How I Track Volatility in Small-Cap Tech Stocks

$NEBIUS(NBIS)$

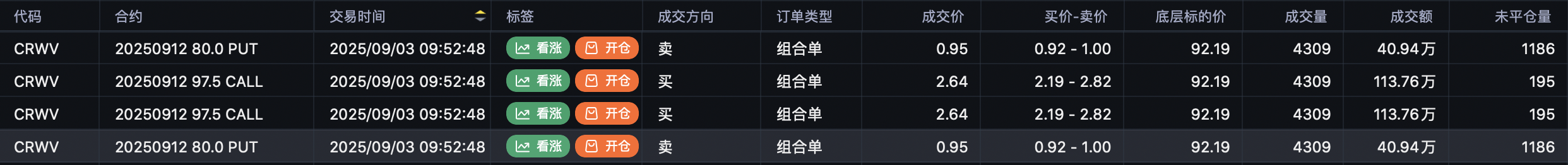

NBIS suddenly jumped 50%, but surprisingly, there was almost zero response from options open interest.

For moves like this, you’d normally expect to see some early OTM call buying, but looking at the call open interest, there was basically no pre-positioning.

That said, even small-cap names like NBIS do get institutional flows on weekly option strategies—it’s just not what most people imagine. For example, last Friday, some institutions put on trades and then closed them right away on Monday.

Unlike the classic bull call spread strategies you see in large-cap tech, for these smaller names, institutions often just open a call leg and a put leg separately. I’m still not totally sure what the logic is behind the direction of each leg.

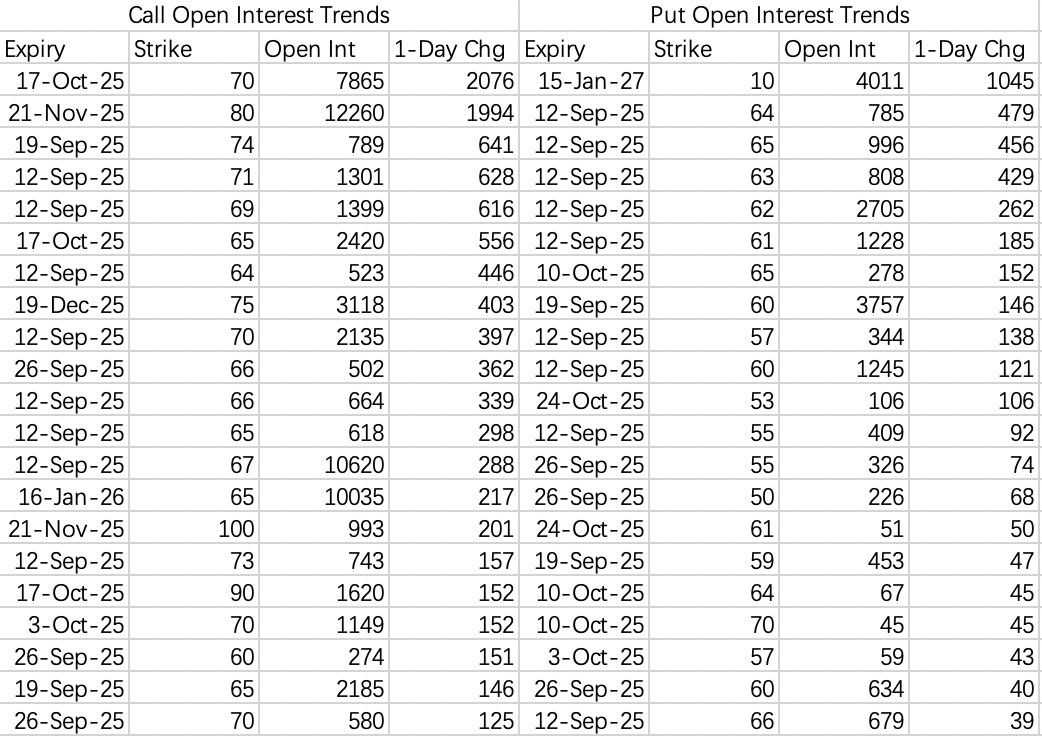

The good news is $CoreWeave, Inc.(CRWV)$ uses a similar approach. For example, this week institutions opened $CRWV 20250912 80.0 PUT$ and $CRWV 20250912 97.5 CALL$ .

Based on the last couple of weeks, the strikes tend to line up with support and resistance, so it looks like CRWV will likely trade in the $80–97.5$ range this week.

