How META survive the "DeepSeek" AI Root?

Zuckerberg likes to play "anti-logic".While investors are convinced that the advent of DeepSeek reduces costs across the industry, $Meta Platforms, Inc.(META)$ has chosen to be a maverick, further increasing its capital expenditures, much of which will be spent on AI infrastructure.

However the market bought in!

Summary.

The Capex boost has already been previewed, not incremental information; and the Capex structure is different, focusing on inference measurement;

Meta's Capex load is not just AI, but more importantly its recommendation system and advertising products that directly generate revenue;

Only by investing is it more likely to come out on top.

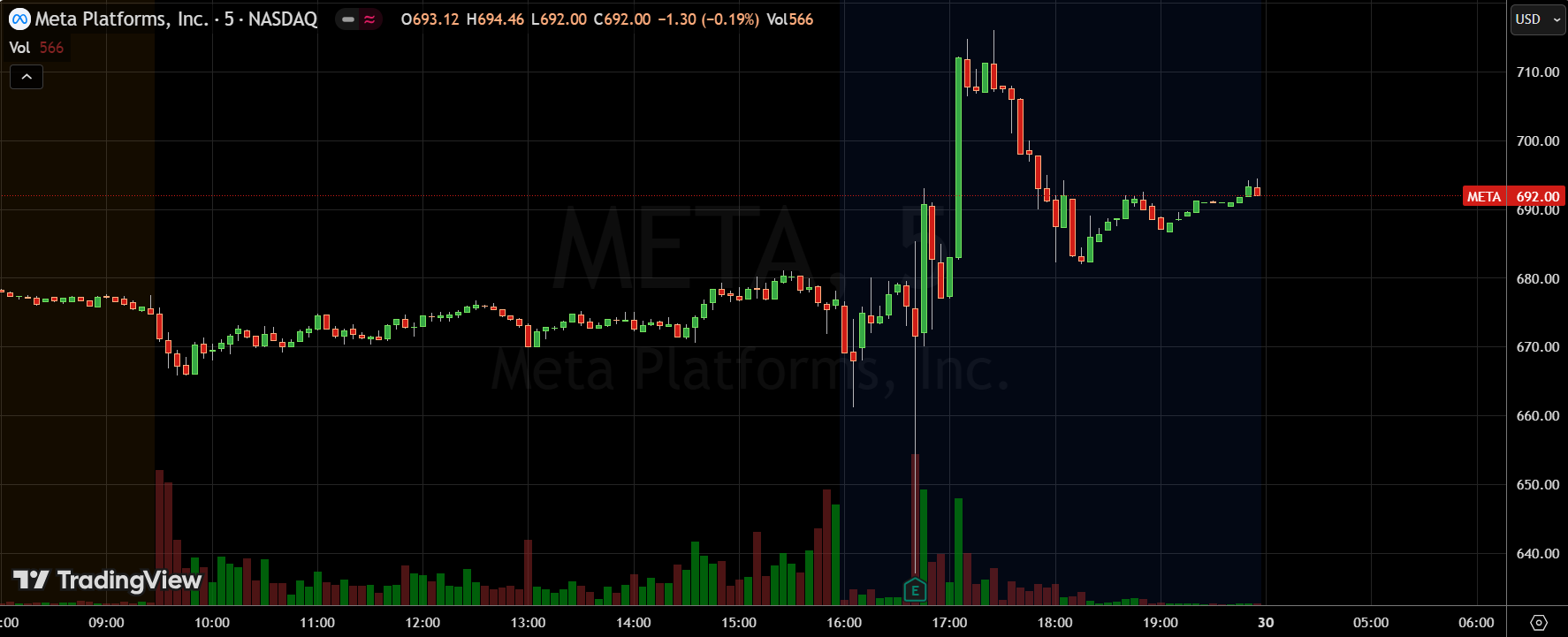

Q4 Results and Market Feedback

META was shaken within minutes of releasing Q4 earnings, then immediately rose slightly before pulling back on the call.

