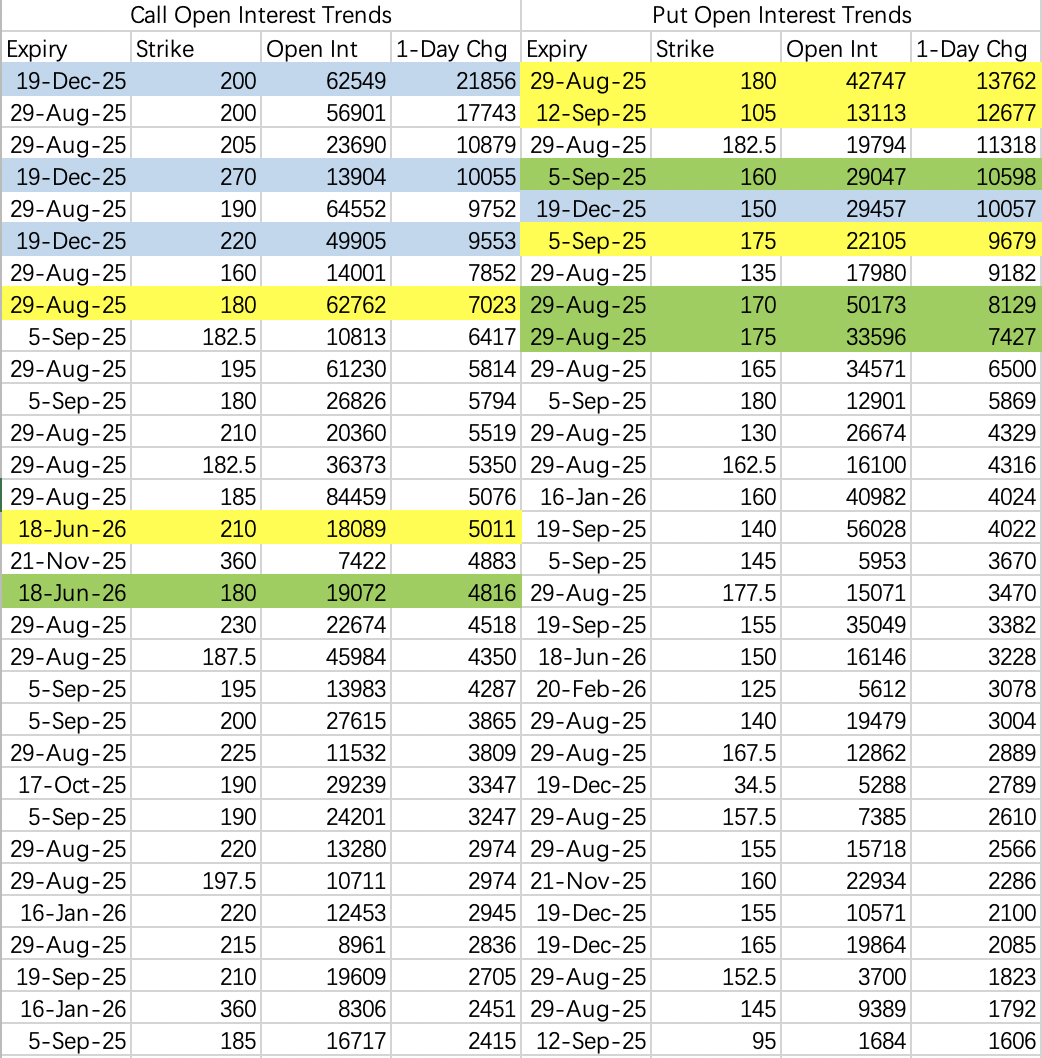

$NVIDIA(NVDA)$

Monday’s rally has boosted bullish sentiment, with big bets coming in for a move above $200 by year-end.

There are still some puzzling put positions opening up—likely institutional hedges, possibly speculating that a lack of new catalysts in the second half could trigger a pullback.

For this week’s close, I see two main ranges: either $170–185 or $180–190. Bottom line, earnings are solid—this is a great setup for selling puts to short volatility.