So, for NBIS, the $67$ call and $58$ put opened last Friday were probably a similar play—that’s likely why positions were closed out on Monday.

My take: this is probably stockholders managing their position, rather than speculators. Otherwise, if someone knew a big move was coming, why wouldn’t they just buy more stock?

Unless something changes, institutions will likely reopen option trades tonight, which will give us a new implied range for the week—same logic applies to CRWV.

$GameStop(GME)$

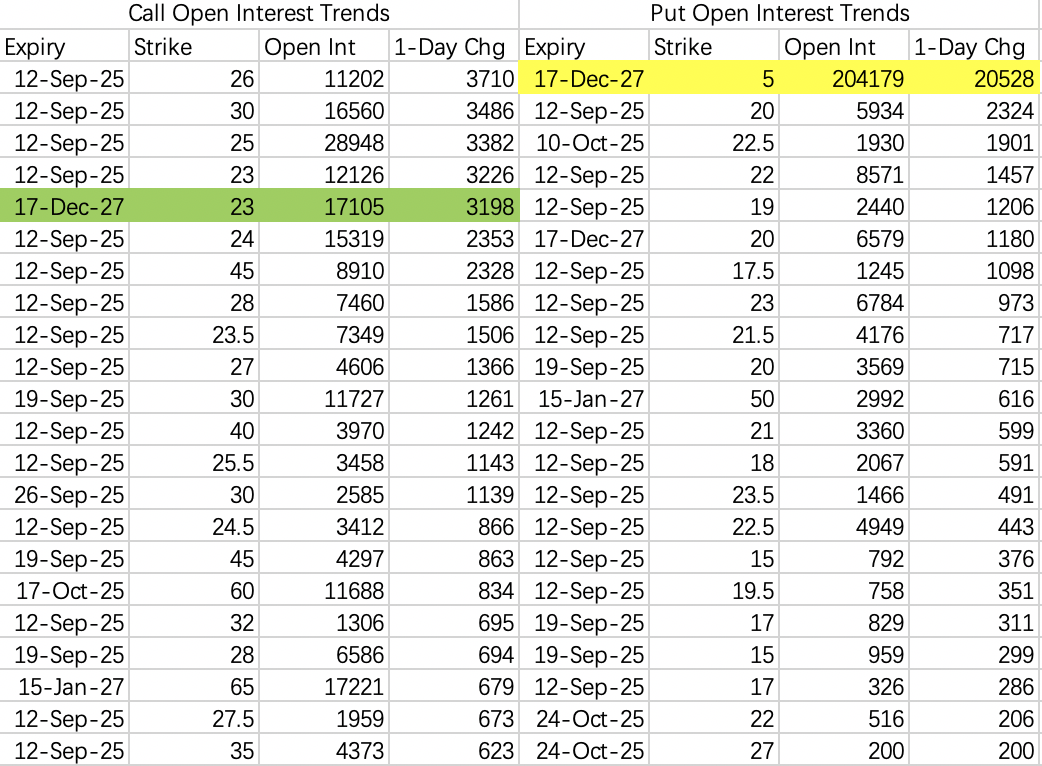

GameStop will report earnings after the close on September 9. Worth noting: this year, both long-dated calls and puts on GME have been unusually active, suggesting traders are positioning for a massive move.

Both sides could be right—after all, these options expire in 2027. With a meme stock like GME, you’re pretty much guaranteed both explosive rallies and crashes over a multi-year window. If volatility gets low enough, almost any long option trade makes sense, but capital efficiency is low. With these types of “meme” names, it usually pays to short volatility after the big move.

