Still Watching Inflation & Jobs Data

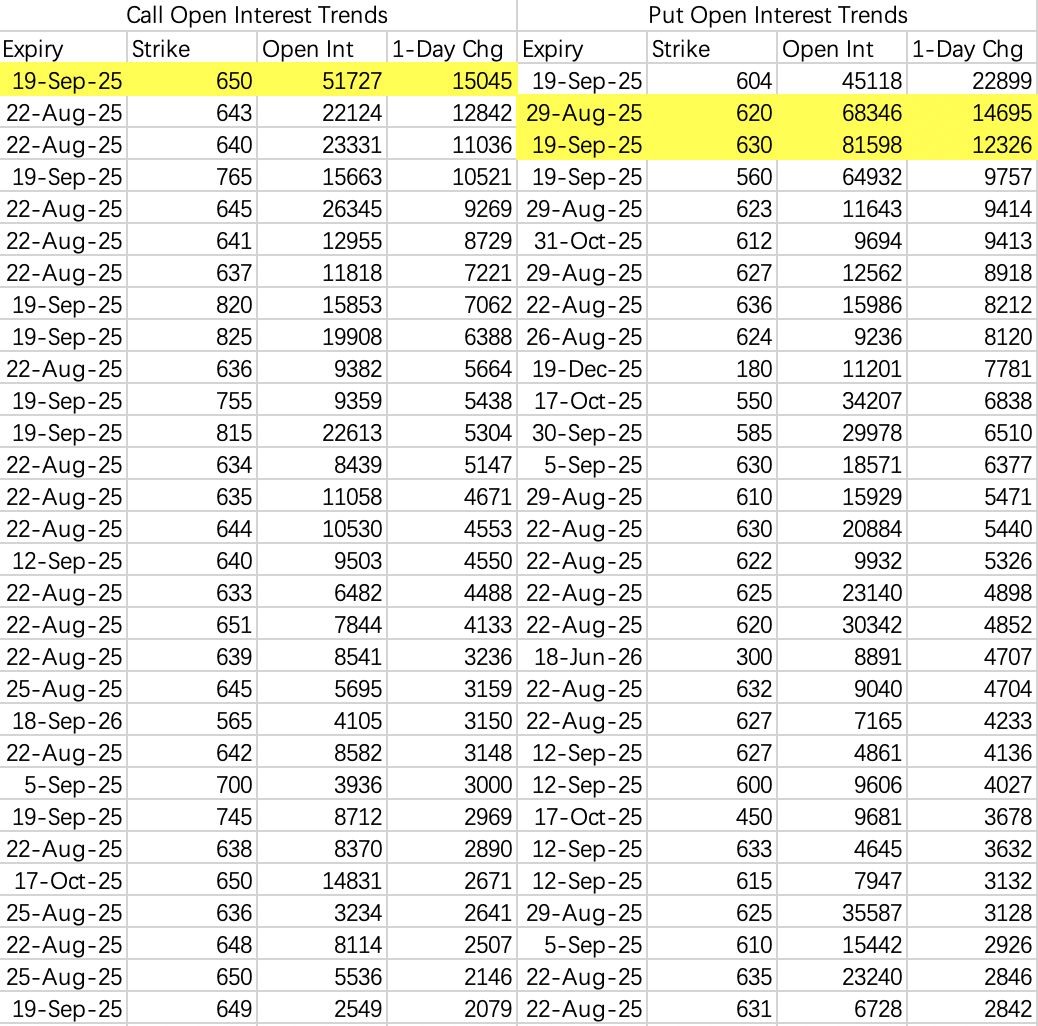

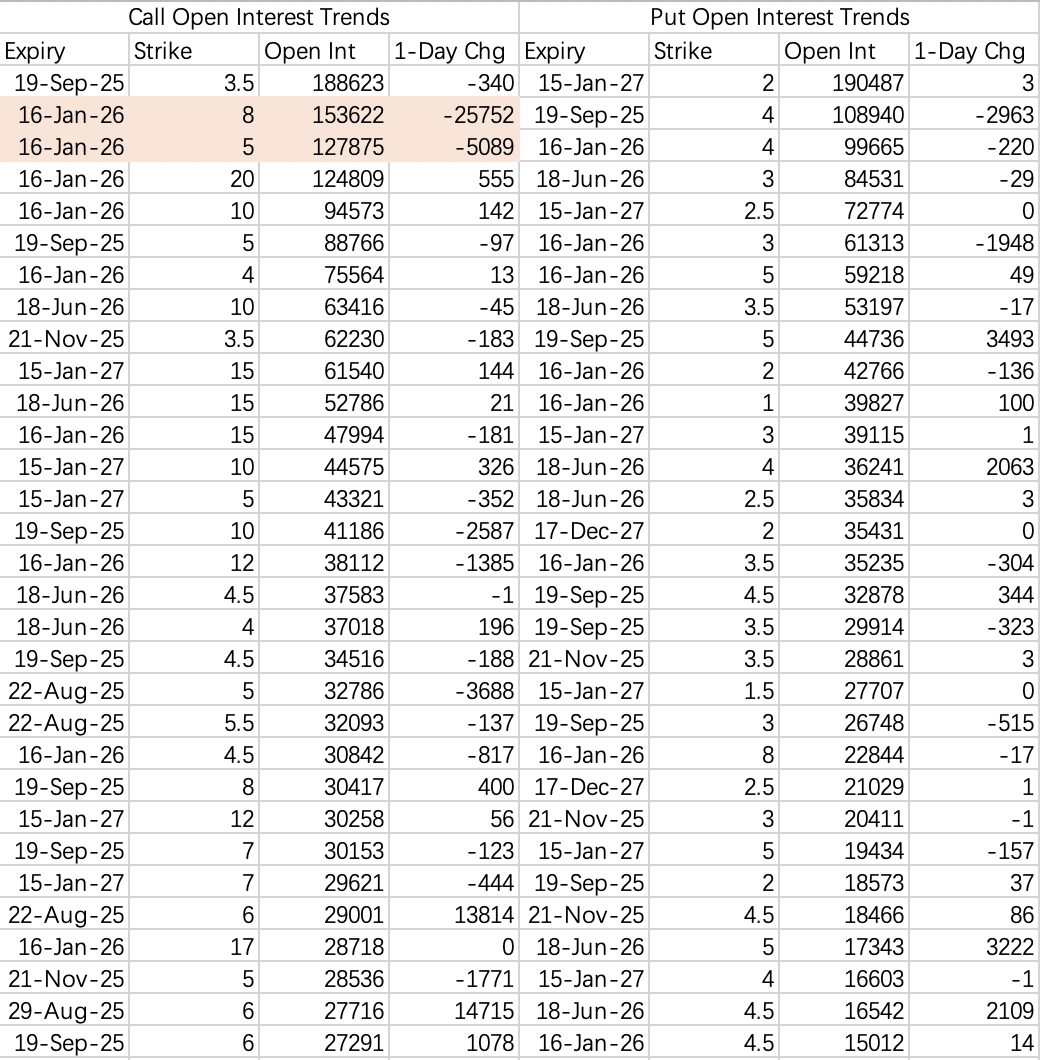

$SPDR S&P 500 ETF Trust(SPY)$

Despite a slightly dovish Jackson Hole, rate cuts still depend on inflation/employment.

Market sentiment for next week is bearish; big hedges buying the 620 put.

