How Low Can the Market Go?

Neck pain kept me out Tuesday—turns out the market got a stiff neck too.

Tuesday’s tech dump didn’t have a specific trigger—just a failed handoff of bullish catalysts, so the long-anticipated pullback began.

Tickers covered: SPY, NVDA, TSLA, PLTR, AMD, AAPL, GOOGL, CRWV

$SPDR S&P 500 ETF Trust(SPY)$

On Tuesday, tech stocks fell harder than the index, but that doesn’t mean the overall market drop is done—expect more downside.

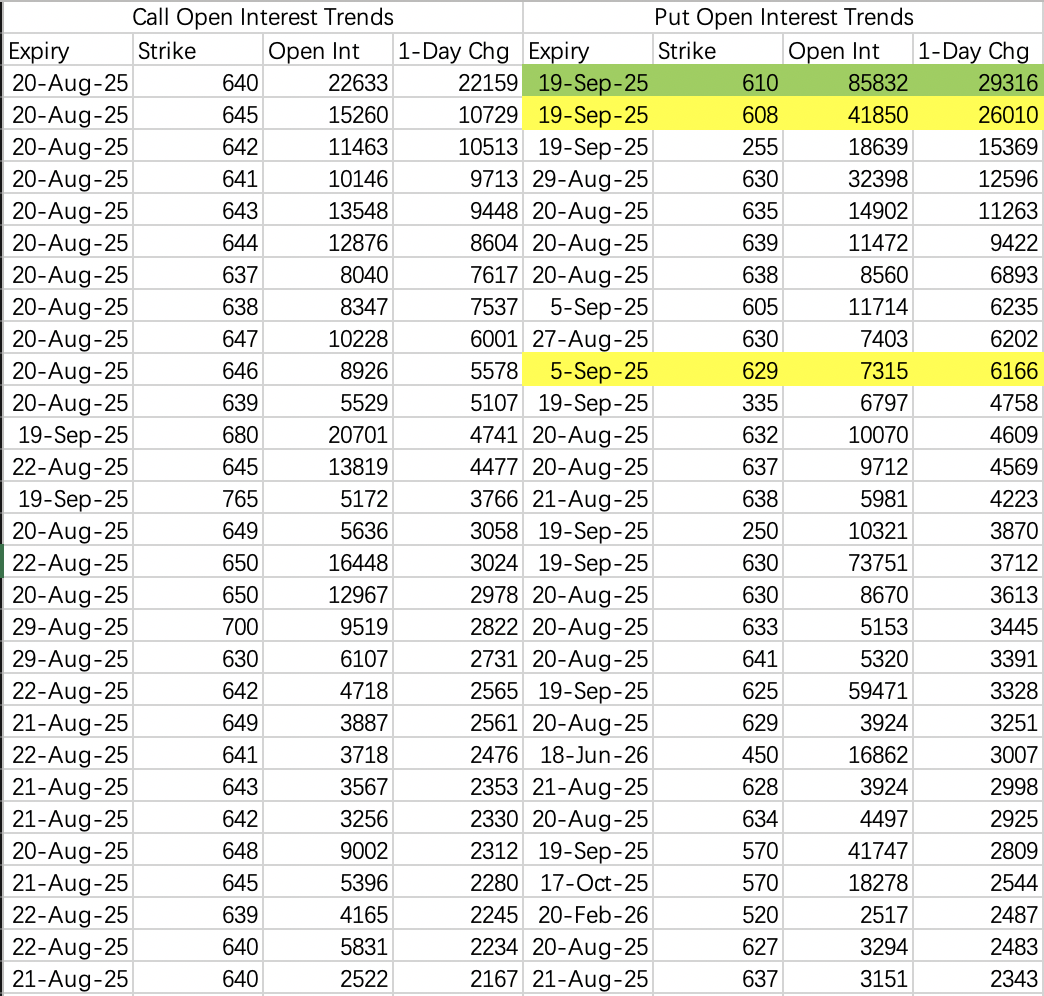

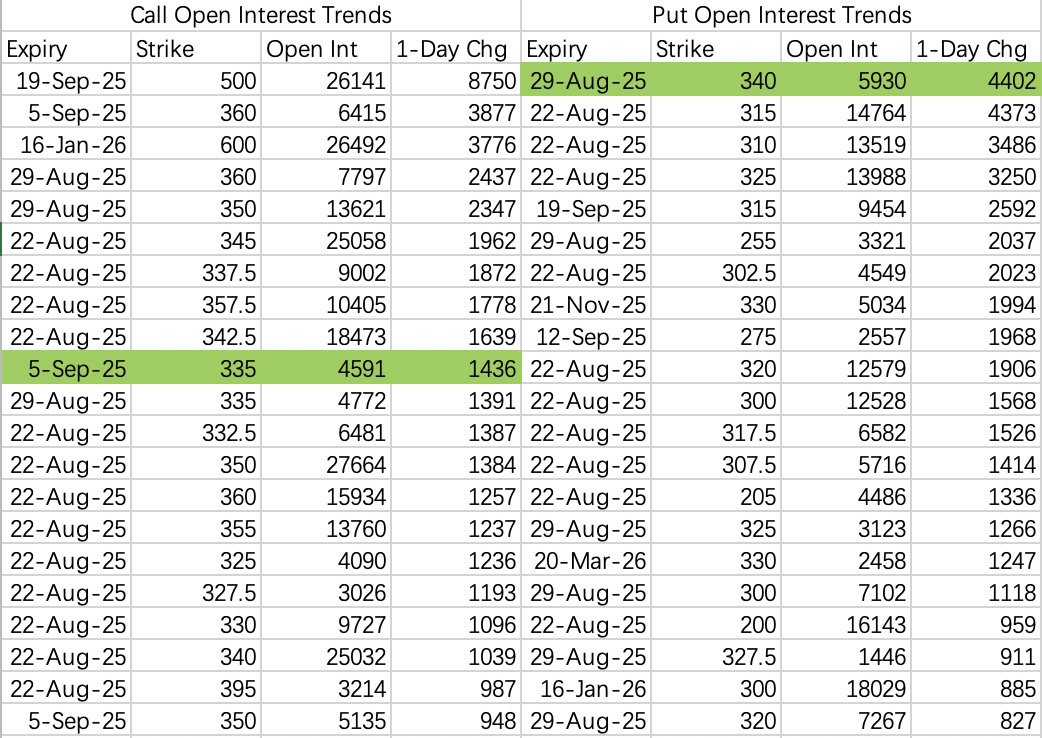

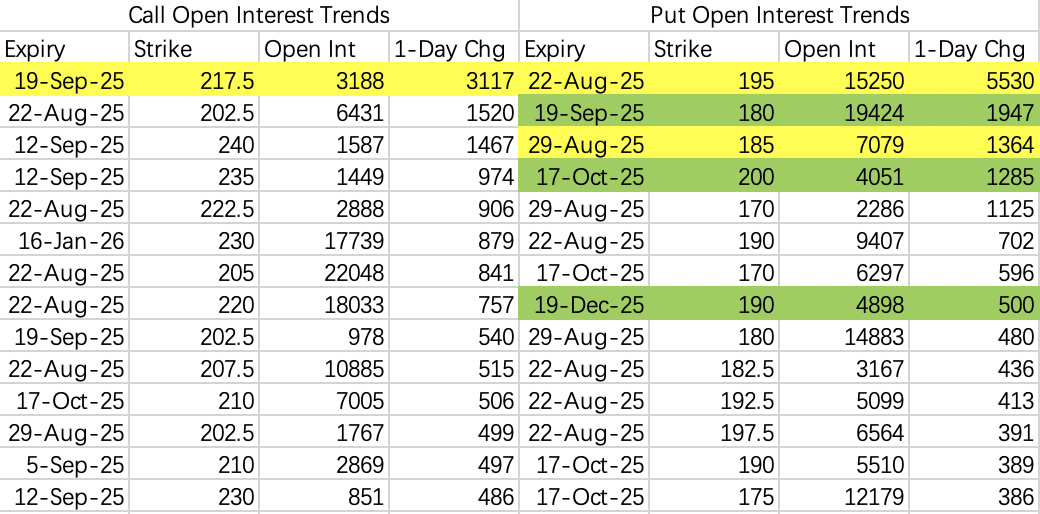

Big open interest in puts, with the next two weeks targeting 630.

As mentioned in Monday’s note, someone opened a SPY 620–640 put spread.

If the market isn’t done dropping, expect more tech weakness.

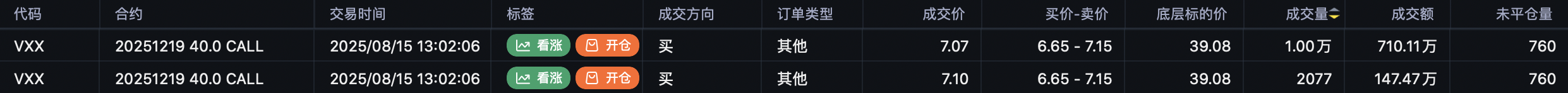

Notable: Large call buys in VIX and VXX—$VXX 20251219 40.0 CALL$ ($8.57M) and $VIX 20251119 22.0 CALL$ ($8.03M).

The VIX 22 call is way out of the money, betting on VIX >20, which would mean SPX around 630 (down ~1.5–1.6%).

Large single-leg VIX call buys are rare—usually it’s spreads/combos. Seeing this means the odds of further market downside just went up.

