Market Turns on a Dime!? Big Sell Call Orders Target Oracle

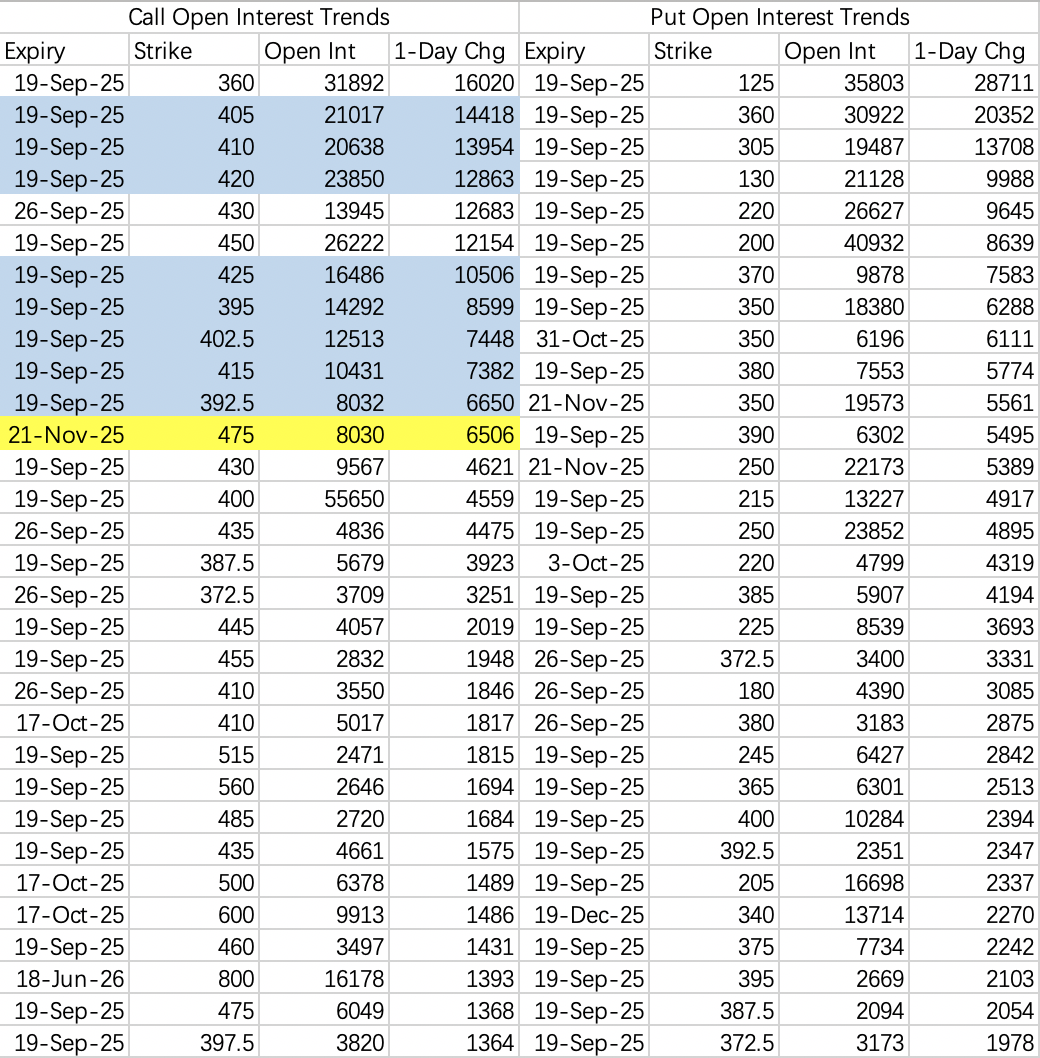

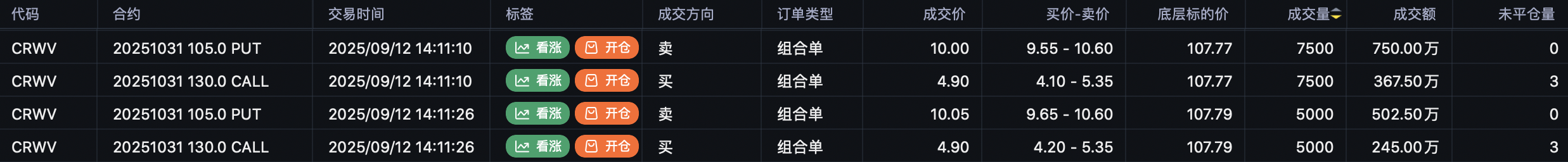

$Tesla Motors(TSLA)$

Tesla ripped to $426$ at the open, then pulled back. Why? Because institutions were once again forced to cover massive sell call positions.

On Friday, the biggest bearish call spread was in the $405$ ($TSLA 20250919 405.0 CALL$ ) to $425$ ($TSLA 20250919 425.0 CALL$ ) range—expectation was for the stock to stay below $405$, with hedges buying the $425$ call. Other ranges are shown in blue on the chart; you can pair lows and highs yourself. Bottom line: just as predicted last week, we got a relentless squeeze from $392.5$ all the way to $425$.

