Did the $80 million in PDD call options just go up in smoke?

Markets ripped higher Friday—not just on rate-cut hopes, but also a major short squeeze. Still, let’s watch a couple more days to see if bears are really done.

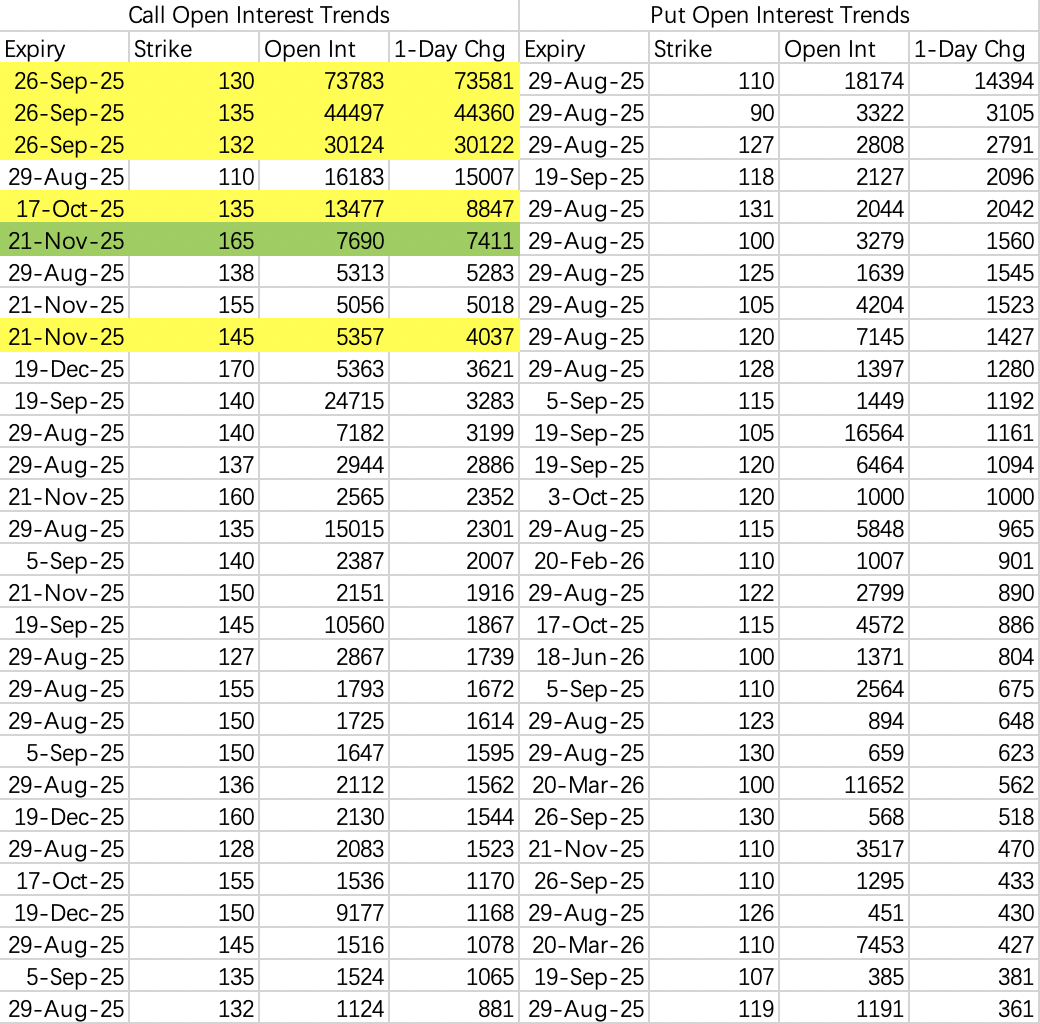

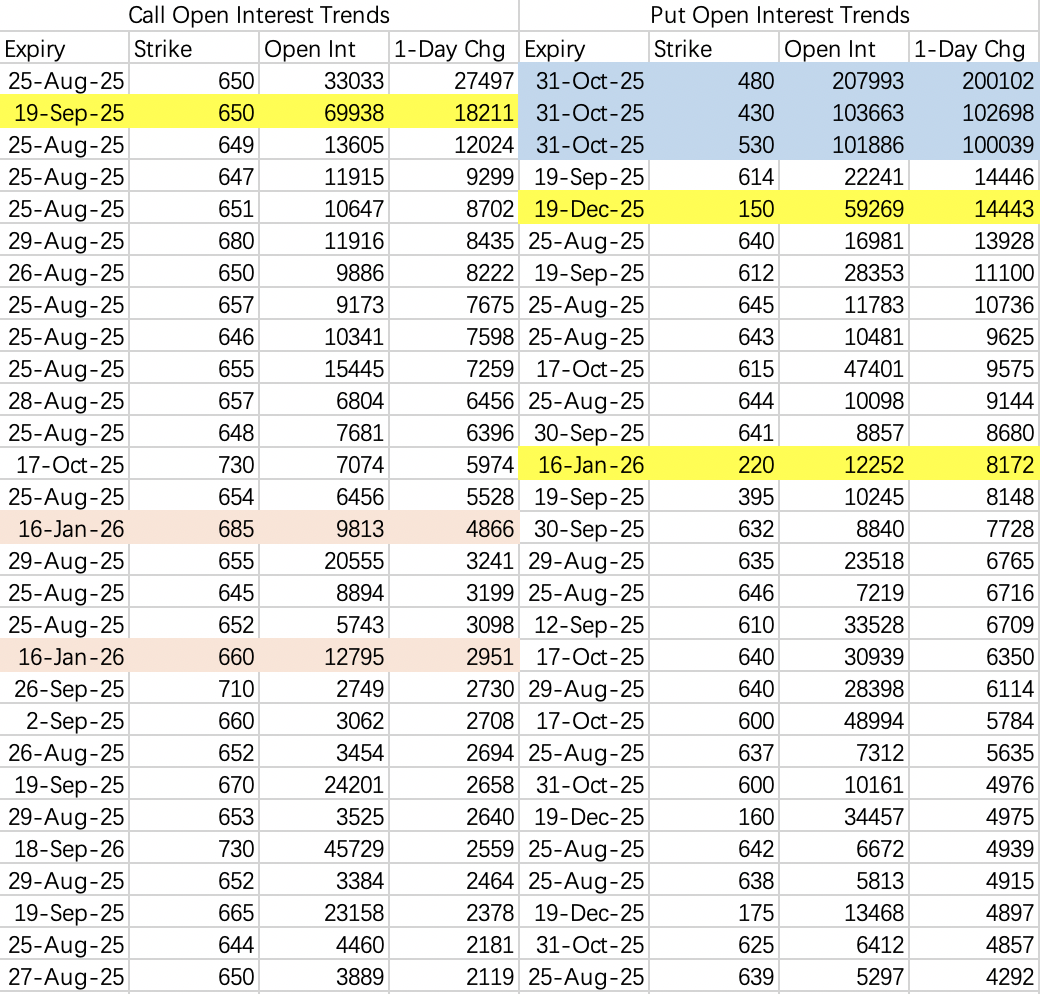

$PDD Holdings Inc(PDD)$

Earnings beat: Huge net profit beat, but management was very cautious (said the strong trend might not continue). That capped gains.

Big Friday call buys: A whale spent ~$80M buying $PDD 20250926 130.0 CALL$ , $PDD 20250926 132.0 CALL$ , $PDD 20250926 135.0 CALL$ (all Sep 26 expiry, about $5 each), betting on a post-earnings move to $135–140.

Many other calls: Lots of bullish flow targeting $130–140 for autumn. Odd outlier: some $PDD 20251121 165.0 CALL$ sell calls (Nov expiry).

Put side: Cautious. Notable is a straddle ($PDD 20250829 110.0 CALL$ + $PDD 20250829 110.0 PUT$ ) for this week—likely hedging, not outright bearishness, but puts are at scattered strikes, showing weak downside conviction.

Stock opened down 2%, back to $125—right at prior bullish targets.

Those Sep calls are now worth much less, but don’t rule out a rebound.

Very important: If PDD dips post-earnings, that’s a buy-the-dip opportunity. Don’t chase calls—safer to sell puts ($115–120), or $110 for the most conservative.

