Pullback Next Week?

$NVIDIA(NVDA)$

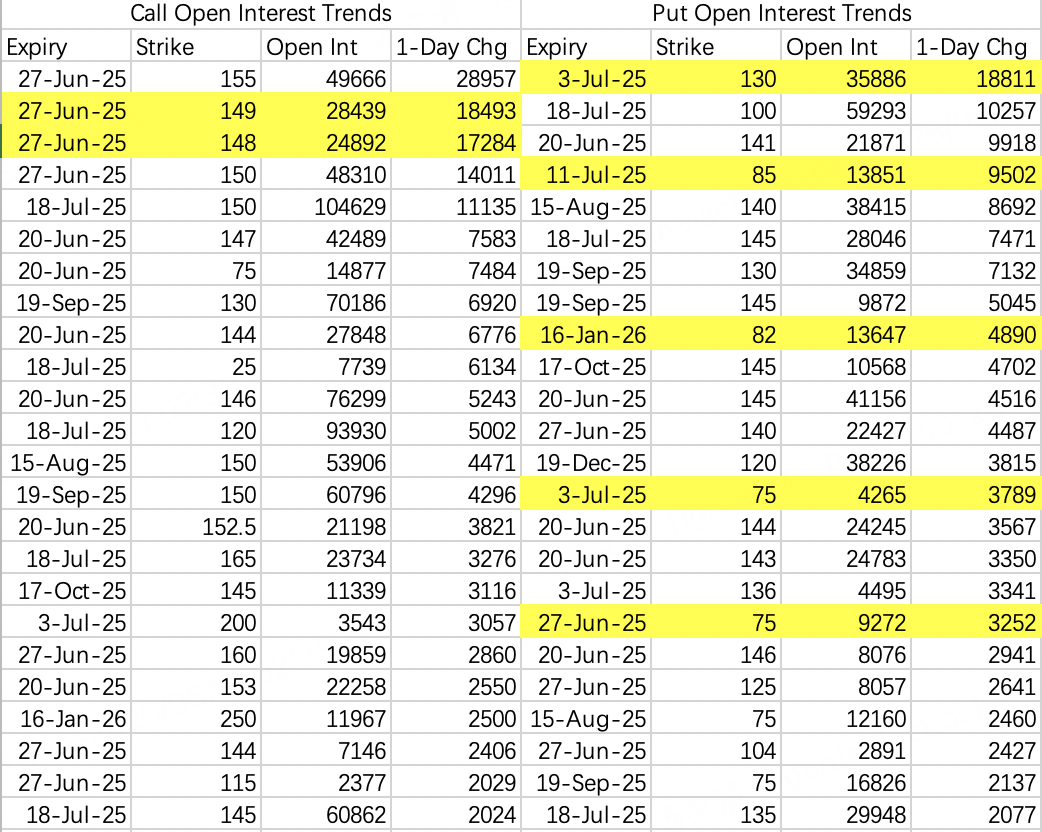

Bears seem to have plans to act next week. The July 3 $130 put $NVDA 20250703 130.0 PUT$ saw an unusual open interest of 18,800 contracts, with most trades being on the buy side, according to transaction records.

Due to the quiet period and unfavorable macroeconomic conditions, bulls also agree that NVIDIA’s upside next week will be limited, similar to this week’s range. Institutions have set sell call strike prices between $148–$149.

Overall, while the AI theme remains strong, the week of June 27 is likely to see sideways to slightly downward movement.