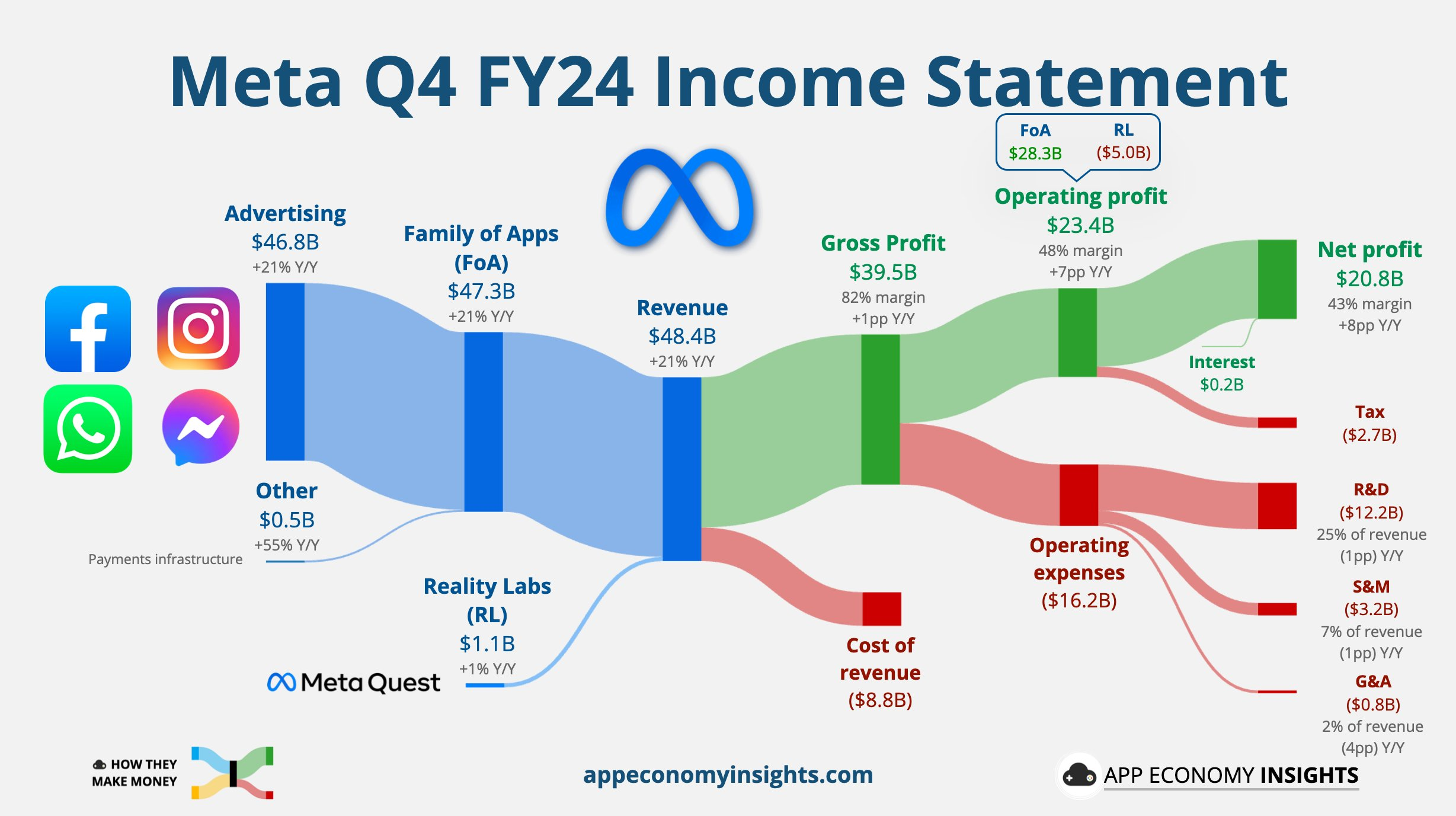

Significantly ahead of expectations Q4 results with $48.39 billion in revenue (+21%YoY, beating Consensus' $46.98 billion), operating margin (48.3% vs. 42.8%), and subscribers (3.35 billion DAUs, +5%YoY).