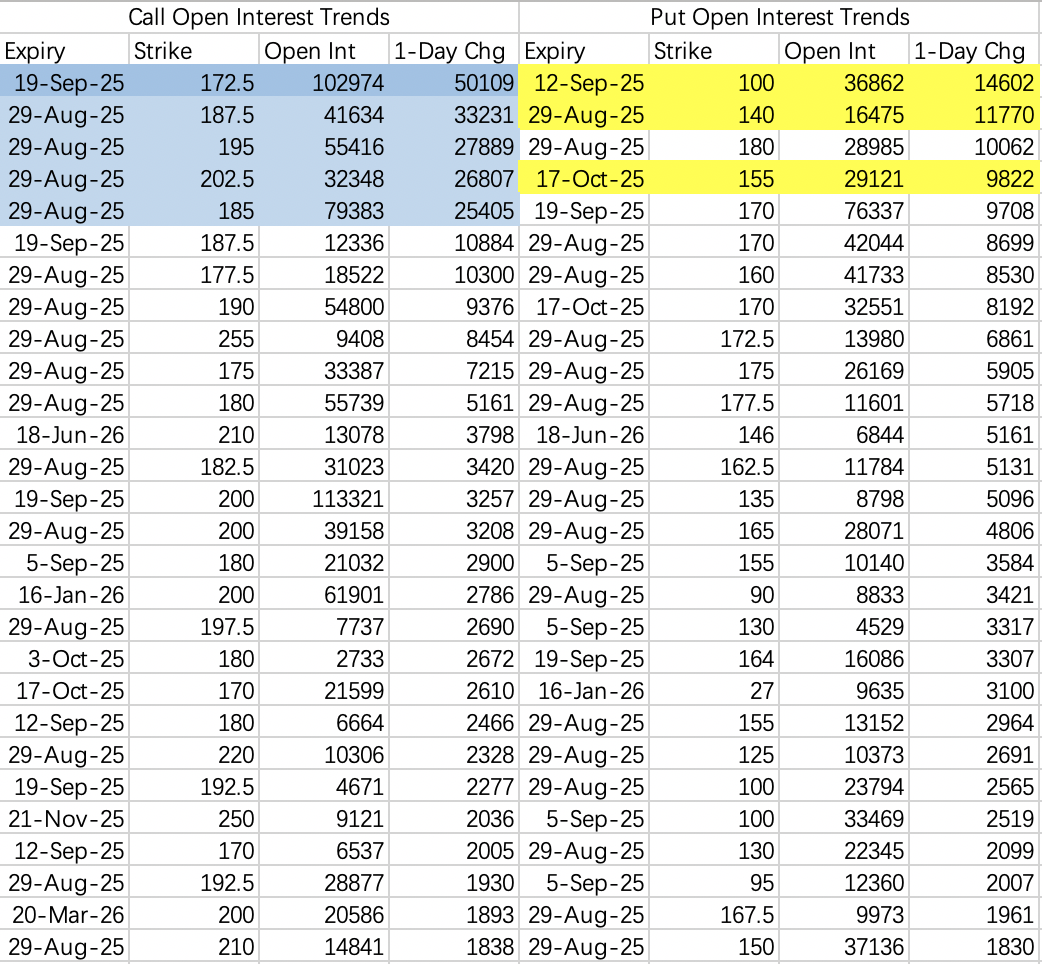

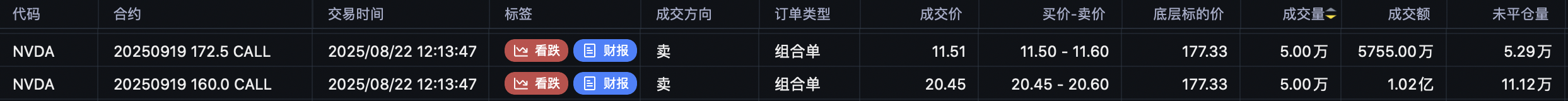

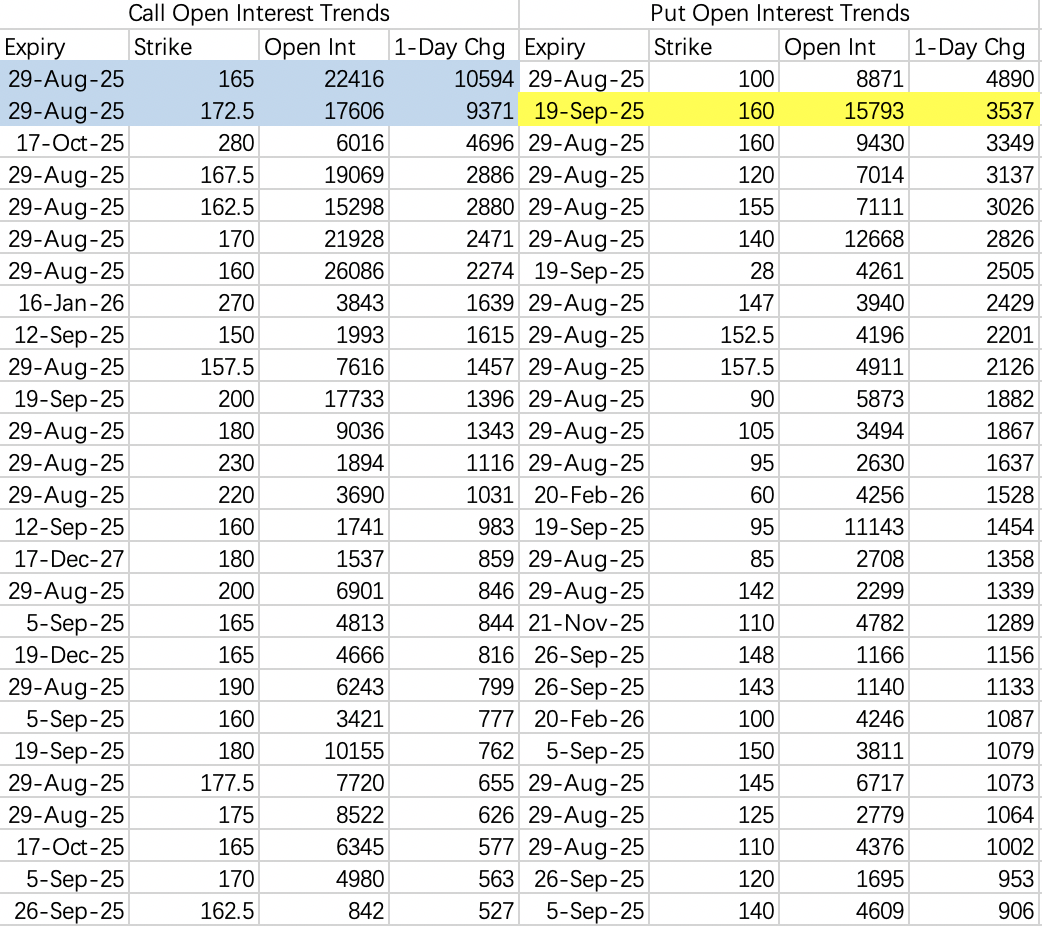

$NVIDIA(NVDA)$

Earnings out: Data center demand still strong, but stock already priced for perfection—like last quarter, limited upside likely.

Institutions selling $185/$187.5 calls, hedging with $195/$202.5 calls. They don’t expect a new high, but are hedging in case.

Sell put $175 or $170 for a mild bullish play.

Notably, some heavy put buying at lower strikes—probably macro/market hedges, not company-specific.

“$200M guy” rolled $NVDA 20250919 160.0 CALL$ up to $172.5, but with much smaller size—effectively trimming exposure.

