$Broadcom(AVGO)$

AVGO’s earnings are a major catalyst for the AI chip sector, but with the data largely in line with expectations, both the AI chip names and $AVGO$ are likely to maintain their pre-earnings trend.

The results will definitely be solid—AI business growth for FY2025 should top 60%, and based on current data, the street is likely underestimating 2026 numbers.

But just like NVIDIA, all this growth is already priced in, so the stock’s post-earnings action will probably mirror what we saw with $NVDA$.

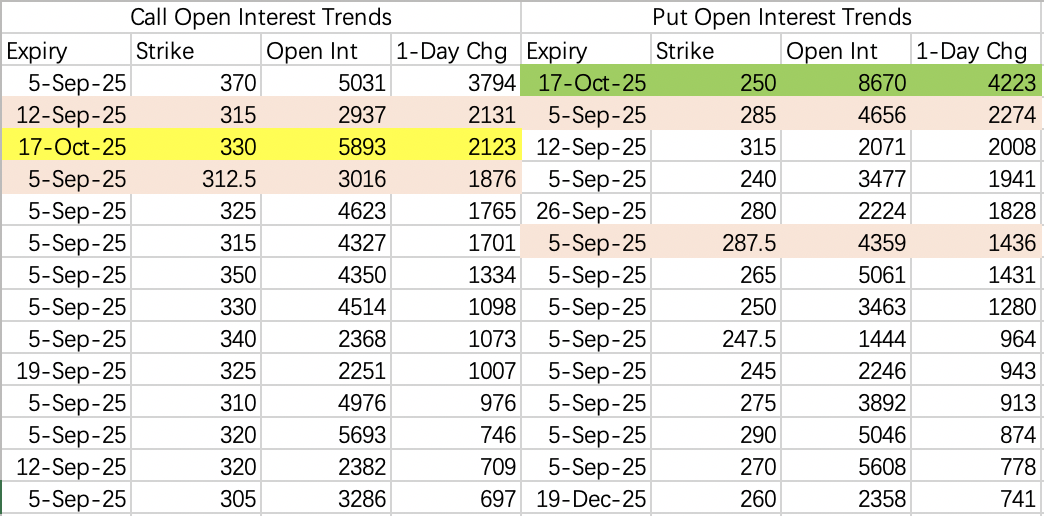

Expect $AVGO$ to trade in a narrow range of $287.5–312.5$ after the report, but there are some medium-term put buyers targeting the $250 “bottom-fishing” level.

From a long-term perspective, if there’s a sharp selloff this month, $AVGO$ is definitely worth bottom-fishing. For put-selling, look at strikes below $280$—for example, $AVGO 20250905 280.0 PUT$ .

