An Earnings Beat in the Truest Sense: Oracle Crushes the Shorts

September’s pullback looks unlikely now—AI infrastructure spending is driving the market higher again.

Any stock tied to data center construction is rallying, including AI chips and nuclear power.

Oracle just dropped a bombshell with earnings, revealing their first “Five-Year Plan”—three years longer than $AVGO$’s two-year outlook. Analysts are losing their minds.

The market, which had been cautiously feeling its way forward, now has no excuse for a pullback. Everyone’s forced to rerate valuations.

The Tuesday option flow in AI chip stocks is now essentially irrelevant. Institutions had lined up for a pullback, but Oracle’s report stunned everyone.

$Oracle(ORCL)$

This was a true, across-the-board earnings beat—option flows show even the most bullish positioning underestimated the move.

After the surge, expect $ORCL$ to trade sideways for a while, similar to $NVDA$ after its May 2023 blowout quarter.

If you’re selling puts, any strike below $300$ is fair game. For selling calls, wait until tomorrow for a clearer setup.

$NVIDIA(NVDA)$

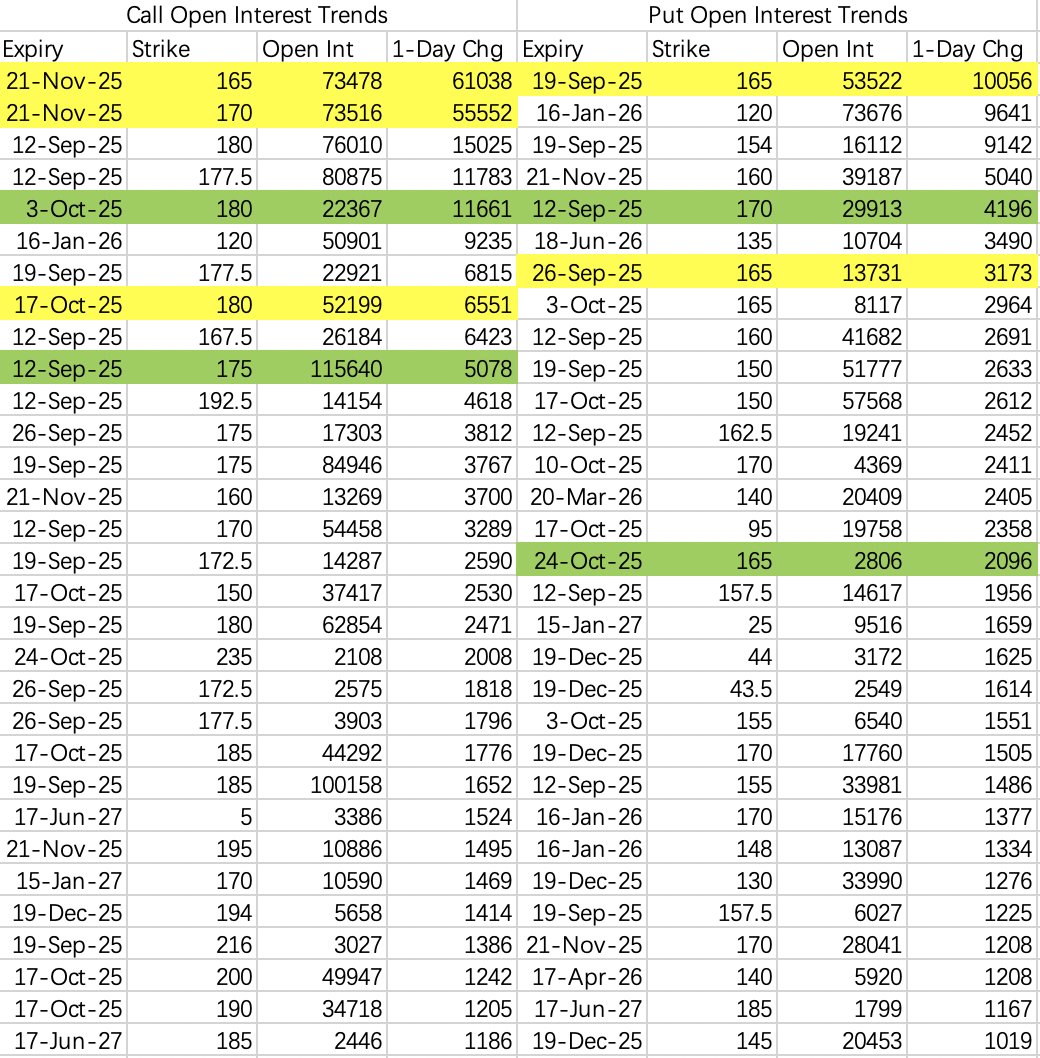

It was clear on Tuesday that the market was prepping for a pullback into the $160–165$ range, but that’s out the window now. We’re back in the $170–180$ zone—not sure if it holds into triple witching.

