Oracle RPO Surges 3X Forecast, Fueling a Frenzied AI Narrative

$Oracle(ORCL)$ delivered a Q1 FY2026 earnings report that stunned investors with sheer scale of contractual backlog, but also revealed some structural mismatches in near-term execution.

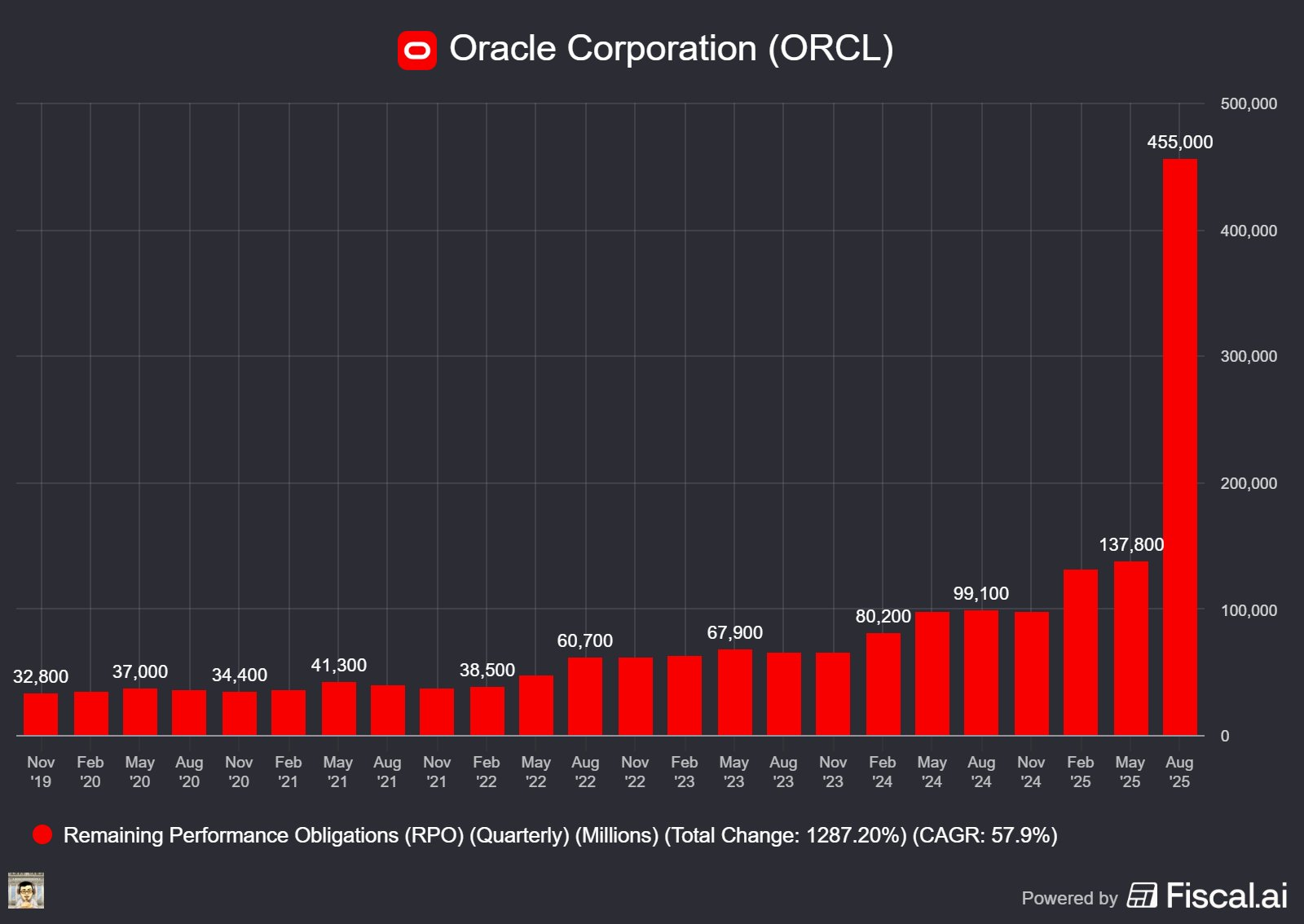

The headline number was striking: Remaining Performance Obligations (RPO) soared to $455 billion, up 359% YoY—nearly triple consensus expectations. Alongside this, Oracle sharply raised its long-term growth trajectory and CapEx guidance for Oracle Cloud Infrastructure (OCI). Investors embraced the narrative of Oracle as a go-to infrastructure provider for AI training and inference, sending the stock sharply higher in after-hours trading.

While quarterly revenue came in at $14.9 billion and non-GAAP EPS at $1.47—roughly in line but slightly below estimates—the magnitude of backlog and management’s confident growth outlook flipped market sentiment from cautious approval to outright enthusiasm.

Big picture: Oracle’s results show a favorable structure—massive contracted backlog and marquee AI clients entering its ecosystem—while short-term uncertainties remain around revenue conversion, CapEx payback, and margin pressure. This mix provides immediate support for the stock but leaves long-term execution to be proven.

Financial Results & Market Reaction

Total revenue: $14.9bn (+11% YoY), driven primarily by cloud (Apps + Infrastructure). Growth was led by AI-related large contracts that boosted deferred revenue. While slightly below the ~$15.03bn consensus, the pace improved versus last year’s +8%, signaling solid fundamentals but delayed revenue realization.

Cloud revenue: $7.2bn (+27% YoY), now 48% of total revenue.

OCI (Infrastructure): $3.3bn (+54% YoY).