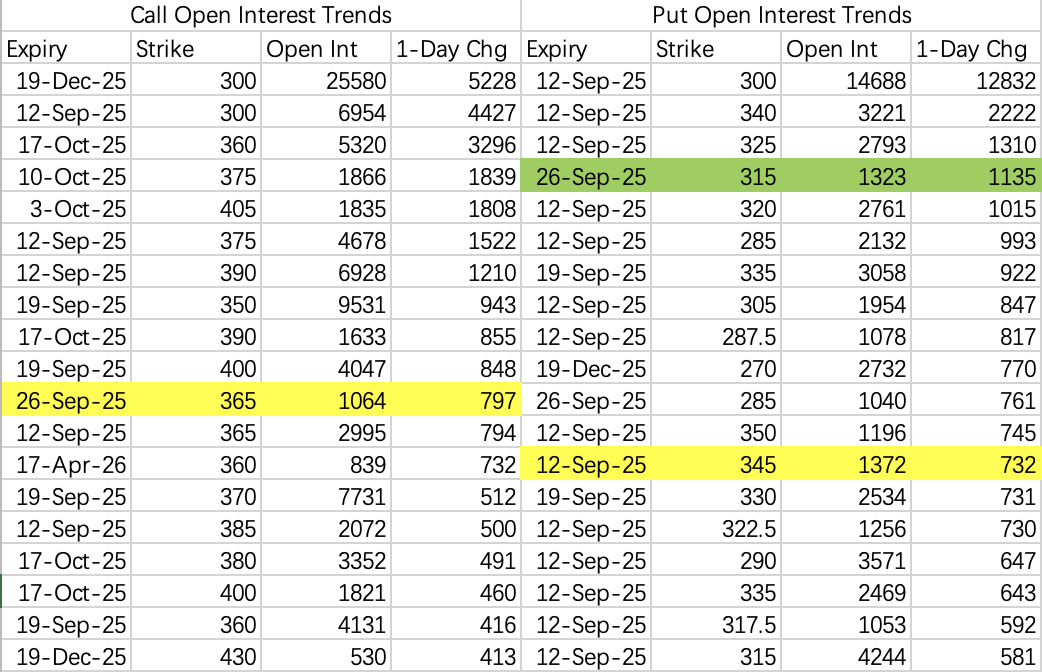

$Broadcom(AVGO)$

Steadily bullish up to $400$, but expect some consolidation in the near term. For sell put strategies, look for strikes below $325$.

$NVIDIA(NVDA)$

AVGO’s earnings narrative put some downside pressure on NVDA, with analysts saying enterprises may shift more toward TPUs, eating into GPU demand. The current chop can be seen as a bit of a shakeout.

Lately, some $200$ strike long calls have been trimmed, and there’s also been some new positions opened in long-dated sell calls.