$CoreWeave, Inc.(CRWV)$

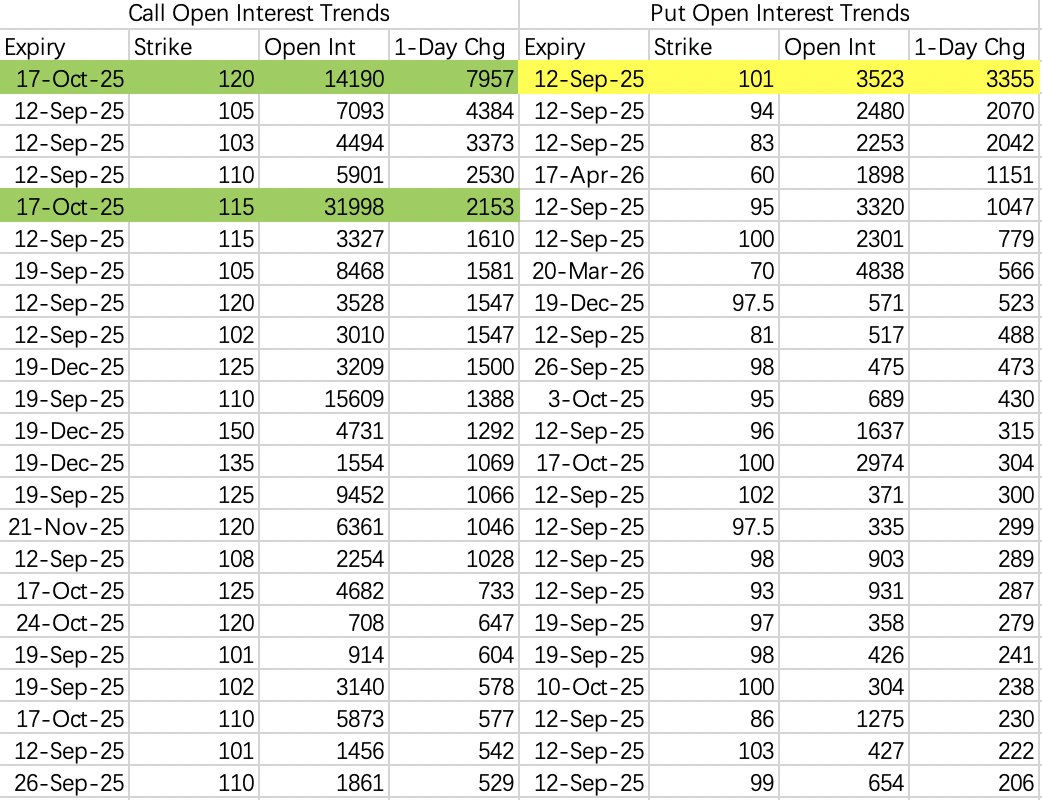

This has been a serious short squeeze. The street expected $CRWV$ to stay below $120$ through October, yet it’s already broken $120$ tonight.

