The Second Pillar of AI

$Broadcom(AVGO)$

Broadcom surprised the market with its latest earnings.

Q3 and Q4 numbers were in line with expectations, but what really stood out was the outlook: future growth is exceptionally strong, with total order backlog now at $110 billion.

In addition to the big three customers (GOOGL, META, TikTok), Broadcom also announced a fourth major customer—market speculation points to OpenAI.

The post-earnings rally was driven by the emergence of this fourth customer, which exceeded analyst expectations. While this client won’t impact Q3/Q4 numbers, it’s clear they’ll significantly boost FY2026 and FY2027 results.

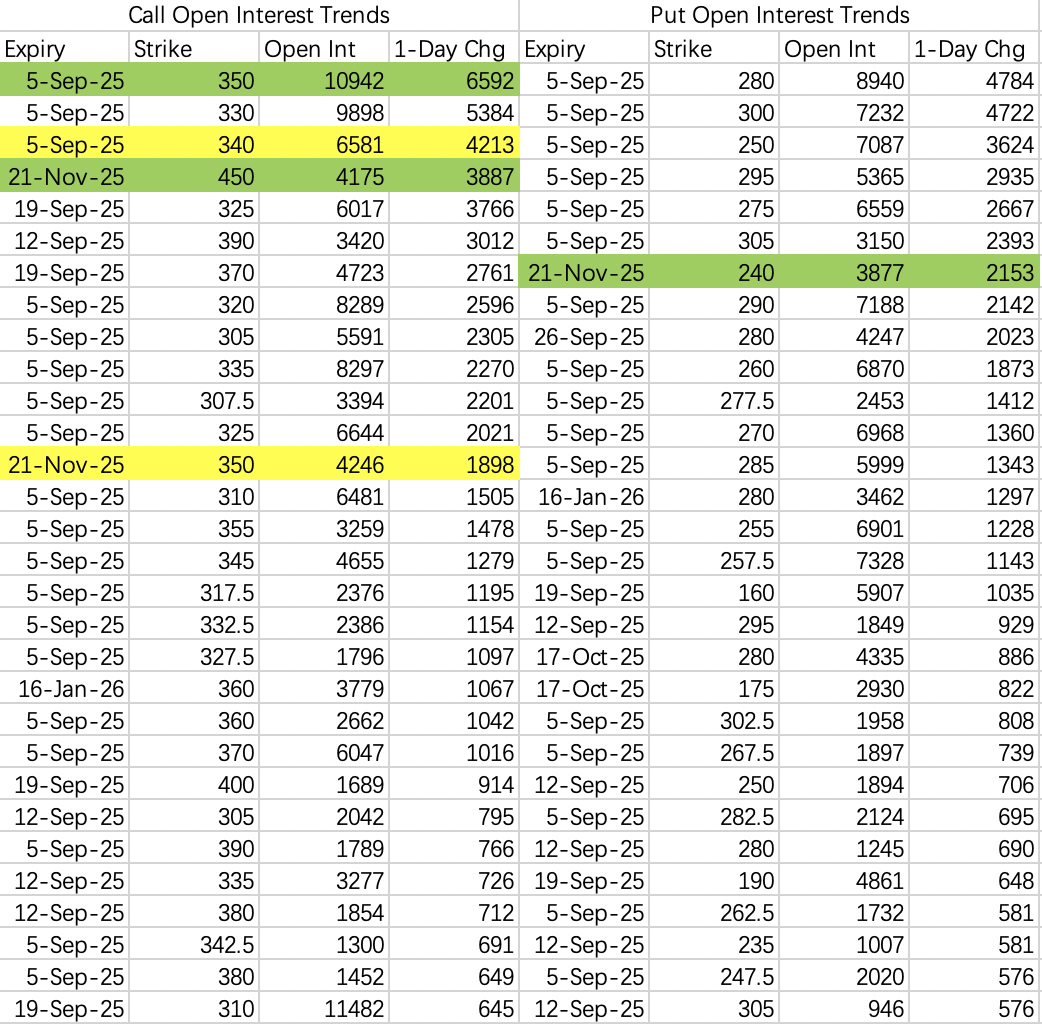

Pre-earnings, bulls expected a $340–350 range this week, with a medium-term target above $350. With the stock now trading higher in the pre-market, it’s not the best time to chase—wait for things to settle before looking to sell puts.

