Big banks Q4 Earnings Review

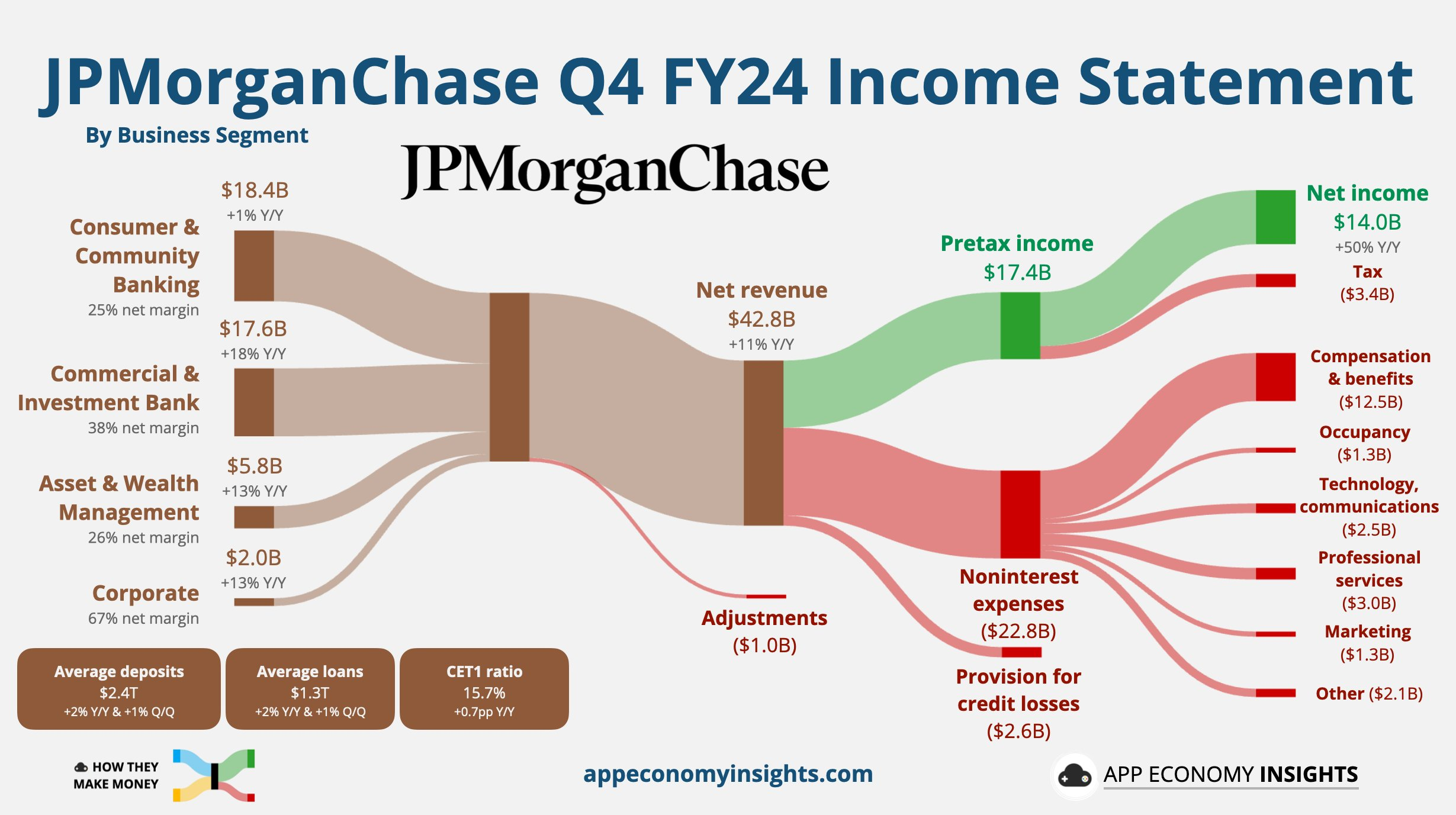

1. JPMorgan Chase & Co. $JPMorgan Chase(JPM)$

JPMorgan Chase had a strong fourth quarter, with key metrics beating analysts' expectations.The bank reported adjusted revenue of $43.74 billion, significantly beating the widely expected $42.01 billion.Earnings per share came in at $4.81, demonstrating strong profitability.Shares of JPMorgan Chase were up 2% in pre-market U.S. trading.

