A Thunderous Start.

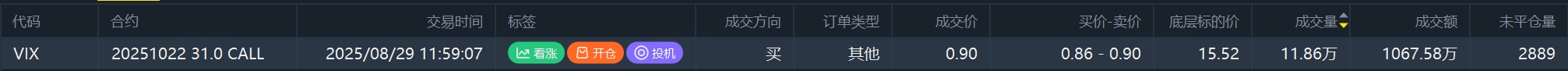

On Friday, someone purchased 1.1186 million contracts of the $VIX 20251022 31.0 CALL$ with a total transaction volume of $10.6758 million. Both the volume and value of this trade warrant significant attention. The expiration date covers all of September and October, traditionally two of the weaker months for the U.S. stock market.

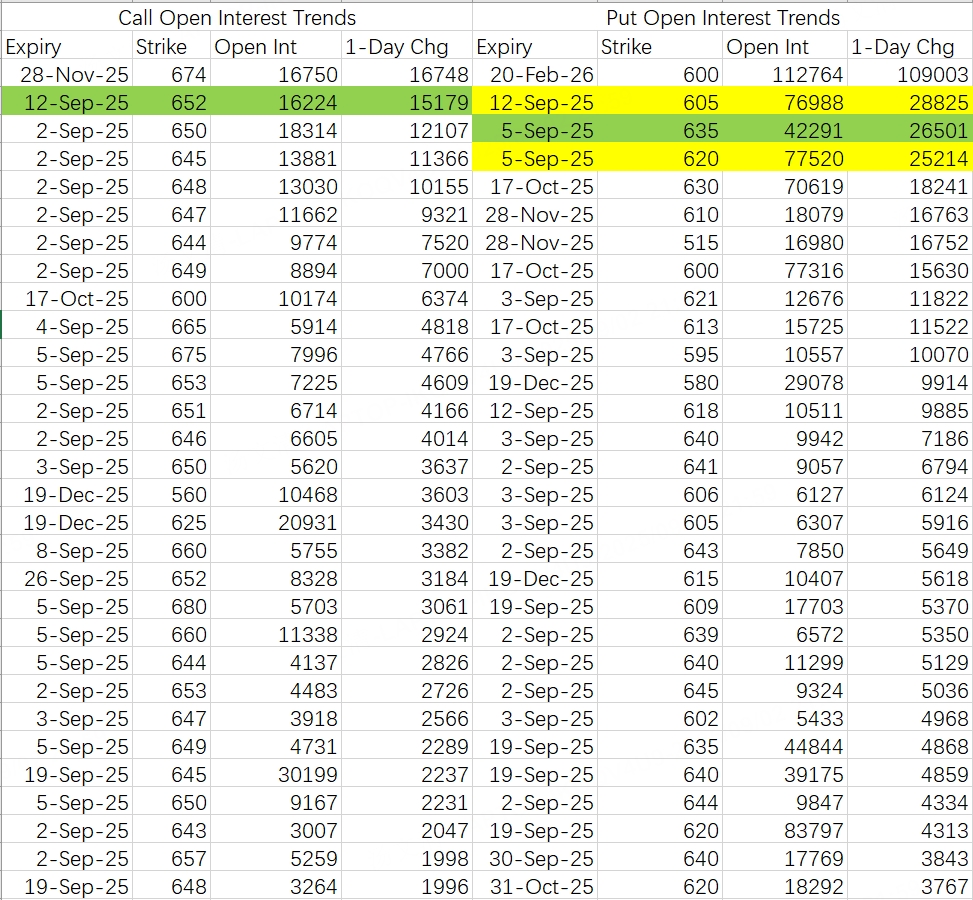

Based on SPY option activity, there appears to be support at 635 this week, but next week remains uncertain. After Broadcom's (AVGO) earnings report, tech stocks lack a new catalyst, making a market pullback before the FOMC meeting seem reasonable. However, this hypothesis still needs confirmation—Friday's developments will provide more clarity.

