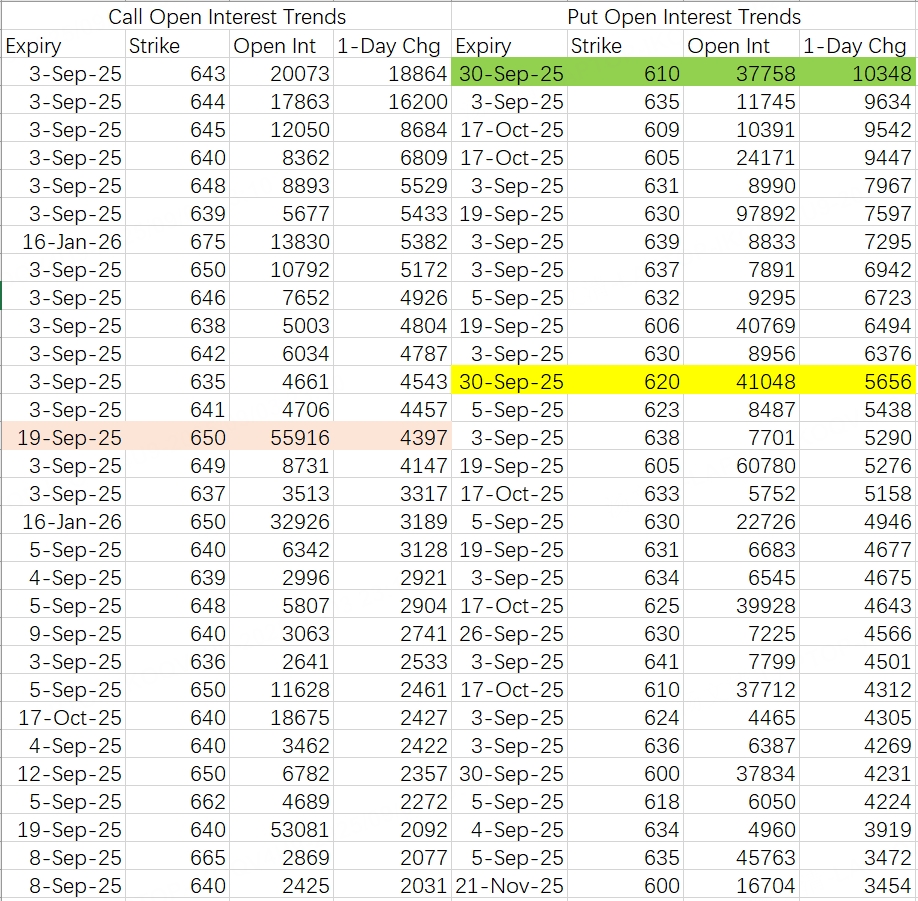

The seasonal downward trend in September cannot be ignored, but for this week, the downside risk appears relatively low. SPY is expected to fluctuate within the range of 635–650.

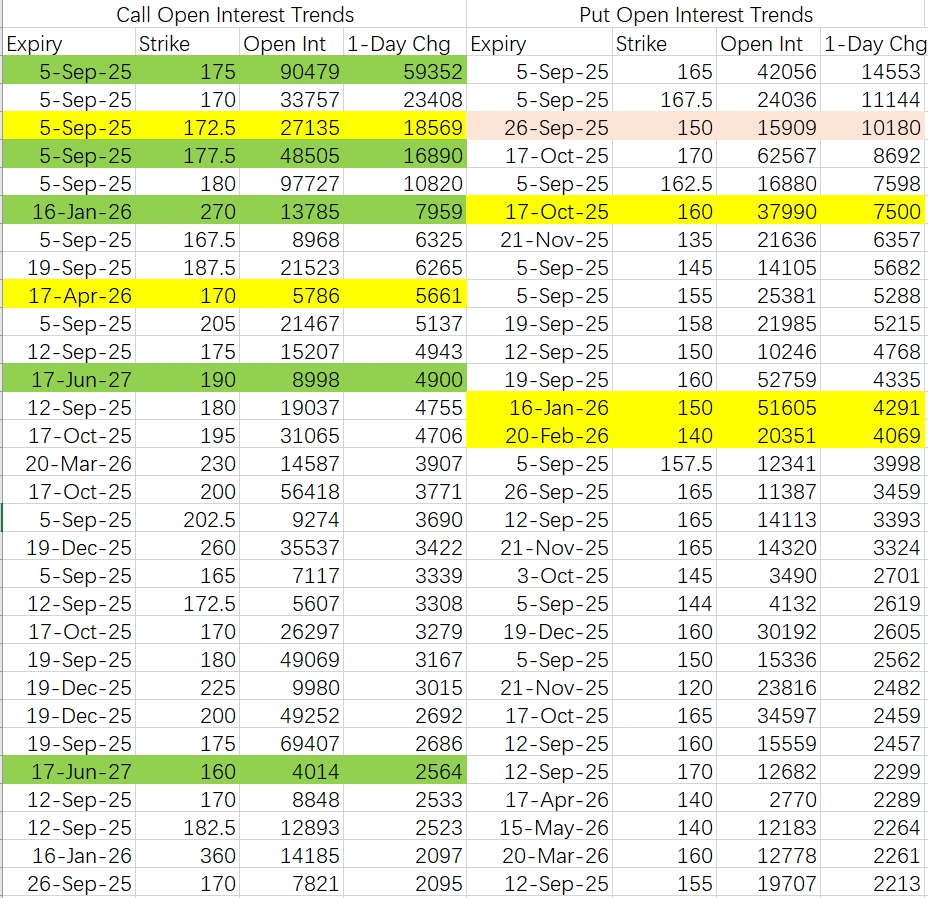

The bearish option activity for Nvidia is somewhat perplexing, with three distinct groups of traders expressing different views on downside targets:

Those targeting the 160–170 range.