$NVIDIA(NVDA)$

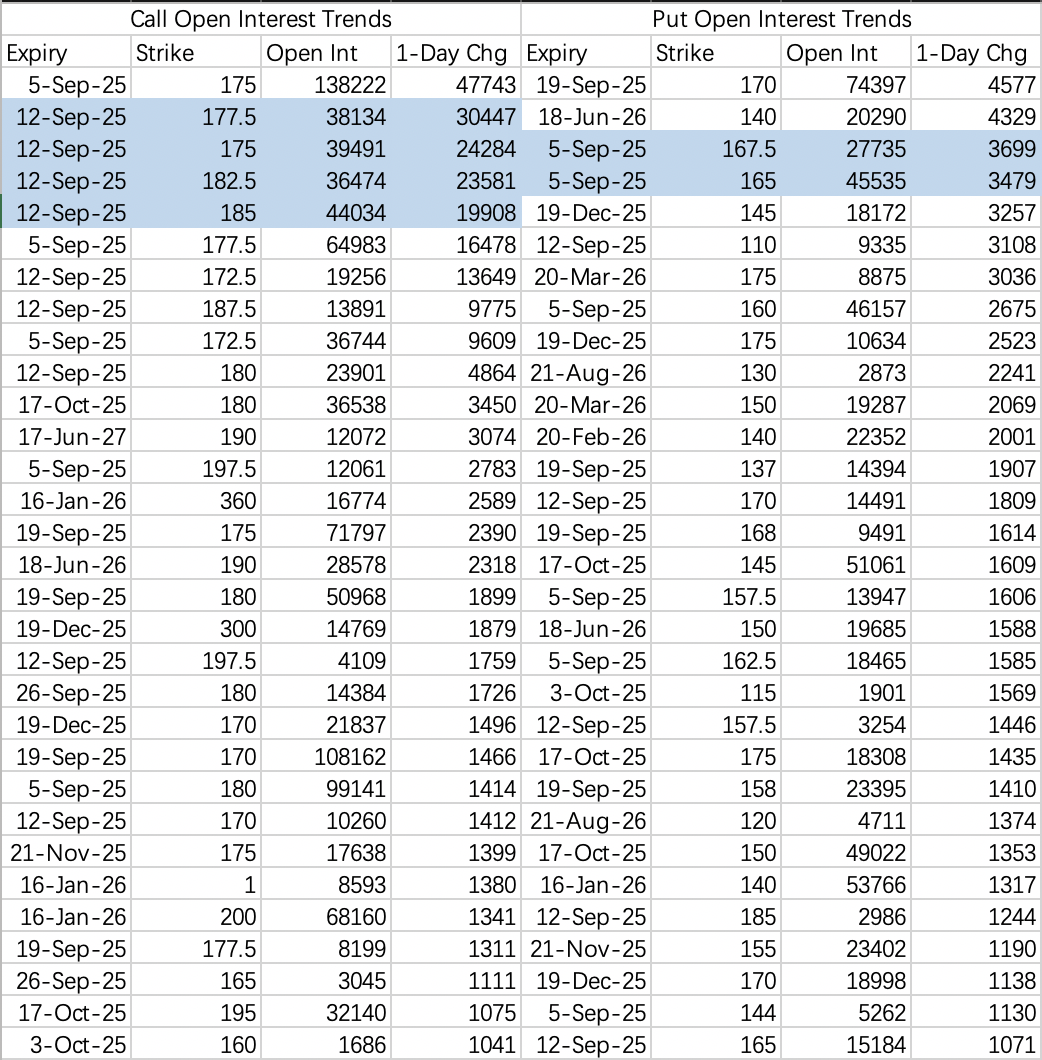

Closed this week in the $165–175$ range, most likely to settle around $170$. If nothing unexpected happens, triple witching on September 19 should also see a close near $170$.

If there’s a surprise and the stock tests $140$, consider a covered call plus protective put strategy if you’re long the shares.

Right now, there haven’t been any major at-the-money put buys—most hedges are focused on the $140$ level. No big reason to load up on puts while $NVDA$ is just chopping around $170$.

But if $NVDA$ actually drops to $140$, most other stocks would probably be down 50% or more.