$Advanced Micro Devices(AMD)$

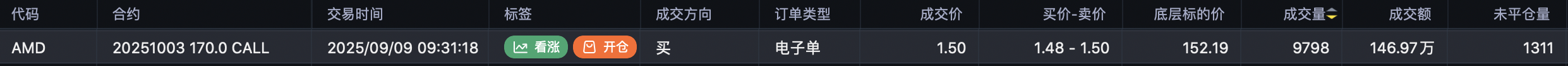

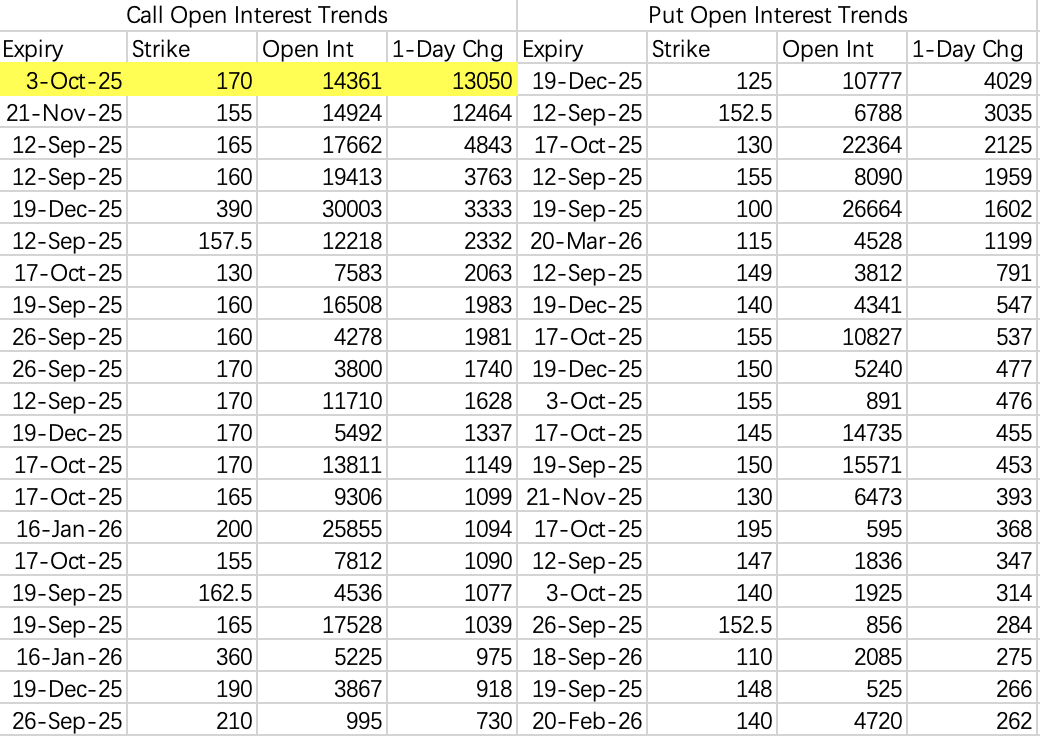

Worth noting: AMD saw a big bullish options print after the bell on Tuesday—a large buy in the $AMD 20251003 170.0 CALL$ . Position was still open at the time of writing and is worth watching.

Aside from that $170$ call, there’s some put buying that looks like a bottoming play. If there are no new black swans in the next two weeks, this is probably the low.