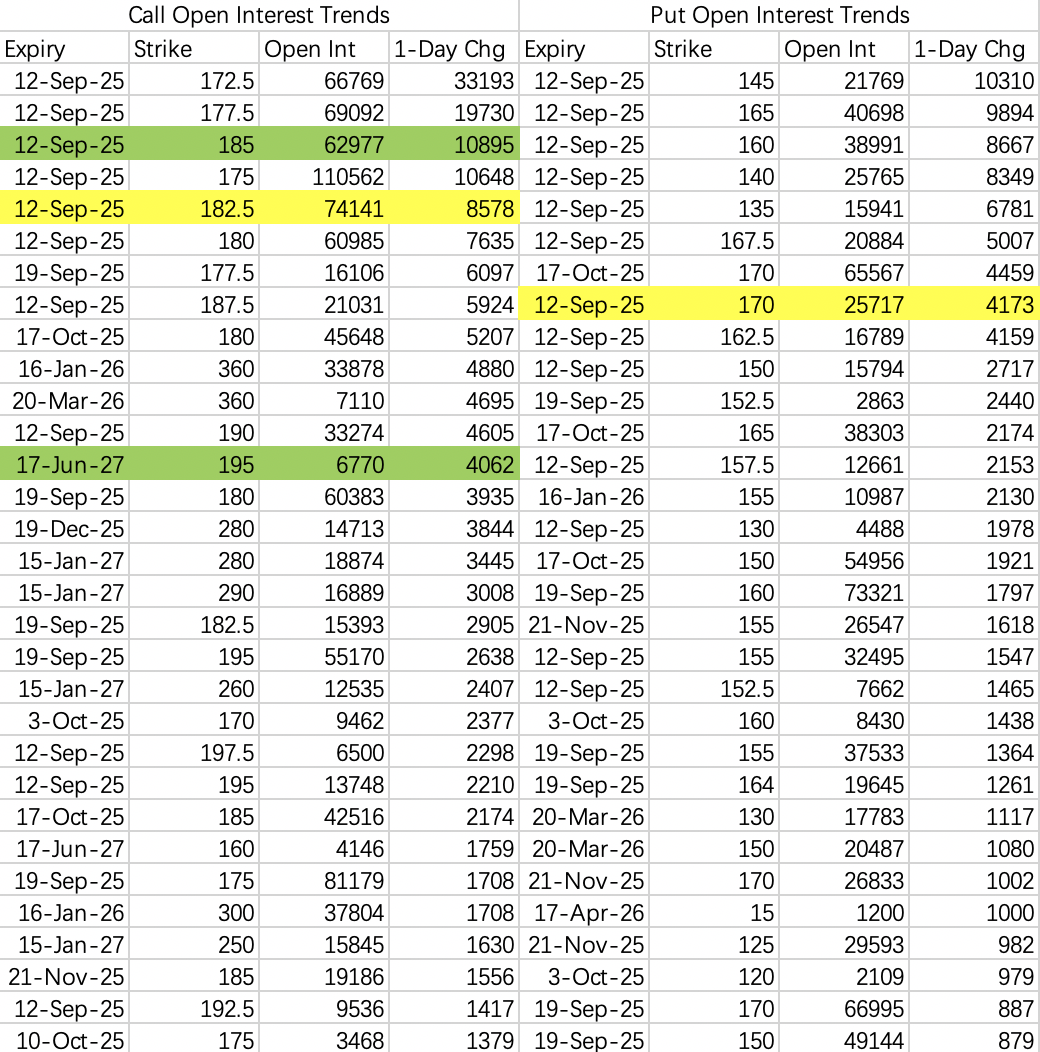

Open interest is concentrated this week: calls in the $170–180$ range, puts in the $160–170$ range.

Expect NVDA to trade $160–175$ this week; a dip to $160$ isn’t off the table. There are also some aggressive crash-risk put positions, but unless you’re max leveraged, the risk seems contained.

Ironically, AMD is getting hit hardest by NVDA’s “narrative downgrade.” AMD looks set to pull back to $140$—if you’re selling puts, stick to strikes below $140$, or wait for the stock to get close to $140$ before bottom-fishing.

$Oracle(ORCL)$

Oracle reports after the close on September 9. With the OpenAI contract in hand, the numbers should be decent. Analysts see it the same way as AVGO: the current price already reflects growth expectations.

