$.

Notably, for the last two trades, I initially thought these were butterfly spreads (long both wings, double short the middle), but the 100 put and 95 put actually saw closing, not opening, activity—so these could be a mix of new and closing trades.

If these are butterflies, the max profit is at $135$, which is a pretty extreme "black swan" bet—rare for funds to size up like this unless they see something big coming. Still, the big picture: AI compute demand will remain supply-constrained for years. Any NVIDIA crash is a chance to buy.

Today’s pullback is a great spot to sell puts: $NVDA 20250919 165.0 PUT$ .

$Tesla Motors(TSLA)$

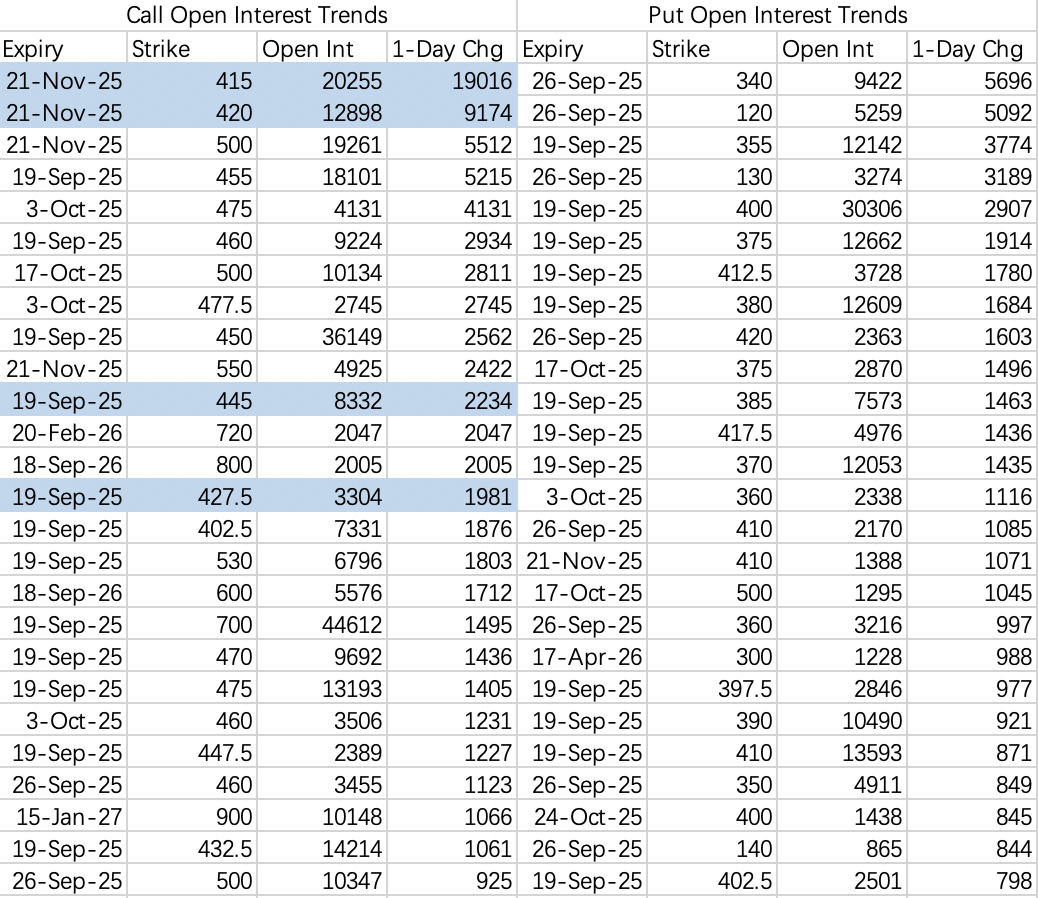

Institutions showing serious conviction—rolling long calls out to at-the-money November strikes: $TSLA 20251121 415.0 CALL$ and $TSLA 20251121 420.0 CALL$ . Compared to Oracle’s recent flow, this is much more aggressive.

There are also new bullish call spreads opening for next week: short $427.5$ ($TSLA 20250926 427.5 CALL$ ), hedged with $445$ ($TSLA 20250926 445 CALL$ ). If we see more consecutive strikes open, expect another squeeze next week.

For conservative sell puts, consider strikes below $390$ ($TSLA 20250919 390.0 PUT$ ).

Also, big bullish flow in the 2x levered ETF: $TSLL 20251219 25.0 CALL$ (10,000 contracts opened, $2.6 million notional).

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.