$SPDR S&P 500 ETF Trust(SPY)$

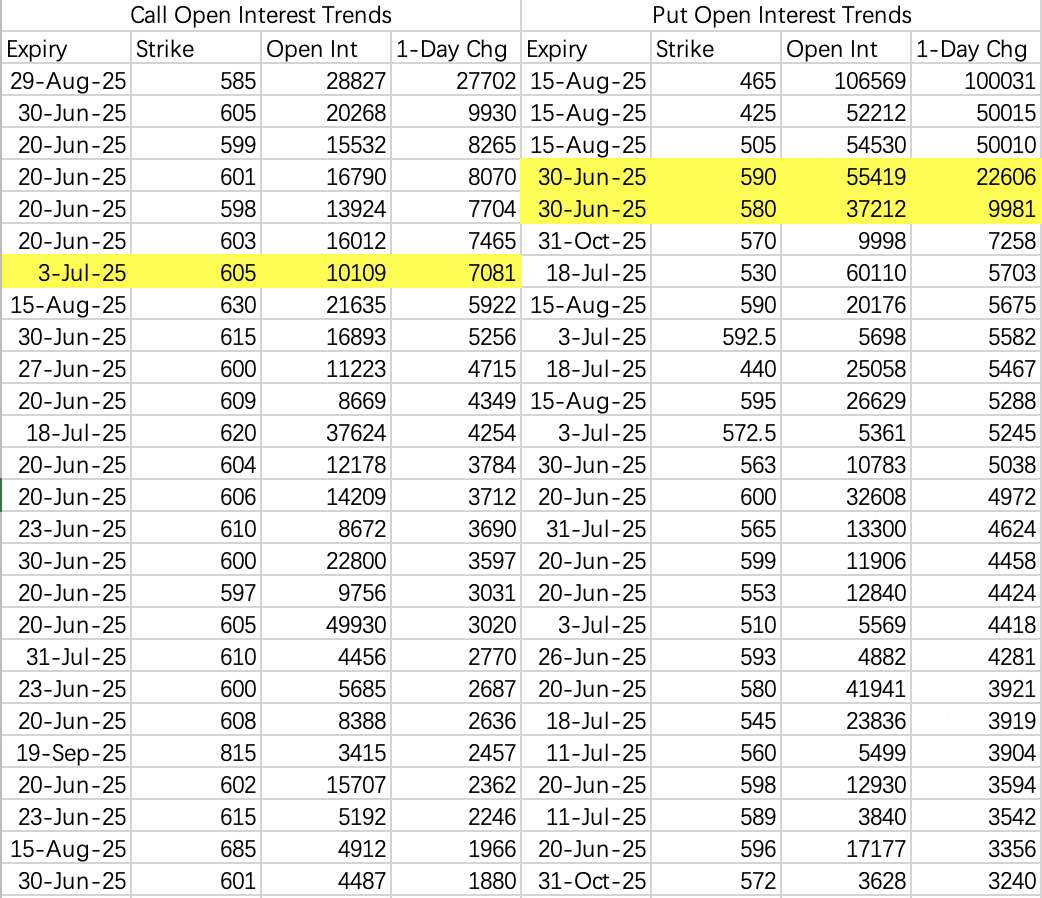

Bears are also positioning for a minor pullback in SPY next week. Some traders have bought a 590–580 put spread expiring June 30:

This suggests an expectation that SPY could drop below $590, but remain above $580.

This projected drop aligns with implied volatility. Based on at-the-money options, next week’s expected trading range for SPY is approximately $586–$607.

One notable trend is the increase in long-dated bullish call positions, indicating that bulls are gaining confidence in SPY over the long term.