Most likely, we’ll see another round of rolling at the open: institutions will close in-the-money $395–415$ spreads, and shift the upper bearish call spread range to $432.5$ ($TSLA 20250919 432.5 CALL$ ) to $452.5$ ($TSLA 20250919 452.5 CALL$ ), targeting a cap at $432.5$ with a $452.5$ hedge.

Honestly, it feels like Oracle’s headline last week lit a fire under Elon Musk’s competitive spirit. Anyone who knows Musk knows he loves two things most: starting companies and being #1 on any leaderboard.

That’s why I don’t think this Tesla run stops at $420$. Look to buy on any meaningful pullback.

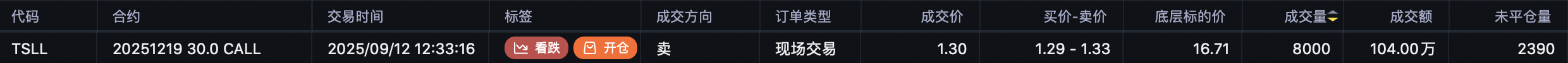

$Direxion Daily TSLA Bull 2X Shares(TSLL)$

Tesla’s 2x leveraged ETF saw a massive bullish order: 8,000 contracts of the $TSLL 20251219 30.0 CALL$ expiring in December. The filter tags it as a sell, but my own read (after analyzing the spread) leans more toward a buy—interpret as you will.

