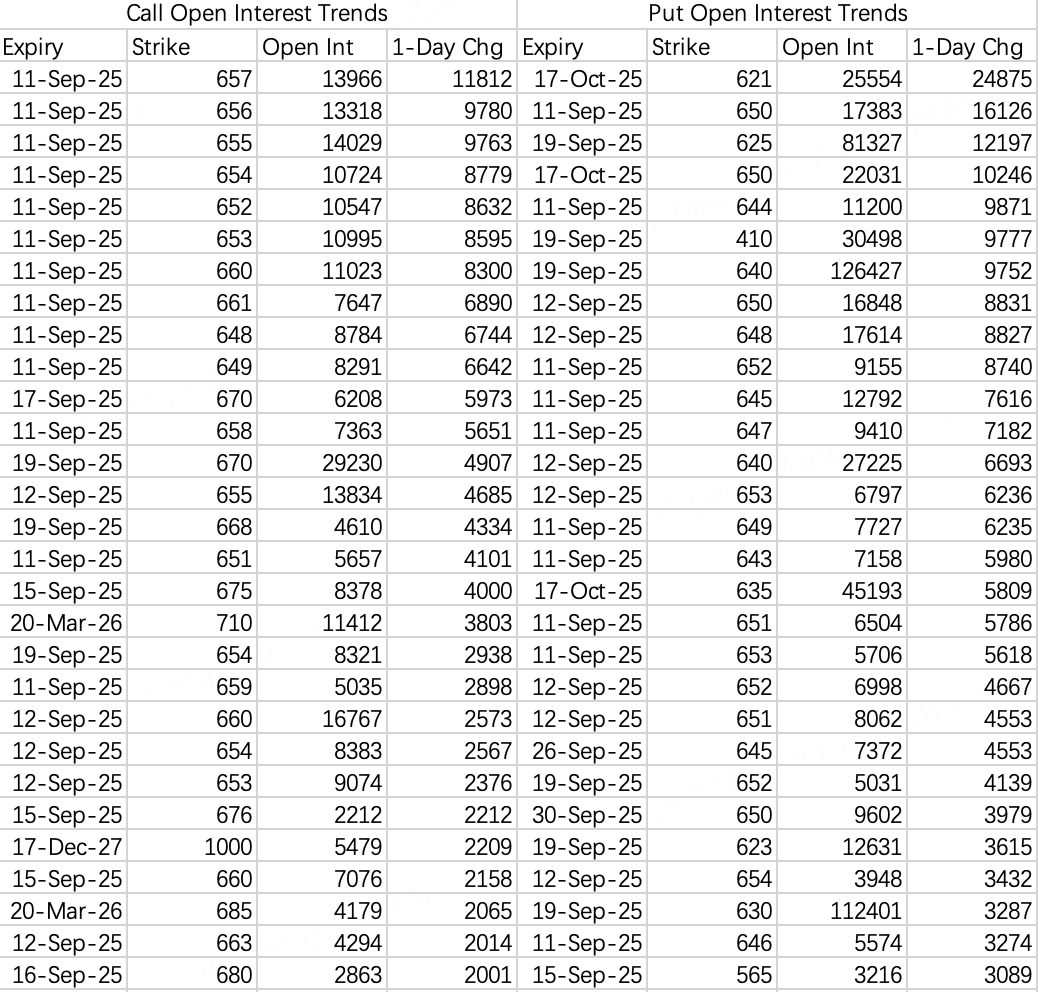

$SPDR S&P 500 ETF Trust(SPY)$

Oracle’s surprise earnings effectively broke the market’s pullback, and also expanded the volatility range for $SPY$. This week’s range looks like $645–655$, and next week we may see a test of $660$.

