NVIDIA Q2 Earnings: Can It Break Above 185?

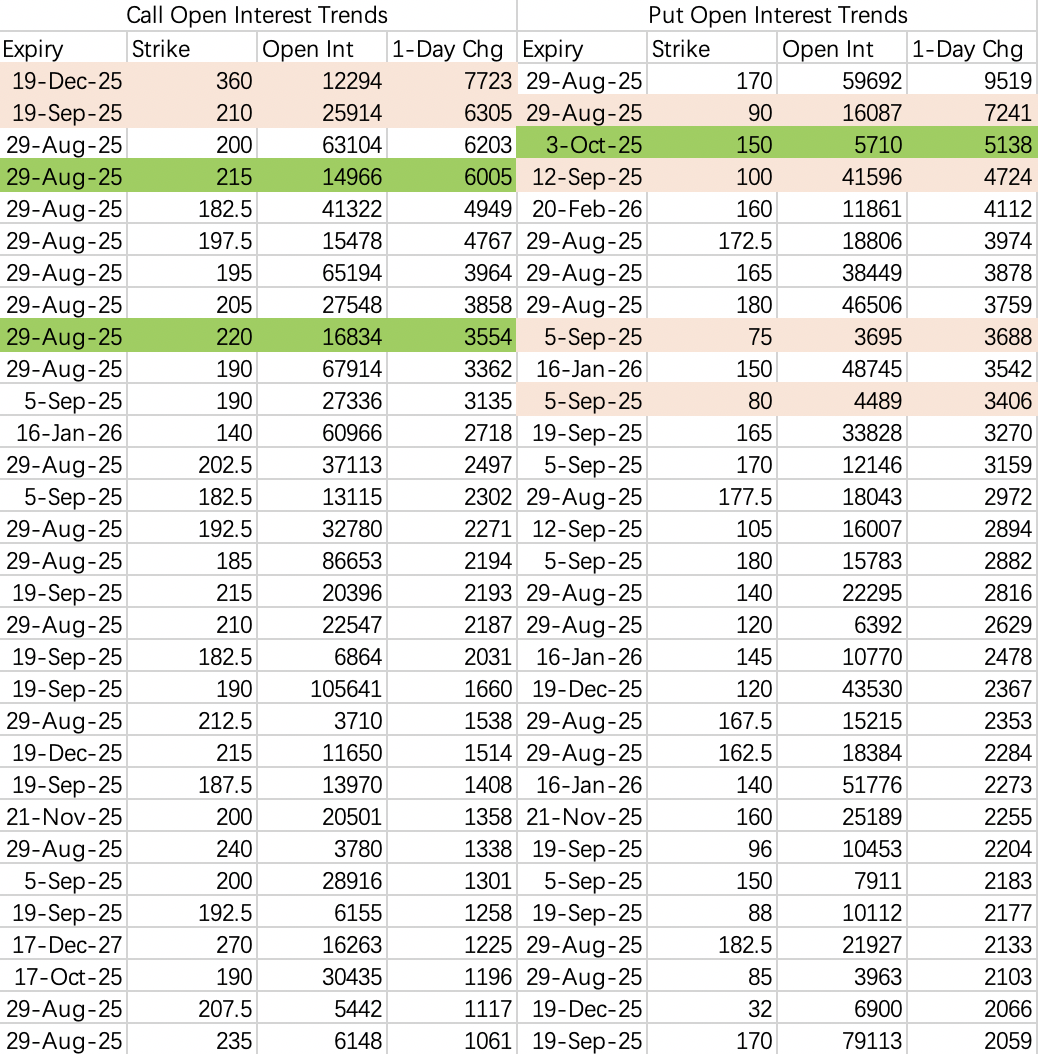

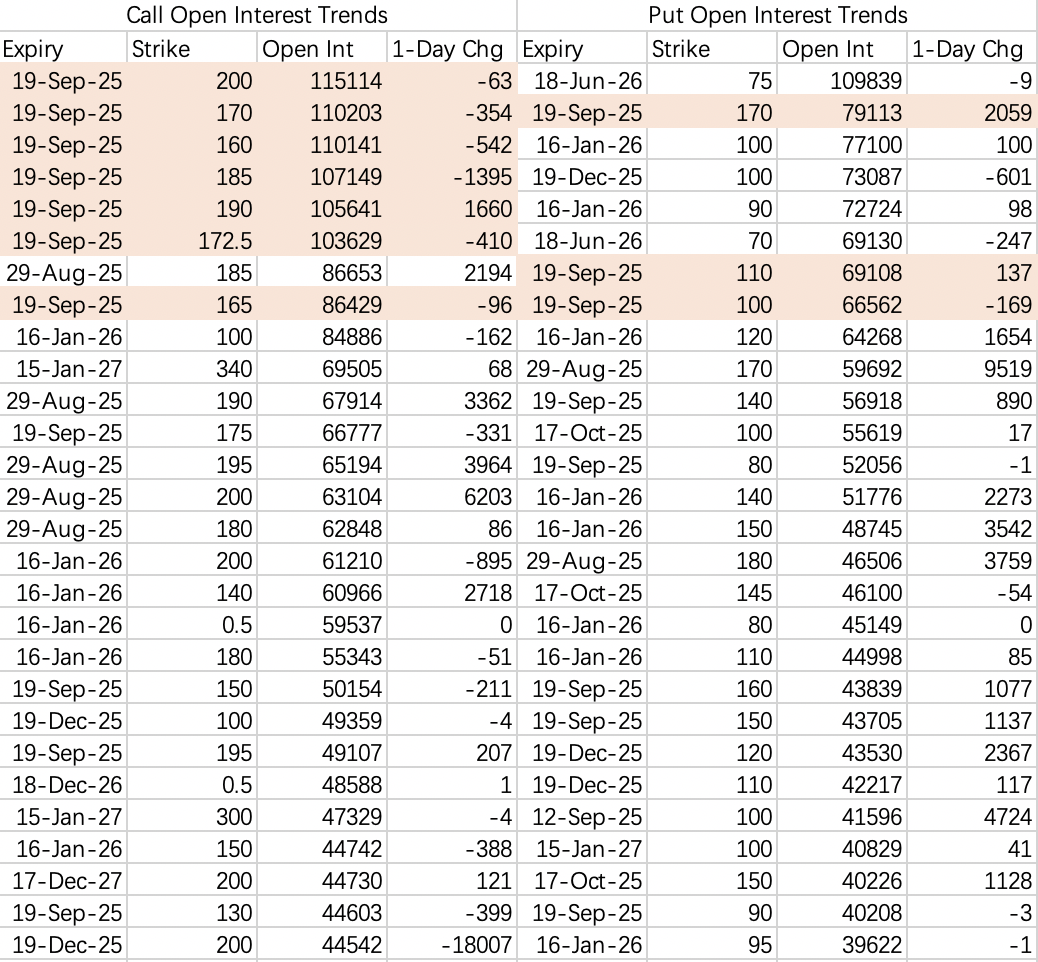

$NVIDIA(NVDA)$

Bottom line:

Just like the May earnings, expect limited volatility. My strategy is to short volatility around the $185 level.

September brings both the FOMC and triple witching, similar to June.

First, NVIDIA’s earnings are extremely transparent—all the good and bad news is already priced in.

Unlike the previous pattern of “sell the news” after results, the current AI boom means each old headline is quickly replaced by new bullish expectations. There’s a view that if results merely meet expectations, the high-growth narrative will break down—I’m skeptical of that.

Most likely, earnings will be in line and the stock will chop sideways between $170–190, then resume the June playbook with upside after triple witching.