$NVIDIA(NVDA)$

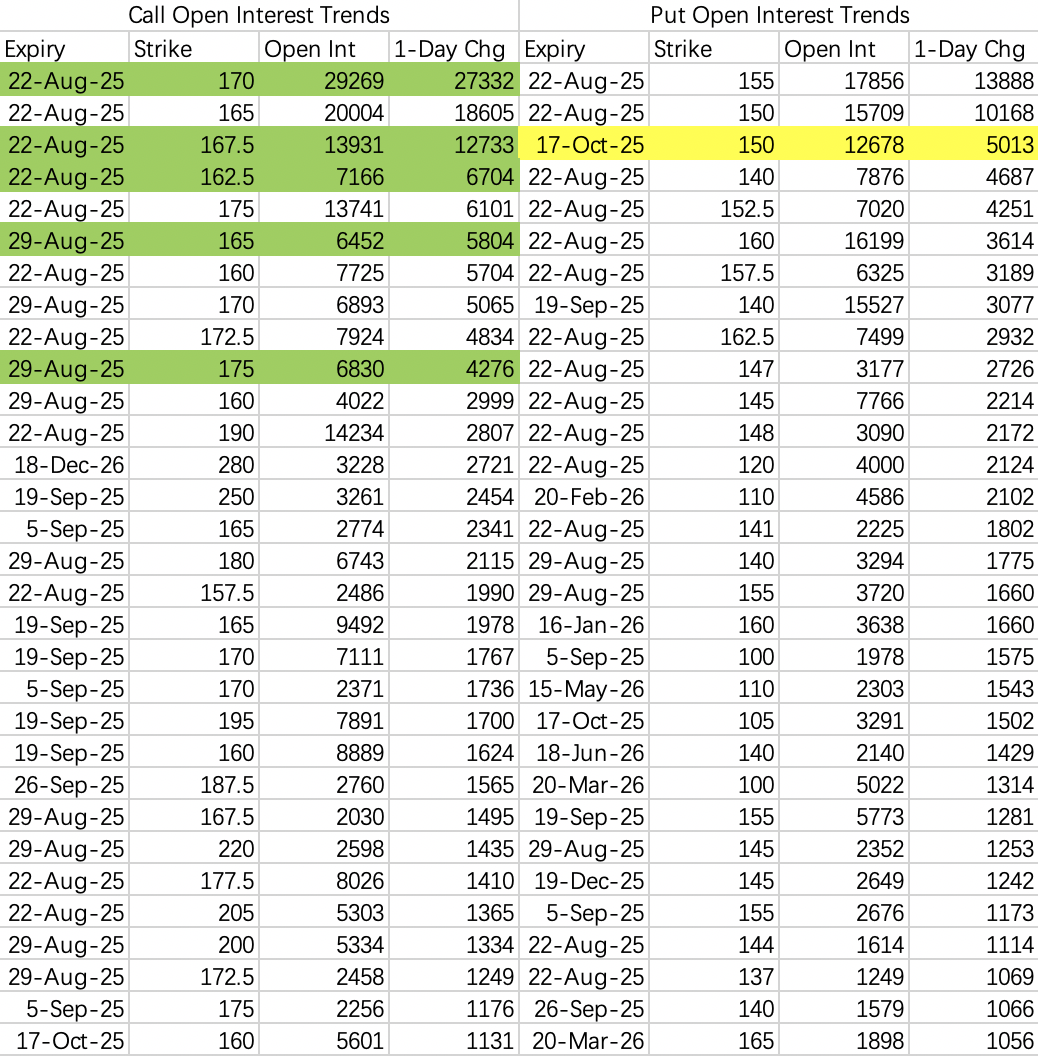

NVDA is still the strongest name this week.

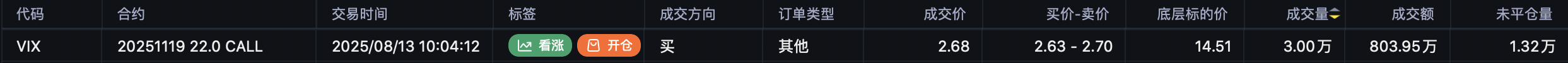

On Tuesday, “$200M guy” rolled calls: closed 160 $NVDA 20250919 160.0 CALL$ and 185 call, rolled up to 190 $NVDA 20250919 190.0 CALL$ and 200 $NVDA 20250919 200.0 CALL$ .

On the put side, big “buy the dip” trades: selling 172.5 put $NVDA 20250822 172.5 PUT$ , buying 170 put $NVDA 20250822 170 PUT$ —suggests NVDA won’t break below 172.5 this week.

Ahead of earnings, NVDA should remain supported.

$Tesla Motors(TSLA)$

Bears weren’t able to push TSLA down—found strong support.

Given bullish call activity, I wouldn’t sell calls here—might miss a move up.

Downside put activity targets 310; if selling puts, stick to 300 strikes.