The most significant earnings report this week comes from Broadcom, but the results are expected to be similar to Nvidia’s—highly transparent, with little room for a surprise in stock price performance.

The market generally believes that approximately 60% of Broadcom's AI revenue growth for fiscal year 2026 is already priced in.

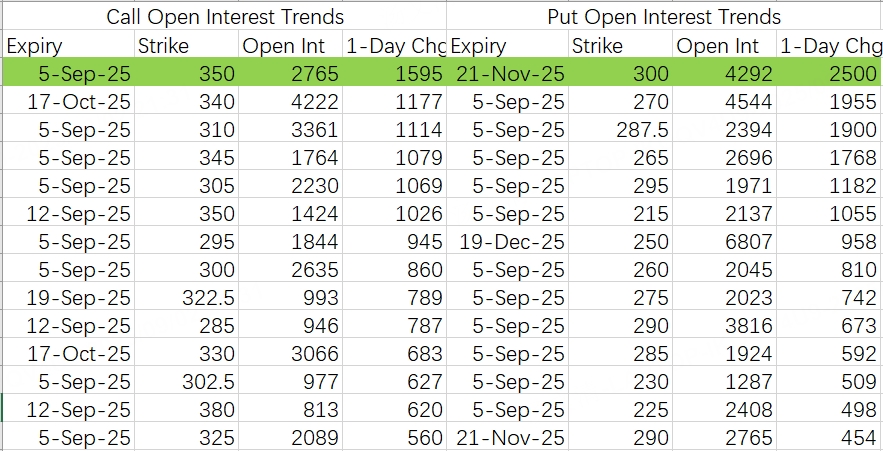

From option activity, there was a large sale of the $AVGO 20251121 300.0 PUT$ with a November expiration. This suggests a projected price range of $270–$320 for this week, making it suitable for short straddle or strangle strategies within this range.