Those targeting the 150–160 range.

Those targeting the 140–150 range.

This implies potential price floors at 160, 150, or 140, depending on the group.

All three ranges have their justifications, but those targeting the 140 range seem to be focusing on mid- to long-term expirations, while those targeting 150 are likely planning to open positions next week. For this week, Nvidia is expected to remain in the 165–180 range.

A trading note to keep in mind:

For range-bound movements, consider sell-call and sell-put strategies without limiting yourself to weekly expirations. For example:

Sell calls at the upper range, and if the stock price pulls back to the lower range, consider closing the position early.

Similarly, sell puts at the lower range, and if the stock rebounds to the upper range, close the position early.

Additionally, avoid selling calls at low levels and selling puts at high levels.

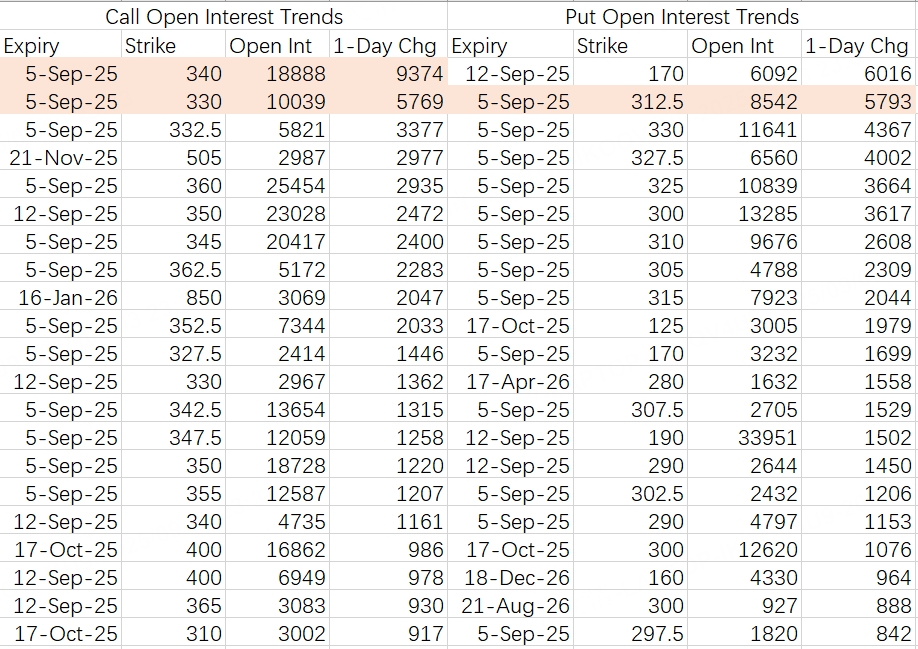

Tesla is expected to continue fluctuating within the 300–350 range this week.

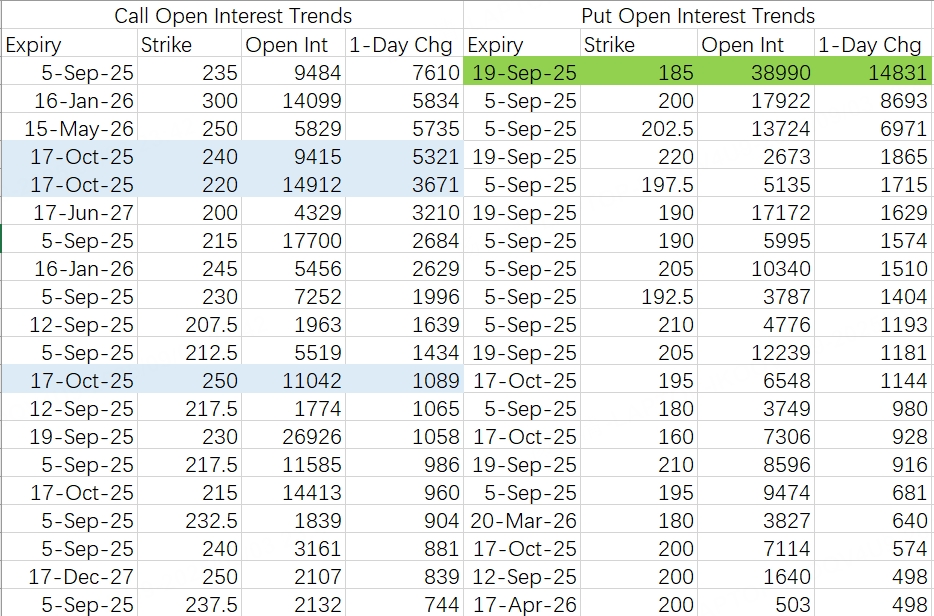

Initially, it seemed Google would rise slowly, offering consistent opportunities to profit from sell-put strategies each week. However, a major positive development has propelled the stock price higher unexpectedly. The news that Google will not need to sell Chrome is indeed a significant bullish factor.

A notable butterfly spread trade has targeted a 240–250 range as the profit zone, with maximum gains achieved when prices reach 240:

Sell: $GOOGL 20251017 240.0 CALL$ (2x contracts)

Following this jump, the upside potential is limited. However, sell-put strategies remain viable, with strike prices below 210 being a reasonable choice.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.