The write-back of legal expenses in this case led to much higher than expected profits, with actual operating margins about 3 percentage points higher than expected

But revenue expectations for Q1 were more conservative ($39.5-$41.8 billion, weaker than Consensus' $41.7 billion)

After the delayed earnings release, CEO Mark Zuckerberg opened Meta's conference call with optimistic expectations for AI in 2025, after which shares rose 5% after hours.

Investment highlights

Incremental advertising comes from e-commerce, Reality Labs increases revenue and reduces losses, Zuckerberg continues to paint the pie for AI glasses.

Ad revenue reached $46.78 billion (+21% YoY), with the number of ads shown in the app family growing 6% in Q4 and average ad prices up 14%; e-commerce was the largest contributor to Meta ad growth, with more volume growth coming from APAC;

The Reality Labs division delivered growth ($1.08 billion, +1.1% YoY); Reality Labs posted a better-than-expected operating loss of $4.97 billion;

Zuckerberg has high hopes for Ray-Ban's Meta AI eyewear as potentially the next major segment and sees 2025 as the "decisive year" for AI eyewear, and he sees Reality Labs as another segment that could provide the next catalyst for non-linear growth;

META AI product goals;

User tier goal: 1 billion users by the end of 2025 to become the leading AI assistant; short-term goal of user growth, exploring paid recommendations or premium versions of Meta AI in the future;

The open source AI model Llama is getting more and more adoption, becoming an industry standard for its open source approach and extensive hardware support;

Capex investment is only increasing, is it in line with market expectations?

2025 capex guidance of $60-65bn (actual will generally be at midpoint) + 50% YoY is also higher than Consensus of $52bn (long overdue update), but this has been announced before and is therefore not incremental information;

Total full year 2025 spending is expected to be in the range of $114 billion to $119 billion, with the largest single driver of spending growth to be infrastructure costs driven by higher operating expenses and depreciation, i.e., there will be some impact on CY25 margins.This comes on the heels of META's projected 5.5-year depreciation life for AI servers and the like;

Much of META will be used for AI infrastructure, and more pre-training resources won't necessarily be needed in the future, but inference loads will grow significantly, so it's too early to tell if chip demand will stop growing.

Invest in large AI data centers to support the growth of AI technology.Nearly 1 gigawatt of capacity is expected to come online this year, and a 2 gigawatt or even larger AI data center is under construction.

Chip adoption discussion

META explicitly said it is developing its own custom chips to optimize AI workloads;

Meanwhile, ASIC MITA is used for training (recommendation and ranking systems), hinting at a possible replacement for NVIDIA's GPUs, hence the divergence in performance between $NVIDIA(NVDA)$ and $Broadcom(AVGO)$ after hours.

Final question to Q4 Rarnings

Why is it that META, which guided less than expected (on the revenue side) while also boosting Capex (and also stating that it will impact margins in 2025), didn't have a selloff like MSFT?

The Capex boost has been telegraphed, the market has digested quite a bit of it, and in terms of ring-fencing, it has also been non-growing;

Capex is structured differently, don't think more pre-training resources will necessarily be needed in the future, but the inference load will grow significantly (more SHORT lived assets)

Meta's Capex load is not just AI, but more importantly its recommender system and advertising products, which are directly revenue-generating (ad boosts, adding new inventory such as Message, Threads, Marketplace, etc.), and in the CFO's exact words on the call: continue to spend the majority of the investment on the development and operation of our family of apps

Only if this part of the production goes down can we continue to lift the Capacity constraints, and the company expects the resource constraints to ease significantly in the first half of 2025;

The overall market size of AI has just exploded, and coming out on top will allow for a bigger slice of the market pie (as in, NVDA accounts for 80% of the AI chip market share).

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Krispnz·01-31Savvy response to market competition. This one’s worth holding or buying.LikeReport