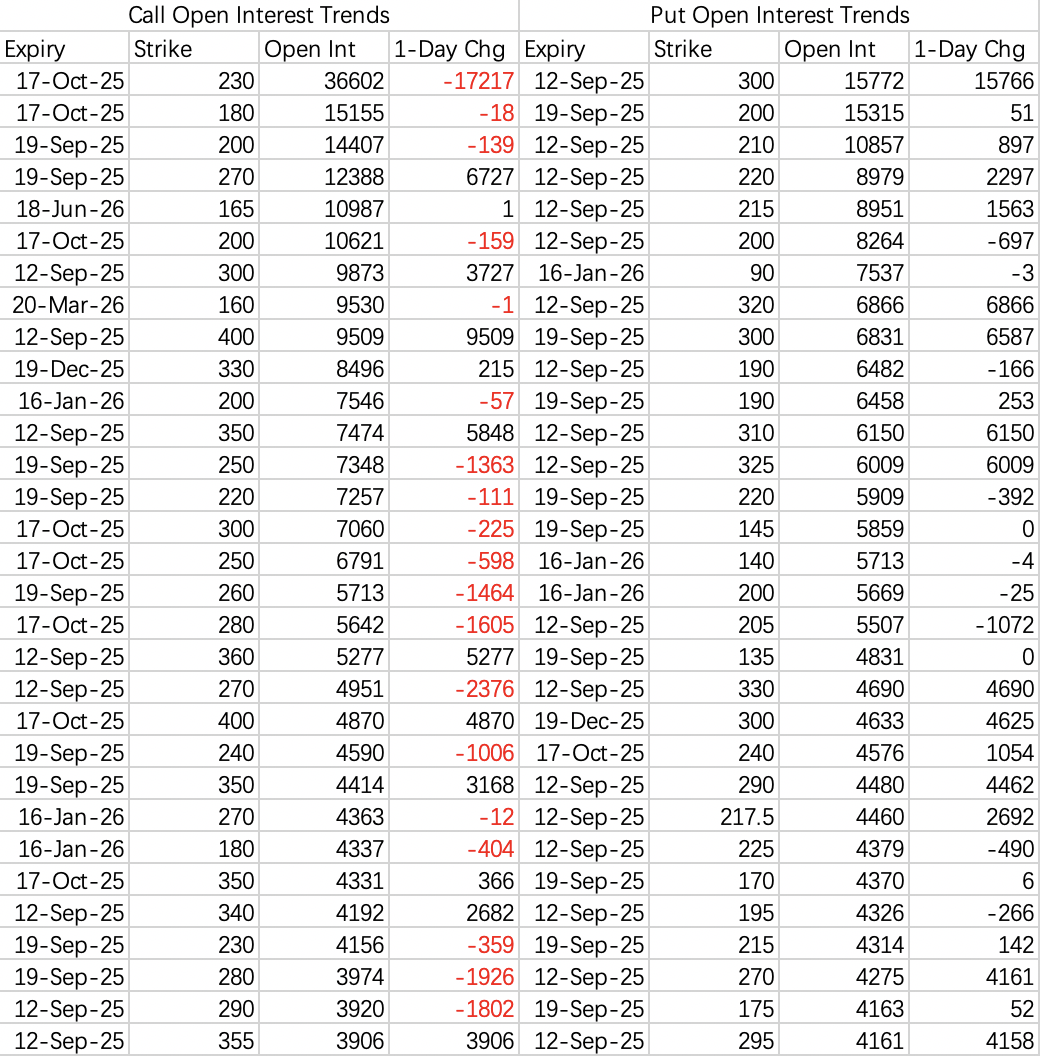

$Oracle(ORCL)$

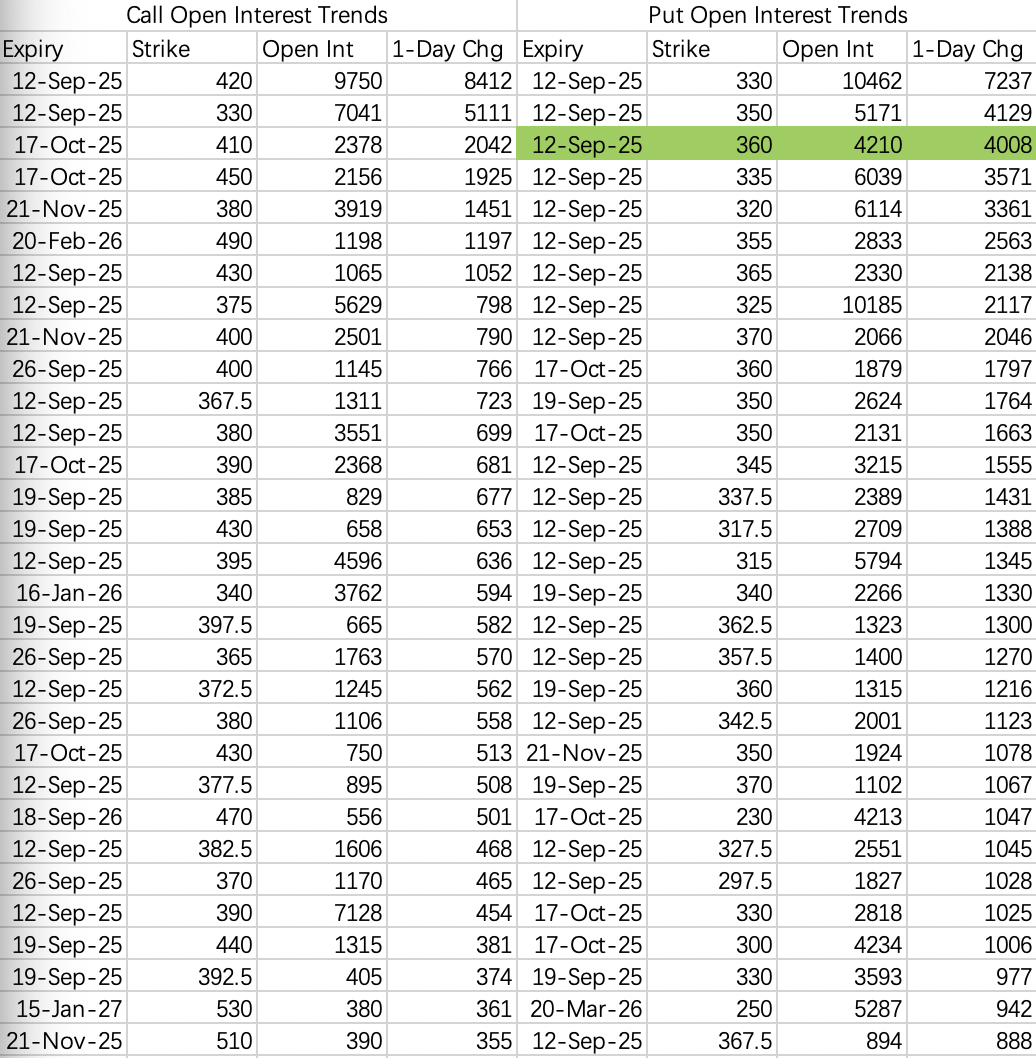

Option flow is out and surprisingly muted—at least in terms of big block trades. Sorting by open interest, there’s more aggressive opening of puts and more closing of calls. The bulls are not piling in right away; most are on the sidelines after the 35% surge, even though $330$ isn’t expensive from a valuation perspective.

After the initial excitement, Wall Street analysts are taking a very “corporate” view of the backlog: unless it’s converting directly to revenue in the near term, it’s just talk. That’s why the market isn’t chasing the stock hard post-earnings.

On Wednesday night, it was revealed that the $300B$, five-year contract partner is OpenAI. After the news, $ORCL$ shares actually drifted lower. The explanation: customer concentration risk—if OpenAI can’t raise enough capital, the $300B$ pipeline might not materialize.

But there’s another angle: regardless of OpenAI’s status, Oracle will likely sell $300B$ worth of cloud services over five years anyway; OpenAI just locked in capacity first. That suggests AI cloud resources will be scarce in the next few years, and only a pure AI giant like OpenAI can make such a massive, long-term commitment.