Key performance indicators:

Loans: $1.35 trillion, in line with expectations

Provision for credit losses: $2.63 billion, below expectations of $3.04 billion

Return on equity: 17% (vs. 14.1% expected)

Return on tangible common equity: 21% (expected 17.2%)

Book value per share: $116.07

CEO Jamie Dimon emphasized the company's strong performance across all lines of business, particularly in the following areas:

Investment banking fees (up 49%)

Markets business revenue (up 21%)

Payments revenue (record $18.1 billion for the year)

Consumer Banking growth (2 million net new demand deposit accounts in 2024)

Asset & Wealth Management (record revenue of $5.8 billion)

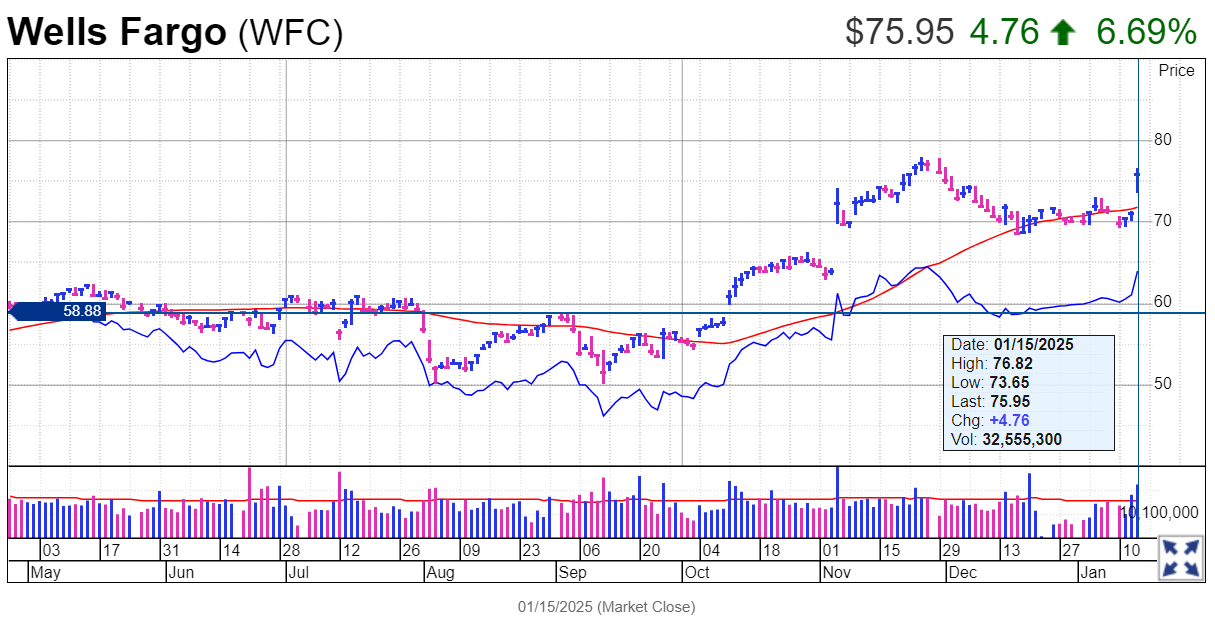

2. Wells Fargo & Co $Wells Fargo(WFC)$

Wells Fargo reported mixed Q4 2024 results, with strong net interest income performance but some pressure on overall revenue and expenses.Wells Fargo shares are up 2.5% in pre-market trading in the US.

Key metrics:

Net interest income: $11.84 billion (beating expectations of $11.7 billion)

Revenue: $20.38 billion (slightly below expectations of $20.59 billion)

Earnings per share: $1.43

Average loans: $906.4 billion

Efficiency ratio: 68% (higher than expected 64.9%)

Business Segment Performance:

Commercial Banking revenue: $3.17 billion

Corporate & Investment Banking revenue: $4.61 billion

Wealth & Investment Management Revenue: $3.96 billion

Consumer banking and lending revenue: $8.98 billion

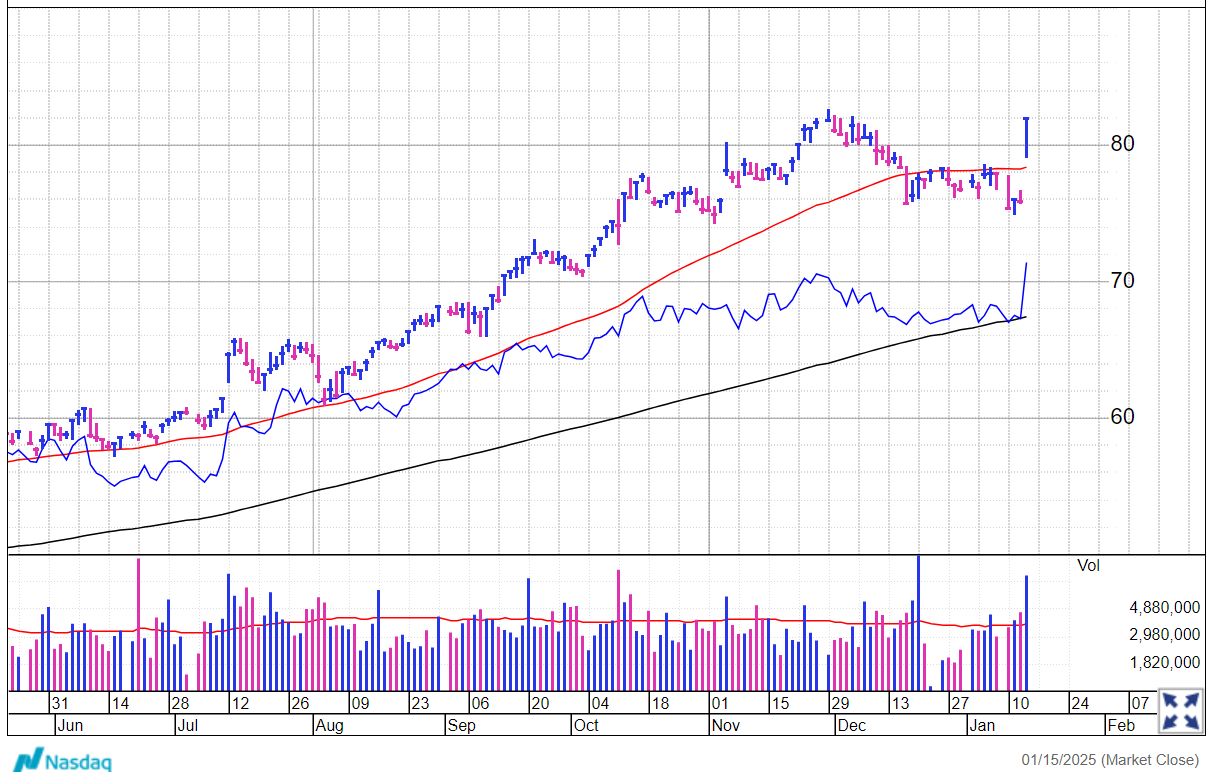

3. Bank of New York Mellon Corp $Bank of New York Mellon(BK)$

Bank of New York Mellon reported strong fourth-quarter results, thanks to better-than-expected interest income and fee income, with both earnings and revenue significantly beating estimates.Shares of Bank of New York Mellon rose 1.75% in U.S. premarket trading.

Key highlights:

Adjusted EPS: $1.72 (vs. $1.58 expected)

Total revenue: $4.85 billion (up 11%)

Net interest revenue: $1.19 billion (beat expectations of $1.06 billion)

Net interest margin: 1.32% (beat expectations of 1.17%)

Total fee and other revenue: $3.65 billion (beat expectations of $3.61 billion)

Asset Management & Services:

Assets under management: $2.03 trillion

Assets under custody: $52.1 trillion

Net outflow of funds: $15 billion

Total deposits: $289.52 billion

Operational Efficiency:

Noninterest expense: $3.36 billion

Return on equity: 12.2%

Tier 1 common equity ratio: 11.2 percent

Liquidity coverage ratio: 115%

CEO Robin Vince noted the success of the bank's transformation efforts in 2024, with technology improvements leading to a 5% reduction in the unit cost of custody transactions and a 15% reduction in the cost of traditional fund servicing.Eliza, the bank's artificial intelligence platform, now supports 35% of its employees.