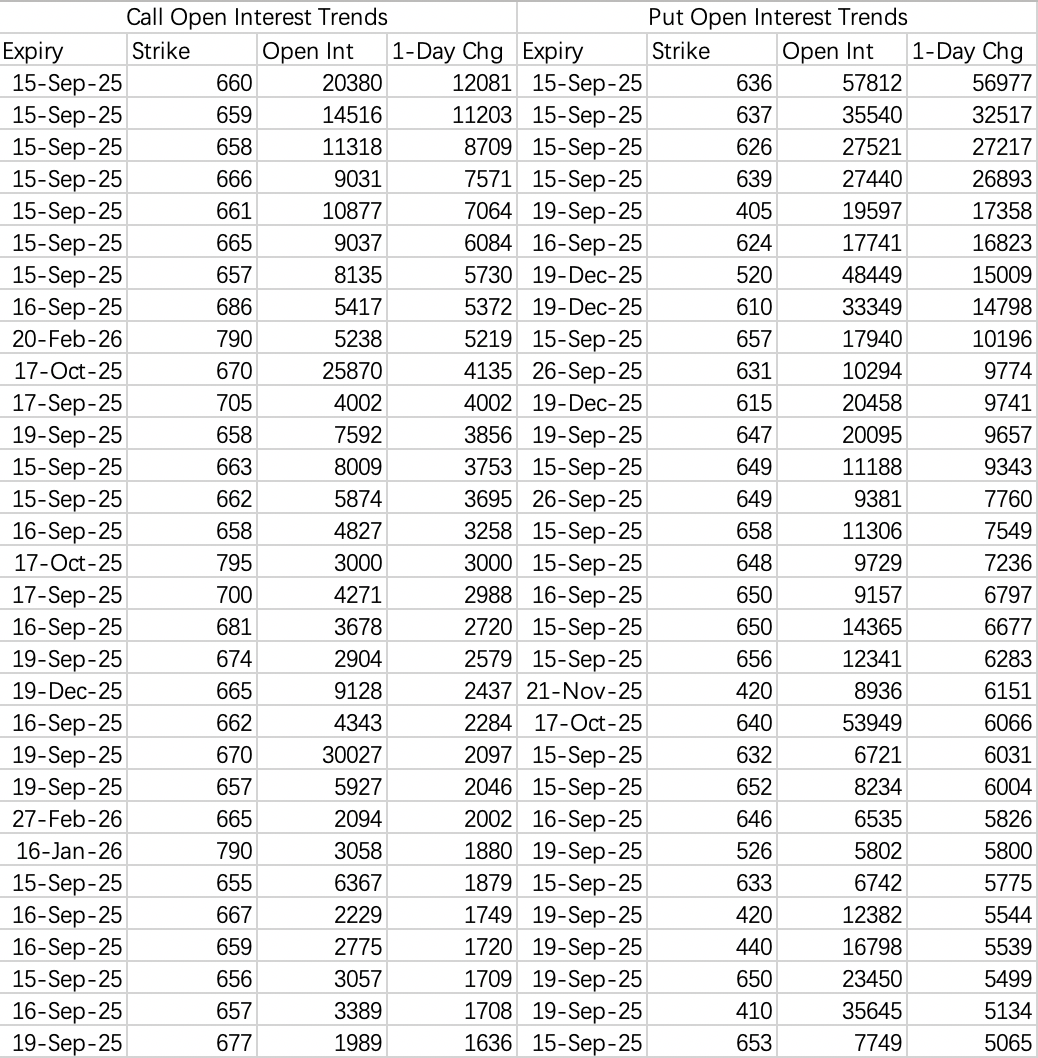

$SPDR S&P 500 ETF Trust(SPY)$

$SPY$ options are tilted toward a pullback this week, which makes sense with triple witching ahead. Expect a range of $645–660$; by the time this goes out, we should be in a dip.

Still, nobody expected Oracle to save the market from a breakdown last week, and now Tesla’s taking the baton. Who knows, maybe Musk will wait until after triple witching to really push it, giving market makers a break.

