Range-Bound, Collecting Premiums in Peace

$NVIDIA(NVDA)$

With earnings out, the biggest uncertainty is resolved. AI growth remains strong, and there’s no clear reason for a major pullback—so the stock continues to grind higher in a range.

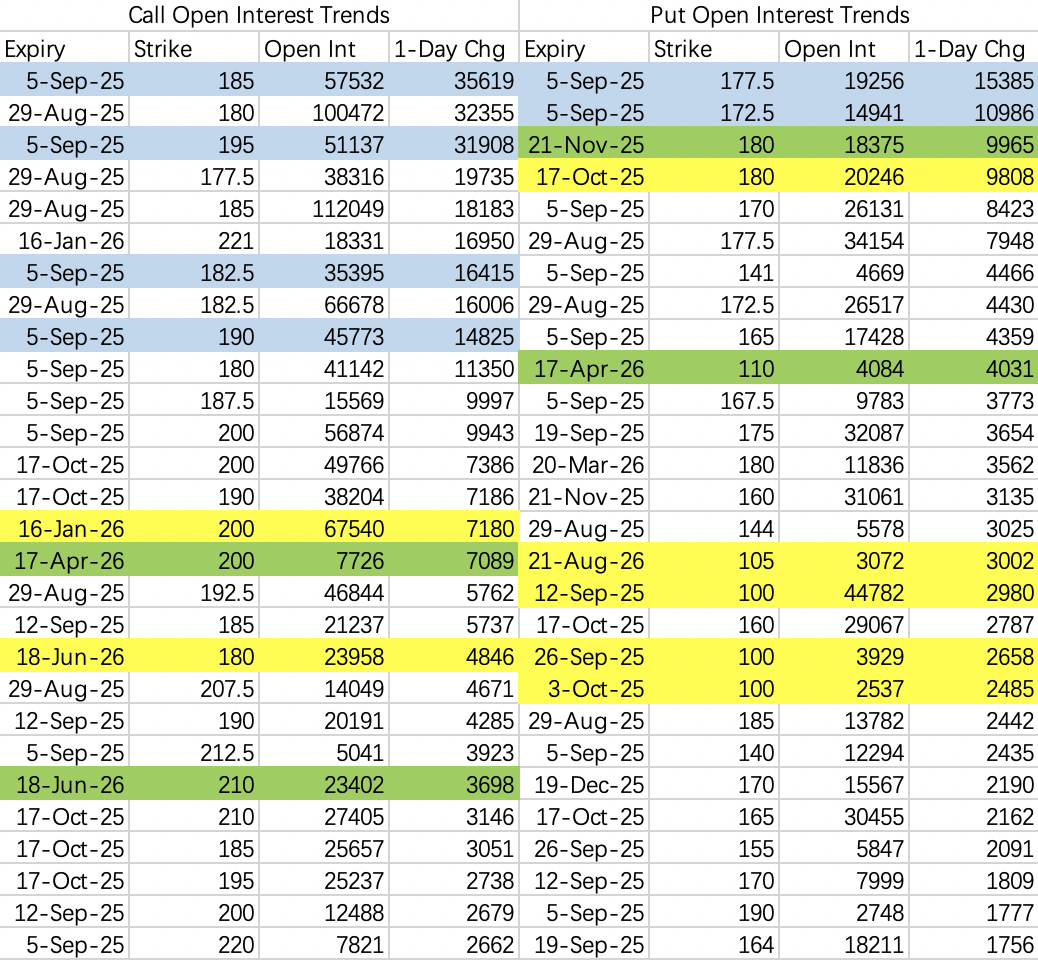

Based on NVDA’s options open interest, the expected range for next week (through Sep 5) is mostly $170–190, with a core band of $175–185.

Key Call Option Strikes:

$180.0: OI 41,142 (highest), IV 30.16%

$185.0: OI 57,532 (next highest), IV 29.23%

$190.0: OI 45,773, IV 30.06%

$175.0: OI 12,555, IV 31.53%

Key Put Option Strikes:

$180.0: OI 24,069 (highest), IV 29.83%

$175.0: OI 28,447 (next highest), IV 31.31%

$170.0: OI 26,131, IV 34.41%

$165.0: OI 17,428, IV 39.14%

Call-side resistance is still dominated by institutional call spread strategies. After earnings, institutions keep rolling spreads in the $185–195 zone—selling the $185 call ($NVDA 20250905 185.0 CALL$ ) and buying the $195 call ($NVDA 20250905 195.0 CALL$ ), implying the stock is unlikely to break above $185.