$Tesla Motors(TSLA)$

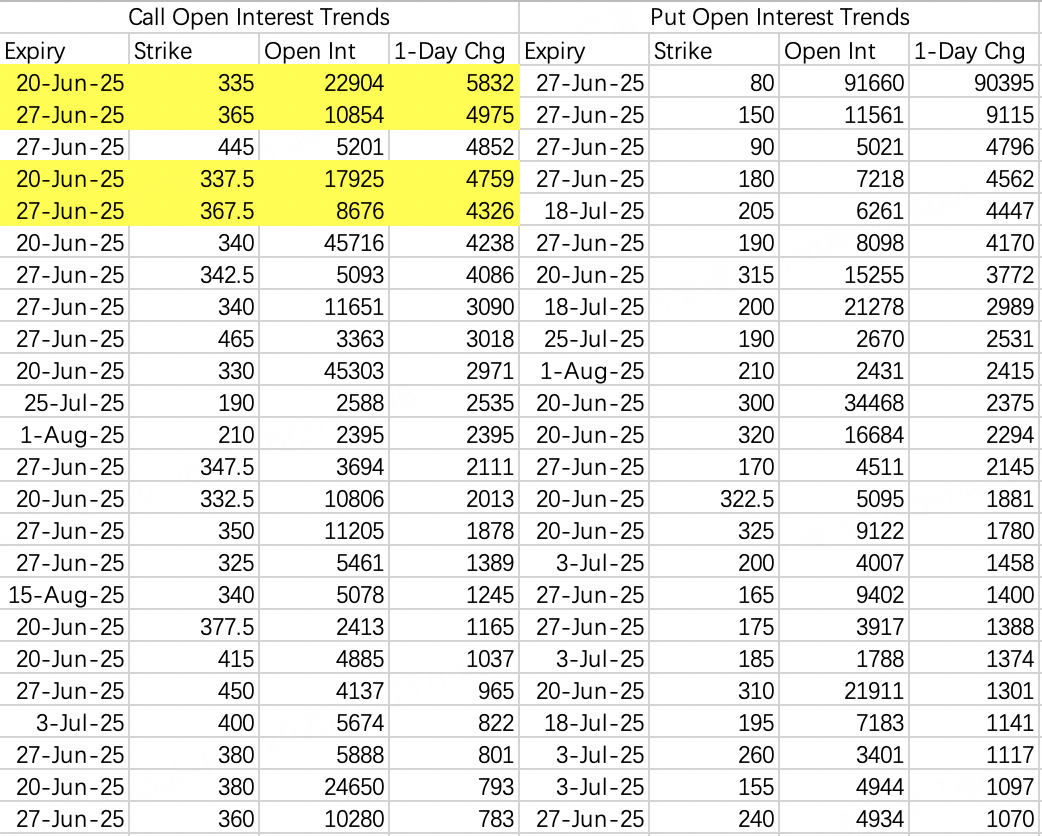

Tesla doesn’t seem to have much upside expectation either. Institutions are selling calls at strikes of $335–$337.5, while hedging at $365–$367.5.

There’s no clear consensus on Tesla’s downside. Bears expect this pullback to drop Tesla below $300, but there aren’t many serious short positions being opened.

$Coinbase Global, Inc.(COIN)$

The passage of the stablecoin regulation bill, combined with payment-related tailwinds, has caused CRCL to drive a surge in Coinbase’s stock price. Since Coinbase shares in CRCL’s new revenue streams, the rally was expected.