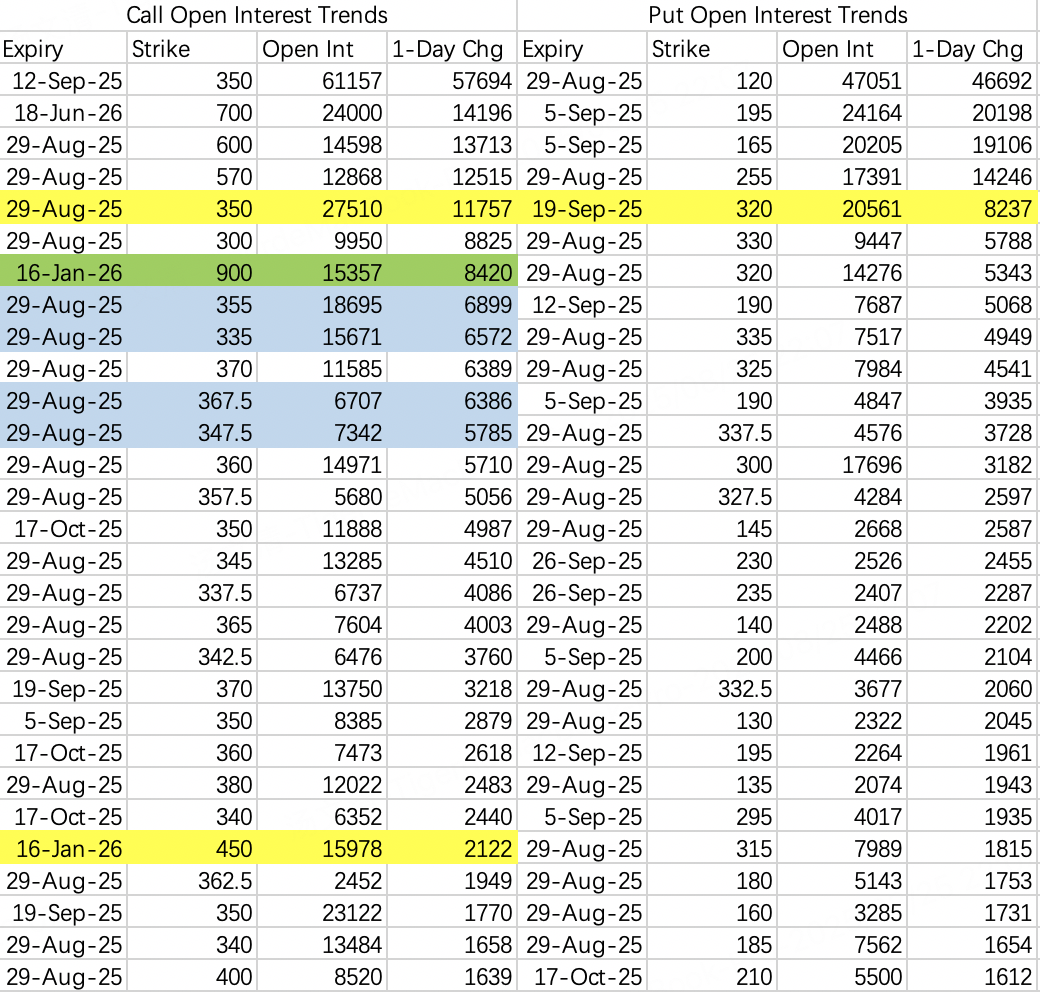

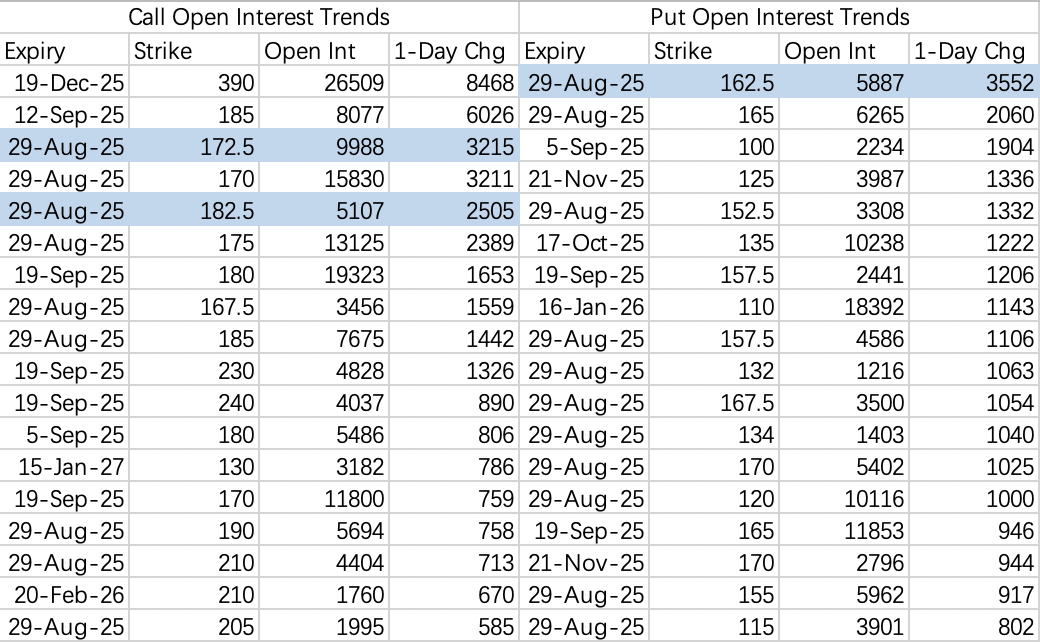

$Tesla Motors(TSLA)$

Very strong: Big bullish call action, including mid-term spreads: buy $450 call, sell 5x $900 call ($TSLA 20260116 450.0 CALL$ /$900.0 CALL$).

Institutions selling $347.5/$335 calls, hedging with $355/$367.5 calls.