$Palantir Technologies Inc.(PLTR)$

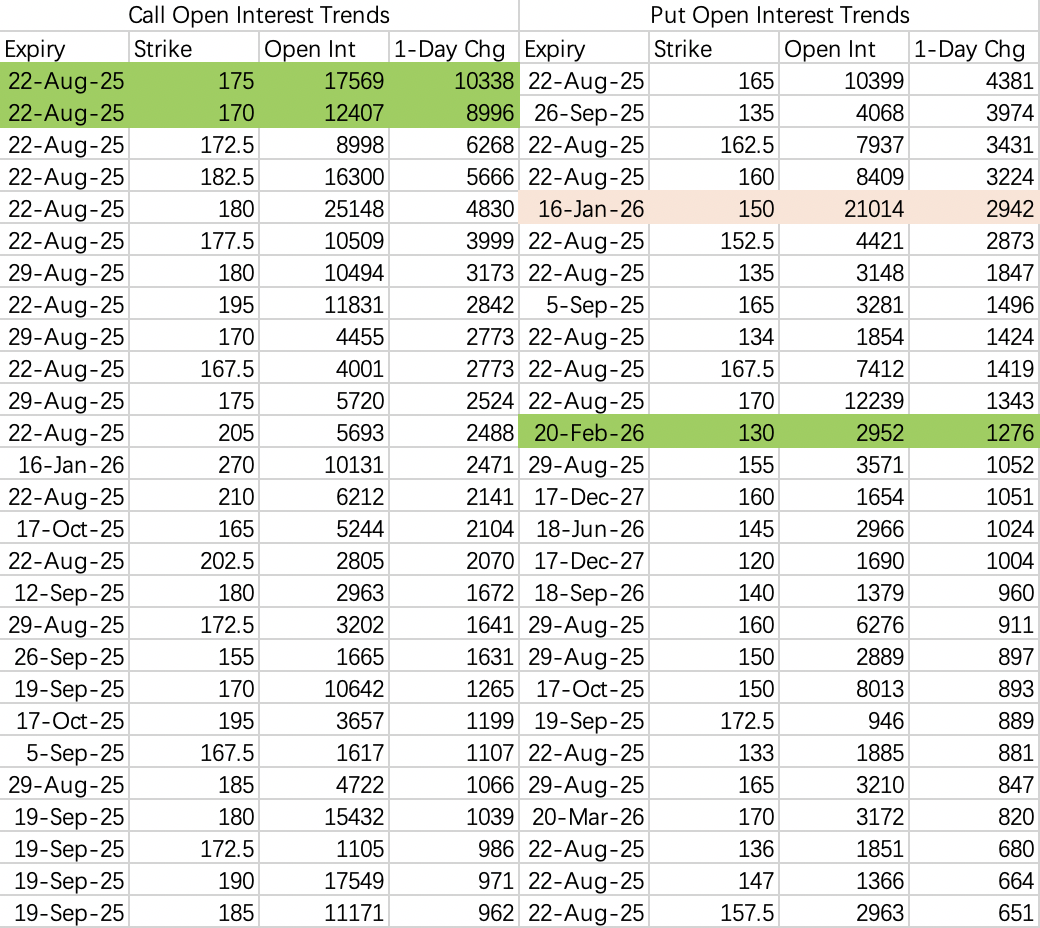

Most call activity is selling, so lots of sell call flows.

Downside target is 150, with possible chop around the 60-day MA (~147).

$Advanced Micro Devices(AMD)$

Calls above 170 are mostly bearish.

Puts are targeting a drop below 165; there’s some disagreement at 150 (bulls vs. bears). If you want to bottom-fish, wait for 160.