After this report, $AVGO$ is starting to look like it could stand shoulder to shoulder with $NVDA$. Hopefully, its options volume will catch up too: $NVDA$ averages 2.8 million contracts traded daily, but $AVGO$ is still below 200k—so there’s still a liquidity gap.

$NVIDIA(NVDA)$

Why did $NVDA$ sell off after $AVGO$’s earnings? Analysts and the market expect that, going forward, hyperscalers will use more Broadcom custom chips (ASICs) rather than GPUs—both are compute chips, but ASICs are more specialized for certain workloads.

It’s a bit ironic—this is a blue ocean market, and there’s really no need to pick a “winner,” but the market still wants to crown a #1 and #2. With the pullback, it’s a good chance to sell puts on $NVDA$.

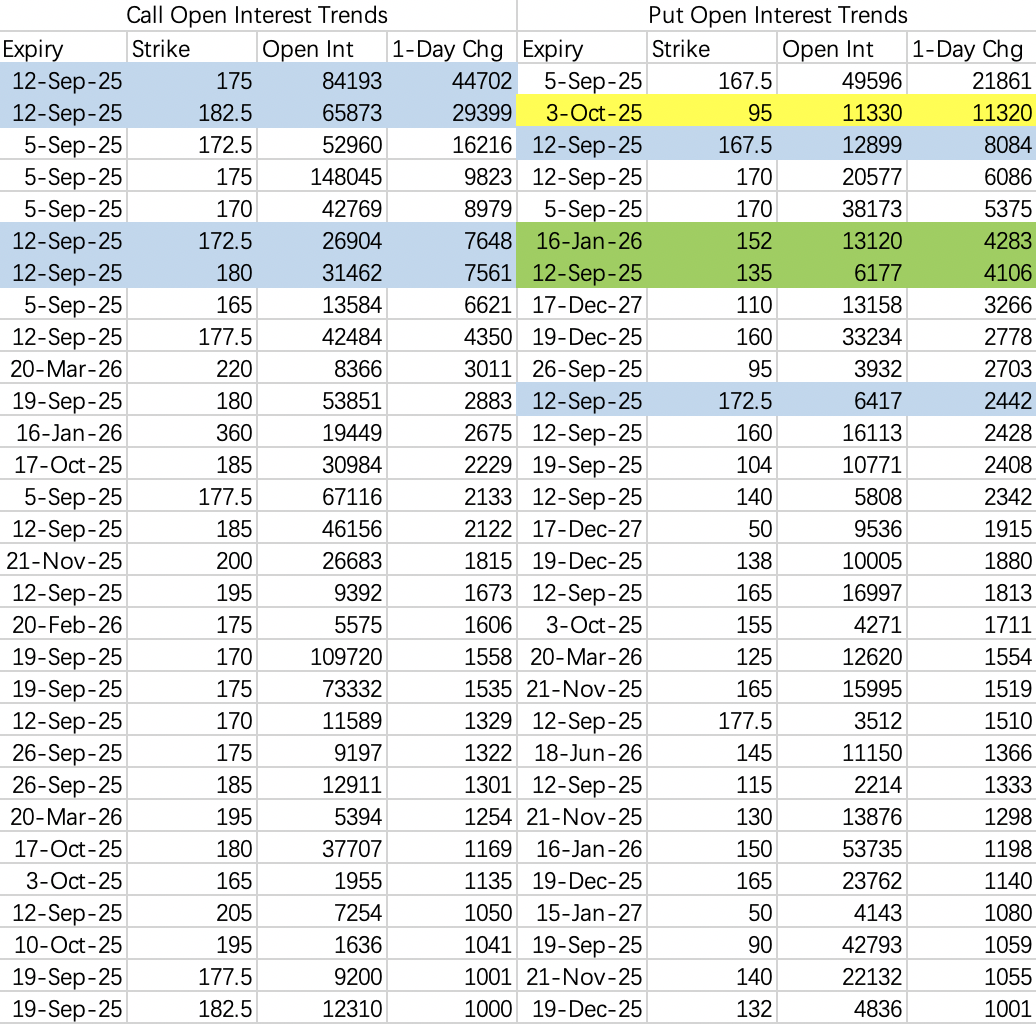

Expected range for next week: $167.5–175$. Institutions are selling calls at $175$ and $172.5$, and hedging with long calls at $180$ and $182.5$.

Important: the probability of a flash crash is higher next week—do not use leverage to go long.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.