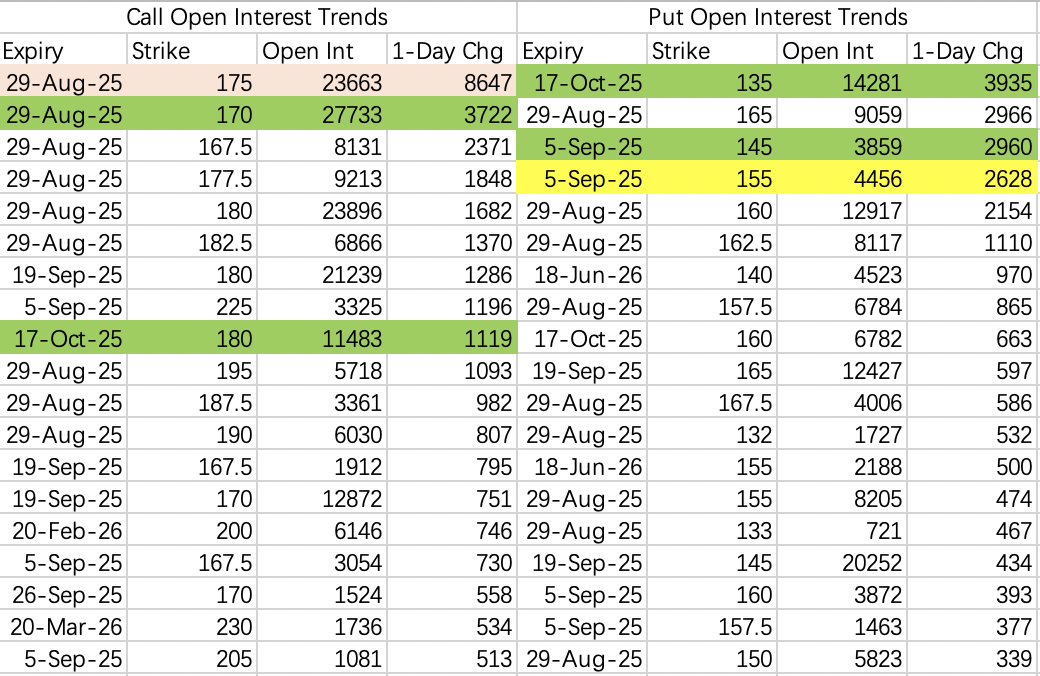

Institutional call spreads are putting real money on $NVDA$ staying below $185, so there’s no reason to lean aggressively bullish or bearish. The best play is to sell puts and harvest volatility.

Strike selection:

Be conservative with sub-$170 strikes ($NVDA 20250829 170.0 PUT$ ), or if you’re confident in the earnings, consider $175 or even at-the-money ($NVDA 20250829 175.0 PUT$ ). Remember to close positions at the open after earnings.

On Tuesday, there were some extreme bets on both calls and puts—nothing particularly actionable.

One thing to watch: for triple witching (Sep 19 expiry), the largest open interest on calls is in the $160–200 range, which fits the expected volatility.