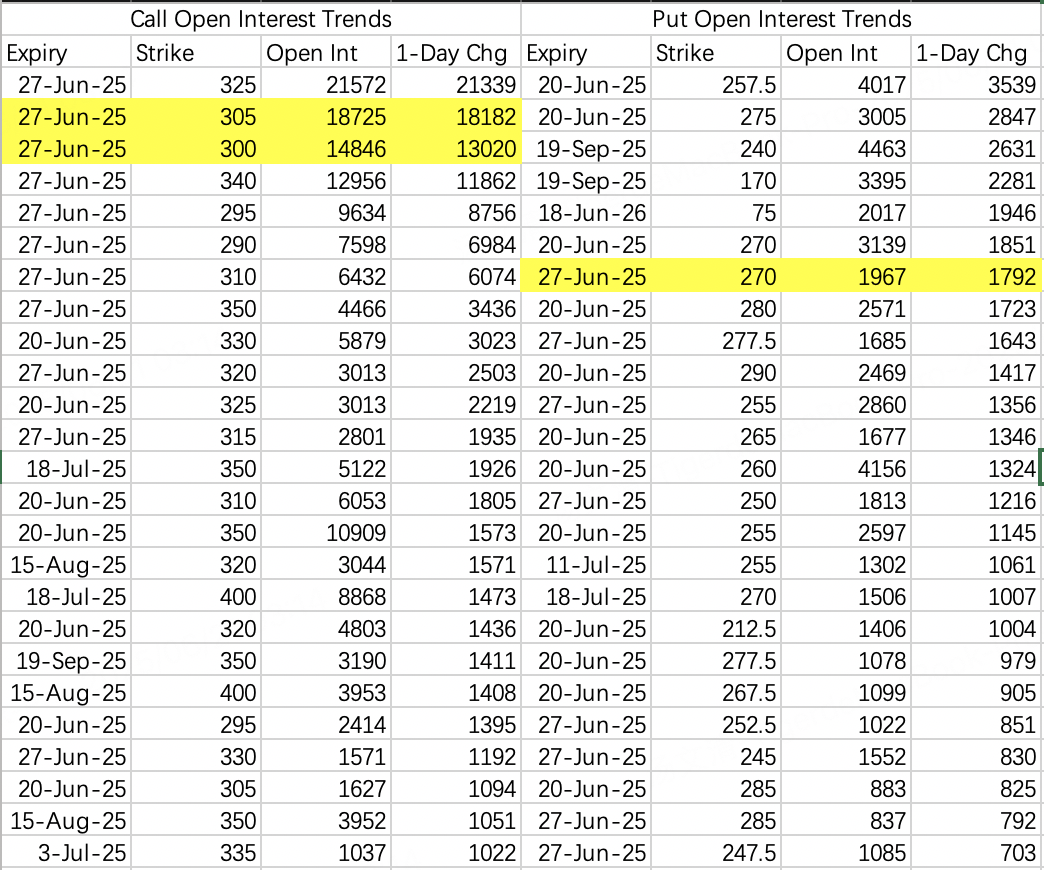

This rapid spike caught sell-side arbitrage institutions off guard. In response, they rolled their positions to moderately high strike prices. Based on the chart, institutions expect Coinbase’s stock price to stay below $300–$305 during the week of June 27. However, Coinbase’s stock already reached $305 on Friday.

Institutions likely anticipate a pullback, which is why they set these targets. On the downside, the pullback is expected to test $270.

As a side note, CRCL’s options data has limited reference value since higher strike prices are being added daily.

$Advanced Micro Devices(AMD)$

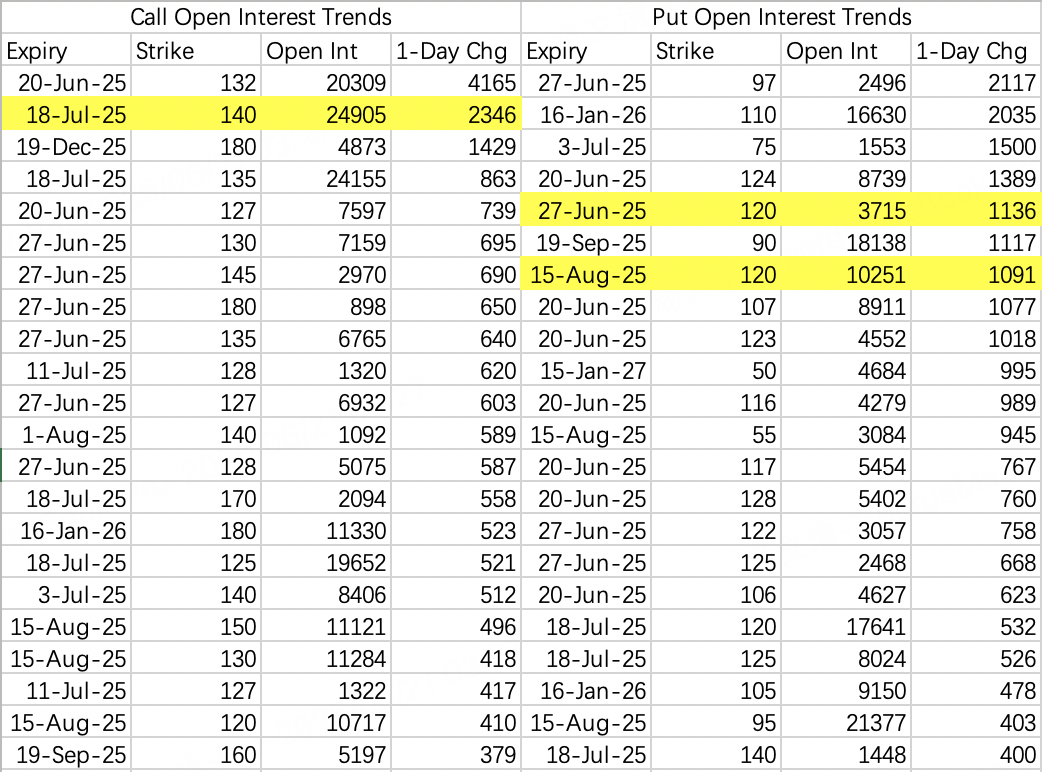

Opinions are sharply divided between bulls and bears on AMD, a stock that has seen strong upward momentum. Sell-side institutions are bearish on AMD’s performance next week, expecting AMD to trade below $132–$134 during the week of June 27. To hedge, they’ve bought calls at $140.

There’s no strong consensus on AMD’s downside either. Based on open interest data, the preferred bearish target appears to be $120.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.