Some downside protection: buy $320 put ($TSLA 20250919 320.0 PUT$ ).

Overall: Tesla is best played from the long side for now.

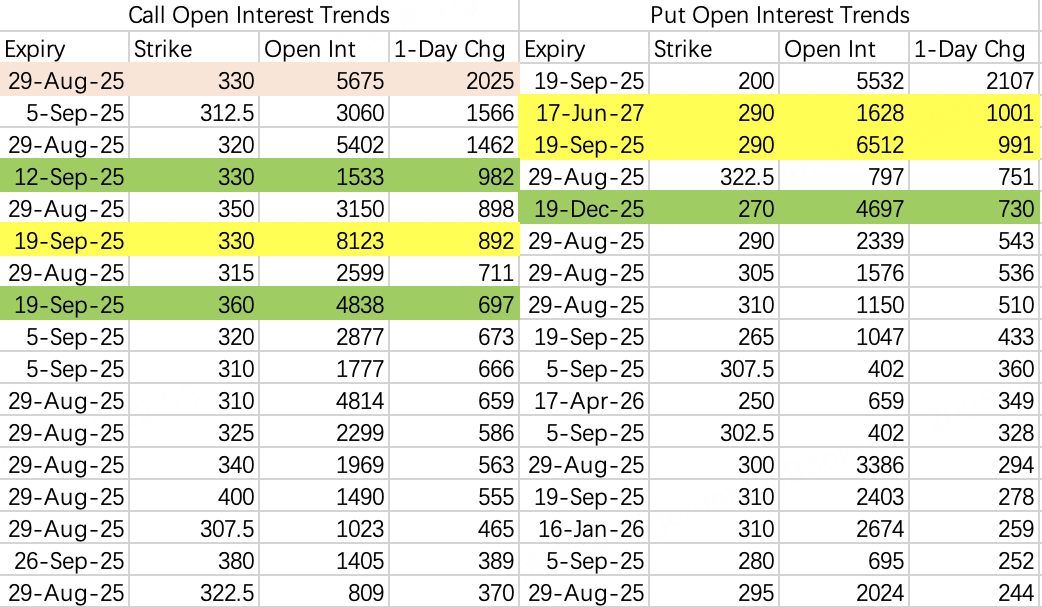

$SPDR S&P 500 ETF Trust(SPY)$

Index is split, with both bullish and bearish volatility bets.

Some are targeting $650 calls—optimistic side.