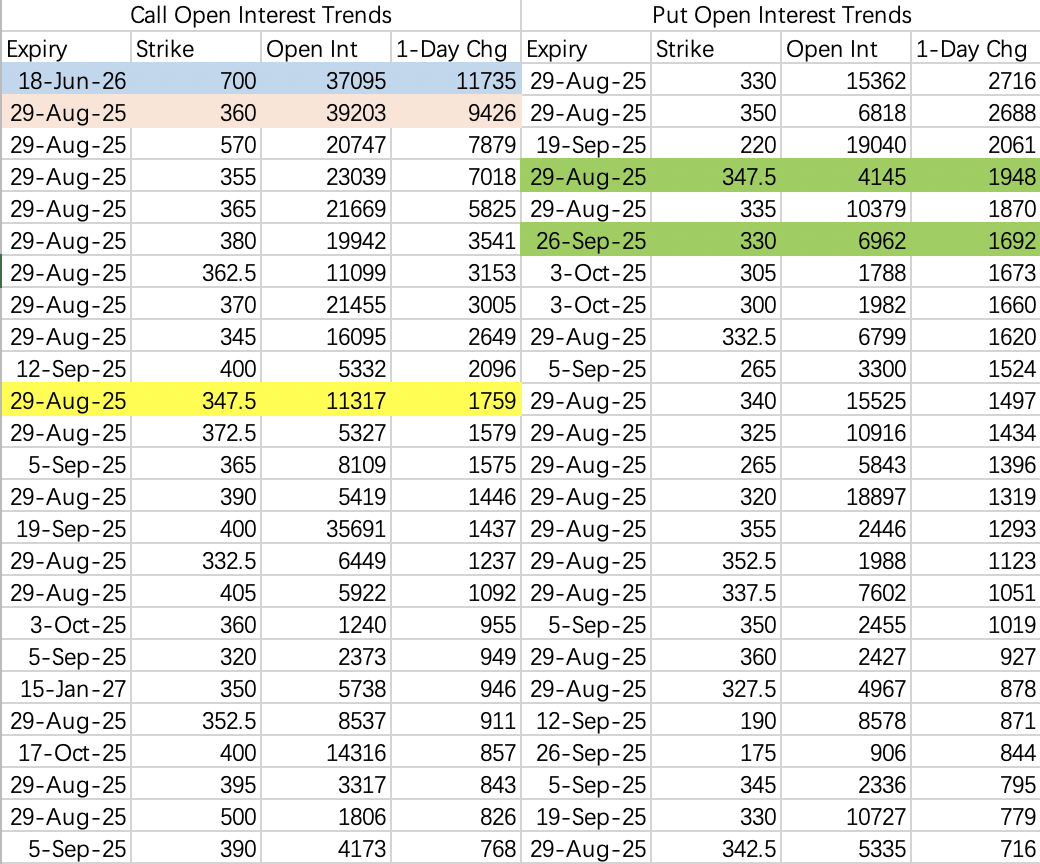

$Tesla Motors(TSLA)$

$360$ is a key level this week; look for sell call opportunities on Thursday or Friday.

$SPDR S&P 500 ETF Trust(SPY)$

Index ETF traders are hedging for a possible pullback after $NVDA$ earnings—more cautious than they were around the May report.

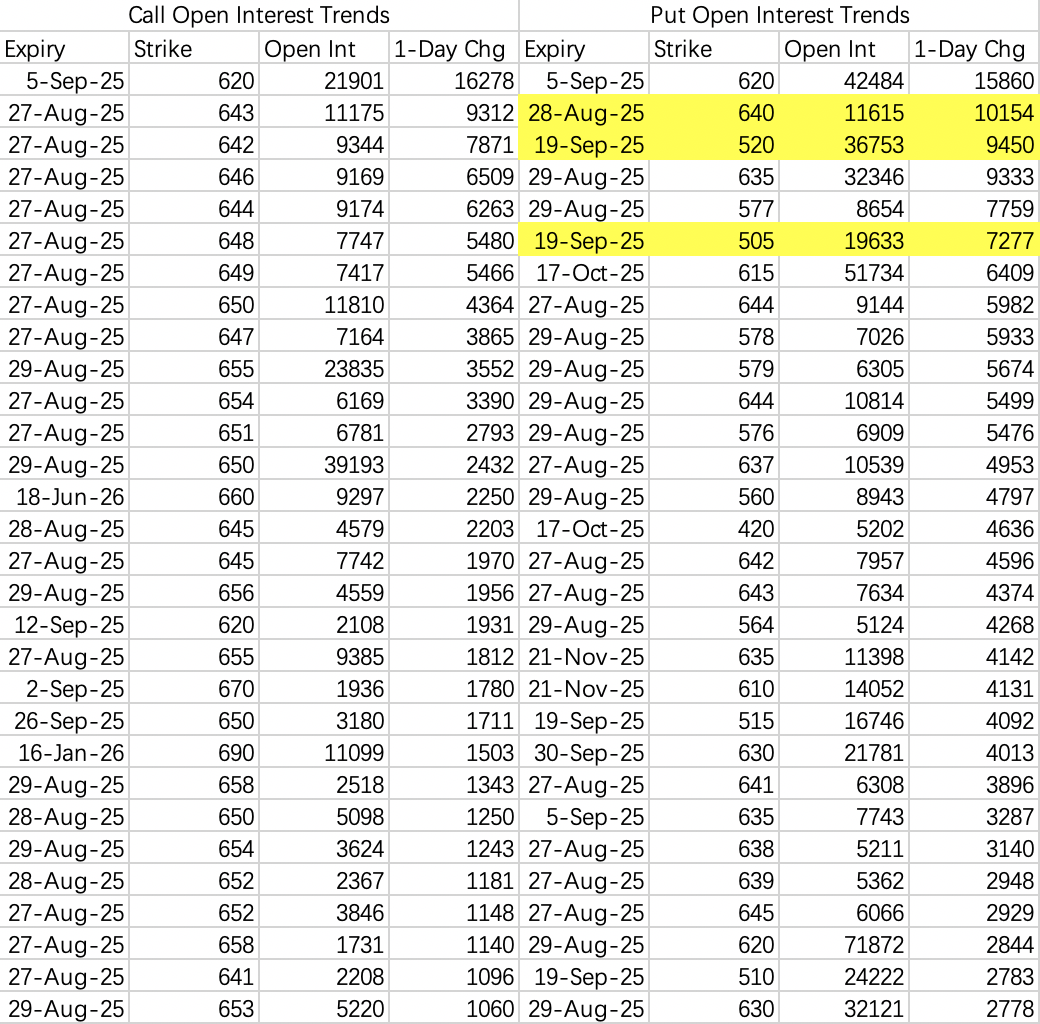

$Advanced Micro Devices(AMD)$

Compared to $SPY$ and $NVDA$, $AMD$ traders are pretty relaxed—no aggressive downside hedging. Selling the $155$ put is worth considering.

