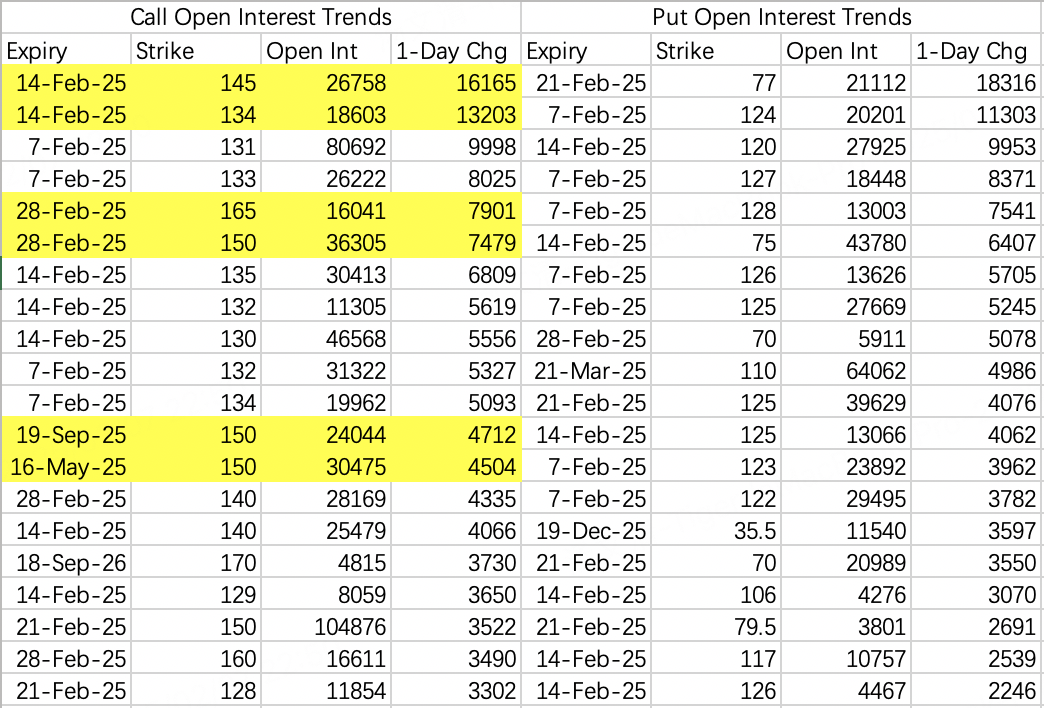

Today's Friday closing above 124. Institutions selling 134 calls next week might face a squeeze.

Yes, the stock price will reach 130 next week and challenge 134.

Institutions very carefully widened the bear spread strike distances, buying 134 and selling 145, but there are too many new call positions below 134 for February 14th week. Uncertain if price will stay below 134 next week:

Sell $NVDA 20250214 134.0 CALL$

Buy $NVDA 20250214 145.0 CALL$

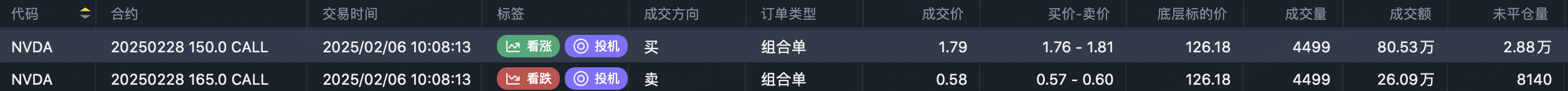

Thursday saw two large earnings-focused positions, with break-even analysis suggesting traders expect 150 for earnings.

February 28th expiry call spread targets above 150 but below 165:

Buy $NVDA 20250228 150.0 CALL$ , transaction value 800K

Sell $NVDA 20250228 165.0 CALL$ , transaction value 260K

Calendar spread with stock holding strategy expects 150 cap in H1, new highs in H2. This aligns with current market consensus of moderate H1 performance and stronger H2:

Stock position

$NVDA 20250516 150.0 CALL$ , transaction value 3.375M

$NVDA 20250919 150.0 CALL$ , transaction value 6.825M

I continue to sell 120 puts $NVDA 20250214 120.0 PUT$ , and have sold 135 calls.