$Tesla Motors(TSLA)$

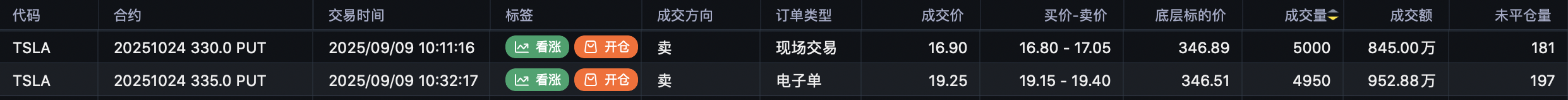

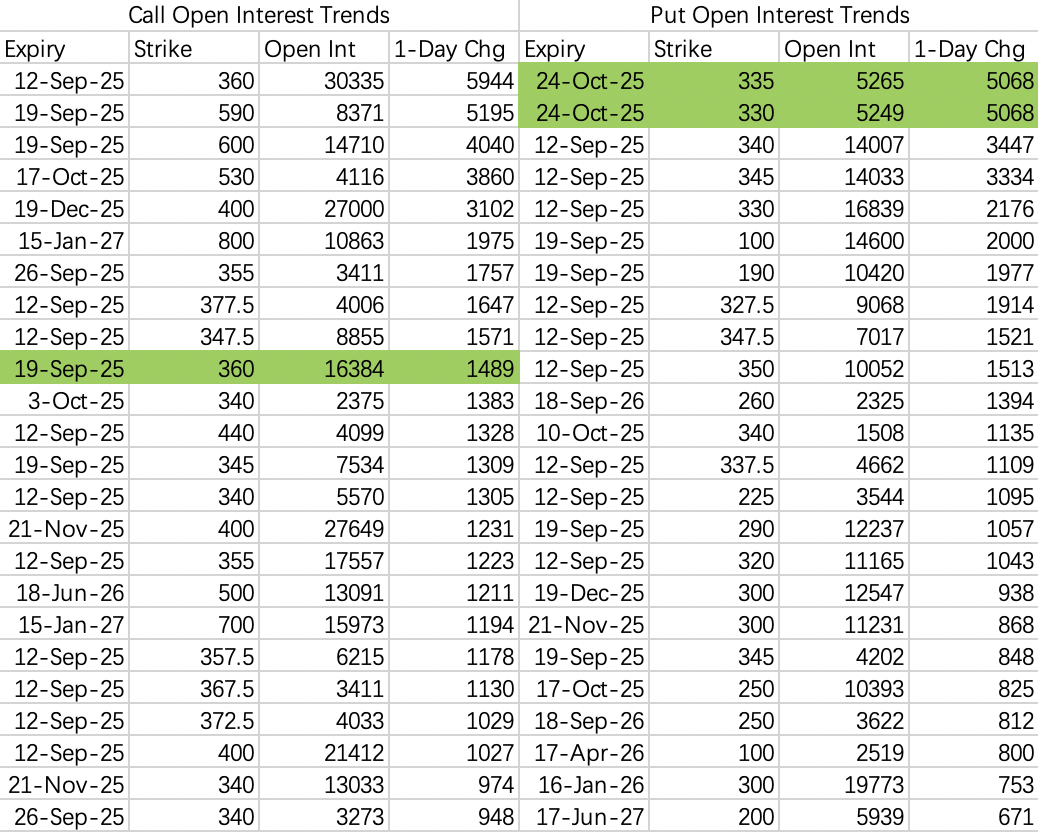

Tesla remains as strong as ever. Notably, there were large sell put trades on Tuesday: sold $TSLA 20251024 330.0 PUT$ and $TSLA 20251024 335.0 PUT$ , both with 5,000 contracts opened and nearly $20 million in notional.

For this week, selling calls with strikes above $360$ looks reasonable.

$SPDR S&P 500 ETF Trust(SPY)$

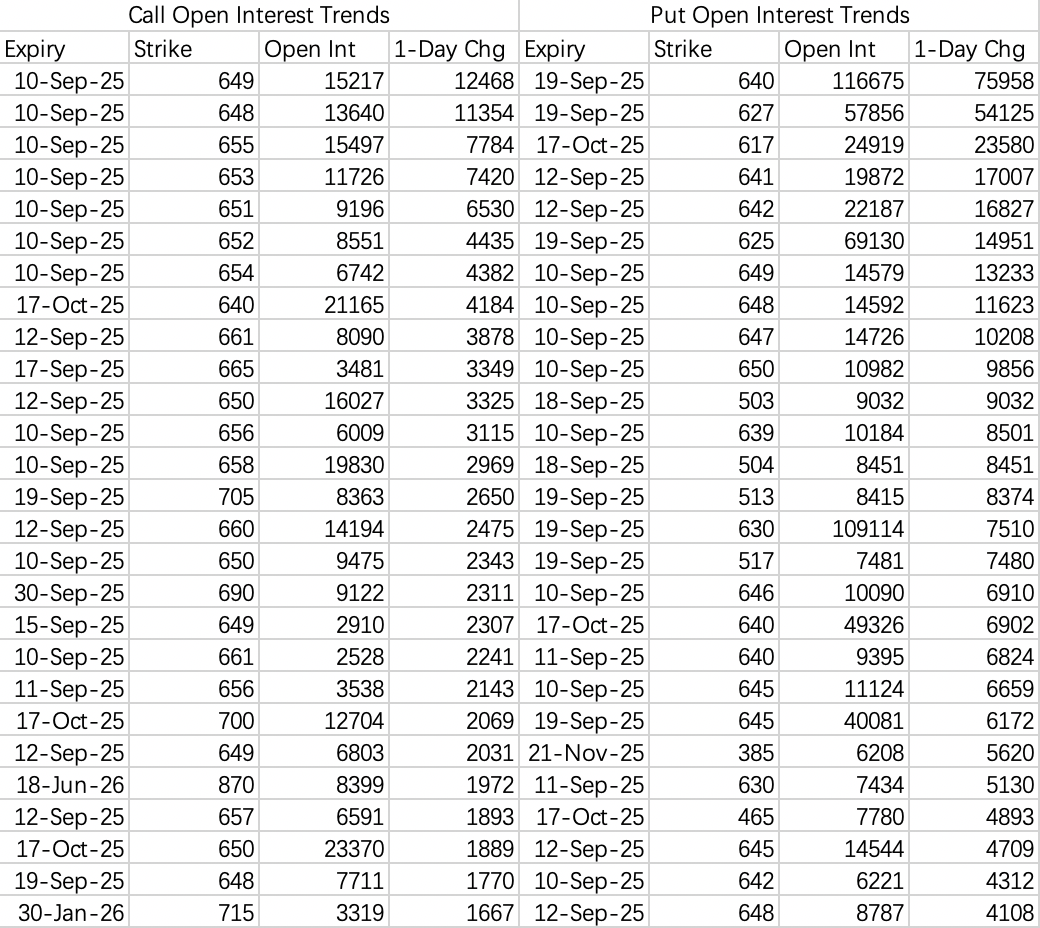

Options flow suggested a move down to $640$ was in the cards today, but the market ripped higher instead.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.