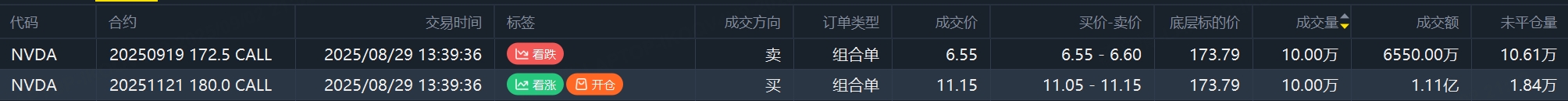

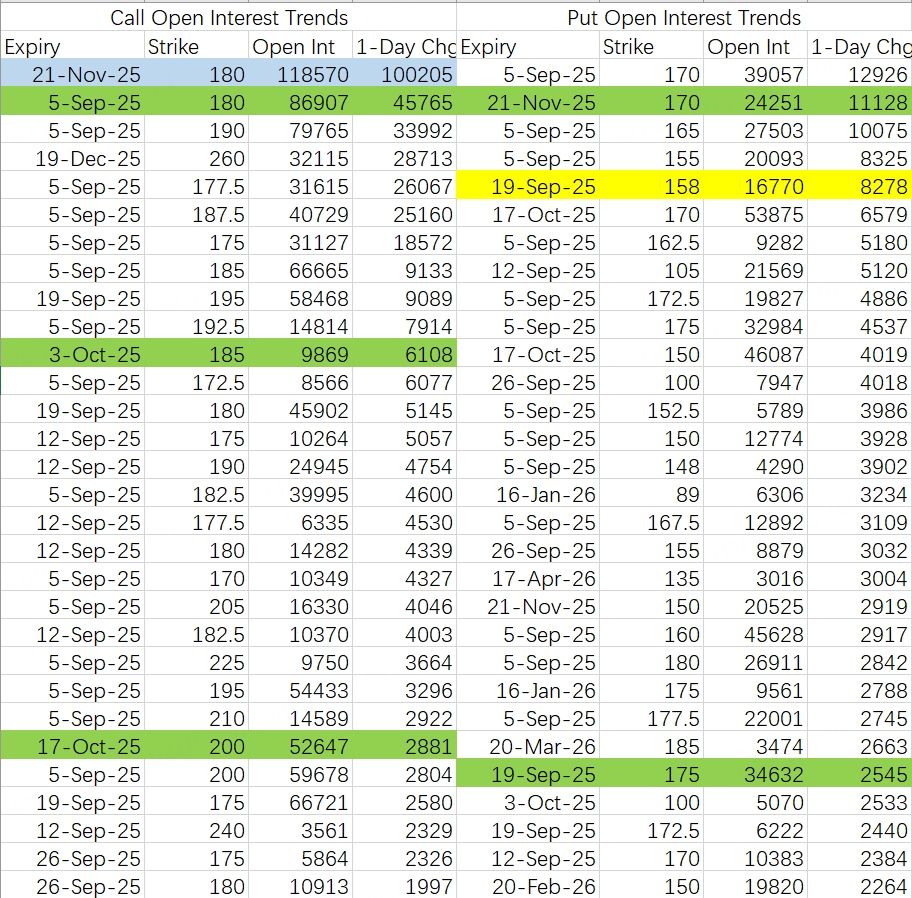

After Nvidia’s earnings report, the "200M Whale" rolled their position from the $172.5 call to the $NVDA 20251121 180.0 CALL$ , with a transaction volume of 100,000 contracts and a total value of $111 million. This implies a November price target of $190, which seems reasonable.

Similar to Broadcom, Nvidia also saw a large sale of November-expiring puts at $NVDA 20251121 170.0 PUT$ . This suggests that regardless of market volatility in September and October, the market expects a rebound by November.

This week, institutions hedged by selling the $180 call while buying the $190 call. The projected price range is $165–$180. For sell-put strategies, consider strike prices below $165 or wait for the stock to drop to $165 before selling puts.