$Apple(AAPL)$

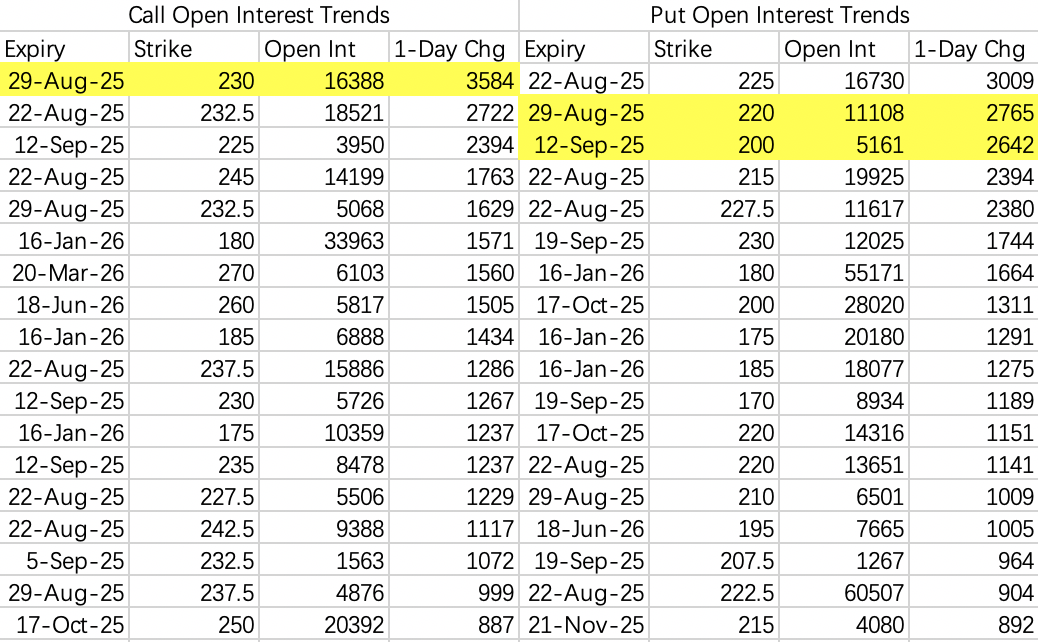

Apple’s pullback targets are split—some see 200, others 220. Oddly, bullish expectations are also strong.

$Alphabet(GOOGL)$

Potential pullback to 190.

$CoreWeave, Inc.(CRWV)$

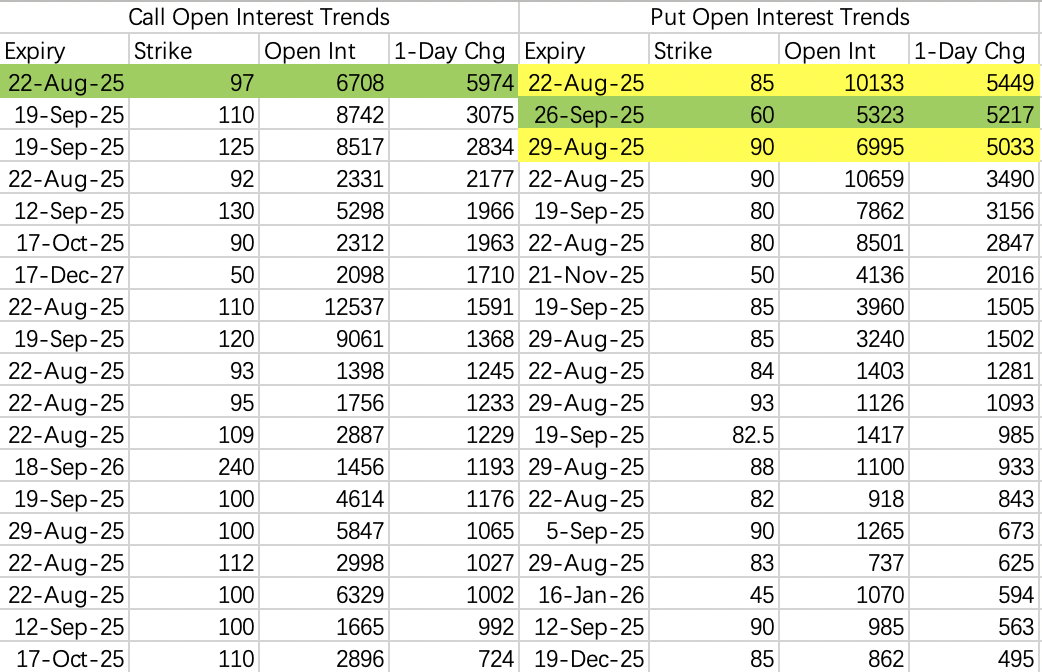

Market sees downside to 80–85.

Last week’s big put roller moved from 100 puts to next week’s 90 put $CRWV 20250829 90.0 PUT$ , suggesting a move below 90.

Funds aren’t interested in bottom-fishing here.

If you’re holding shares, consider a covered combo: sell 97 call $CRWV 20250822 97.0 CALL$ , buy 85 put $CRWV 20250822 85.0 PUT$ .

Trades: Closed out GOOGL puts for safety. Also sold NVDA 170 put $NVDA 20250822 170 PUT$ .

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Jcll·2025-08-20nvda hanging onto 170, might fall further.LikeReport