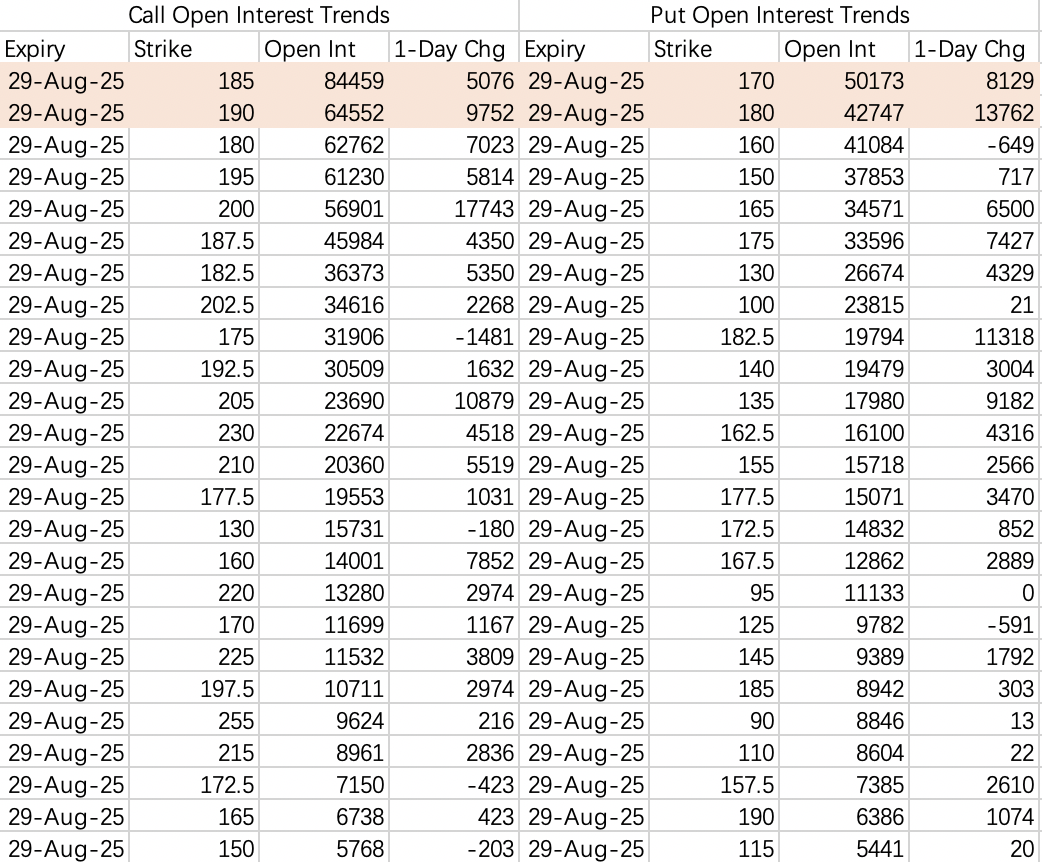

$Tesla Motors(TSLA)$

Institutions are rolling bear call spreads in the $350–367.5 range, and I see renewed short-squeeze risk.

For selling puts, the ideal strike range is $300–320.

