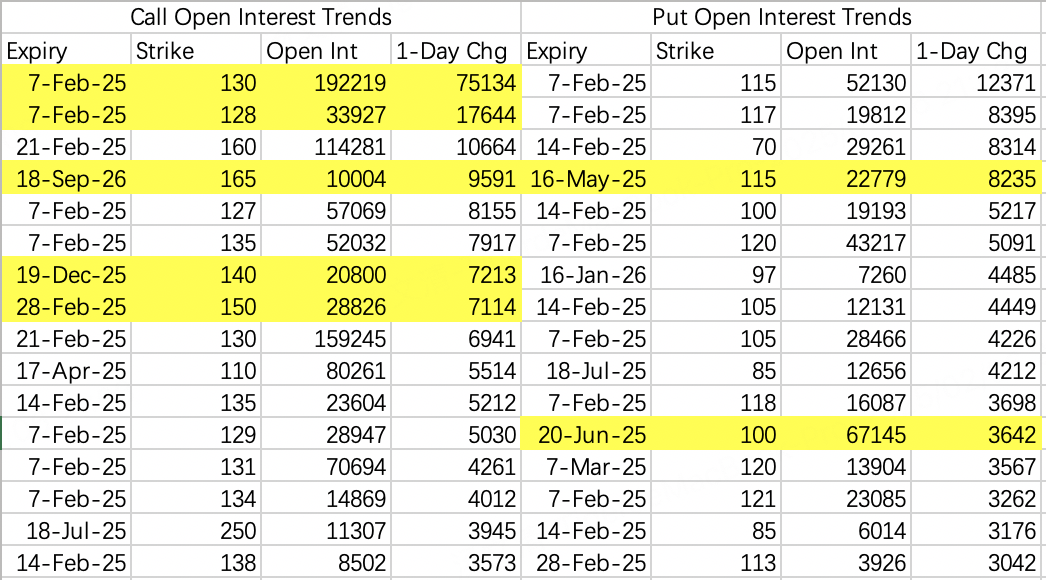

Without tariff disruptions, NVIDIA would fluctuate between 120-130 before earnings and push toward 140, but wouldn't reach 150.

According to Wednesday's options details, 75,000 new contracts of this week's 130 calls were opened, mainly as sell orders. The stock price can be used for selling calls on highs.

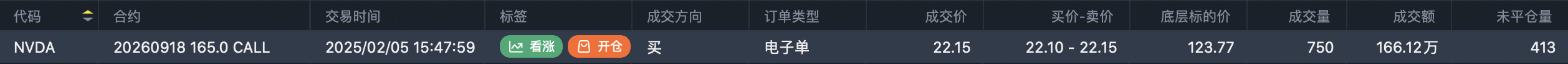

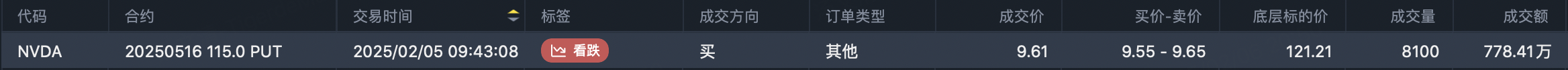

Notable large orders include 9,591 contracts of $NVDA 20260918 165.0 CALL$ and 8,235 contracts of $NVDA 20250516 115.0 PUT$ , both with transaction values in the millions. The former targets pre-earnings price rebounds, while the latter targets tariff risks.

Both scenarios are highly probable - choose a direction based on whether you're bearish or bullish.

However, buying single-leg calls remains aggressive. Based on opening positions, we'll likely see price oscillation between 120-130 over the next two weeks, risking time decay.

Bulls might worry about sudden drops, but given current conditions, elasticity should remain good even in a downturn. Tech giants have revealed increasing rather than decreasing AI capital expenditure, providing a floor for NVIDIA's earnings expectations. If there's a sharp drop before earnings, it might actually present a good opportunity to buy calls - making this a relatively safe period.

Note that March 4th, after earnings, is the tariff implementation date, which could cause complications.

Amazon is expected to report strong Q4 results, with robust holiday sales and continued growth in online advertising and cloud demand. Morgan Stanley sets a target price of 280, with a bull case target of 350.

Institutional long call strike price choice of at-the-money 235 $AMZN 20250417 235.0 CALL$ also indicates positive price expectations for Amazon.

Selling puts at the money seems viable, though for safety, consider selling 220 puts $AMZN 20250207 220.0 PUT$ .

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- YueShan·02-07 00:45Good ⭐⭐⭐LikeReport