$Tesla Motors(TSLA)$

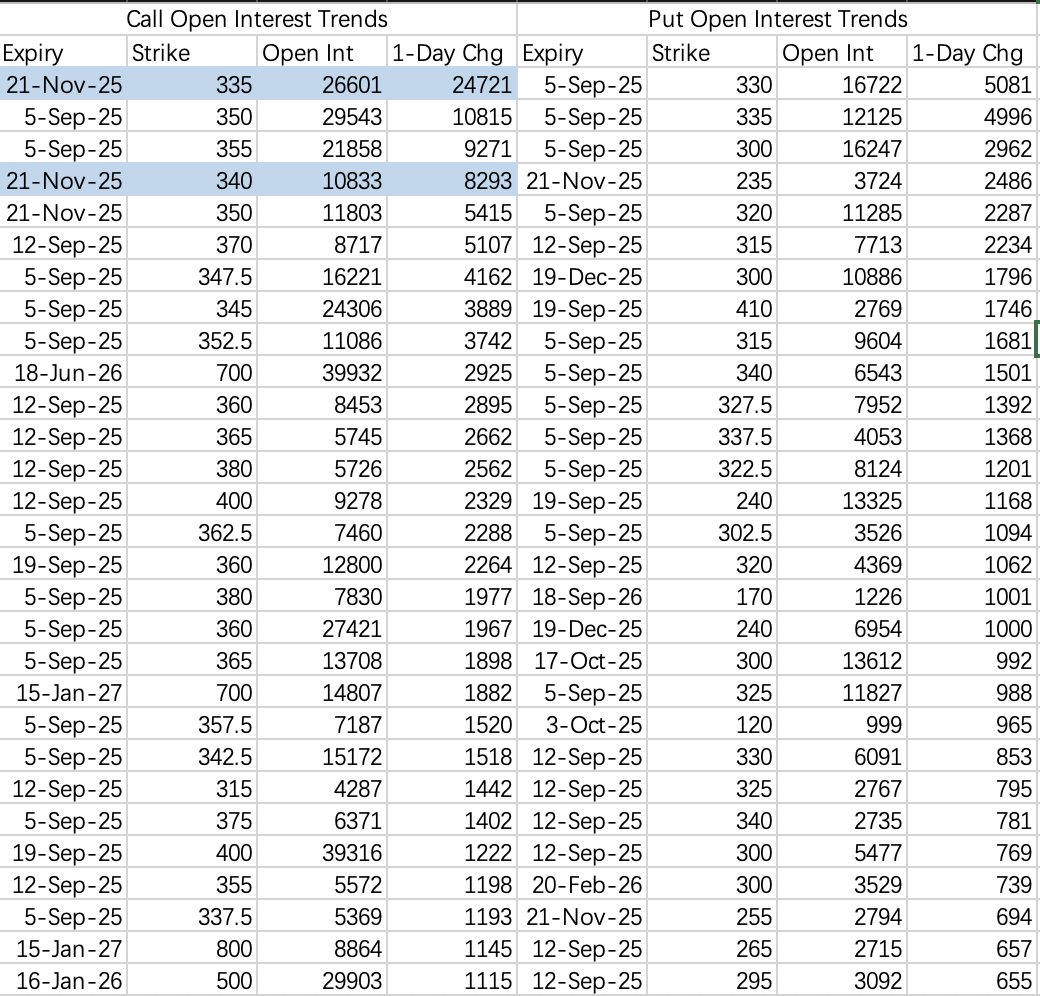

Continues to trade in a tight range this week, closing between $330–340$.

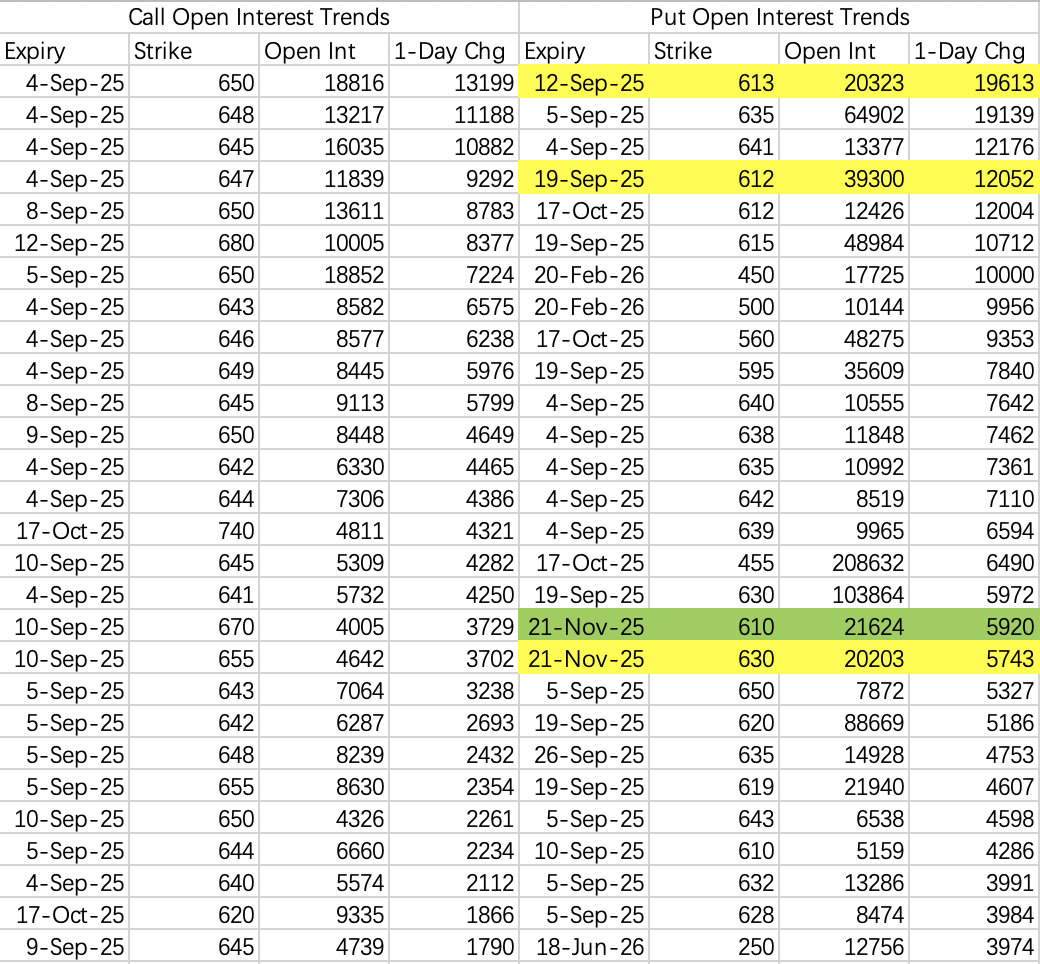

$SPDR S&P 500 ETF Trust(SPY)$

Non-farm payrolls are out tomorrow. Honestly, after the downward revisions in May and June, any prediction feels like a bit of a joke. Judging by Powell’s last comments, there should be a rate cut this month.