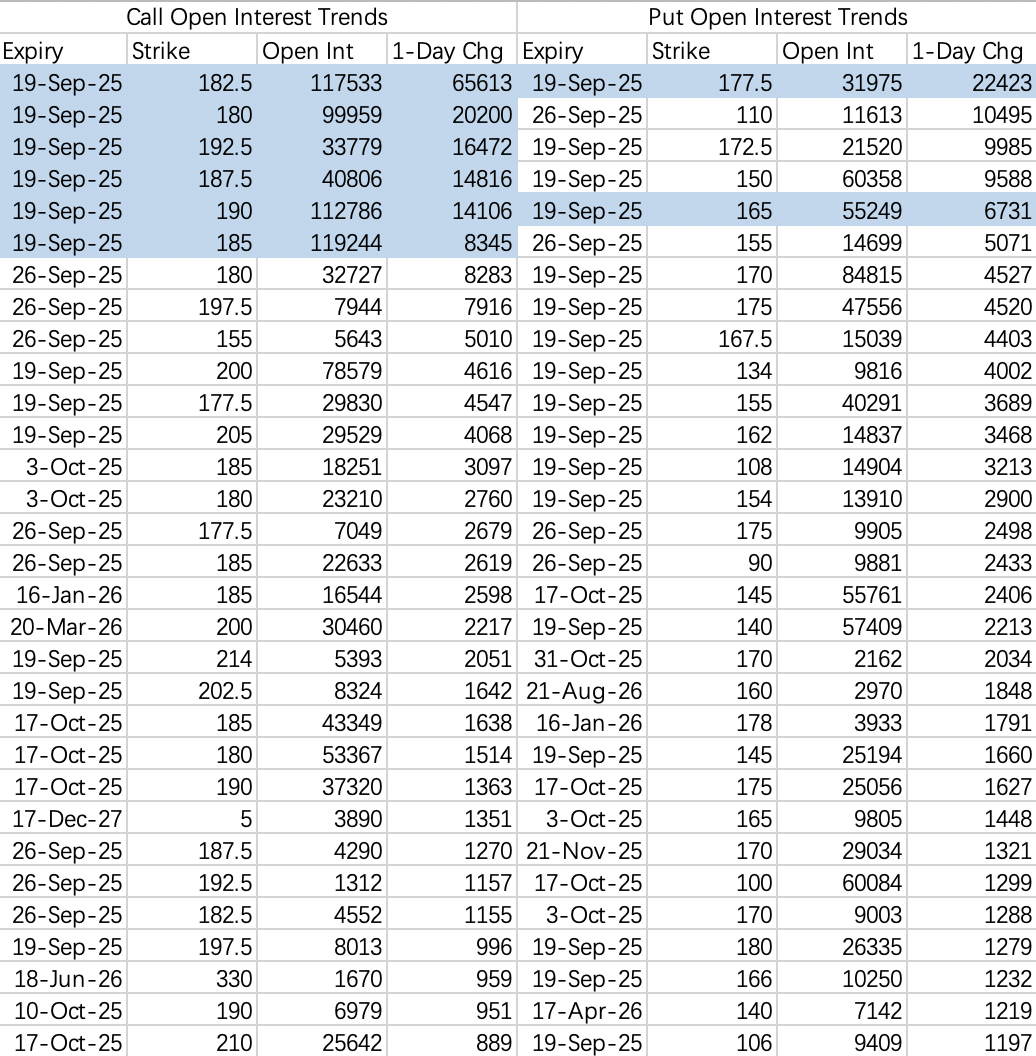

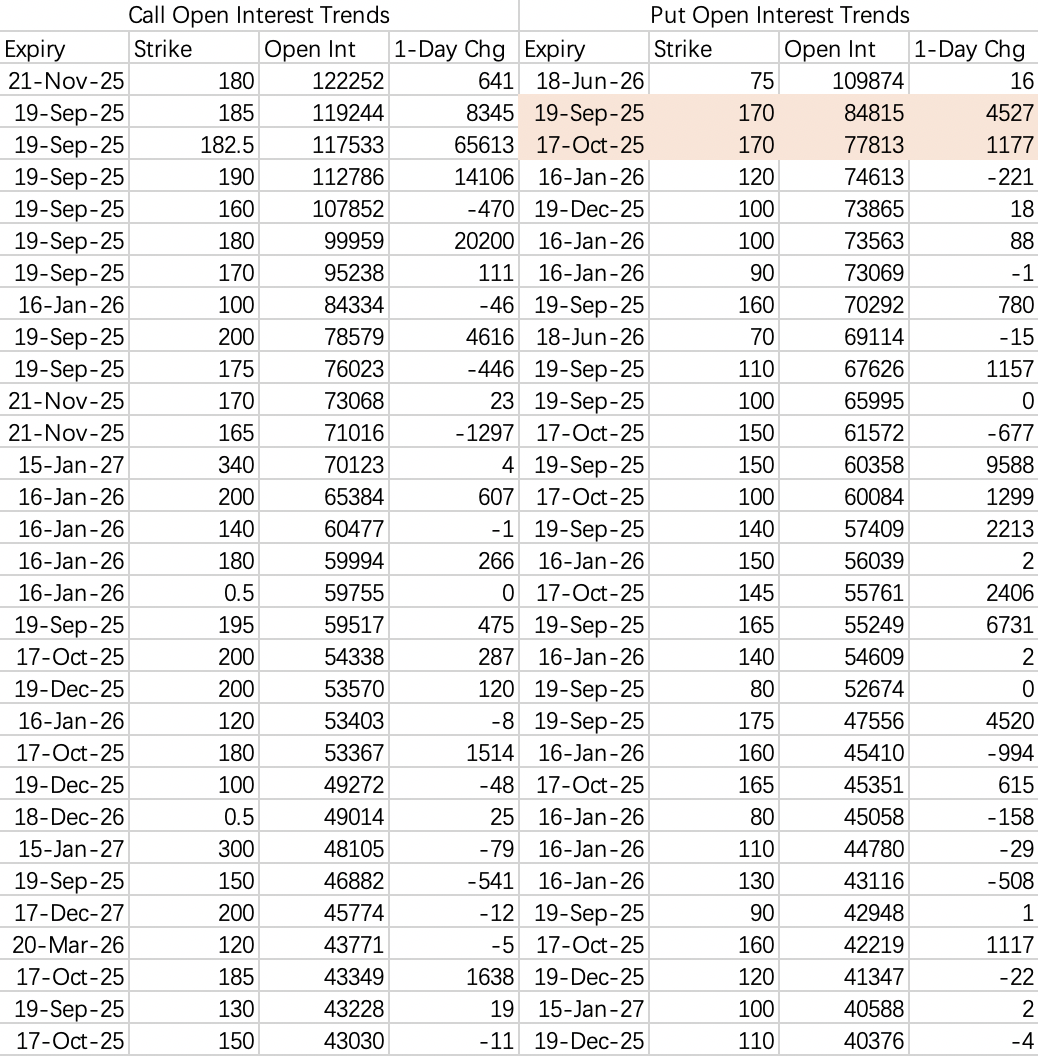

$NVIDIA(NVDA)$

No real suspense for this week’s close—should settle between $170–180$.

Call spreads are being sold at $182.5$ ($NVDA 20250919 182.5 CALL$ ), hedged with buys at $190$ ($NVDA 20250919 190.0 CALL$ ). Other similar spreads are in the $182.5–192.5$ and $180–185$ ranges—see the blue areas on the chart.

On the bearish side, there’s a big put spread: buying $177.5$ ($NVDA 20250919 177.5 PUT$ ), selling $165$ ($NVDA 20250919 165 PUT$ ). The trade is bearish below $177.5$, but not expecting a break below $165$, in line with weekly volatility expectations.

Looking out to October, still possible for $NVDA$ to close above $170$.

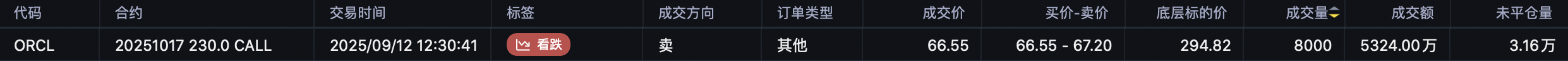

$Oracle(ORCL)$

Awkwardly, Oracle’s rally feels overdone, almost as if the market is refusing to price in the earnings beat.

There’s a massive, deep in-the-money sell call: 8,000 contracts of the $ORCL 20251017 230.0 CALL$ sold for $53.24 million. Normally, I’d treat this as a synthetic short, but based on option flow, there are people who genuinely think $ORCL$ is heading back to $240$.

A pullback to $280$ is possible in the next couple weeks. If you’re long shares, look at covered call strategies; for sell calls, focus on strikes above $320$ ($ORCL 20250919 320.0 CALL$ ).