So, a pullback in $ORCL$ over the next two weeks would be a prime sell put opportunity. The market expects a retracement to the $300–320$ zone; for conservative trades, focus on strikes below $300$.

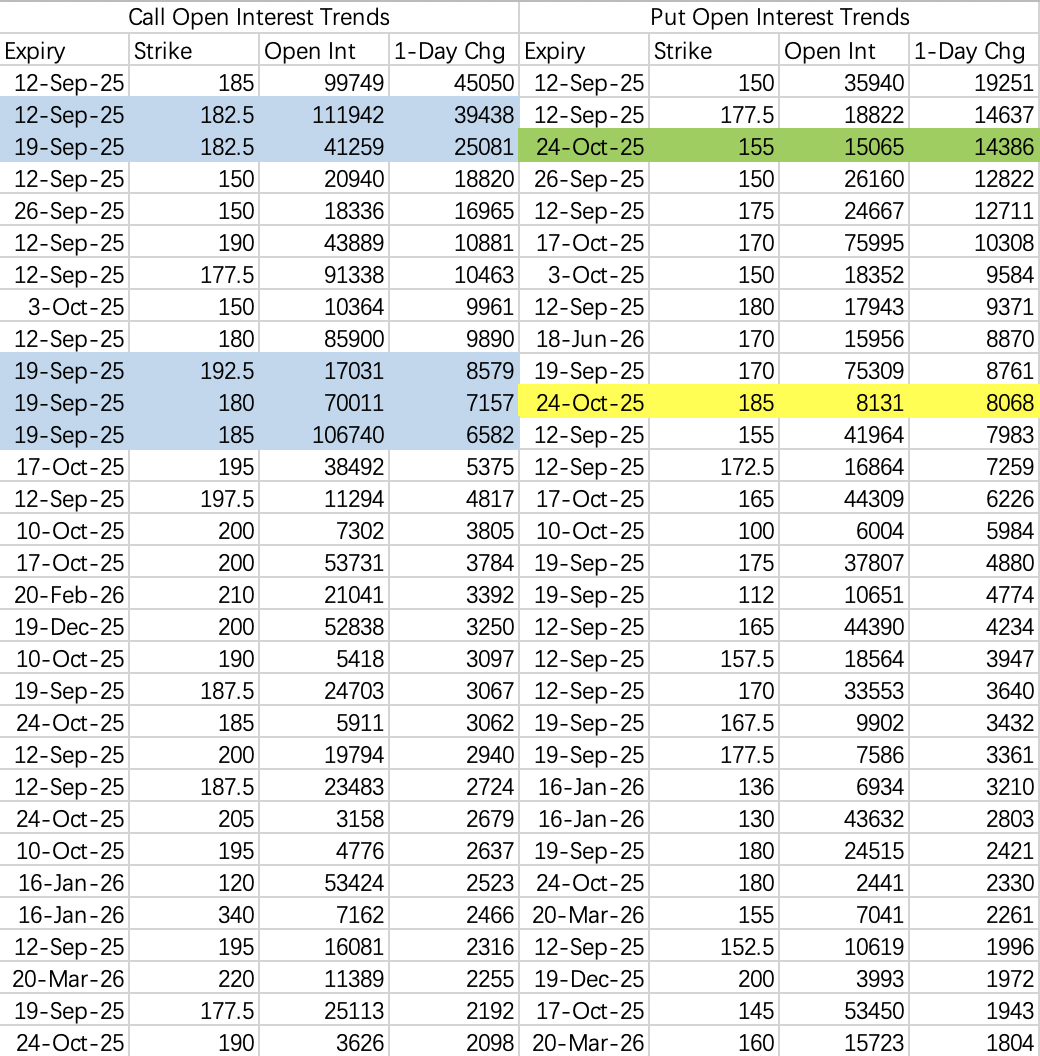

$NVIDIA(NVDA)$

Expect continued chop in the $170–180$ range through the rest of this week and into next week.