$NIO Inc.(NIO)$

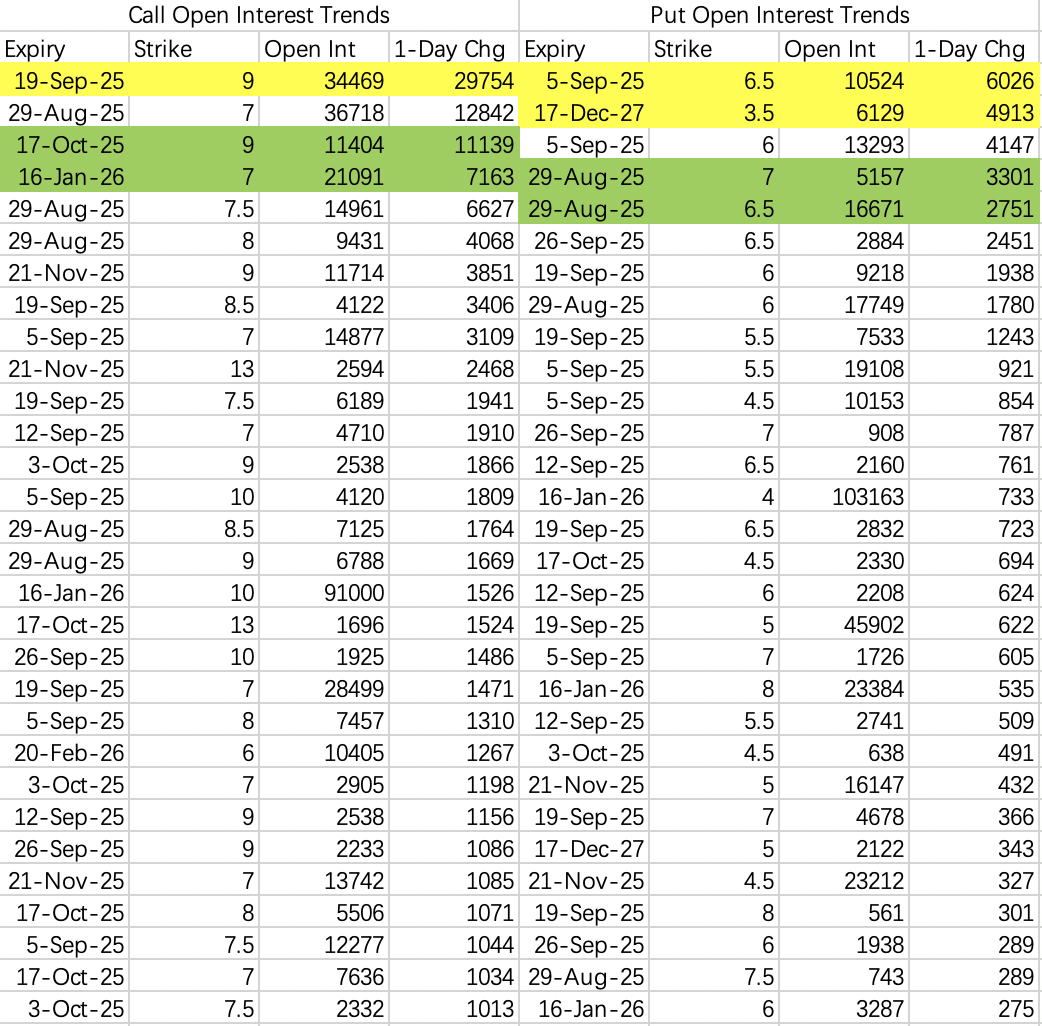

$ES8$ order numbers look good and the recent rally is justified by the data. If we see a pullback to $6$, it’s a good spot to sell puts.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

很棒的文章,你愿意分享吗?