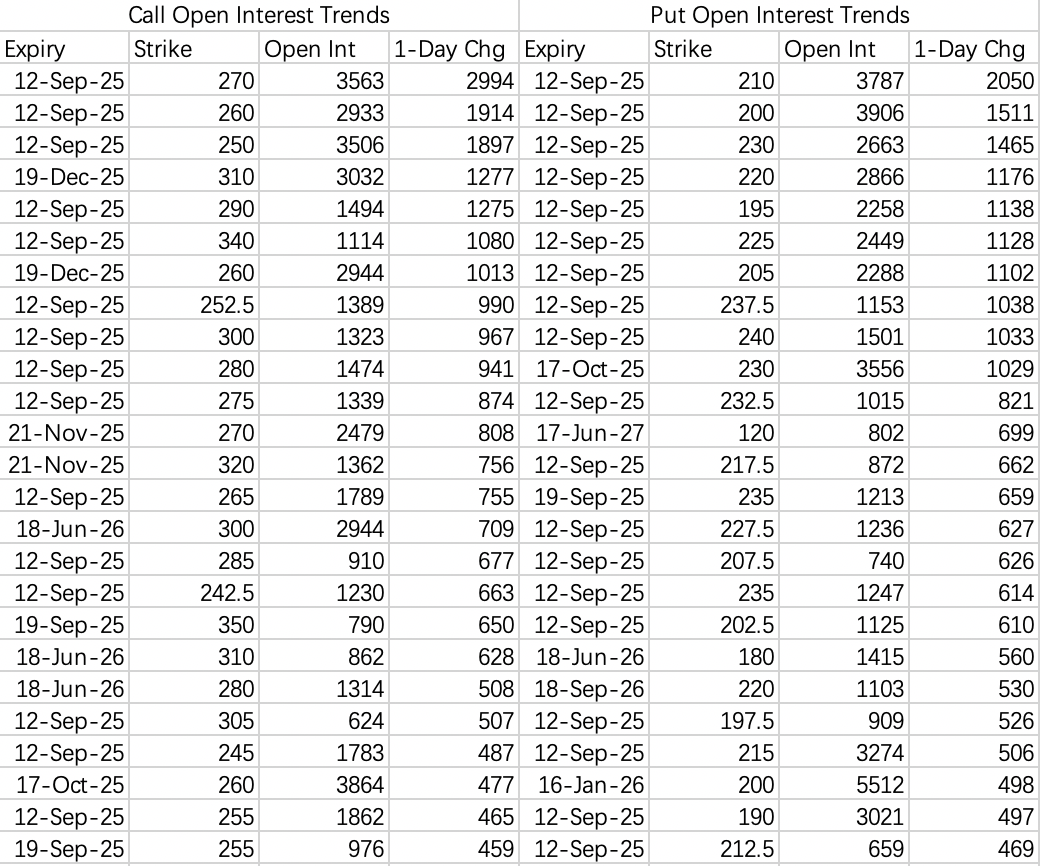

Expected trading range: $215–260$, which lines up with where the options are opening. If you want to short volatility, don’t just naked sell calls—if you do, make sure it’s a call spread. There’s plenty of bullish call activity, similar to AVGO, and some strikes are pricing in a more optimistic earnings outlook.

$Robinhood(HOOD)$

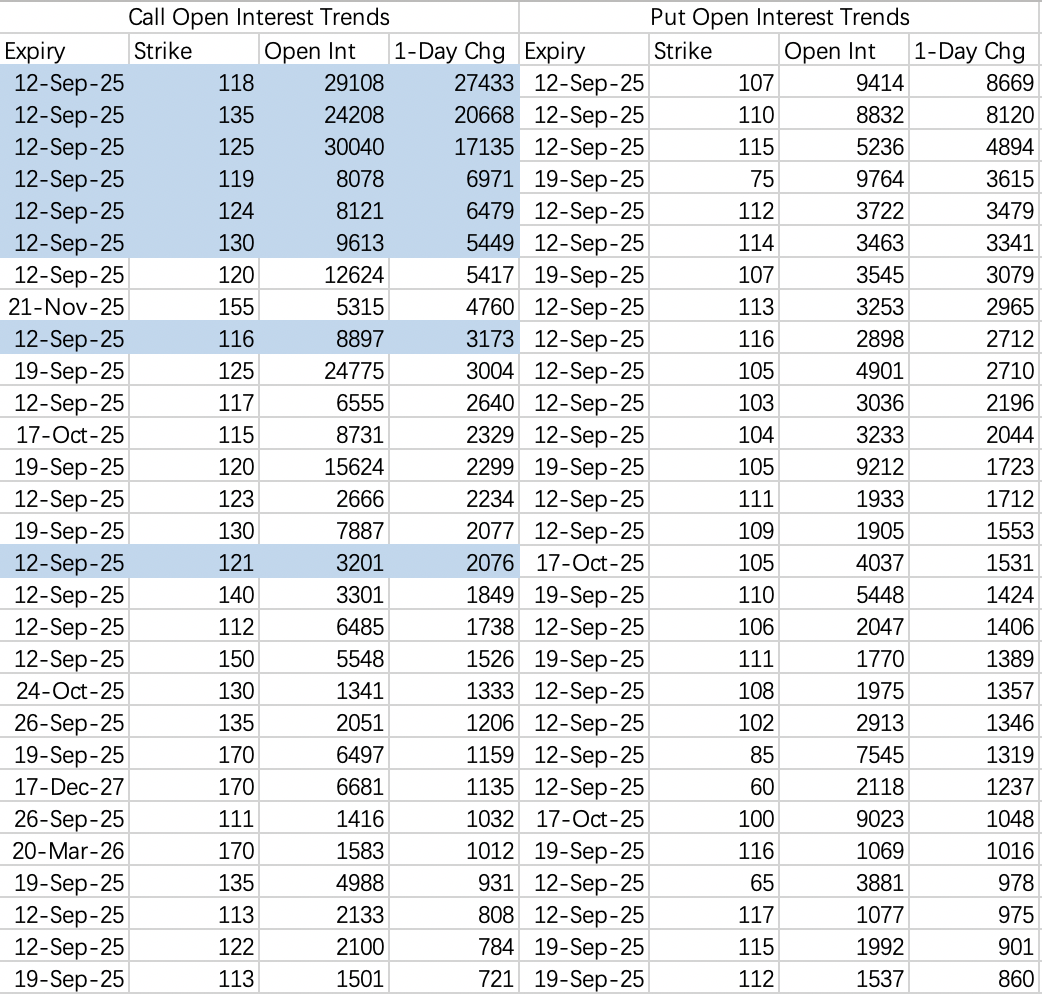

High open on Monday, institutions cut losses and rolled into a bunch of weekly bull call spreads. Currently, the focus is on selling $116–119$ calls and hedging with $124–130$ calls. Right now, it’s a good setup to sell calls.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.