OCI consumption: +57%, fueled by GPU- and datacenter-intensive AI contracts. Oracle is positioning itself as a supplier for AI training/inference workloads, with hyperscale contracts lifting both consumption and infrastructure revenue.

Multi-cloud integration (embedding OCI into AWS, Azure, GCP) is creating new growth channels.

Oracle’s cloud growth rate not only outpaces traditional peers but stands as the key positive surprise this quarter.

Explosive RPO: $455bn (+359% YoY, +$317bn QoQ). Driven by multi-billion-dollar long-term contracts with clients including OpenAI, xAI, Meta, NVIDIA, AMD. Management sees this as proof of multi-year visibility for rapid growth. The sheer scale reframed expectations for Oracle’s future cloud revenue trajectory and powered the post-market rally.

Earnings: Non-GAAP EPS $1.47 vs. $1.48 consensus; GAAP EPS $1.01. Free cash flow was negative $362m, weighed down by $8.5bn CapEx in Q1. Adjusted profitability was steady but did not materially beat expectations. Management stressed long-term margins will expand as scale and efficiency improve.

CapEx & Guidance

CapEx: $8.5bn in Q1, with FY26 guidance raised to ~$35bn (from >$25bn previously). Oracle framed this spending as front-loaded datacenter/GPU cluster buildout, with assets immediately generating revenue once deployed—meant to ease concerns over ROI timing.

FY26 guidance highlights:

Total revenue growth: +16% cc (Q2: +12–14% cc, or +14–16% USD).

Total cloud revenue: +32–36% cc (+33–37% USD).

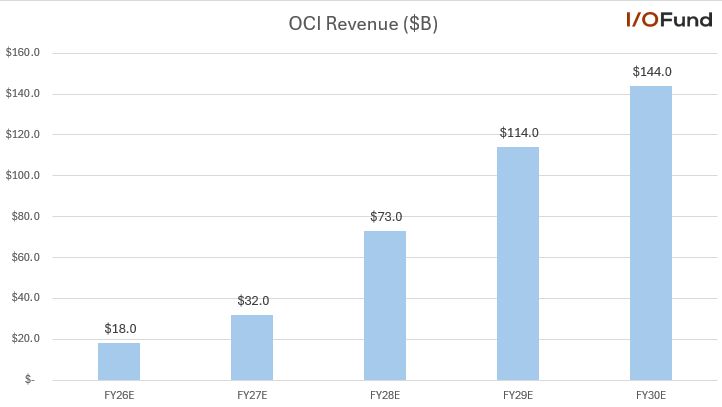

OCI: +77% to $18bn this year; management outlined an aggressive multi-year trajectory—$32bn, $73bn, $114bn, $144bn over the next four years.

This reflects bold confidence in hyperscale client commitments. However, delivery capacity, contract pacing, and pricing stability remain critical uncertainties.

Key Takeaways from Earnings Call

On positioning: “Clearly, we had an amazing start to the year because Oracle has become the go-to place for AI workloads... RPO reached $455 billion...”

On CapEx: “CapEx looks like it's going to be about $35 billion for this fiscal year... we're literally putting it in right when we take possession and then handing it over to generate revenue right away.”

Management sought to reframe record CapEx as operational investment with immediate payback rather than a long-term cash drag.

Investment Themes

OCI + Cloud Database (incl. AI Database): If Oracle continues to secure large-scale GPU clients and integrate enterprise data into vectorized AI-ready databases, both OCI and database services could sustain long-term high-growth momentum. Client roster (OpenAI, Meta, NVIDIA, etc.) enhances revenue visibility.

Legacy software: Still provides stable cash flow, but growth is flat-to-declining. Acts more as a cash cow and customer retention vehicle rather than a growth driver.

Multi-cloud contracts: Some of the RPO surge reflects one-off, project-driven deals tied to AI clients. If customers shift to self-build or other providers, growth could normalize. Contract length, cancelability, and pricing terms bear close scrutiny.

Competitive moat: Oracle highlights integrated hardware+software and network speed advantages, arguing this delivers cost and efficiency benefits. If true, it could create durable moat; if rivals (AWS, Azure, GCP, or custom chip vendors) close the gap, moat could erode.

Strategic positioning: Oracle is clearly building a dual play—AI infrastructure + AI database platform. Short-term this lifts ARPU; long-term success depends on ecosystem integration and third-party compatibility.

Risks & Valuation

Key risks:

Pace of RPO → revenue conversion and impact on gross margin.

CapEx ROI risk: $35bn spend could strain cash flow if deployment lags or unit economics weaken.

Competitive responses: hyperscalers and chipmakers may reclaim share through scale or vertical integration.

Valuation:

After-hours trading reflects strong optimism that Oracle can rapidly convert RPO into high-margin recurring revenue.

At ~37x forward P/E, valuation embeds aggressive growth expectations. For comparison: $Microsoft(MSFT)$ ~32x, $Amazon.com(AMZN)$ / $Alphabet(GOOG)$ lower but with broader cloud dominance. Oracle’s CapEx intensity also makes it structurally closer to hyperscalers than to legacy software vendors, complicating peer comparisons.

Upside remains if RPO conversion proves consistent over the next 2–4 quarters while maintaining margin stability. However, today’s pricing assumes Oracle will meaningfully capture share from AWS/Azure and emerge as a core AI-era infrastructure provider.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Merle Ted·2025-09-10most targets are 350-380 and there is a long list including a 400 target ...with that much backlog and more to come as they stated on the call targets will go even higherLikeReport

- Amal raj madhavan·2025-09-12What is the target AVGO?LikeReport

- Valerie Archibald·2025-09-10There’s still room 400 eodLikeReport

- zaza10·2025-09-10Exciting times for OracleLikeReport