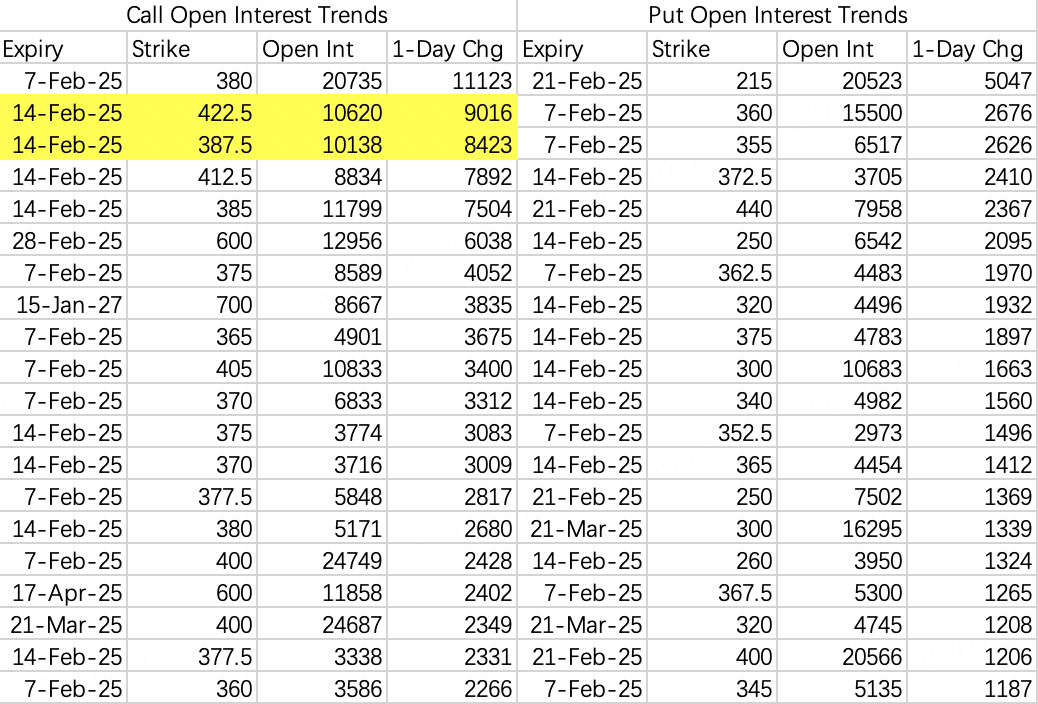

Tesla looks set for a big drop, but put option openings are sparse with no real bearish momentum. Call options actually suggest a potential counterattack.

For February 14th week, institutions selling 387.5 calls:

Sell $TSLA 20250214 387.5 CALL$

Buy $TSLA 20250214 422.5 CALL$

Given Tesla's previous price action, market cap management team might intervene. I won't short at this level, selling one 320 put $TSLA 20250214 320.0 PUT$

Long Call Large Orders

Major tech stocks all have institutional long calls. Institutions typically roll positions post-earnings, though sometimes pre-earnings like NVIDIA.

These calls have mixed results, but historically prices oscillate around strike prices. Strike price minus 10% can serve as reference for put selling:

$NVDA 20250417 110.0 CALL$

$TSLA 20250516 400.0 CALL$

$AAPL 20250516 255.0 CALL$

$MSFT 20250516 400.0 CALL$

$AMZN 20250417 235.0 CALL$

$TSM 20250516 200.0 CALL$

$GOOGL 20250516 240.0 CALL$

$AMD 20250417 105.0 CALL$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- SiliconTracker·02-08 11:47Follow it upLikeReport