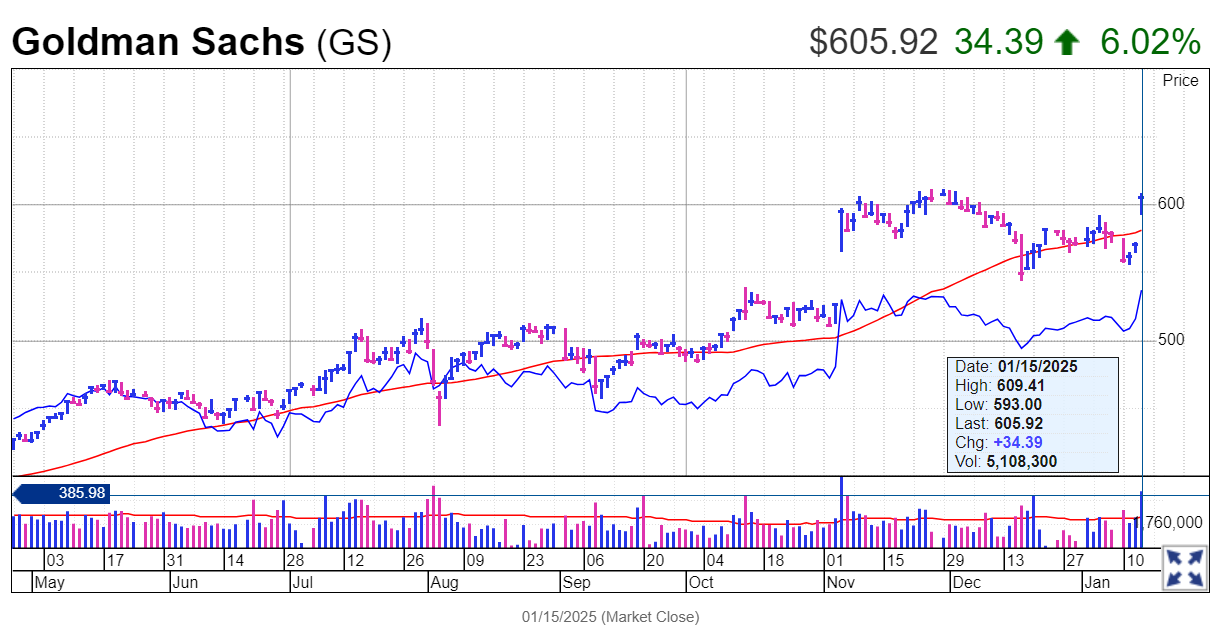

4. goldman sachs group $Goldman Sachs(GS)$

Goldman Sachs had a stellar fourth quarter with key business lines significantly outperforming expectations and a record-breaking equity trading business. 2024 Goldman Sachs shares are up 48%, ahead of major U.S. banks, and continue to be strong.

Key Financial Metrics:

Net revenue: $13.87 billion (beat estimates of $12.37 billion)

Earnings per share: $11.95 ($5.48 in the year-ago period)

Return on equity: 14.6% (beat expectations of 9.98%)

Return on tangible equity: 15.5 percent

Book value per share: $336.77 ($313.56 in the prior year period)

Efficiency ratio: 59.6 percent

Trading & Investment Banking Performance:

Fixed Income, Currency and Commodities (FICC) Sales & Trading Revenue: $2.74 billion (beat estimates of $2.44 billion)

Equities sales and trading revenue: $3.45 billion (up 32% year-over-year)

Global Banking & Markets net revenue: $8.48 billion (up 33%)

Investment banking revenue: $2.06 billion (up 24%)

Advisory revenue: $960 million

Equity underwriting revenue: $499 million (up 98%)

Bond underwriting revenue: $595 million (up 51% year-over-year)

Asset management and other metrics:

Asset management size: $3.14 trillion (up 12% year-over-year)

Total net asset inflows: $92 billion

Loans: $196 billion (up 7.1%)

Total deposits: $433 billion

Net interest income: $2.35 billion (up 75% year-over-year)

CEO David Solomon emphasized the company's success in meeting or exceeding its five-year strategic goals, growing revenue by nearly 50 percent and enhancing the sustainability of the business.Given the company's expected positioning for a recovery in the trading business and strong market performance, growth momentum is expected to continue in 2025.