But starting next week, the risk of $SPY$ falling below $620$ rises. Watch for potential sharp drops in the weeks of September 12 and September 19.

$Alphabet(GOOGL)$ / $Alphabet(GOOG)$

There were two notable long call roll trades on Wednesday.

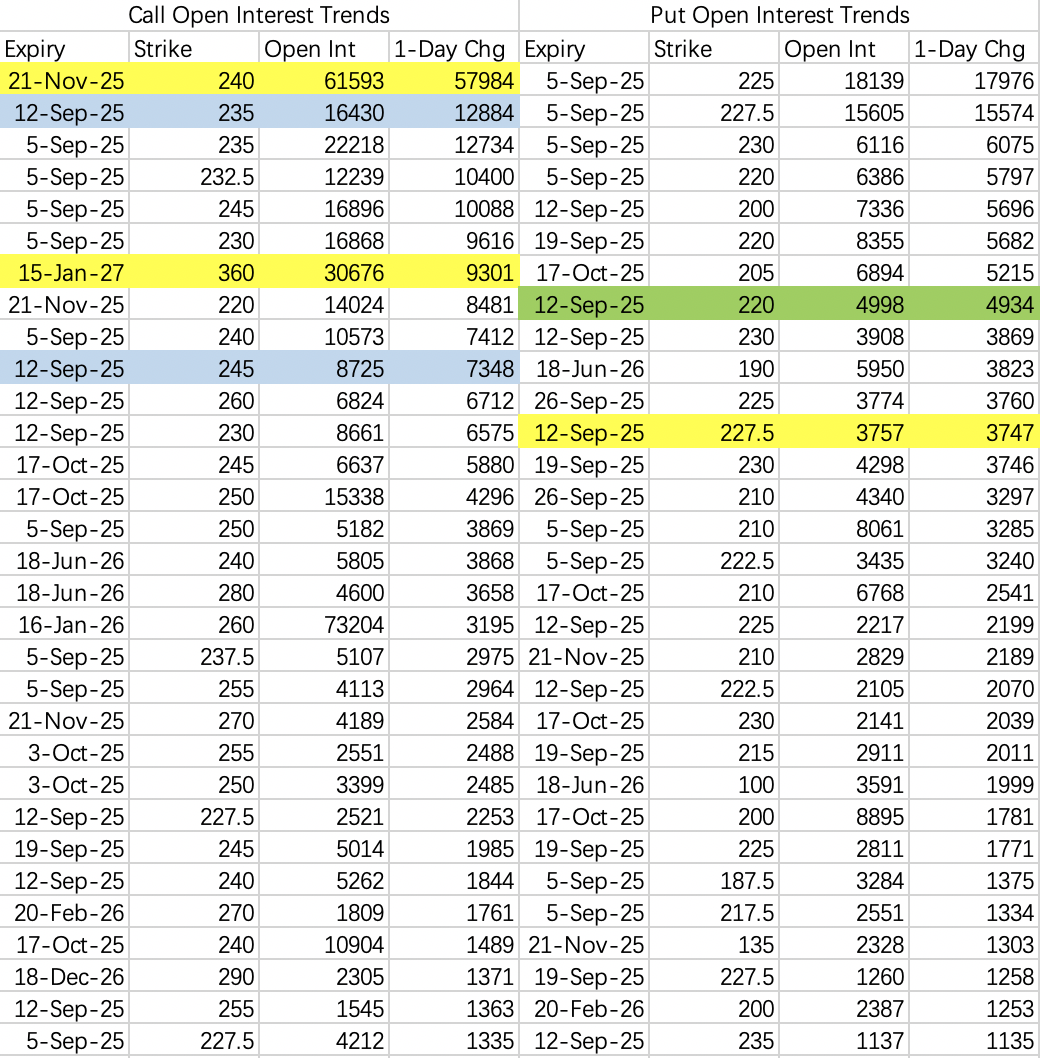

The first was a short-term roll: rolling September $210$ calls into November $240$ calls ($GOOGL 20251121 240.0 CALL$ ), with 57,000 contracts opened. Institutions are clearly bullish, and the choice of deep OTM strikes is rare.

The second was a long-term bullish roll: rolling January 2026 $240$ calls into January 2027 $360$ calls ($GOOGL 20270115 360.0 CALL$ ), with 12,800 contracts opened. Looks like there’s big upside expected for Google next year.

Near-term, watch for a pullback toward $220$—selling options in the $220–235$ strike range could be a good double short play.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.