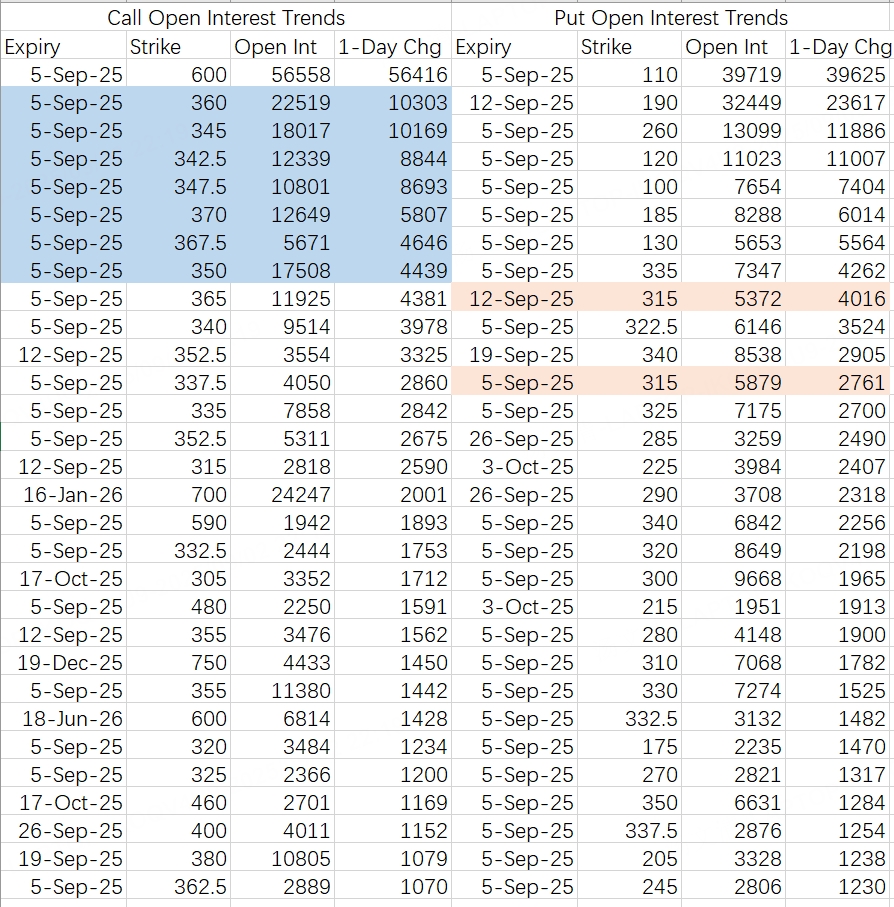

Tesla’s setup is similar to last week. Institutions have placed numerous sell-call positions, with the upper range capped at $342.5–$347.5 and hedging above $360. Sell-put strategies can target strike prices below $315.

One word: strong.

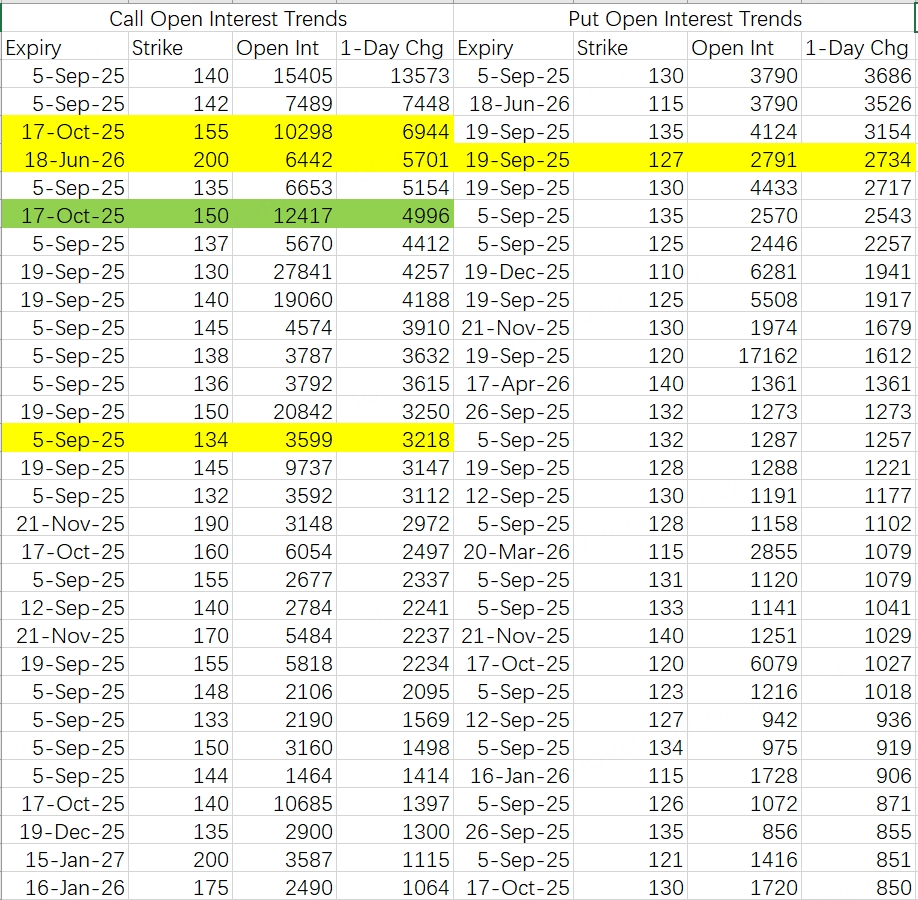

This week, it is unlikely for the stock to fall below $130, with resistance at $140.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.