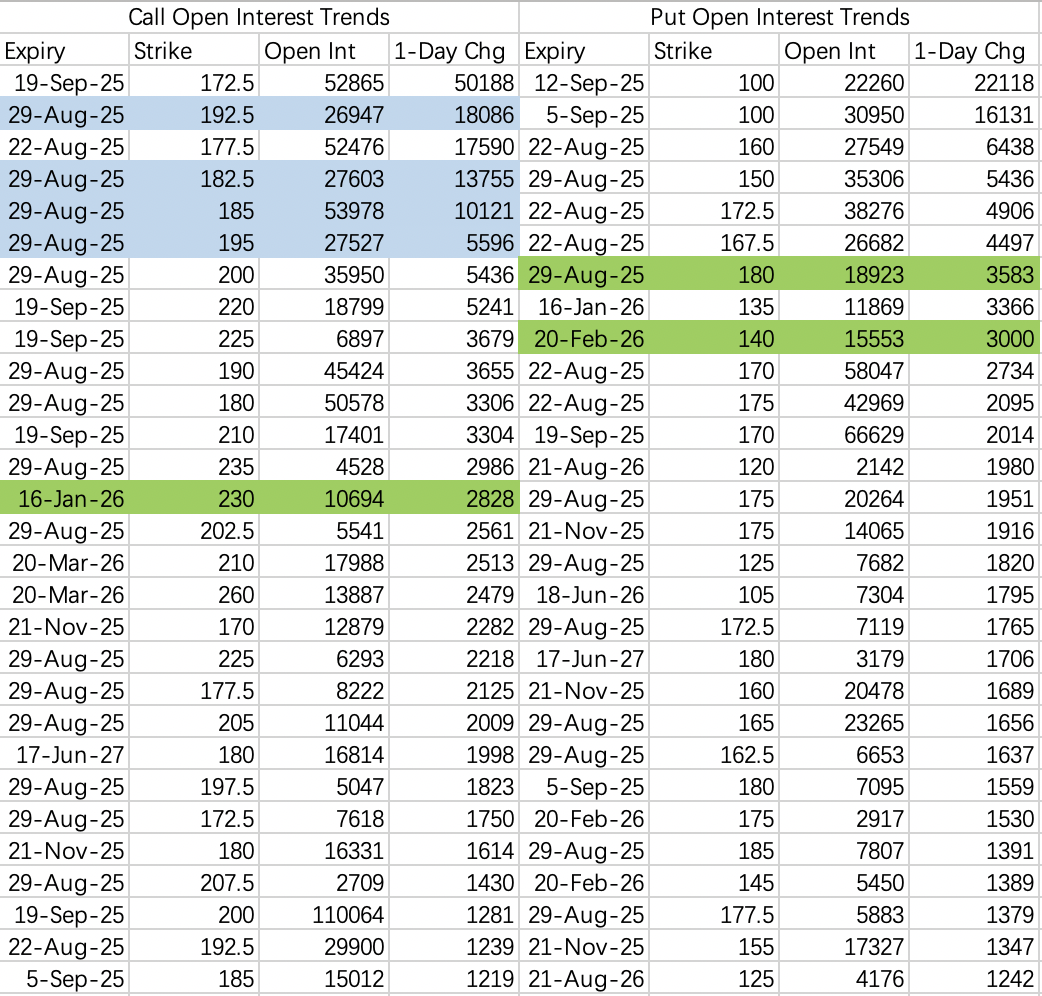

$NVIDIA(NVDA)$

This quarter’s earnings setup is similar to last quarter.

Institutions selling next week’s 182.5 and 185 calls, hedged by buying 192.5 and 195 calls—implying no shot at $200 on earnings.

Uncertainty about next week (“black swan” risk); there’s heavy put buying at much lower strikes.

Still, selling the $170 put for earnings week ($NVDA 20250829 170.0 PUT$ ) looks like a solid trade.