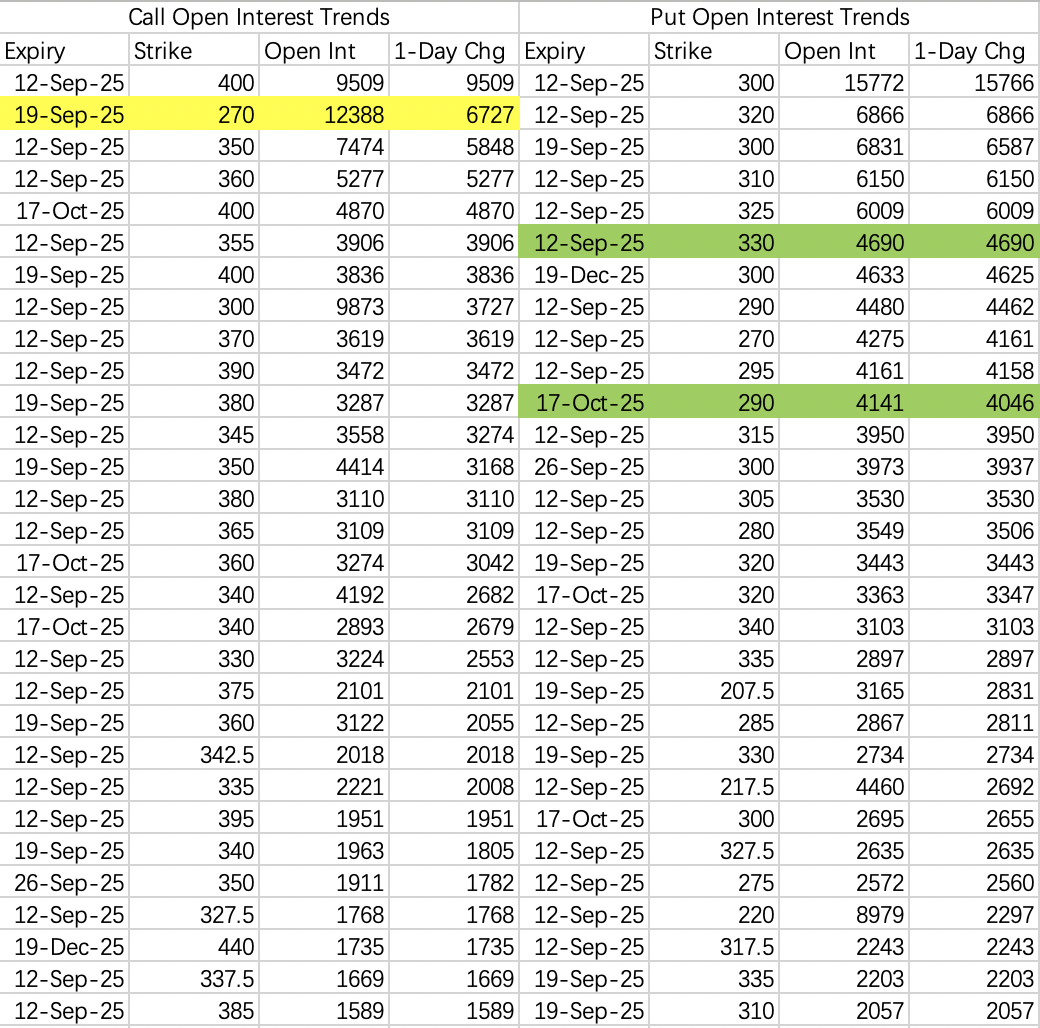

$Broadcom(AVGO)$

For $AVGO$, the conservative sell put strike remains below $330$.