Further out, there’s some ambiguity about a year-end move above $200, and some $200 sell calls expiring next year are likely covered calls.

On the put side, institutions are also active, providing support for next week by buying $NVDA 20250905 177.5 PUT$ and selling $NVDA 20250905 172.5 PUT$ , suggesting price could dip below $177.5$ but not much further than $172.5$.

Worth noting: despite solid earnings, there are still some extreme bets on $100 strike puts—macro policy could be the biggest risk in September.

Trading strategy for next week is much the same as this week:

Sell puts if price dips to $175–177$, and sell calls if price rallies above $180$.

$Tesla Motors(TSLA)$

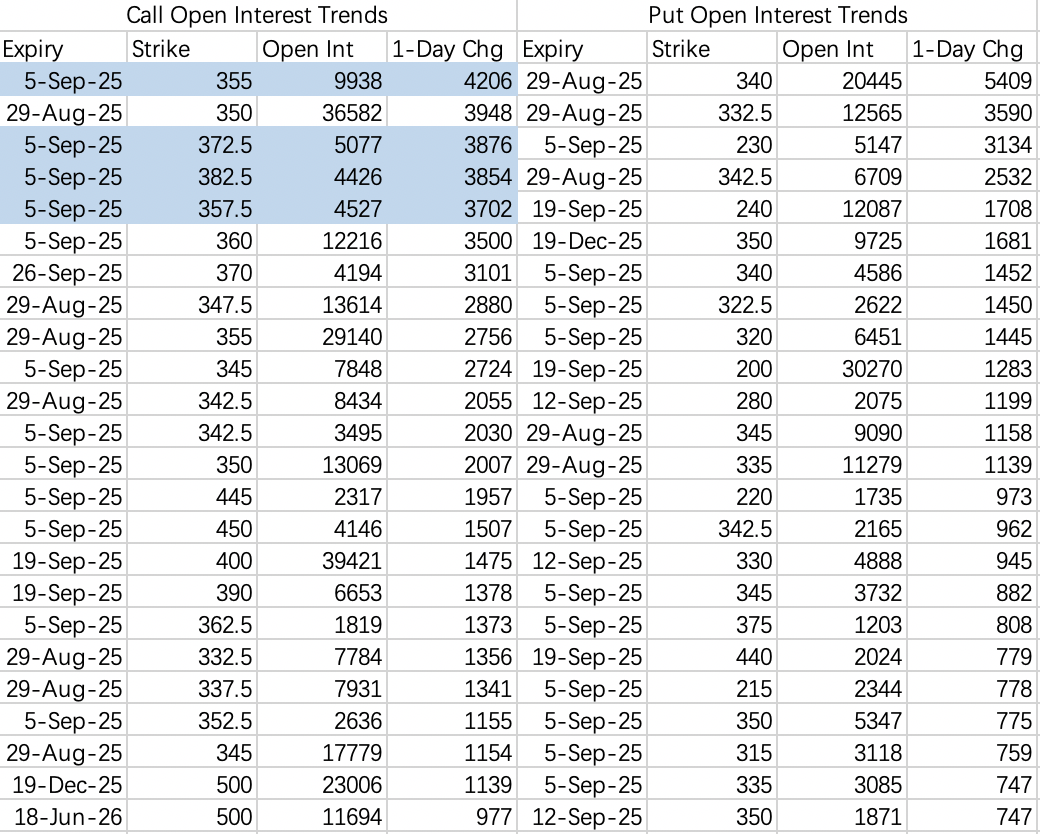

Implied volatility points to a $316–363$ range next week, while open interest suggests a practical range of $320–350$.

Put OI is concentrated around $320–330$—if $TSLA$ drops to $320$, expect put sellers to cover and provide support.

Call OI is clustered at $340–350$, creating short-term resistance.

Institutions are running call spreads, selling $355$ and $357.5$ calls, hedged by buying $372.5$ and $382.5$ calls. A breakout above $350$ can’t be ruled out—prefer buying the dips in the near term.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- AuntieAaA·2025-08-30好的LikeReport