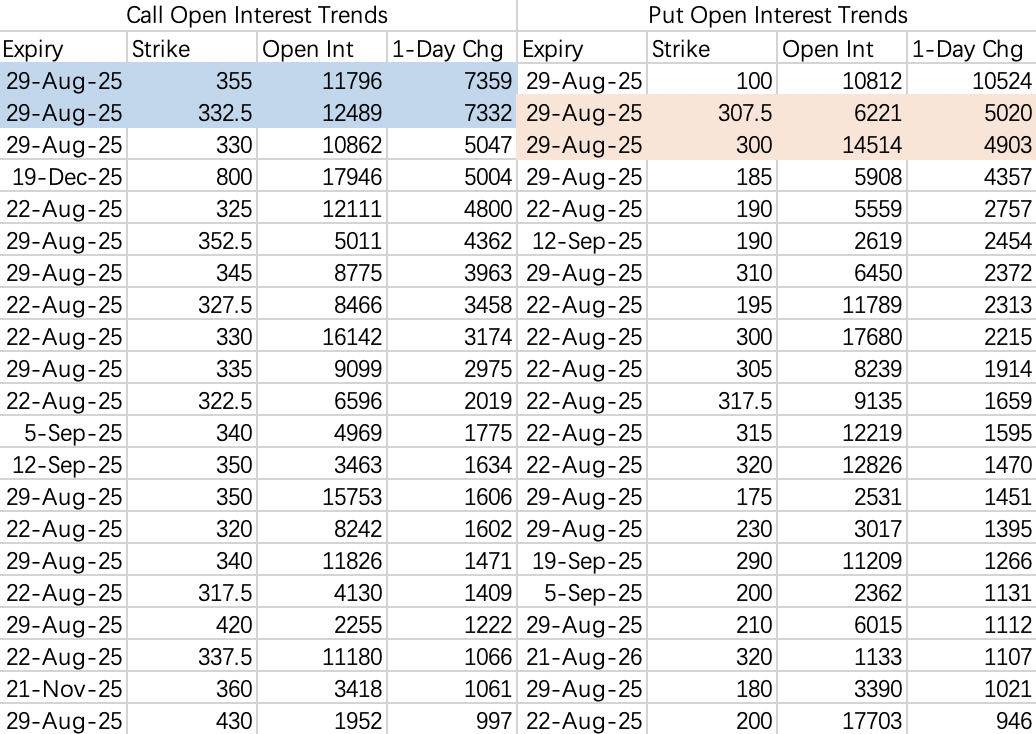

$Tesla Motors(TSLA)$

Next week’s institutional spread: sell 332.5 call ($TSLA 20250829 332.5 CALL$ ), buy 355 call ($TSLA 20250829 355.0 CALL$ ) as a hedge.

Still seeing support at $300.

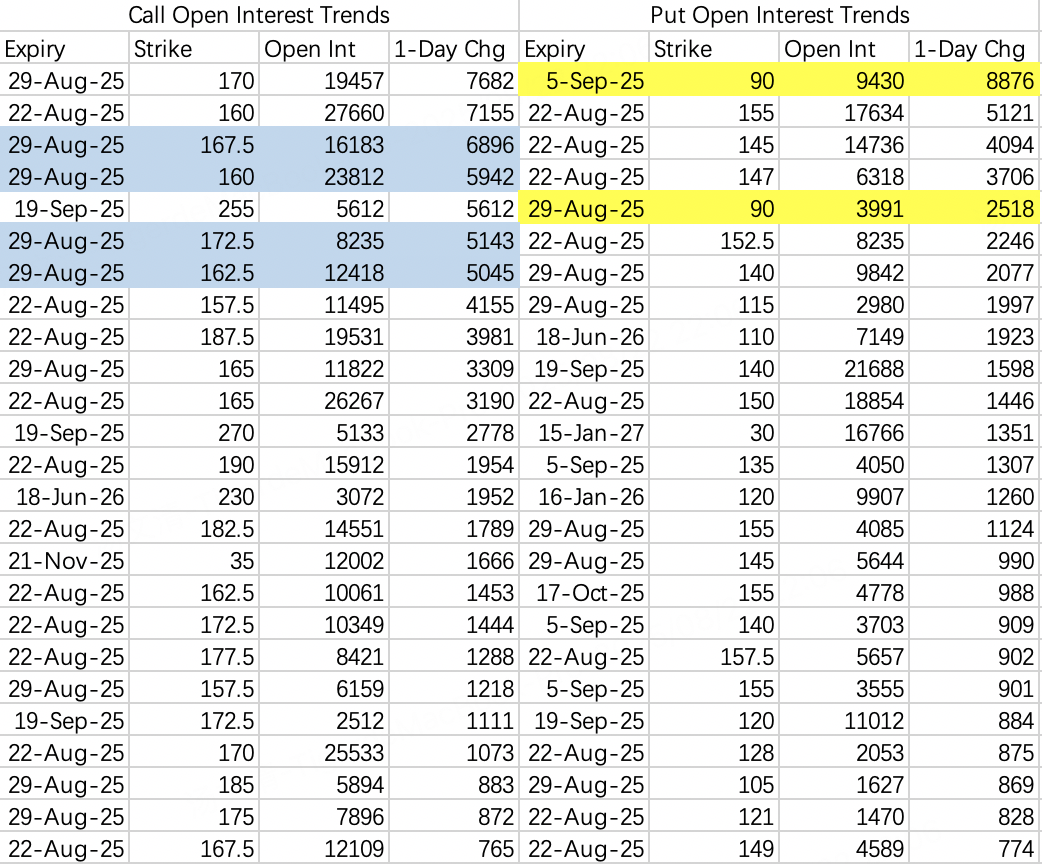

$Palantir Technologies Inc.(PLTR)$

PLTR is often the target of call sellers who then get squeezed higher; use these strikes as squeeze reference points.

Institutions selling 162.5 and 165 calls for next week, hedging with 167.5 calls.

Put activity also at much-lower “crash” strikes—be cautious about leverage on the long side for now.