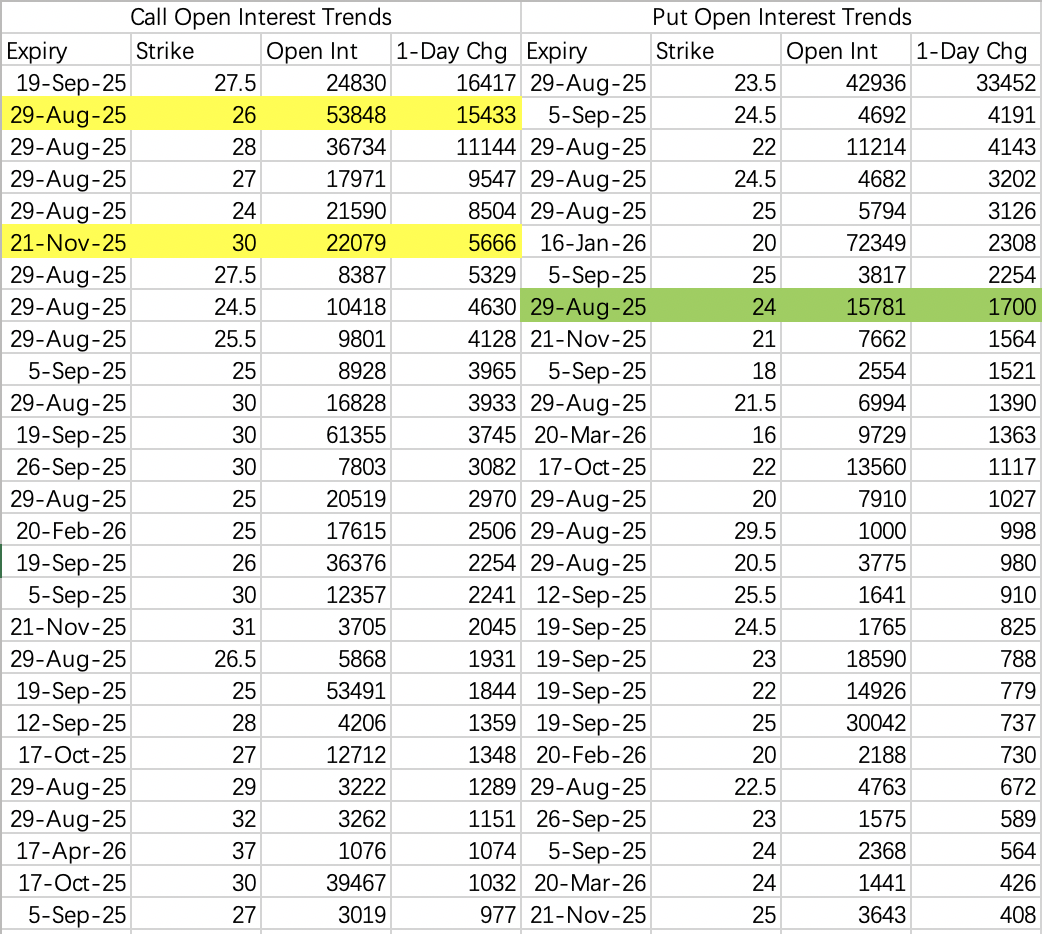

$Palantir Technologies Inc.(PLTR)$

Institutions rolled up on the squeeze: sell $165 call, hedge with $172.5 call ($PLTR 20250829 165.0 CALL$ /$172.5 CALL$).

Heavy sell call flow on big drops is often a squeeze signal.

Puts show no consensus; surprisingly, more people bet on a crash after the rally.

Long-term, $140 put is reasonable, but better opportunities elsewhere if you’re capital-constrained.

$Advanced Micro Devices(AMD)$

Selling $172.5 call, hedging with $182.5 call. Should hold above $160 this week.

$UnitedHealth(UNH)$

Possible dip to $290. Covered call at $330 is reasonable.

$Intel(INTC)$

Cash-rich and government backing—bullish bias. Unlikely to fall below $24; consider selling puts.

$CoreWeave, Inc.(CRWV)$

Probably in a shakeout phase, could retest $85.

Notably, big money is accumulating ratio call spreads: buy $100 call, sell 2x $165 call ($CRWV 20260320 100.0 CALL$ /$165.0 CALL$). This has been building for days, now a multi-million dollar bet. Likely strong hands positioning for a rebound from the bottom.

$Alibaba(BABA)$

Earnings outlook: mild bullish, $125+ possible. Current price is good for selling puts ($BABA 20250829 118.0 PUT$ ).

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Gman1234567890·2025-08-26nice1Report