"Tema" tear each other apart, using the Buy Write strategy to buy Tesla at the bottom?

After Musk bombarded the "Big Beautiful Bill" again, Trump ended up angrily, and the drama of "Tema" tearing each other was staged again!

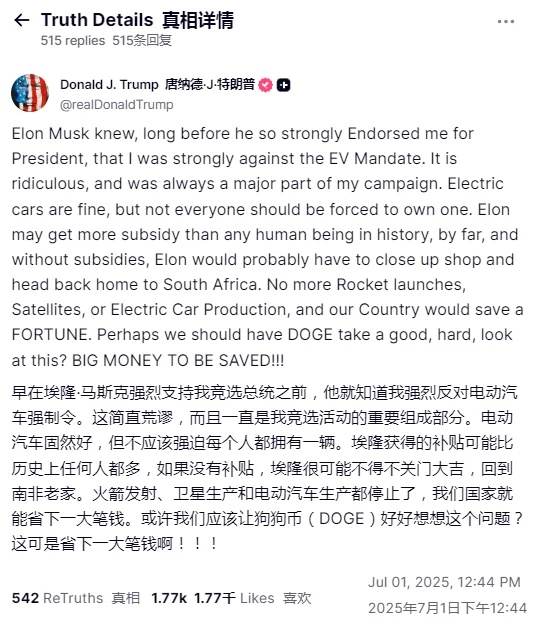

On July 1, local time, Trump bombarded Musk on real social networks, saying that the latter may have received more subsidies than anyone else in history.Without the subsidy, he may have to close down and "return to his hometown in South Africa".

Trump said:

"Musk knew long before he strongly endorsed me for president that I had always been strongly opposed to EV mandates. This policy is ridiculous and has always been an important topic of my campaign. EVs themselves are fine, but everyone shouldn't be forced to own one.Musk may have received more subsidies than anyone else in history, and without them, he may have to shut down and return home to South Africa.Then there will be no more rocket launches, satellite projects or electric vehicle production, and our country can save a lot of money.Perhaps we should let DOGE take a good, careful look at this issue? This can save huge amounts of money!!! "

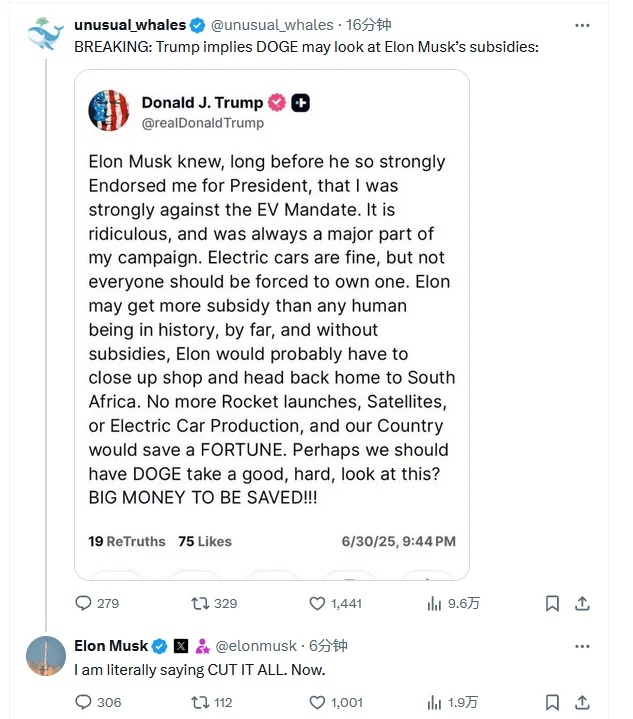

Subsequently, Musk quickly responded on the X platform:

"All cuts, right now."

Musk said:

"I'm just asking not to bankrupt America. If we keep raising the debt ceiling, what's the point?"

After only half a month of reconciliation, "Tema" once again "turned against each other"

Back in early June, Musk criticized the congressional spending bill as "sickening" on his social media platform X and called on lawmakers to withdraw support. Trump then voiced a fight back,Suggested that it would re-examine the government subsidies and contracts received by Tesla and its subsidiaries, "I am very disappointed. It is hard to say how long our relationship can last."