$CoreWeave, Inc.(CRWV)$

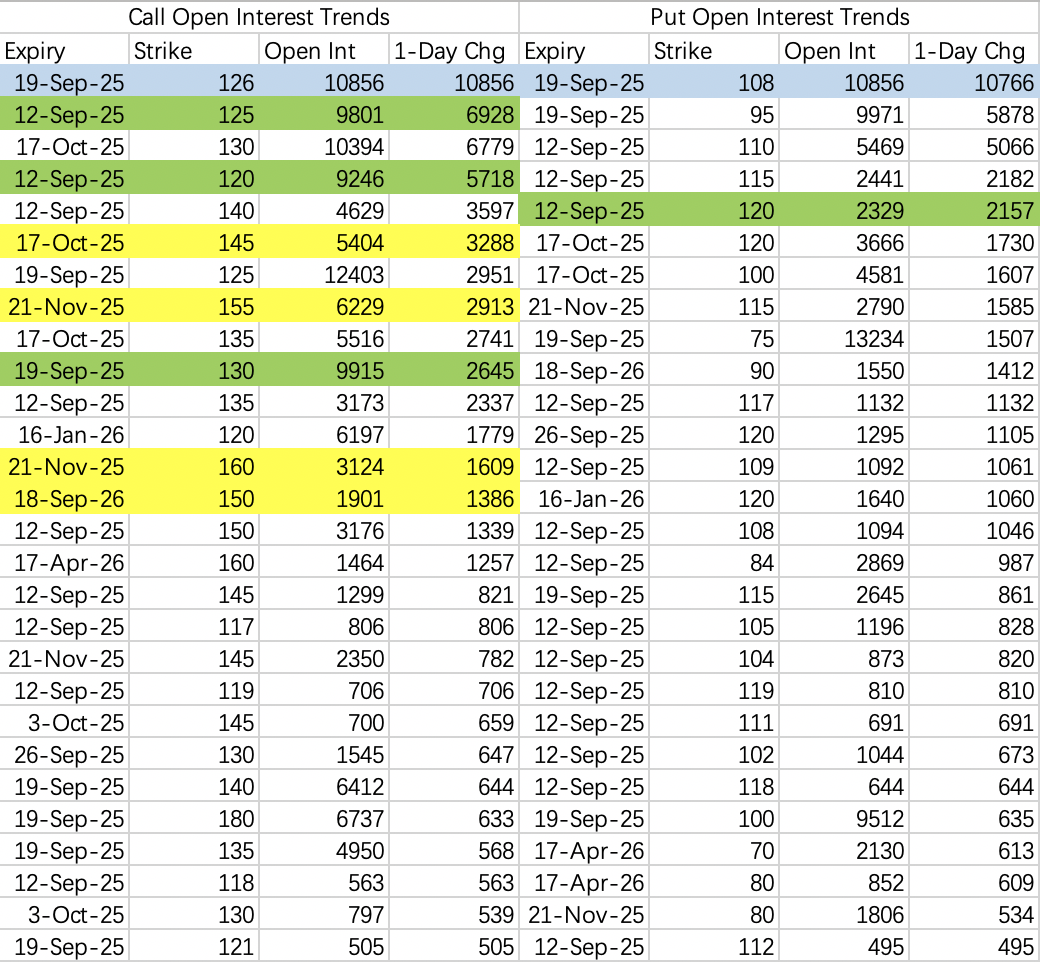

On Wednesday, institutions rolled positions to the $CRWV 20250919 108.0 PUT$ and $CRWV 20250919 126.0 CALL$ , implying a $108–126$ range for that expiration week—just a reference, not gospel.

Given what we saw from $NBIS$ and $ORCL$, it’s reasonable to guess $CRWV$ also has a large backlog yet to be announced. If that’s true, its earnings could see a major spike. Even though $CRWV$ popped 16% on Wednesday, it’s still nowhere near what we saw from ORCL or NBIS.

Others are thinking along the same lines, so $CRWV$ action should be very interesting over the next few weeks. For a conservative approach, wait for a pullback near $110$ to sell puts at the $110$ strike.

Also, keep an eye on the large single-leg call buys—implied target is $150$ by November.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.