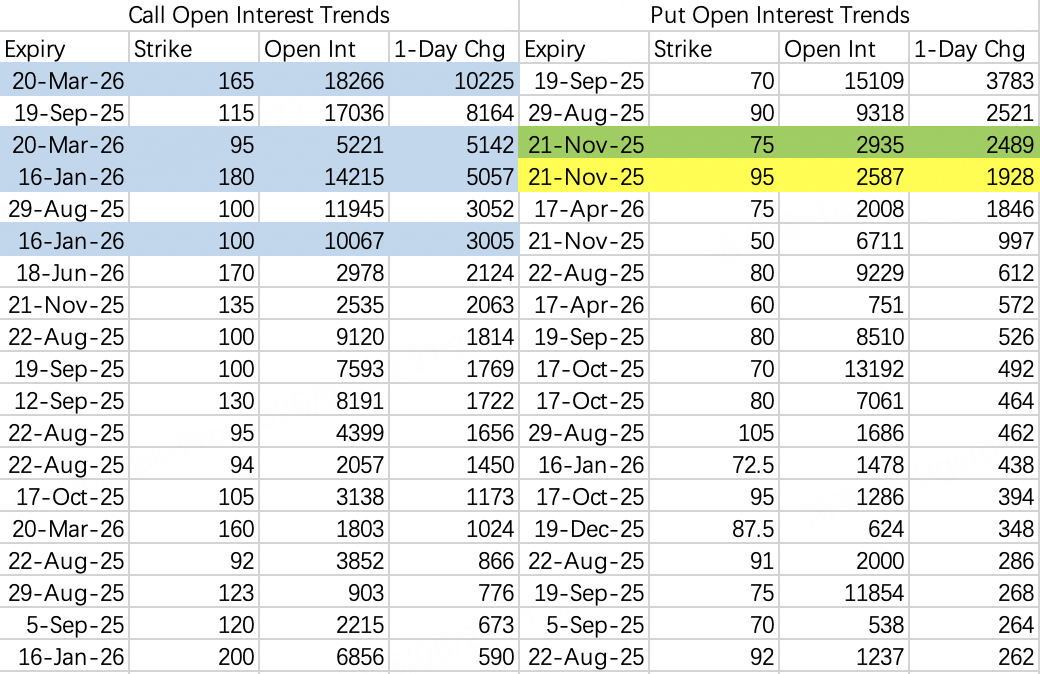

$CoreWeave, Inc.(CRWV)$

Two main camps:

Speculative bulls: Buy long-dated 95 calls, sell double 165 calls as a hedge ($CRWV 20260320 95.0 CALL$ , $CRWV 20260320 165.0 CALL$ ), or buy 100 calls, sell double 180 calls ($CRWV 20260116 100.0 CALL$ , $CRWV 20260116 180.0 CALL$ ). This “ratio spread” suggests weak confidence in a big rally.

Bears: See a base between 75–95 ($CRWV 20251121 95.0 PUT$ , $CRWV 20251121 75.0 PUT$ ). Current price (~90) may bounce around to form a bottom.

Selling puts at 80 is possible, but be prepared to take assignment—it’s not a bad entry for long-term.