The war of words ended in reconciliation on June 12. After Musk expressed his remorse, Trump gave him a "like" for his remorse, saying, "I think it's good for him to do this." However, Trump did not make a clear statement on whether he was willing to make up with Musk regardless of past grievances.

On the 29th, after a fierce tug-of-war, the U.S. Senate passed the updated version of the "Big Beautiful Act" pushed by Trump with 51 votes in favor and 49 votes against, canceling the $7,500 tax credit enjoyed by consumers when buying electric vehicles in advance.

This once again triggered Musk's dissatisfaction. On the same day, Musk fiercely criticized the "Big Beautiful Act", saying that cutting subsidies for electric vehicles and clean energy would destroy future industries in the United States and destroy millions of jobs. It was political suicide for the Republican Party and would cause "incredible damage" to the United States. ".

As the "battle" between Trump and Musk escalates again,$Tesla (TSLA) $In response to the sharp drop, the stock price once fell by nearly 7% in night trading. For investors who want to buy bottoms, you can consider using the Buy Write option strategy.

Tesla Buy Write Strategy and Profit and Loss Analysis

In options trading, the Buy Write strategy (buying stocks while selling corresponding call options) is a robust strategy that can not only reduce the cost of holding positions, but also lock in some returns when the stock price rises moderately. Below we will take Tesla's current data as an example for detailed analysis:

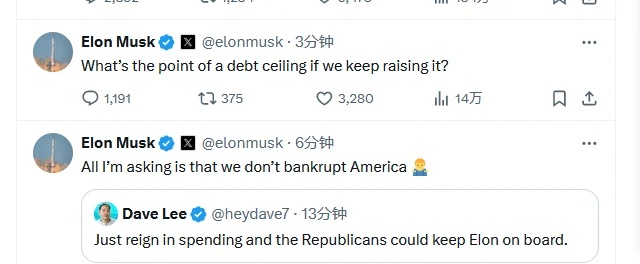

Tesla Current Price: 300dollar

Call option strike price:$360 (due: March 20, 2026)

Options premium:$4940/share (assuming each option corresponds to 100 shares)

Strategy name: Buy Write (buy spot + sell call options)

Buy 100 shares of Tesla (TSLA), the current stock price is $300, and the total cost is $30,000;

At the same time, sell a call option with an exercise price of $360 and an expiration date of March 20, 2026, and earn premium revenue of $4,940 (i.e. $49.40 per share);

Therefore, your net position cost is $30,000-4,940 = $25,060, and the equivalent buying cost is $250.60 per share.

Maximum benefit analysis:

If Tesla shares rise to $360 or above at expiration:

Stock gain gain = (360-300) × 100 = $6,000;

Plus premium gains of $4,940;

Total proceeds of 6,000 + 4,940 = $10,940;

The input cost is $25,060, so the maximum return is about 43.7%.

Break-even point:

Net input was $25,060;

So the break-even point per share is $250.60;

Positive gains are realized if the stock price is higher than $250.60 at expiration.

Maximum loss analysis:

If Tesla's stock price falls to 0, the stock part will lose $30,000;

Net of $4,940 received from premium;

The maximum loss is $30,000-4,940 = $25,060.

Examples of profit and loss at different stock prices:

If the share price is $200, the total loss to maturity is about $5,060;

If the share price is $250, it is close to breakeven;

If the stock price is $300, the option is voided, and the gain is $4,940 for premium;

If the stock price is $360, the stock is executed and sold, and the total gain is $10,940;

If the stock price rises to $400, you can only get $10,940, because the earnings are capped.

Strategic advantages:

Lock in premium earnings and perform well when the stock price goes sideways or moves up slightly;

The actual purchase cost has been greatly reduced, increasing the margin of safety;

The risk is slightly lower than simply buying stocks.

Risk warning:

The room for stock price growth is capped, and you cannot enjoy all the rising gains;

If the stock price plummets and the loss is still significant, premium can only buffer part of it;

If you want to continue your holdings in the future, you need to consider extending or covering options.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- andy66·07-01Actually, all of this is manipulated by capital behind the scenes.Large funds are buying put options and they are starting to have conflicts.The large funds gain profits and sell their options, and then they reconcile.LikeReport