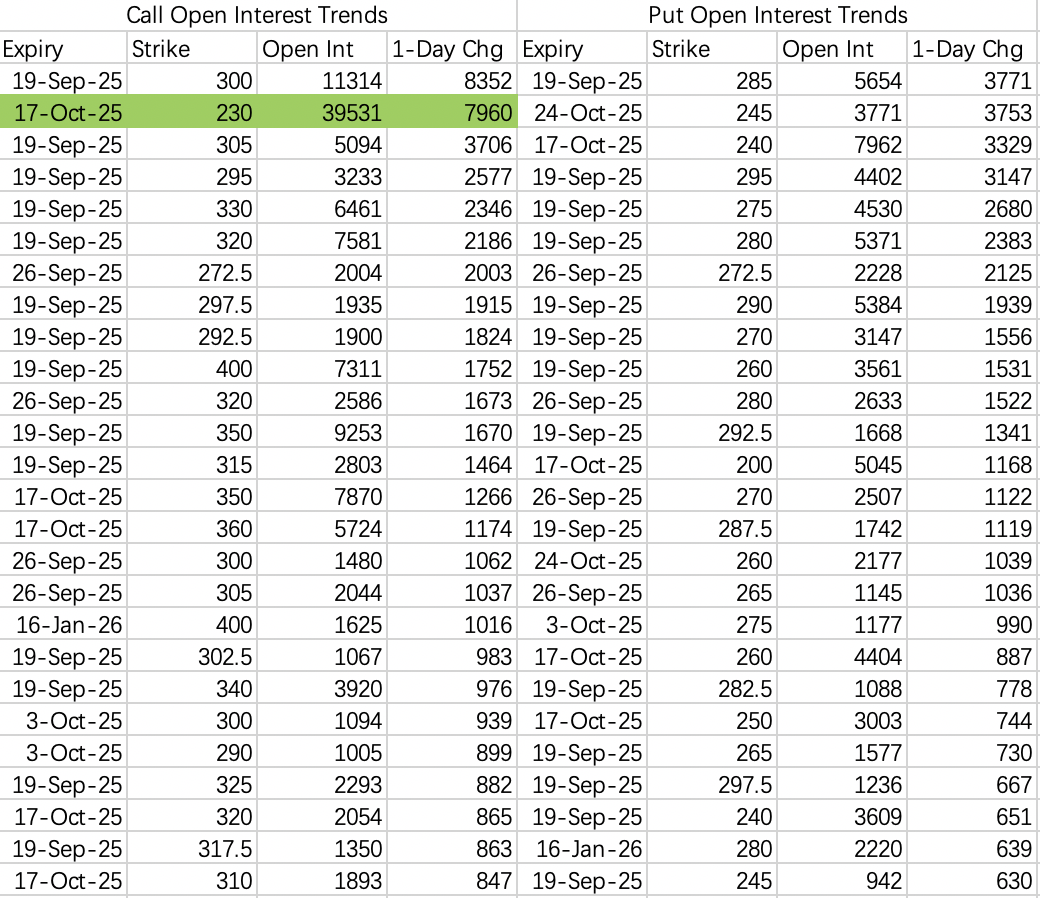

$CoreWeave, Inc.(CRWV)$

With Oracle’s results in mind, institutions started building new positions in $CRWV$ during last Friday’s broad market pullback.

Key bullish trades: a combo of sell puts and buy calls, specifically buying the $CRWV 20251031 130.0 CALL$ and selling the $CRWV 20251031 105.0 PUT$ , both with 12,000 contracts opened. This is similar to a stock + long call strategy, but using a sell put as a synthetic “floor” to avoid chop decay—if you just hold stock + call during a flat market, you bleed, but with a sell put underneath, you don’t.

There’s also a pure call buy: $CRWV 20260918 130.0 CALL$ , 7,370 contracts, nearly $20 million notional.

If you’re worried about theta decay, you can copy the previous combo and sell short-term puts as a hedge.

One thing’s for sure: CRWV’s implied volatility is rich, with 8% intraday moves even outside earnings. But unless you’re a pure short, just selling volatility isn’t attractive here. For high-potential growth stocks like this, holding equity or using light leverage best fits the risk/reward profile.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.