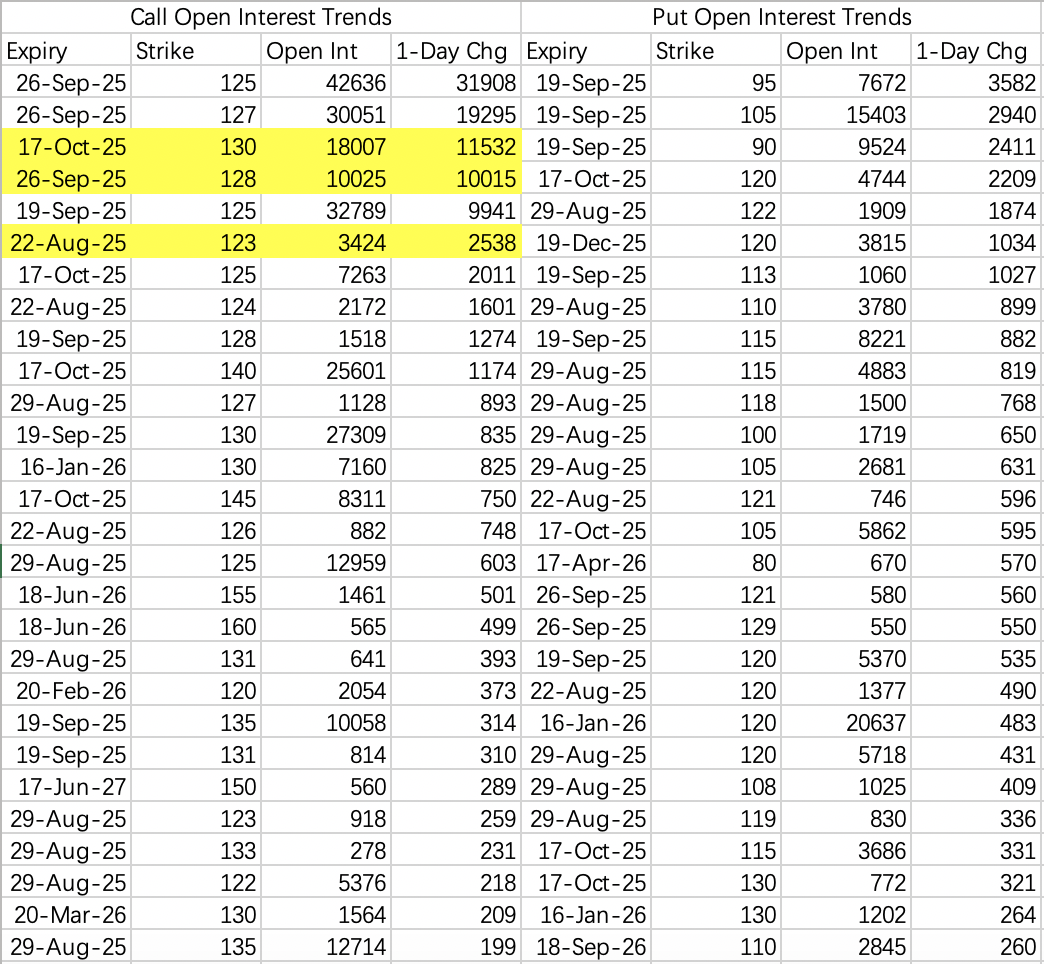

$PDD Holdings Inc(PDD)$

Lots of bullish flow, with target prices mostly 125–130. Most of these were opened when the stock was 115–121.

Now that PDD is above 125, be careful about chasing calls. Bullish? Consider selling the 115 put ($PDD 20250829 115.0 PUT$ ).

Earnings were solid; Temu losses narrowing. Rumors of HK dual listing.

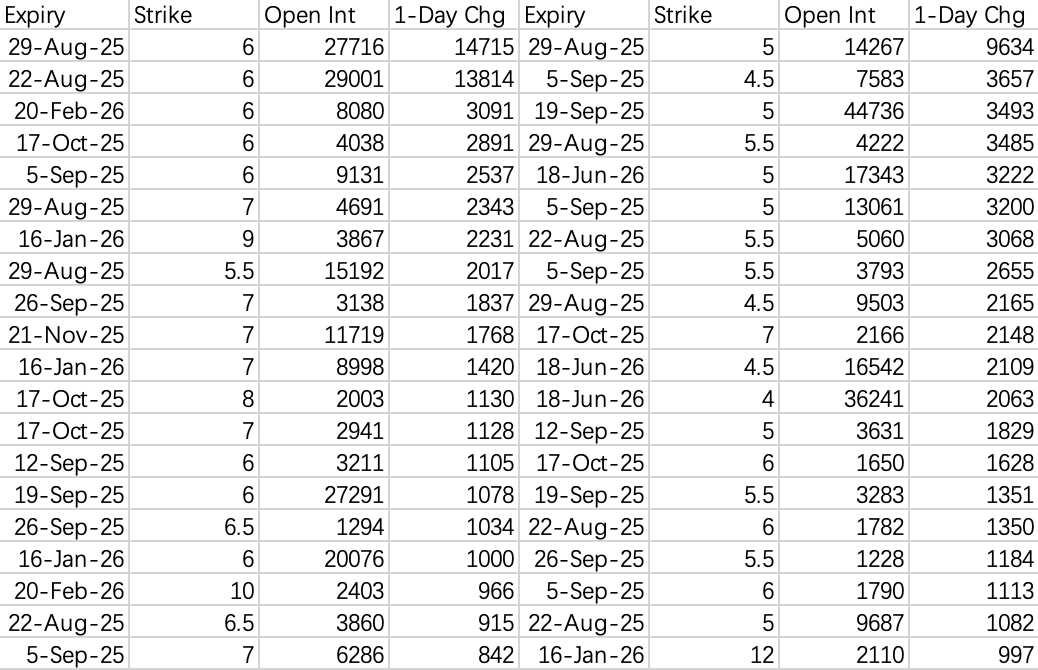

$NIO Inc.(NIO)$

Quick scan: bull positions have been closing out aggressively.

New bullish activity mostly at the $6 strike—so short-term upside is limited.

Not much aggressive bear action either; likely just range-bound for now.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.