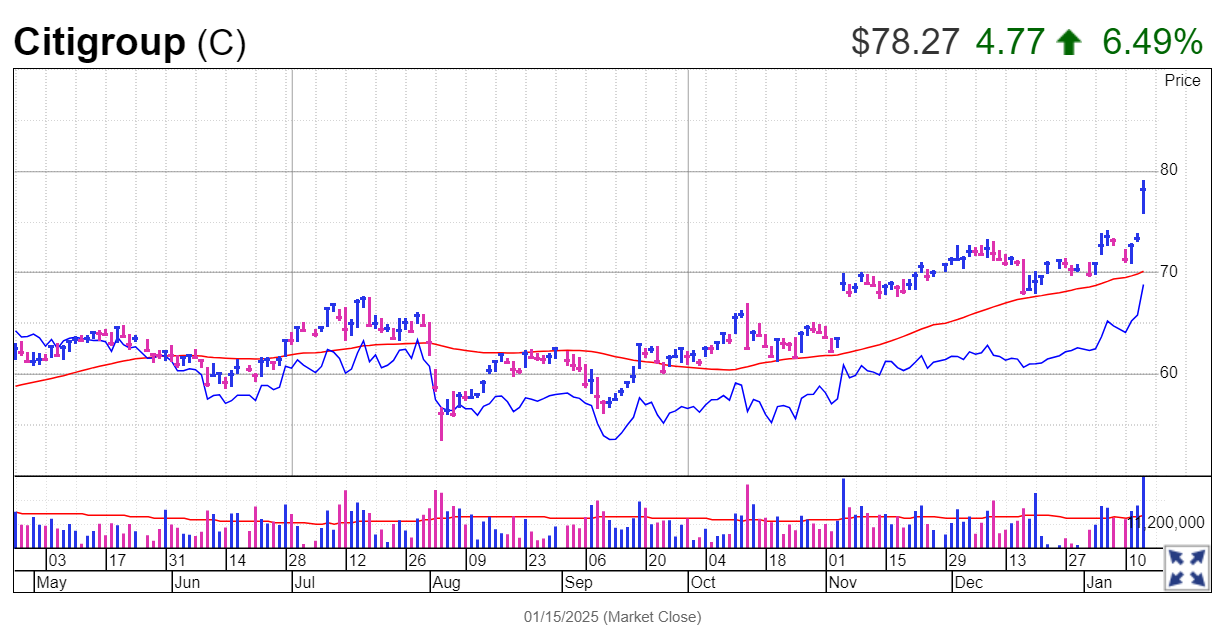

5. Citigroup Inc. $Citigroup(C)$

Citigroup reported strong fourth-quarter results that beat analysts' expectations, while announcing revised earnings targets and a massive share buyback program.However, the bank still faces challenges in its transformation process.Citigroup shares rose 3.5% in pre-market U.S. trading.

Key financial metrics:

Revenue: $19.58 billion

Earnings per share: $1.34 (beat estimates of $1.24)

Return on average equity: 5.4 percent

Return on average tangible common equity: 6.1%

Efficiency ratio: 67.3%

Tier 1 common equity ratio: 13.6 percent

Trading & Banking performance:

Markets revenue: $4.58 billion (beat expectations of $4 billion)

FICC sales and trading revenue: $3.48 billion (up 37%)

Equities sales and trading revenue: $1.10 billion (up 34% year-over-year)

Banking revenue: $1.24 billion

Investment banking revenue: $925 million

Business Segment Performance:

Services business revenue: $5.18 billion

Wealth business revenue: $2.00 billion

U.S. Consumer Banking revenue: $5.23 billion

Net interest income: $13.73 billion

Strategy Update:

Revised return on tangible common equity (ROTCE) target to 10 - 11% by the end of 2025 (previously 11 - 12%)

Board of Directors approves $20 billion share repurchase program

Full year 2024 net income up nearly 40% to $12.7 billion

Returned approximately $7 billion in capital to shareholders

CEO Jane Fraser emphasized that 2024 was a pivotal year, with strategy advancing as expected and record results in Services, Wealth and U.S. Personal Banking.However, the downward revision of the profitability target reflects the challenges the bank continues to face in managing expenses as it overhauls its global operations.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- pixelo·2025-01-16Great insightsLikeReport