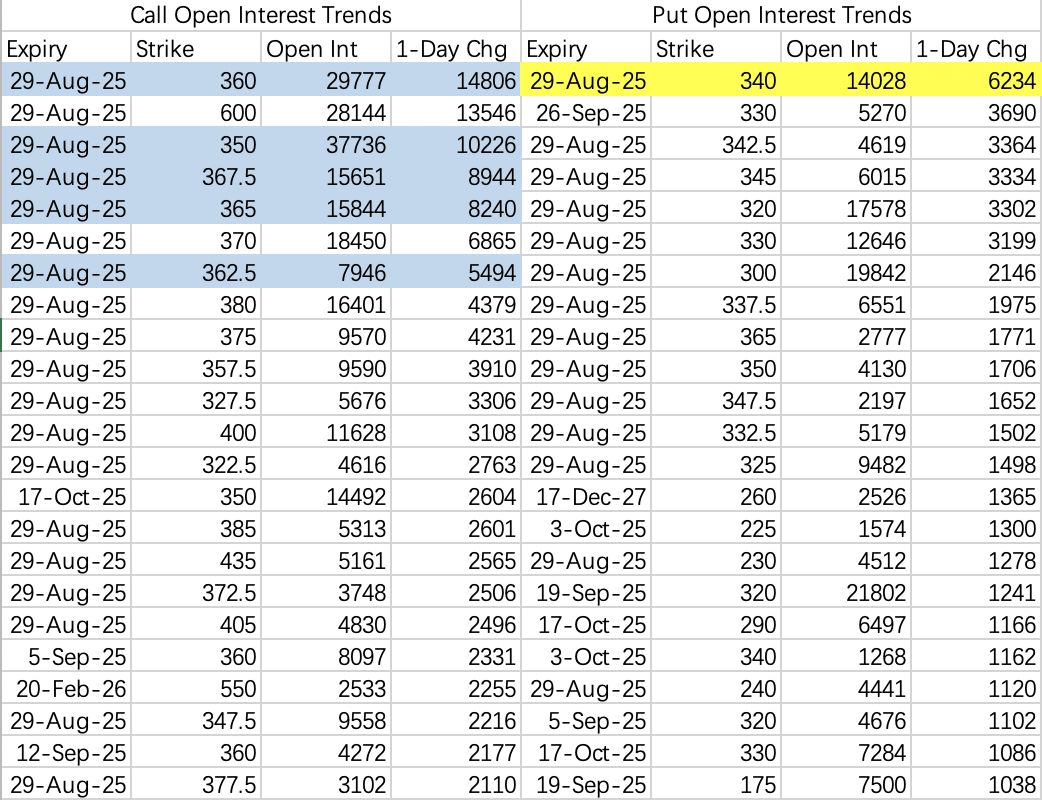

$PDD Holdings Inc(PDD)$

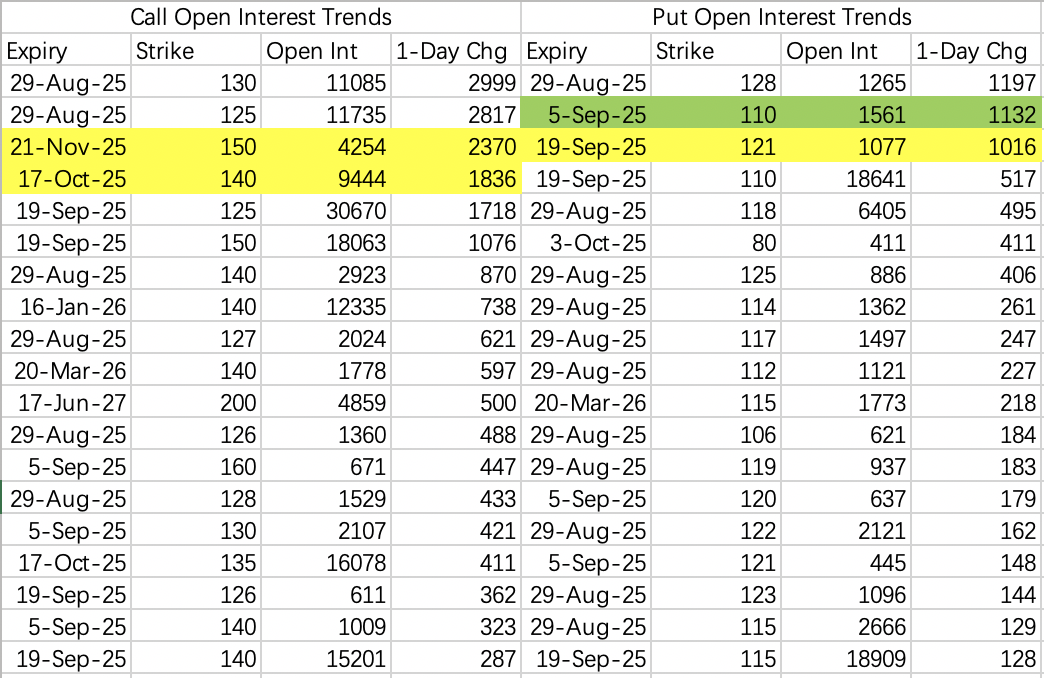

First, the three massive call positions totaling $80 million haven’t closed: $PDD 20250926 130.0 CALL$ , $PDD 20250926 132.0 CALL$ , $PDD 20250926 135.0 CALL$ .

Second, more bullish flow hit on Monday, with both put selling and call buying: $PDD 20251017 130.0 PUT$ , $PDD 20251121 145.0 CALL$ .

There are also some recent $130 sell calls, but that’s not a big concern—$PDD$ remains a top candidate for put selling right now. Strike selection depends on your risk appetite; anything below $120 isn’t too aggressive.

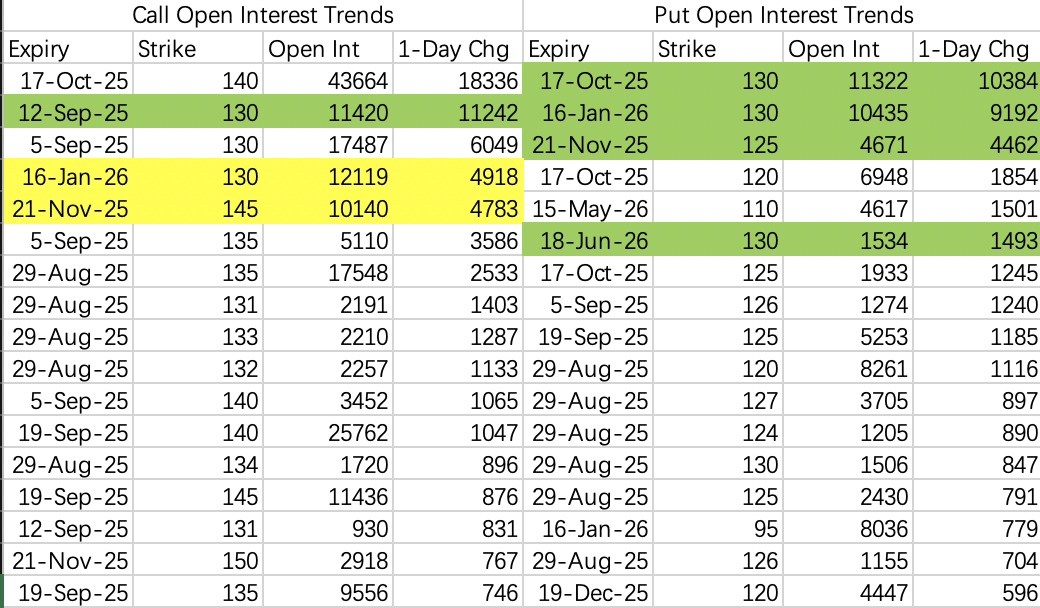

$Alibaba(BABA)$

Compared to $PDD$, options flow in $BABA$ is much quieter. For earnings, the safest play is to sell the $110 put.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- okalla·2025-08-26很棒的文章,你愿意分享吗?LikeReport